E&P Capital Expenditures Set to Rise, but Remain Below Pre-Pandemic Levels

The upstream oil and gas sector is highly capital intensive; production requires expensive equipment and constant maintenance. Despite higher oil and gas prices, E&P operators have refrained from increasing capital investment and instead, are delivering cash to shareholders. This post explores recent capex trends in the oil & gas industry and the outlook for 2022 through 28 selected public companies.

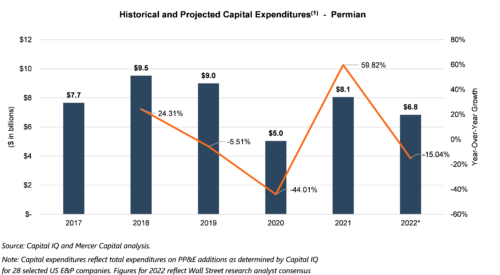

Historical and Projected Capital Expenditures

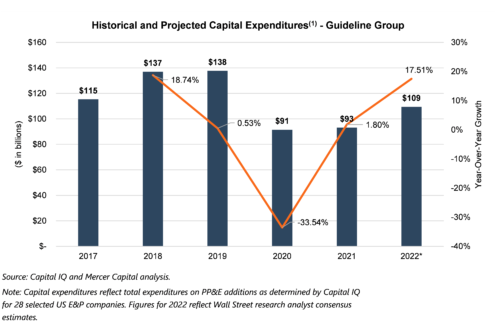

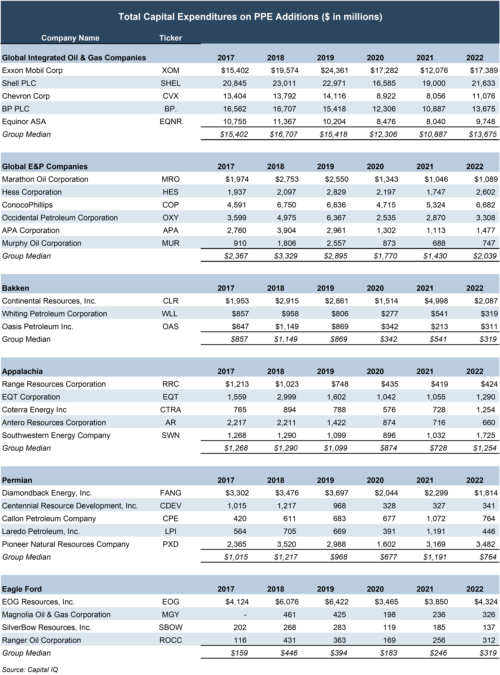

Capital expenditures, as measured by spending on property, plant, and equipment (PPE) has varied widely during the last five years. After the recent high in capital investment in 2019 of $138 billion, guideline group capex dropped 33.5% in 2020 to $91 billion. After minor growth from 2020 to 2021 on the order of 1.8%, capital expenditures are expected to ramp up investment to about $109 billion in 2022, representing a growth of 17.5% but still below pre-pandemic levels.

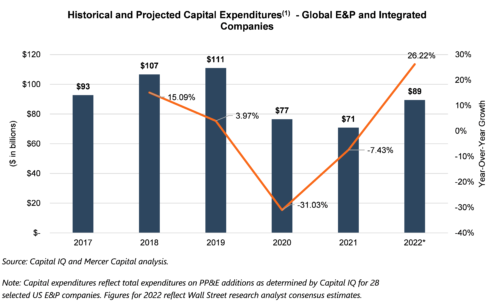

Leading this growth, Exxon (XOM) is expected to increase capital expenditures by 44.0% to $17.4 billion in 2022, up from $12.1 billion in 2021. Chevron follows Exxon with an estimated $11 billion in capital spending for 2022, up 37.5% from 2021’s level of $8 billion.

All in all, global integrated companies and E&P companies are expected to experience capex growth on the order of 26.3%, up from $71 billion in 2021 to $89 billion in 2022.

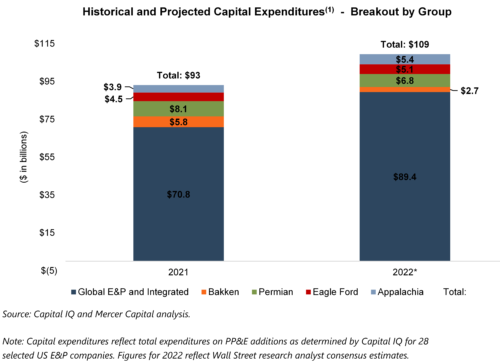

The global guideline companies account for the lion’s share of total forecasted growth in capital spending, as summarized in the chart below.

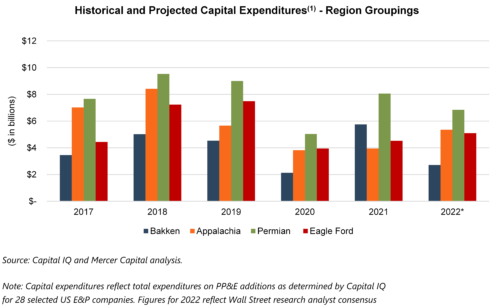

Appalachia Is Regional Leader in 2022 Capex Growth Estimates

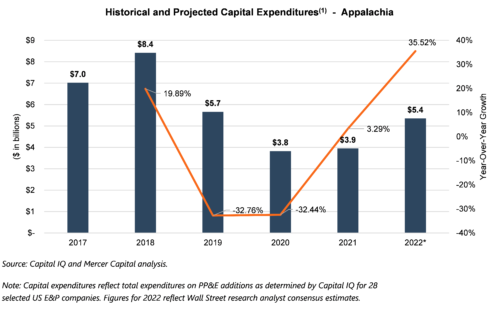

Through the lens of our company groups by region, the Appalachian Basin is expected to see the largest upswing in capital expenditures.

This is by no means an exhaustive indication of growth by region, but it is indicative of the industry environment in Appalachia — capital expenditures are expected to total $5.4 billion in 2022 from the five major operators active in the area, up from $3.9 billion in 2021. As shown below, 2022 is set to be the first year of significant capital investment growth since 2018.

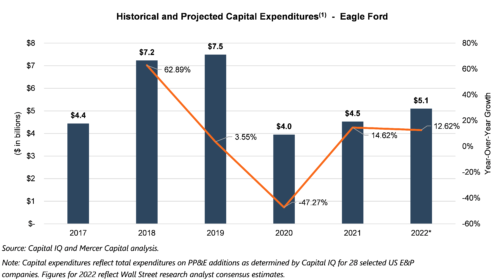

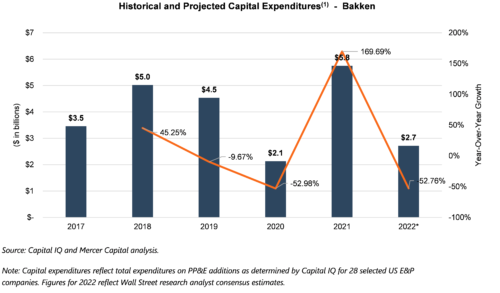

Companies in the Eagle Ford are expected to increase capital spending modestly by about 12.6% to $5.1 billion, up from $4.5 billion in 2021. On the other hand, companies in the Bakken and Permian have lowered their capital plans after relatively high spending in 2021, representing a decrease of 52.8% and 15.0%, respectively.

Cost Inflation Baked into 2022 Capex Budgets

While the expected rise in 2022 capital investment levels from 2021 is encouraging for the global supply of oil & gas, spectators need to acknowledge the effects of cost inflation in the estimates. According to the Bureau of Labor Statistics ‘ March Consumer Price Report, inflation has reached a four-decade high in March 2022 as the Consumer Price Index (“CPI”) rose 8.5% over the last 12 months. Cost inflation, by definition, will detract from operators’ “bang-for-the-buck,” and it is no secret that this is baked into 2022 capex estimates.

“In this upcycle, investors have made it clear they wanted to see discipline from all players. So far, E&Ps for the most [part] are exhibiting capital discipline. A significant part of E&P capital spending growth this year (2022 versus 2021) will be consumed by cost inflation as the cost for all inputs continues to increase…” – Dallas Fed Respondent, Q1 Dallas Fed Energy Survey

Moreover, estimates are directly tied to operators’ budgets and management forecasts — which also commonly attribute rising capital expenditures levels within their budget to, among other things, inflation — a theme we covered in a previous blog post. This helps bridge the divide between rising capital investment budgets and the common industry theme of “capital discipline”.

Conclusion

Capital expenditures fluctuate as operators react to global marketplace demand for Oil & Gas commodities. After a recent low in 2020, capital investment is expected to pick up — rising by about 17.5% in 2022, after relatively stagnant growth in 2021. Rising capital expenditures are generally a precursor to increased production, which will likely help to alleviate the current imbalance of supply and demand of oil & gas in the global marketplace at some point. However, capital expenditures for 2022 are expected to trail pre-pandemic levels still, and rising inflation is eroding the value generated by those investment dollars.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss. your needs in confidence and learn more about how we can help you succeed.

Appendix A – Selected Public Company Capital Expenditures

Energy Valuation Insights

Energy Valuation Insights