“Hayne” in There, Haynesville!

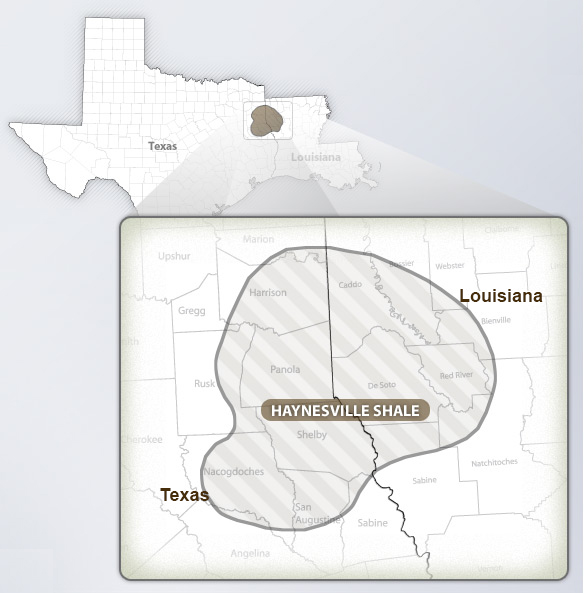

The Haynesville/Bossier Shale was discovered in 2008 in East Texas and Western Louisiana. As a play, it differs from other reserves. The reservoirs are highly pressured and deeper than most other reservoirs. The average hydrocarbon reservoir in Haynesville is almost 12,000 feet deep, far exceeding the average depth of 6,000 feet (per the most recently available data from the EIA). This extra depth can make drilling activities more expensive. This is not just because of the additional pipe length. Temperatures at such great depths can be extremely high, so the equipment to drill wells must be able to withstand particularly high temperatures. Such equipment typically costs more than standard drilling equipment. Additionally, Haynesville is saturated with smaller independent operators compared to plays like the Eagle Ford and the Permian over the last decade. The greater share of independent operators can lead to relatively higher average drilling costs from smaller average contract sizes.

Despite these challenges, Haynesville has a number of advantages over other basins. While the equipment required to complete projects is more expensive, Haynesville is located extremely close to the Gulf of Mexico and its LNG export terminals, especially compared with the Marcellus in Appalachia. While the Marcellus may have cheaper operating costs at the well level because it is not as deep as the Haynesville, the long transportation distance required for its reserves to be exported eats away at its natural price advantage. The Permian is relatively close to export terminals and has cheaper operation costs, but the gas there has faced transmission problems.

Transactions

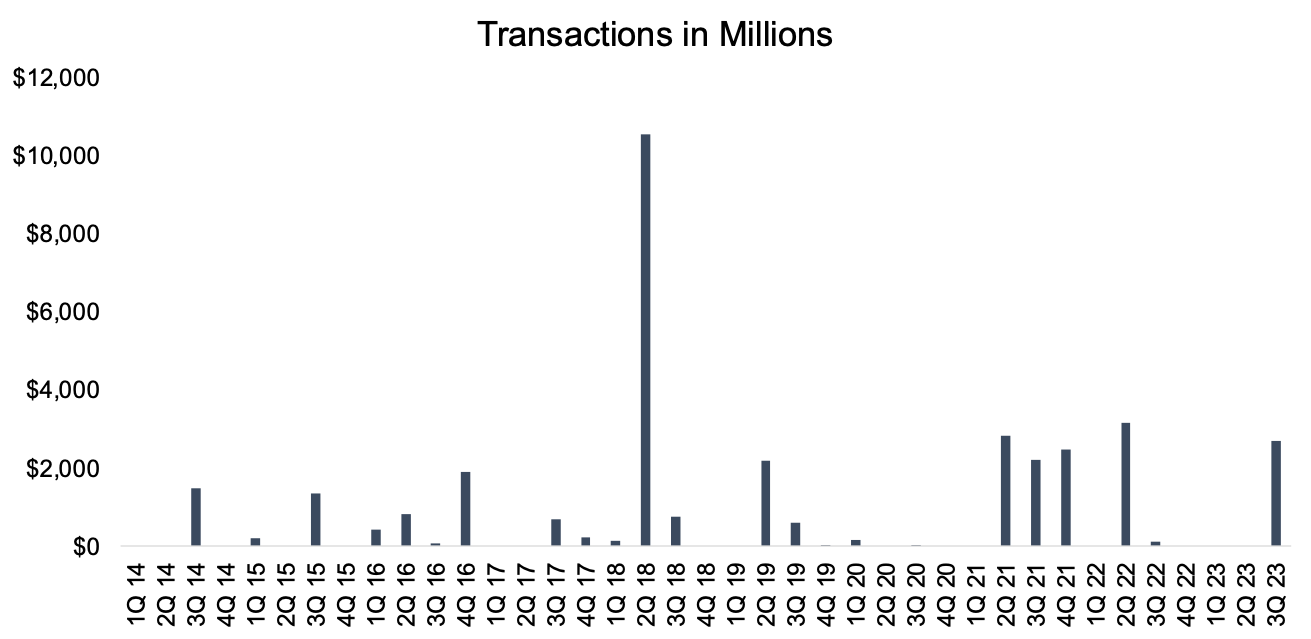

Haynesville has seen unsteady transaction activity over the last ten years. The chart below shows that M&A has been sporadic, with most activity in the last five years occurring in 2021 and additional smaller closings in 2Q 2022 and 3Q 2023. M&A activity in 2024 has been relatively limited per Shale Experts, likely because of the harsh operating conditions for gas-forward plays.

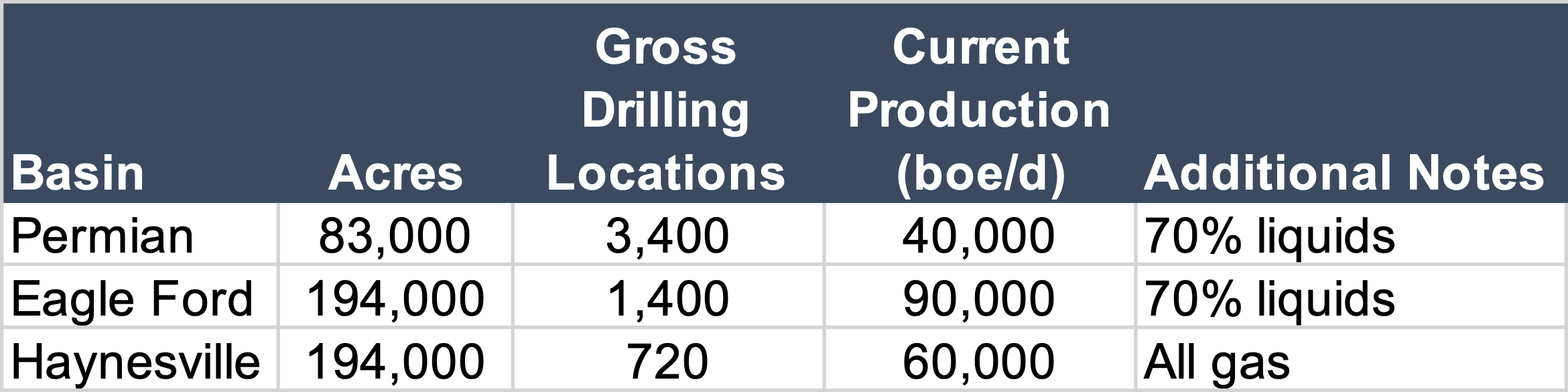

The most notable Haynesville transaction in the Shale Experts data occurred in the second quarter of 2018 when B.P. America Production Company (a subsidiary of B.P.) acquired the assets of Petrohawk Energy Corporation, (at the time) a wholly owned subsidiary of BHP Billiton Petroleum (North America) Inc. The total value of the transaction was $10 billion. Notably, the Petrohawk assets included were not just in Haynesville but also in the Eagle Ford and the Permian Basins. As such, it is not strictly comparable with the other transactions shown in the chart. A specific breakout of the value per basin is unavailable, but the transaction’s press release did include the information summarized in the table below the chart.

Notably excluded from the Shale Experts data is Chesapeake Energy’s acquisition of Southwestern Energy in January 2024 (which we have written about previously). The resulting entity, known as Expand Energy, involves a total consideration of $7.4 billion. Through the deal, Chesapeake acquired 7.9 bcf/d from Southwestern’s assets in the Appalachian and Haynesville.

In recent news, word has spread that Chevron Corporation (CVX) is discussing selling its Haynesville assets with Tokyo Gas. Chevron’s portfolio includes 72 thousand acres of undeveloped land. In the same publication, the author speculates that the potential transaction could be worth up to $1 billion. Tokyo Gas’s interest in the Haynesville assets may be related to Japan’s reliance on imported fossil fuels. Before its conversations with Chevron, Tokyo Gas had also completed an acquisition of Rockcliff Energy for $2.7 billion. As of the writing of this post, the Rockcliff assets contribute as much as 1.3 bcf of gas per day to Tokyo Gas.

Activity

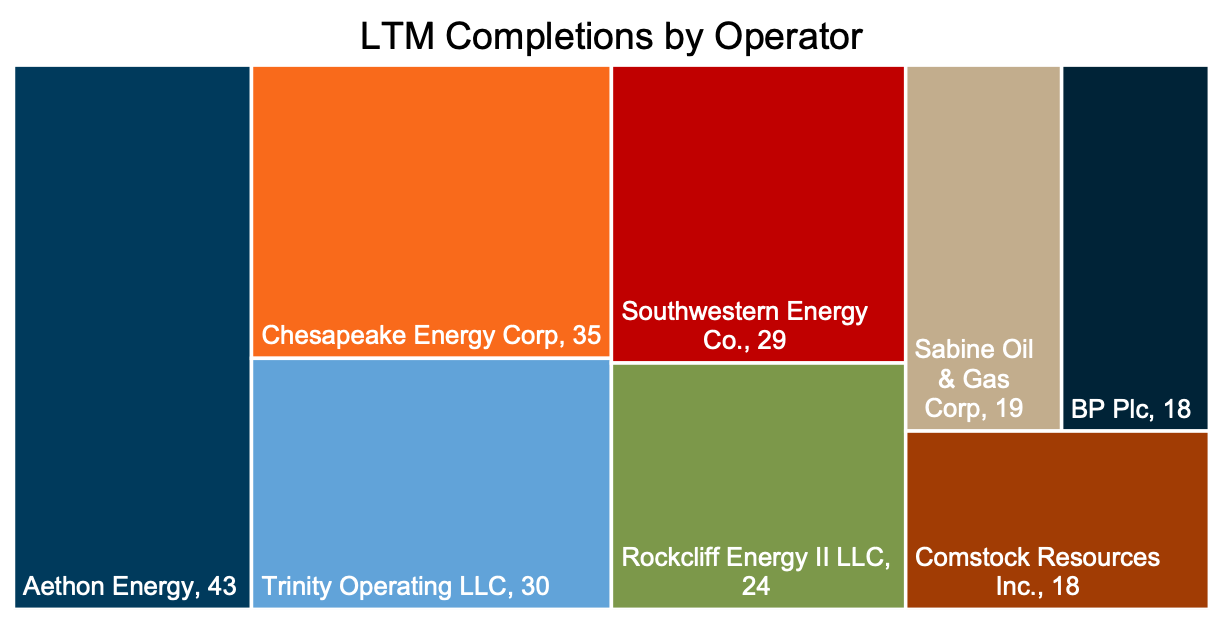

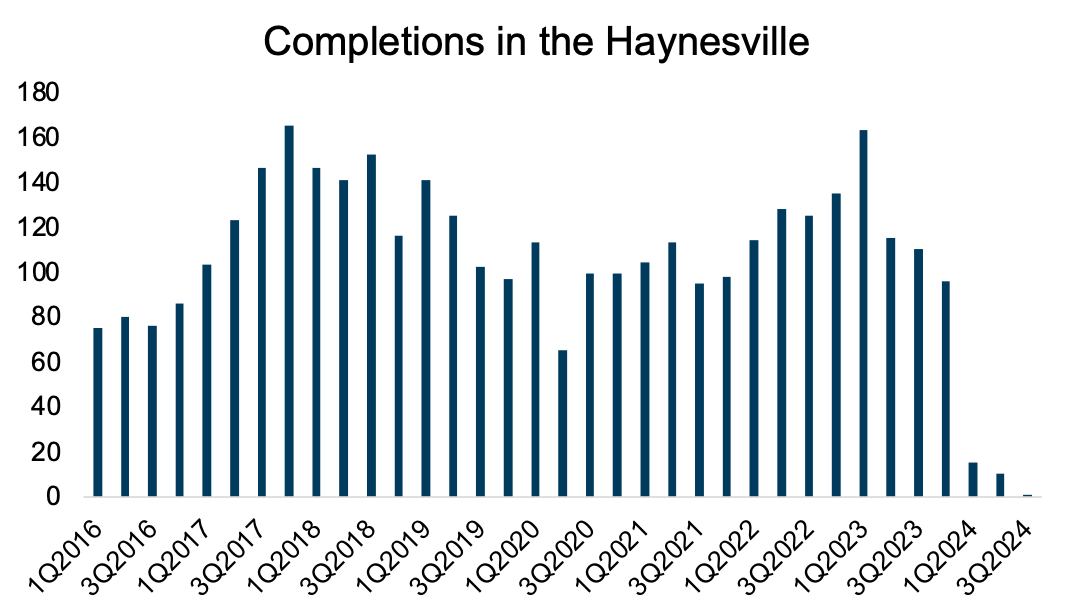

In the last twelve months, Shale Experts shows that there have been 232 total deals completed in Haynesville. These completions have been heavily concentrated among a few operators, as shown above. The top eight operators have a total of 216 completions, representing 93% of all completed deals since the start of 3Q 2023. The chart below shows that transactions have been trending downward since the second quarter of 2023.

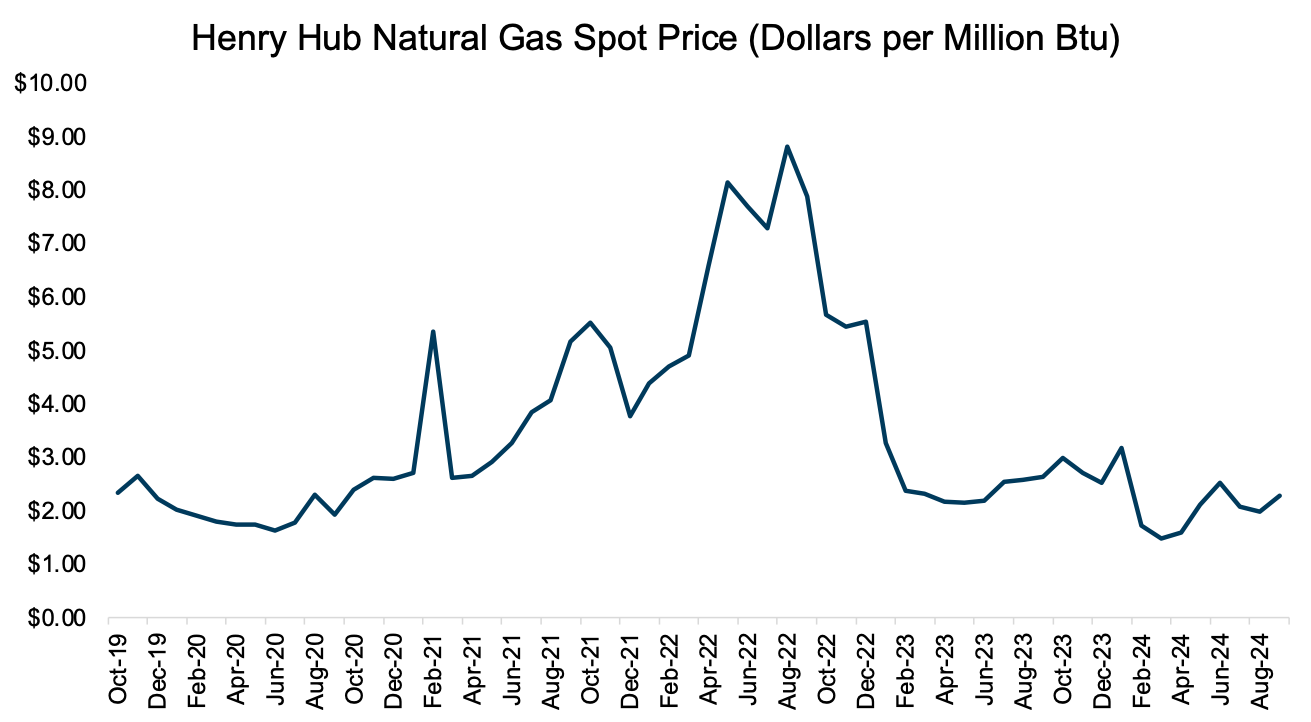

Since it is overwhelmingly a gas-focused basin, Haynesville producers have been hit hard by declining natural gas prices. As of February 2024, S&P estimated that the average breakeven price for efficient operators in the Haynesville Shale was $2.67/MMBtu. For less efficient operators, wellhead clearing prices are well above $3.00/MMbtu. For context, the most recent natural gas weekly update from the EIA places the Henry Hub spot price at $2.42/MMbtu. At current prices, there simply is no incentive for new completions in Haynesville despite its large reserves and convenient geography.

The Biden Administration’s pause on new LNG export approvals has had a brutal impact on the Haynesville Shale. Companies have hesitated to commit to new projects without the certainty of being able to export LNG. As of the writing of this post, the pause is still in place.

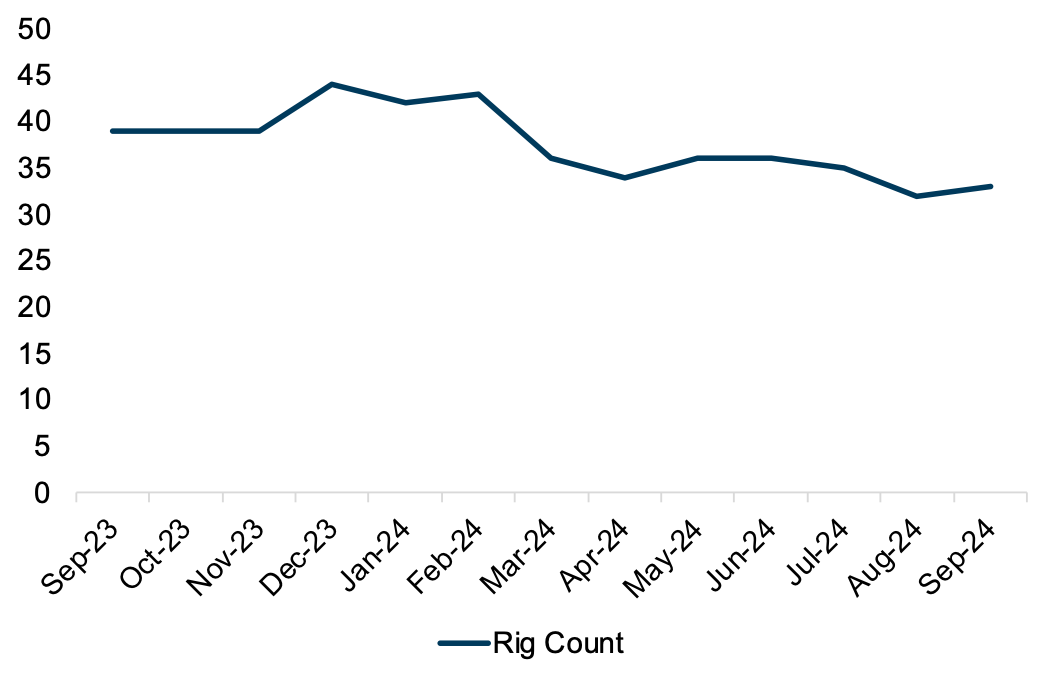

In the longer term, things look much more positive. There are already indications that LNG demand is rising faster than previously expected. Shale operators across the board are looking to lower their capital expenditures without negatively impacting production, and the data shows that they have been very successful in the Haynesville Basin. Over the twelve months leading up to September 2024, rig counts decreased by 15.4% YoY, while production only decreased by 10.1% over the same period (for additional detail, see Mercer Capital’s 3Q 2024 E&P Newsletter). If this trend continues, the decreased clearing price for natural gas operators in Haynesville will cause operations in that area to be economical once again.

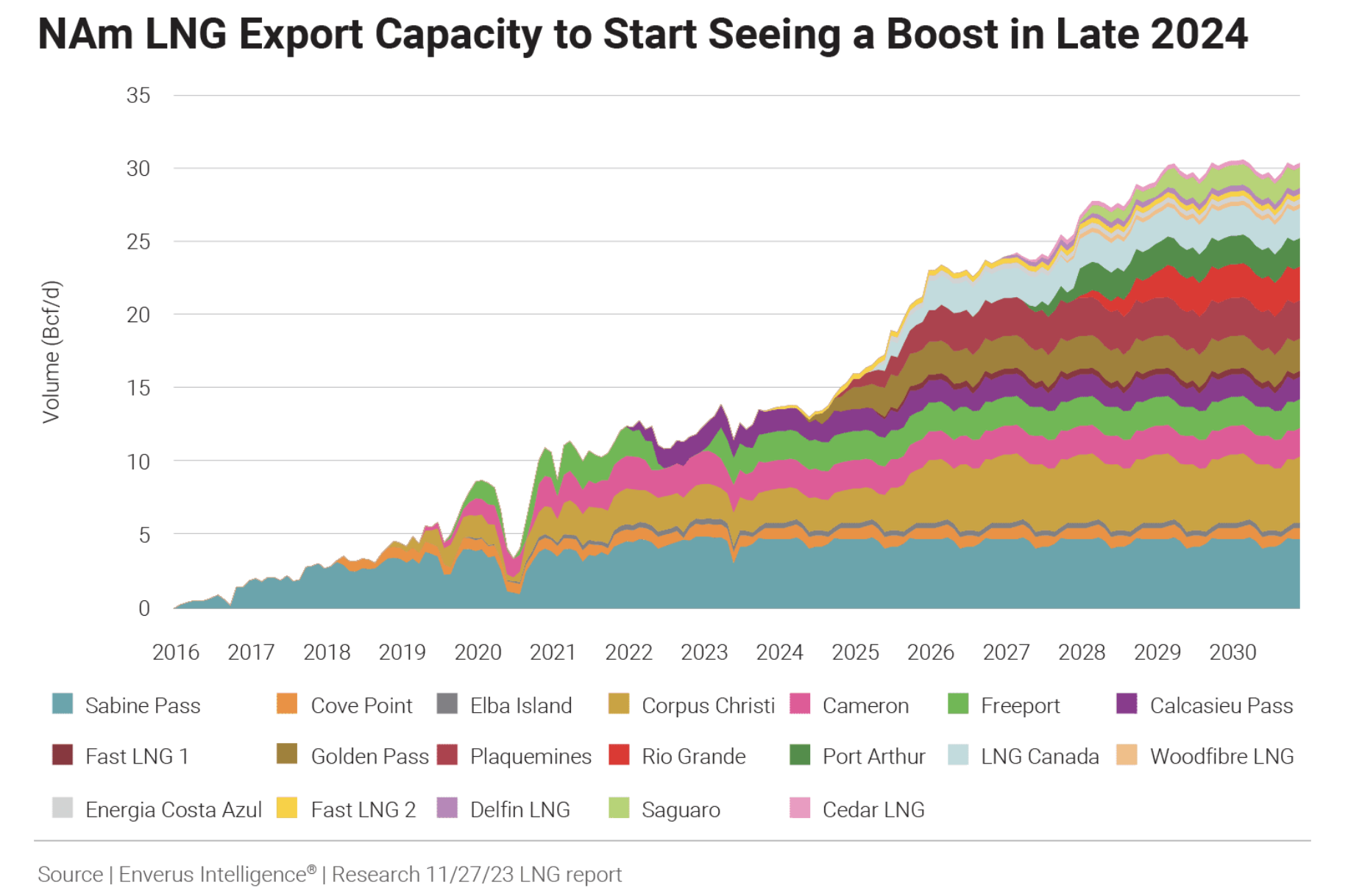

In December 2023, Hart Energy published a report predicting that U.S. LNG capacity will increase from 13 Bcf/d in 2024 to 25 Bcf/d by 2030. Per Hart Energy, Haynesville will be a critical provider of this additional capacity, as the Haynesville is expected to provide 13Bcf/d of that additional demand, making it the dominant provider of a massively ballooning market. One can see the gap between short-term and long-term expectations by comparing the production numbers above with the changes in capacity shown in the graph below (courtesy of Enverus Intelligence).

While current production is low, companies are making significant investments in expanding their LNG export capacity. Naturally, a large portion of these exports will be occurring in the Haynesville Basin. But put simply, there are good times ahead.

Mercer Capital has assisted many clients with various valuation needs in the oil and gas industry in North America and globally. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Additional Sources:

- Assorted data from Shale Experts

- Assorted data from the U.S. Energy Information Administration

- “Haynesville/Bossier Shale Information & Statistics”

- “Haynesville Region Drilling Productivity Report”

Energy Valuation Insights

Energy Valuation Insights