Exxon’s Acquisition of Denbury

A Tale of Two Businesses, and Neither One Is Worth $4.9 Billion

ExxonMobil made waves in the energy M&A markets by announcing its acquisition of Denbury, Inc. Exxon paid somewhere between Denbury’s stock price and a slight premium depending on the timing and stock price fluctuations. In total, the headline value was around $4.9 billion, according to Exxon’s news release.

However, while Denbury is an energy company on the whole, it is made up of two main segments that have very different economics. First, its carbon capture utilization and storage segment (CCUS). Second, its upstream enhanced oil recovery segment. These two businesses, in many ways, represent Denbury’s journey over the last several years that have one foot in the carbon future and one foot in the oily past. Neither of their business segments appears to be worth the $4.9 billion price tag. So what did Exxon buy exactly, and how might one value it?

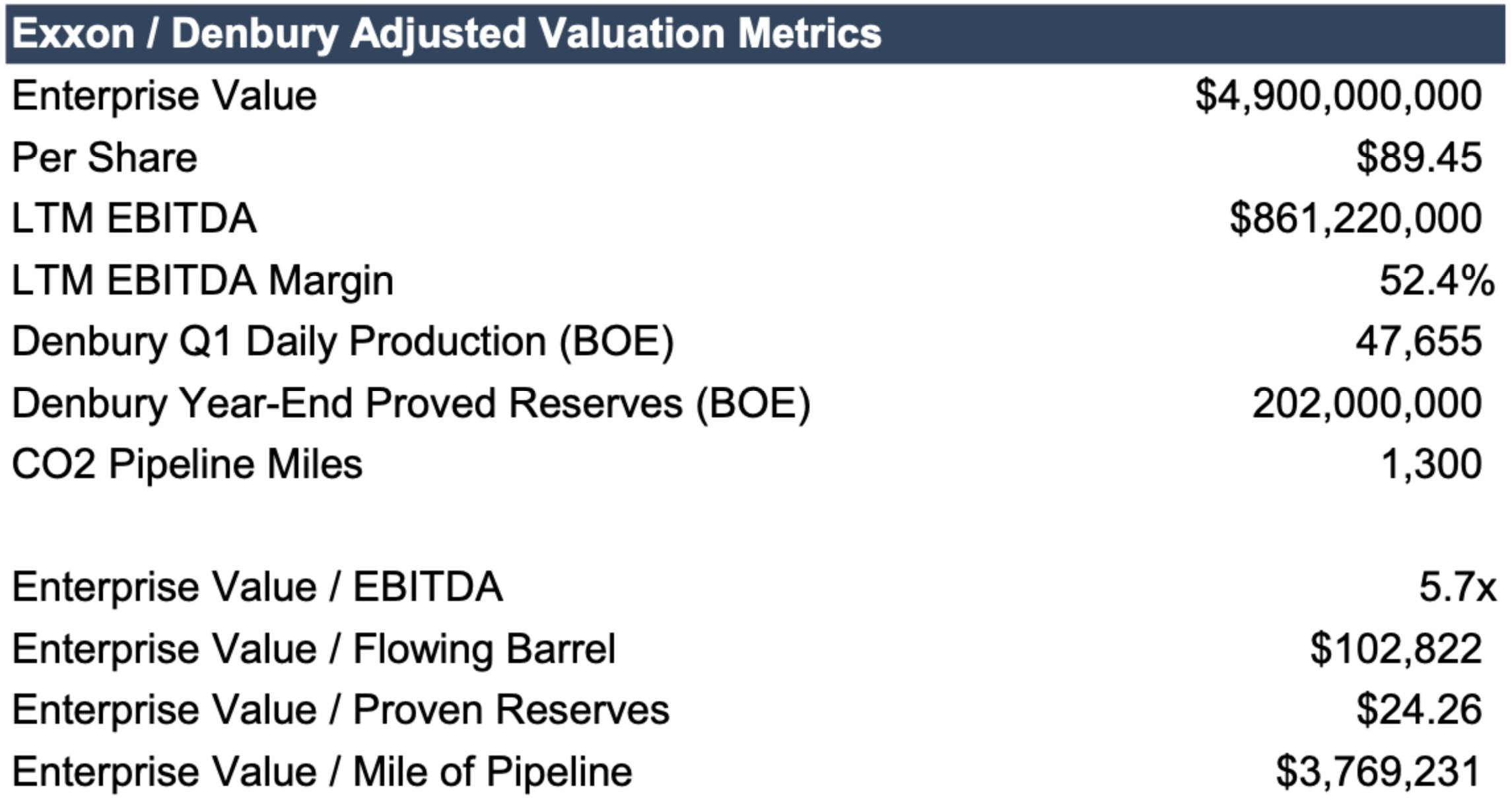

A quick look at some of the overall implied metrics related to the deal reveals some oddities compared to pure-play oil companies. As to CCUS transactions, there really have not been many to compare to, and certainly not at the scale that Denbury has achieved thus far. The table below was compiled based on figures from the announcement and Capital IQ data.

Just looking at the implied values relating to upstream multiples, the flowing barrel metric jumps out as high compared to most operators, especially with an EBITDA margin below 55%. This implies a higher multiple than much larger global companies such as BP, ConocoPhillips, and Occidental Petroleum—which does not make intuitive sense.

On the other side of the equation, the value per mile of pipeline appears relatively high at first glance. This is considering management’s recent earnings call comments about construction costs being between $2 to $4 million per mile, coupled with the fact that the pipelines are not fully utilized yet. There clearly is a mix of segment-made contributions that drive different elements of the overall transaction price.

Denbury’s CCUS business represents the future of Denbury and embodies the key rationale for Exxon’s interest. Denbury has touted this segment, and most of its marketing, to investors centers on this aspect of its business. Its enthusiasm is apparent as its annual report spent almost all its focus on this area of the business. CCUS does represent a synergistic operational advantage for the company because Denbury has been one of the few upstream companies focusing on older, depleted fields that have lost what the industry calls “natural drive” and thus require incremental efforts to bring oil to the surface. Denbury’s solution to this challenge for a long time has been to inject its CO2 into the fields to create pressure and stimulate oil production.

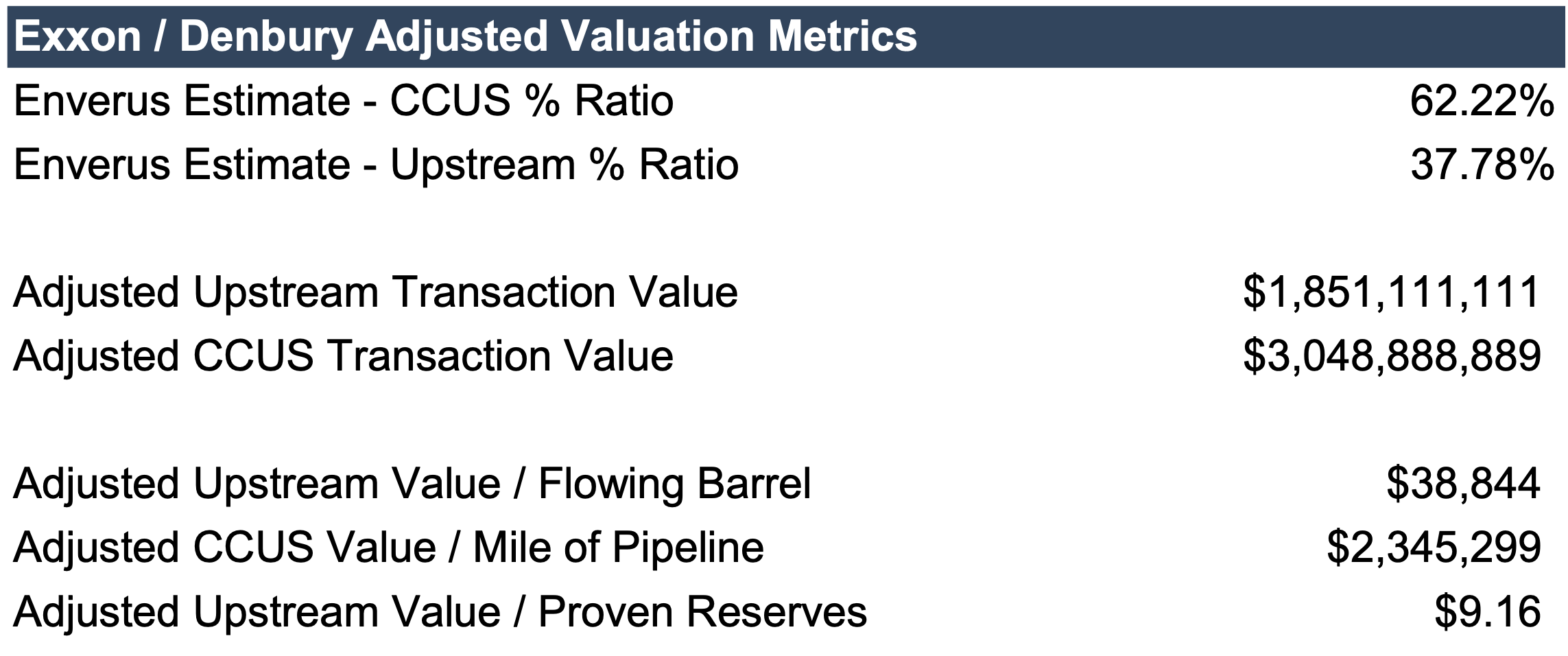

Under this scenario, Denbury’s upstream business would potentially be slotted in with public regional upstream producers with characteristics closer to: (i) under 200 thousand barrels per day of production and (ii) EBITDAX margins under 60%. Companies like Chord Energy (a Bakken-focused producer), Callon Petroleum (a smaller Permian operator), or maybe even Enerplus (another Bakken-focused producer) come to mind. Additionally, the value per mile of pipeline drifts down to the lower end of the construction estimate range, which also appears to be more realistic. Of course, this value depends on commodity expectations, regulatory stability, and execution of Denbury’s plan. Exxon appears to be optimistic about it. Whether or not Denbury’s shareholders will be remains to be seen.

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights