Hedging And Bank Retreats Complicate Royalty Aggregators’ Valuation

As the clouds begin to clear from the oil patch storm that began three months ago, management, analysts and investors are wondering what is going to happen next. Has the proverbial storm system passed? Is it time to venture out and rebuild, or are we still in the eye of the hurricane, with the back wall on its way? Both are possibilities.

As for management teams of royalty aggregators and MLPs, they have mostly given up on gambling on a specific outcome for now. The ones who have initiated new policies are battening down the hatches for another wave to come through. Of the six publicly traded upstream royalty aggregators (VNOM, MNRL, FLMN, KRP, BSM and DMLP) most either suspended guidance or locked down their hedging positions over the last few months so they don’t have to extend their risk profiles. “We really only have today what we have in front of us, which is a strip, and we had to make the tough decision based on the first quarter being one of the biggest cash inflows that we’re going to have over the next five quarters or six quarters, based on where the strip is today,” explained Travis Stice of Viper Energy Partners, LP. This rationale makes sense considering the motives of various stakeholders, particularly bankers.

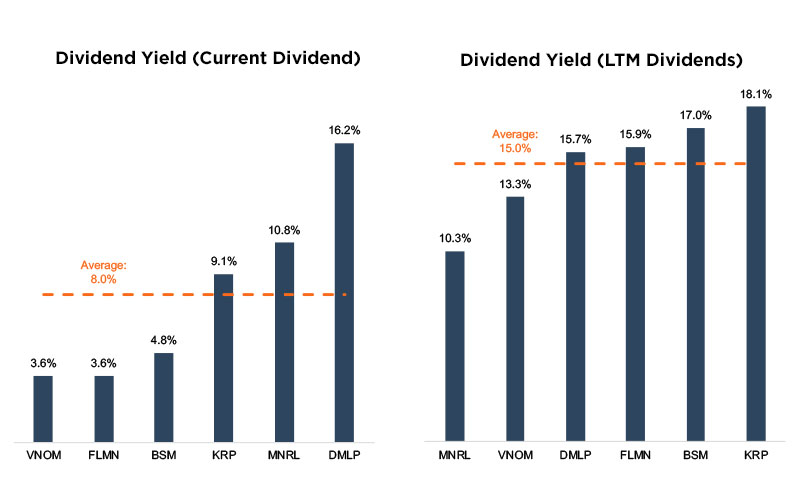

Just about every public aggregator has had their borrowing bases shrunk by their bankers, typically in the range of 20%-25%. This is not a big problem per se for most as they did not have much debt leverage anyway, but it is indicative of the recoil mentality going on. Another indicator of this mentality is the cut in distributions. Kimbell and Viper dropped payout ratios substantially for the short-term. Thus, changing yields significantly. The charts below show this before/after effect of reduced payouts as of last week.

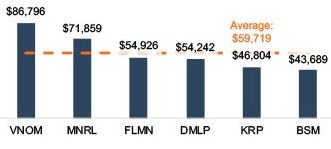

Dorchester is the outlier here, but it is paying out 140% of its earnings right now which is unsustainable. It will have to pull back its payout ratio sometime, perhaps sooner rather than later. In fact, one of the most dramatic examples of this pullback was Blackstone Mineral’s recent announcement that they were selling $155 million of choice Permian royalty interests for an average of $86,111 per flowing barrel. This does not appear to be non-core acreage they sold either. In fact, it is a significant premium compared to what they are trading at as of early June and is on par with Viper whose assets are almost entirely Permian based. It’s also a big premium to average private transaction ranges of $40,000 per flowing barrel that was cited in my last column.

Considering values have fallen significantly, it might be fertile ground for more acquisitions, but management teams generally don’t seem to think so (Kimbell’s Springbok acquisition did happen in late April as an exception). Sellers’ mindsets are stickier and although prices are low, bid ask spreads remain wide. “From our perspective though, the seller’s expectations remain robust, and rightfully so. This is an asset class that’s highly valuable, where if it’s in the best areas, there will be activity over time. There will be production over them and likely growth over time. And so sellers’ expectations will remain, I think, relatively high and they’ll be patient,” said Daniel Herz of Falcon Minerals. This mentality was consistent across analyst calls.

Where does that leave aggregators from a valuation perspective? That is more complicated. The change in prices and the mixed bag of hedgers vs. non-hedgers makes it more challenging. A more specifically constructed discounted cash flow analysis will become as relevant as ever as opposed to benchmarking metrics against guidelines or an index. Why? Hedging is just that – hedging. It boxes in commodity price ranges and limits downside, which banks want. It also limits upside, which shareholders do not want. Several aggregators are hedged in varying degrees through 2020 and into 2021 as well. This makes comparison trickier. Prices have already risen to nearly $40 per barrel in West Texas which is faster than many expected. It may bob up and down this year, but what if the supply shock sends prices on a march upward? It could leave hedged aggregators behind and either undervalued or overvalued. It also de-links several of these entities as a more direct proxy to commodity prices and makes it a more fluid exercise in which to attempt to intrinsically value this aggregator group or any royalty company or asset.

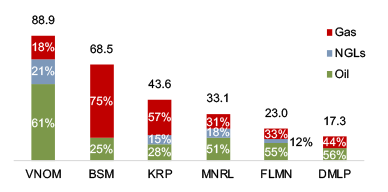

Commodity mix matters too. Oil has been on the downside of a roller coaster, while gas has been stuck at the bottom for a while now, but has been more stable, local and predictable. As such, gas is becoming more popular than it was even six months ago. Chatter on analyst calls affirm this.

Lastly, shut ins and production drops are potentially looming as well. Most management teams believed it would impact them, but not significantly. In fact, it was portrayed as a good thing because it could preserve value for down the road as opposed to realizing little value today. Better to put food in the refrigerator for later than letting it rot on the table now, was the idea. (Not a bad idea by the way). However, if shut ins become more permanent, there will be no food for later. The proverbial fridge will go unplugged.

Valuations appear to have reset a bit, and from an EBITDA perspective, earnings are going to slide, but the market appears to think this will be temporary. How temporary will be the question. The recent OPEC+ meeting was an indicator that prices could rebound sooner rather than later, but that remains to be seen.

Whatever may happen going forward, it has been a turbulent ride the past few months. It is also a signal that things are strange when public aggregators stop aggregating and even go so far as to sell premium assets. It likely will not happen for very long, but it has turned some things upside down. That is both a risk and an opportunity.

Originally appeared on Forbes.com on June 9, 2020.

Energy Valuation Insights

Energy Valuation Insights