Examining Bakken, DJ Basin, and Woodford Shale Production and Activity

The economics of oil & gas production vary by region. Mercer Capital regularly covers trends in the Eagle Ford, Permian, and Appalachian plays. The cost of producing oil and gas depends on the geological makeup of the reserve, its depth, and the cost of transporting raw crude to market. These factors lead to varying production costs across regions. This quarter, we depart from our regular coverage and take a closer look at the Bakken, DJ Basin, and Woodford Shale.

Production and Activity Levels

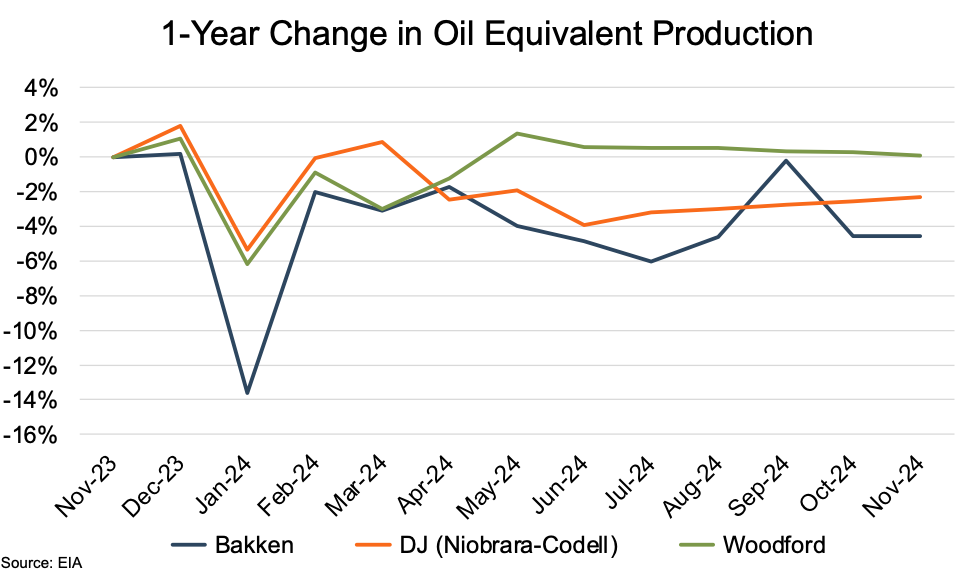

Two of the three shale plays ended 2024 with production levels (on a barrels of oil equivalent, or “boe” basis) below those of the previous year. The DJ Basin ended the review period 2% below levels from a year earlier, while the Bakken ended at nearly 5% lower. Only the Woodford Shale ended the review period at a level above its November 2023 production, though at a negligible 0.1% higher.

DJ Basin

The DJ Basin’s production decline wasn’t unexpected in that, while at a high level, the DJ would seem to have adequate pipeline off-take capacity, two of the four primary pipelines were nearing capacity in early 2024. As such, it was known that basin producers had been pulling back on drilling activity (as evidenced by the declining basin rig count) and that production had been expected to reach a near-term peak during 1Q-2024.

Bakken

Bakken production was burdened by a similar headwind, albeit in the form of declining gas pipeline capacity availability. Although oil is still the Bakken’s primary economic driver, basin operators nevertheless must find markets for the associated natural gas and NGLs. Analyst basin forecasts indicate that the task is becoming more and more complicated as the basin’s production is progressively becoming “gassier” (as noted by Mercer Capital’s Andy Frew in his Energy Valuation Insights blog from January 3, 2025), thereby contributing to the tightening bottleneck at the off-take pipelines.

Woodford Shale

The Woodford Shale formation, which includes primary areas of the SCOOP and STACK, eked out the only year-over-year (YoY) increase in production — with an increase by the narrowest of margins. All three areas posted the usual winter weather-related declines early in the year. However, Woodford’s production recovery exceeded its prior review period high (posted in December 2023), which allowed its YoY production change to remain positive despite the steady decline from May to November.

Rig Counts

Rig counts in the subject basins showed a mixed bag of results over the latest twelve-month period (LTM period), with the Woodford posting a 57% increase, while the DJ Basin count fell by 50%. The Bakken remained near “neutral” with a modest 5% decline.

The DJ and Bakken rig counts showed generally steady declines devoid of any significant short-term “bumps” or “dips.” The Woodford, with its natural gas-heavier production mix, showed notably greater movement with a 93% increase over the first three months of the review period from 14 to 27 rigs, marking a significant recovery from its rig count decline over the prior twelve-month period. However, a second and third quarter drop-off to 18 wells pushed the review period growth down to just 29% as of mid-July. The gradual rig increase over the remainder of the year pushed the total to 22 for the YoY increase of 57%.

Commodity Price Volatility

Commodity Price Volatility

Oil prices, as benchmarked by West Texas Intermediate (WTI) and Brent Crude (Brent) front-month future contracts, generally rose through early April to then 2024 highs of $83.85 (WTI) and $88.21 (Brent) from year-end 2023 prices of $71.65 and $77.04, respectively. The steady rise was largely the result of rising tensions in the Middle East that eased concerns about too much U.S. production and continuing OPEC+ production cuts.

Although OPEC+ continued its production decreases into mid-2024, the next five months saw a fairly steady decline, with WTI reaching $65.75 (down 24% from early April) and Brent reaching $69.19 (down 23%) on non-OPEC production growth and economic weakness slowing oil consumption growth.

Other than a short spike during the first week of October (again tied to Middle East tensions — this time Iran’s launching an estimated 200 missiles into Isreal), both futures held fairly steady through year-end, with WTI holding within a range of $66 to $71 and Brent at $72 to $76.

Henry Hub natural gas front month futures prices showed the commodity’s usual seasonal volatility during 2024.

After an initial uptick during the first half of January to $2.67 ($/mmbtu) resulting from a cold snap and related heating needs, the futures price dipped to its 2024 low of $1.65 in mid-February, largely the result of the Biden Administration’s “temporary pause” in LNG export project approvals. The price generally climbed over the next three months (though with typical natural gas pricing dips and runs along the way), reaching $3.05 in mid-May and $3.09 in mid-June, heavily influenced by expectations for warming temperatures, spurring increased cooling-related demand.

The unusually mild summer, however, held down demand, and rising storage inventories in the third quarter drove Hub futures lower with a six-week slide, bringing the price to a seasonal low of $1.94 in early August.

Through the remainder of the year, the futures price generally rose to $3.10 at year-end. The 4th quarter run included a notable jump from $2.17 on September 9 to $2.63 just three days later (due to unusually high temperatures driving electricity and, therefore, natural gas demand) and an 11-day drop from $3.36 on November 29 to $2.68 on December 10 as temperatures dipped to more typical early December levels spurring heating related demand.

Conclusion

While not nearly in the same league as the powerhouse Permian Basin, the Bakken Shale, DJ, and Woodford Shale play an important role in U.S. energy production.

While these basins mostly experience the same impacts that U.S. energy policy and geopolitical matters have on the primary U.S. basins, they each have unique characteristics that differentiate them from the larger basins and each other.

The Bakken has high-quality crude, a production profile shifting from oil to gas, and seasonal weather production interruptions. The DJ has its focus on tighter formations that require newer techniques and technologies to hold production costs in check and limited water resources. The Woodford and SCOOP/STACK have the dynamics of multiple formation layers and related multiple production zones that contribute to greater well depths and higher production costs. These shared and unique characteristics combine to add to the general complexity and dynamics of the U.S. exploration and production industry.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights