Falling Oil Prices Are Not The Only Thing Bridling Upstream Valuations

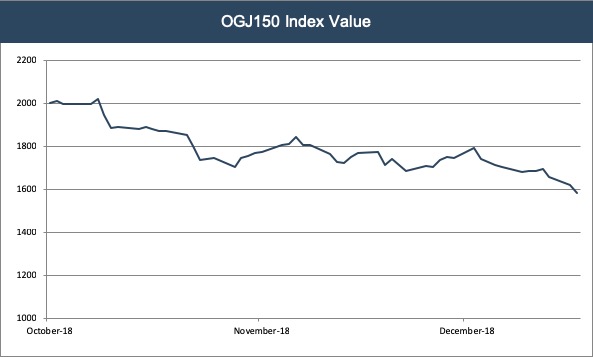

Oil prices have taken a tumble the past three months. On December 17th, they fell below $50, corresponding with a larger market downturn. Compared to the S&P 500, valuations of oil and gas production indexes, such as the OGJ150, have underperformed during this time.

Rig counts have dropped too, but not much. While rigs have been drilling wells, production has been curbed in certain places.

Oil prices are not the only thing that’s been pulling values down for upstream producers. Other metrics matter too. Take drilled but uncompleted well counts for example. “DUCs” as they are called, have been climbing every month since March. According to the EIA’s DUC report, in the seven regions they track, nearly 17% of wells drilled are left uncompleted since June. In the infrastructure-challenged Permian Basin, that figure over the same period is a whopping 33%. This is not necessarily a good thing, especially when oil prices were close to $70 per barrel nearly all summer and peaked over $75 per barrel a few months ago. It would appear to make sense to complete many of these wells at those prices. The pipeline takeaway capacity issue in the Permian Basin has been a well-documented reason for some of this climb. However, it doesn’t tell the whole story.

All of this speaks to why valuations aren’t always solely linked to oil prices. There are a host of potential operational issues that can reign in production, cash flow, investor expectations and, ultimately, valuations. Diamondback Energy’s most recent 10-K put it this way: “Our ability to drill and develop these locations depends on a number of uncertainties, including the availability of capital, construction of infrastructure, inclement weather, regulatory changes and approvals, oil and natural gas prices, costs, drilling results and the availability of water.”

Values have been hampered by a number of these things lately for many producers.

Water Issues

The availability and disposability of a basic resource, water, is a critical issue. Many oil and gas basins in the U.S. are already located in relatively dry climates. As operators drill bigger and more sophisticated wells, the use and disposal of water grow alongside them. The need for freshwater and brackish water for oilfield drilling has grown significantly in the past several years. While sand and a recipe of chemicals are part of the mixture for fracking, water is still a primary component. The need for water is so great, that many operators can’t frack a well and bring it online without a reliable supply. That can be hard to find in remote and dry climate areas.

However, water going down the pipe is one thing. Water coming back up the pipe is another. In fact, the Permian has averaged about four barrels of salty water coming back up the well for every barrel of oil. That’s a lot of water, and it must be disposed of. This growing need has given more prominence to an emerging sub-sector of the oilfield services sector—saltwater disposal. While certainly not new, saltwater disposal companies, particularly in West Texas, have had an opportunity to grow alongside the oil and gas industry.

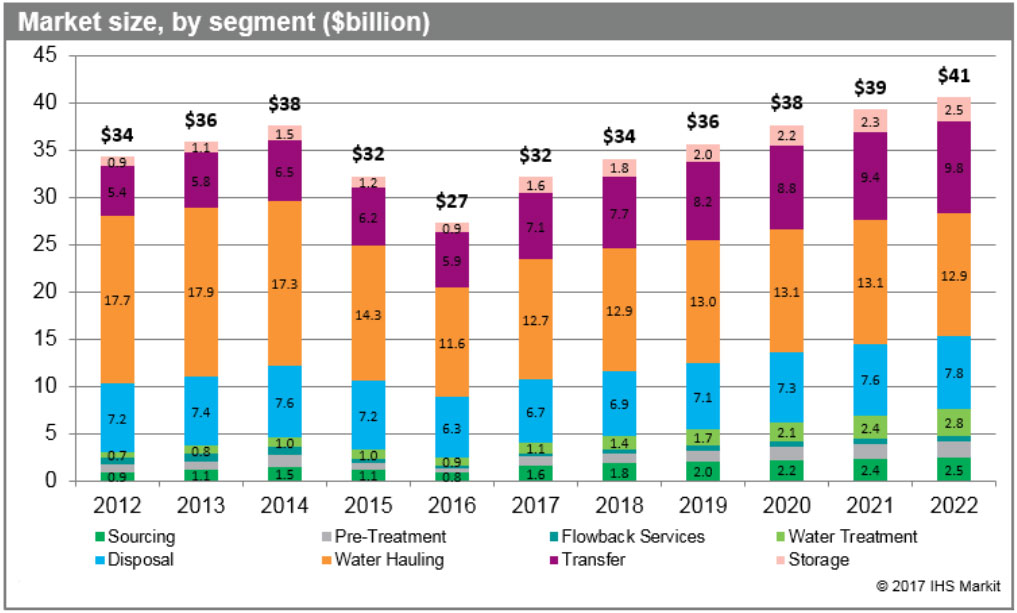

This has been a factor in rising production costs for wells to the tune of several dollars per barrel. However, what is a cost to an operator is revenue to a saltwater disposal company. According to IHS Markit, the overall water management services market will grow from about $34 billion in 2018 to about $41 billion in 2022. Disposal, hauling and transfer of water make up most of that market. In fact, water pipeline growth is becoming its own midstream market. As an example, in the Eagle Ford and Karnes Trough, EVX Midstream Partners is planning to create a water network over an area the size of Vermont.

Additionally, Texas and New Mexico have limited the licensing and permitting of new disposal wells. This can slow fracking and production to a crawl at times, thus limiting operators, mineral owners, land owners and a host of other related industry players from maximizing economic opportunities.

People

In some areas, there simply are not enough people to go around, and the people who are available are more expensive. However, cost is only one factor. Boomtowns have emerged out of ghost towns. It’s like something out of the old west. Take, for example, Whites City, New Mexico. It’s an unincorporated community in Eddy County. Its census population in 2010 was a grand total of seven, yet today there are hundreds of people there. There are practically no rooms available, and some people sleep on cots, while alternating day and night shifts in the oilfield.

Land and Logistics

Another issue bedeviling productivity is land availability. Today’s headline wells can have lateral lengths of two miles. A section of land is approximately one mile, which means a company must have the drilling rights to two contiguous sections of land in order to operate this way. Looking at maps of companies’ land inventory, the rights can be vast. However, they can also be scattered across multiple sections and areas that could preclude drilling, sometimes resembling a checkerboard. Even if the geology is favorable and the land rights are procured, water availability may be scarce. In addition, roads, trucks and people may also be in scarce supply.

Impatient mineral owners have expressed frustration at the inability to produce on their lands, but if a next-door neighbor has leased their rights to a separate operator, or none, it could lead to more frustration and depress mineral interest values.

Conclusion

As a result of these operational challenges, investors in an upstream operator may become ever more impatient. Millions of dollars can be spent to procure the rights to drill, but the longer drilling and production is delayed, the longer cash flows and returns are delayed.

Falling prices have a downward pull on operator and mineral values, but they are not the only contributor. There are many moving parts that need to work together for value to be created. When the price of oil rises again, that will help in a myriad of ways to pull valuations back up. However, it won’t be the only thing buoying values.

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights