Haynesville’s Gigantic Gas Resurgence Could Be A Winner In LNG Export Race

Ever since producers took some big financial beatings after prices plummeted a few years ago, the Haynesville Shale play has positioned itself for an economic resurgence. For those following natural gas production in the U.S., this should not come as a surprise. It has a lot going for it.

Haynesville’s Wells – Bigger, Faster, Stronger

Consider the following:

- It’s a behemoth of a gas field that produces enormous wells. It’s been known for some time that the Haynesville has potential, but that is being realized further as more experience is developed among operators. For example, long lateral wells (some now stretch nearly two miles each) can produce up to 24 bcf of natural gas. Compared to the nearby Eagle Ford Shale, whose wells produce 12-15 bcf of natural gas, the Haynesville wells are big. In today’s low gas price environment, this matters quite a bit.

- The formation is more naturally pressurized than many others. This means, among other things, that more gas is produced in the first year. This is important, considering how expensive it is to drill these wells, and in turn, it means higher rates of return for investors (since time can erode returns according to present value theory).

- Breakeven prices have fallen. According to Chesapeake, which has the largest acreage position in the Haynesville, breakeven prices are currently between $2.00–$2.25 mcf. Even with price differentials of about $0.60 to Henry Hub, this provides an opportunity for profitable wells. Two or three years ago, this was considered an improbability.

Investors have noticed. Amid the land rush for liquid plays such as the Permian Basin, some investors have quietly spent billions to reposition themselves in the Haynesville over the past few years at relatively low valuations. The most notable of which is Jerry Jones’ $620 million investment in Comstock Resources over the summer. Comstock has been one of the leading players in the basin for years and is confident that their experiences, amid a rough recent financial history, will propel them going forward. Lesser known private companies such as Aethon Energy and Indigo Natural Resources (which has contemplated going public) have also poured substantial investments into the play in the past few years.

LNG Exports – A New Proverbial Finish Line

That said, one of the vexing problems that the natural gas sector often has is getting the product to relevant markets. The current situation in the Permian Basin is a prime example. Even though gas production is there, it doesn’t matter much if it can’t easily and inexpensively get to where it’s needed. And while the Haynesville has had its own struggles in this area, there may be solutions on the horizon to provide some relief. This is where the Gulf Coast LNG export resurgence comes into the picture.

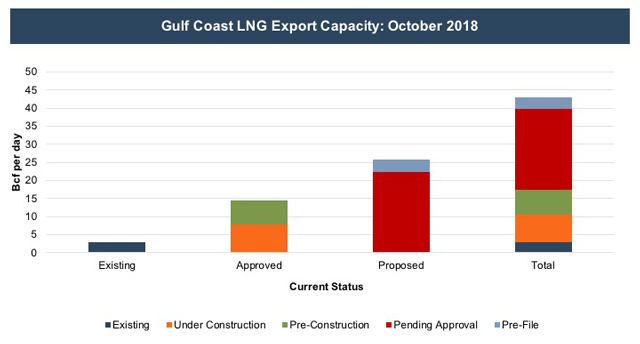

Currently, the ability to export LNG is relatively trivial. The continental U.S. has only two facilities operating with less than 4 bcf of capacity per day. That’s about to change. The Gulf Coast alone has nearly 8 bcf per day capacity under construction and another 6.8 bcf per day has been approved. Over 26 bcf per day has additionally been proposed. Facilities are being proposed up and down the coast from Brownsville, Texas to Pascagoula, Mississippi.

Along with capacity, transportation is getting easier too. The widening of the Panama Canal has certainly helped. In addition, certain transit restrictions on LNG vessels were lifted just last month. Over the past two years, 372 LNG transits have passed through the canal; and incredibly, earlier this year three tankers crossed at the same time. This is incentivizing the investment and engineering race to get capacity built and shipped to foreign markets. Most recently, Germany initiated stepstoward installing an LNG import facility.

Haynesville’s Head Start – A Shorter And Cheaper Race To Run

In the race to chase efficiencies, the Haynesville’s proximity to the Gulf Coast provides a big opportunity for investors.

What are the options to service the strongly growing demand? There’s a plethora of potential gas sources in the U.S. to fit the bill. Currently, the largest supply is the Marcellus and Utica shales in Appalachia, and this would seem to be a natural fit except that there is a problem. Prices for gas in the region are far below Henry Hub prices. In addition, transportation costs tower above other plays due to the multi-state journey it needs to take to get to the Gulf Coast. By the time the gas arrives at its destination, it would almost certainly lose money for producers. Margins are simply too tight right now in the gas business and efficiency is becoming increasingly critical.

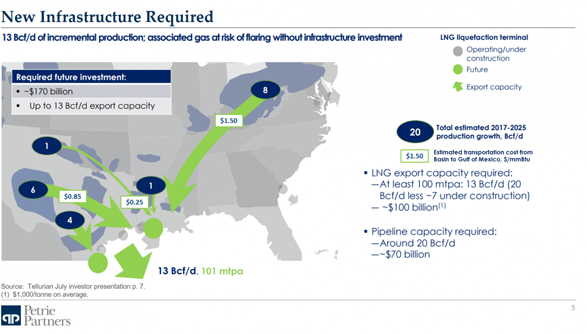

In the race to chase efficiencies, the Haynesville’s proximity to the Gulf Coast provides a big opportunity for investors. At a recent conference, Tom Petrie, a leading energy investment banker, gave some estimates of transportation costs from proximate U.S. gas basins. Not surprisingly, the Haynesville was by far the cheapest at $0.25 per mcf.

In a business where the window for profitability is small, pennies per mcf matter a lot. Naturally this dynamic calls for more localized gas. Considering the Gulf Coast concentration of LNG facilities, the Haynesville, Eagle Ford and other nearby plays may have a leg up with proximity and infrastructure ability to get gas to facilities.

The Haynesville looks like it could have an international role to play in energy markets going forward. That is a golden opportunity to create value. As for the Marcellus and Utica shales in Appalachia, they might miss out on this one. It makes one wonder, why haven’t LNG applications shown up in Pennsylvania yet?

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights