Energy Valuations: Freefall Into Bankruptcy Or Is This Time Different?

This post originally appeared on Forbes.com on Monday, March 9, 2020.

Energy valuations are taking an epic pummeling. Considering declining demand amid COVID-19 concerns, the initial fallout to the Saudi-Russia feud was predictable. Within hours, prices had dropped like an anchor (to $33 a barrel as of this morning). Several companies have already announced cutbacks, including Diamondback Energy, as they dropped two additional drilling crews. Parsley Energy made a similar announcement and more are sure to follow. Perhaps even more draconian, SM Energy’s unsecured bonds fell to $0.42 on the dollar and pushed the yield up to around 25%. These bonds traded above $0.90 as recently as February 24th. Trading has been halted this morning amid the panic. Whether the market fallout has hit rock bottom remains to be seen. Regardless of what Russia may have been thinking, the geopolitical climate has put more pressure on U.S. producers and bankers. Operators who were contemplating hedging production at $50 per barrel but waiting to act are kicking themselves today.

Energy and related bankruptcies that were estimated to rise in 2020 will likely accelerate a few notches. According to Haynes and Boone’s Oilfield Services Bankruptcy Tracker, there were six (6) new bankruptcies in the oilfield services area in the fourth quarter of 2019. Up until this point in 2020, Pioneer Energy Services is the only major oilfield services company to enter Chapter 11 bankruptcy. That’s almost undoubtedly going to change soon. As upstream companies have vowed to spend within their cash flow, oilfield services will take the biggest brunt of this at first. However, producers with high leverage capital structures could quickly follow. Gas prices have held their ground but they’re so low anyway, it’s hard to know how much lower they could go.

Can Banks Hold On?

The looming factor for companies is how banks will go about determining borrowing bases this year. It’s a tough position to be in at this point. Bankers at the Hart Energy Capital Conference in Dallas last week did their best to portray patience towards the upstream sector, but were also clear about expectations. Those expectations were that borrowers can meet their obligations, and that borrowing bases will shrink with valuations. One of the speakers, Tom Petrie, expressed concern about $110 billion in debt coming due in the next decade for the energy market.

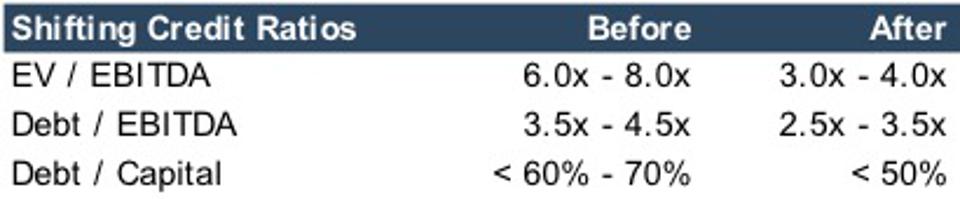

As working interest values for producing interests dive, the expected returns have changed from PV10 to closer to PV20. This has degraded credit quality. The mix of below-investment grade debt has worsened in the past year. In high yield markets, CCC or below is the most common rating according to some recent data.

High Yield Debt Rating Mix

SOURCE: JP MORGAN CORPORATE ENERGY & POWER PRESENTATION

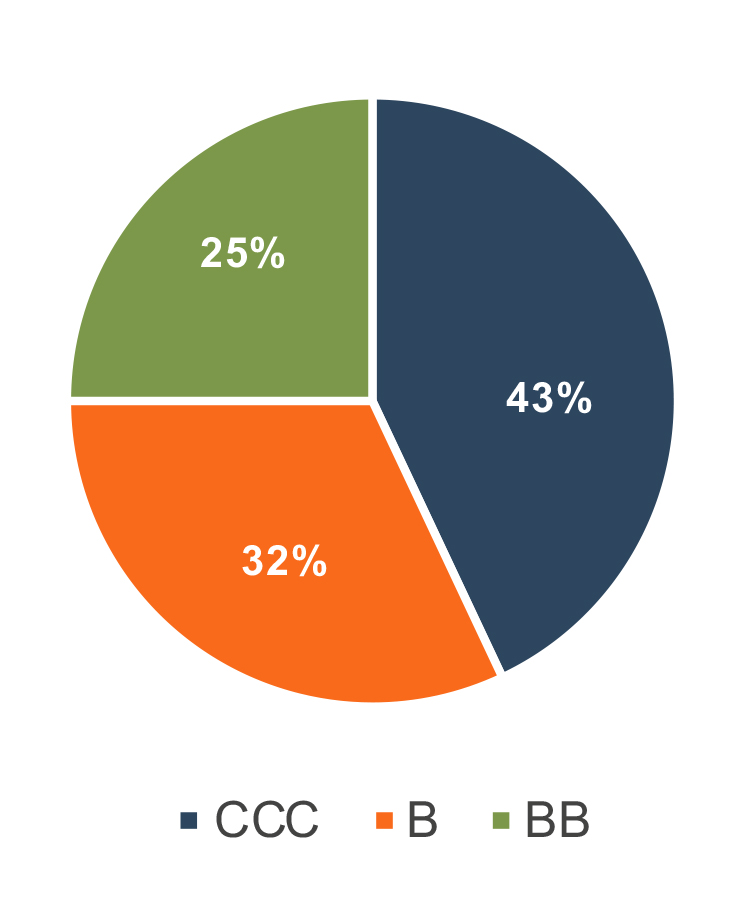

Even if bankers lending on reserves maintain their lending ratios, the borrowing bases will shrink accordingly. However, based on recent indications, lending ratios have and will continue to shrink alongside values. Debt-to-EBITDA ratios which used to often float in the 3.5x to 4.5x range are now, not surprisingly, in the 2.5x to 3.5x range. Enterprise values for upstream producers were often between 6.0x to 8.0x EBITDA too. That is in the past.

Shifting Credit Ratios

SOURCE: OCC GUIDELINES AND AMEGY BANK PRESENTATION

Impacts appear bad and immediate. However, this plunge could, ironically, buy the market a little more time. The founder of OnyxPoint Global Management, L.P., Shaia Hosseinzadeh, told Bloomberg just last week that “Things are so bad now, that the banks can kick the can down the road and say ‘there’s no point of rushing everybody into bankruptcy, we’ll wait until October.’ But if it’s business as usual, it’s going to be a horror show.” That may be a prescient thought. Another consideration is that fewer banks are even lending to energy companies anymore. The rise of the environmental, social, and governance (“ESG”) movement, alongside weak returns, have pushed many bankers and other investors out of the space. There isn’t as much capital to go around, not that it’s cheaply available right now anyway.

Due to valuations being so low, the recovery for bankers coming out of Chapter 7 situations may be less attractive, especially on the oilfield service side. The market value of intangible assets is so depressed compared to other times in the commodity cycle, that it may not make economic sense to rush into the process for some.

Can Values Recover?

This prognostication about delayed bank behavior may be a moot point if liquids values can’t recoup over time. This is an undercurrent that has been a factor in keeping values down recently. Electrification trends and the idea that liquids demand will wane have proffered the notion that demand for liquids will be flat to even shrinking in the future, all while supply becomes bountiful. Some project the electrical passenger car trends to reach around 20% by the end of this decade. However, while the short-term appears bleak, many projections about the medium- and longer-term remain more optimistic for upstream producers and servicers. J.P. Morgan Cazenove recently suggested that the oil industry may be under-equipped to meet demand recovery in 2021 and beyond. Another way of putting that is downward pressure on prices could be its own cure in the medium term. Capex budgets have been slashed and continue to be. Over 200 oil drilling rigs (and counting) have been shut down in the past six months. Production will suffer, even with drilling and production efficiencies achieved in recent years. Especially in the U.S. shale markets, declines on existing wells drop off so fast, that their effect on supply will show up sooner rather than later.

Producers are hopeful for this. Regardless of the market’s relentless pounding down on reserve values, producers know that, particularly proven reserves are next year’s production. They do not want to sell or unload them for the pennies on the dollar (or less) that implied valuation multiples suggest right now. Intrinsically, they have much more value than inferred by market capitalizations. Management teams believe that enterprise values shouldn’t be trading at a fraction of PV10 values over a long period of time. At a minimum, many producers believe there is an optionality to their future drilling inventory.

The question remains, could that happen fast enough to save a bankruptcy slog this year? Only time will tell.

Energy Valuation Insights

Energy Valuation Insights