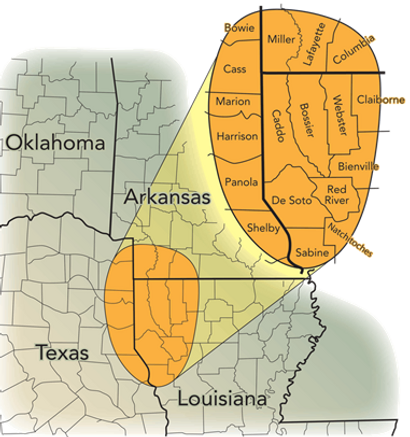

One of the most notable plays along the Gulf Coast is the Haynesville shale, which contains significant quantities of recoverable natural gas. While known for years to have high quantities of natural gas, the play was largely ignored due to the unfavorable cost/benefit economics of drilling pre-2008. [caption id="attachment_50294" align="aligncenter" width="410"]

Source: Venergy Momentum[/caption]

Source: Venergy Momentum[/caption]

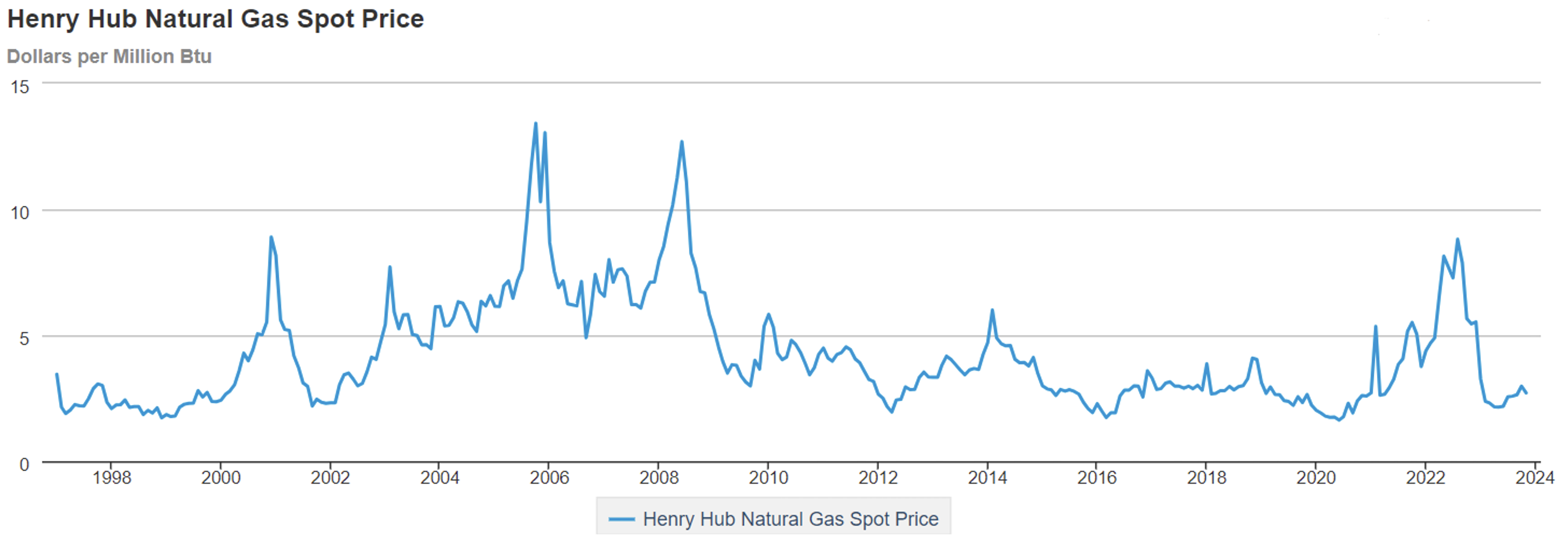

Depressed in 2023, Natural Gas Prices Seek Recovery in 2024

Natural gas producers paused activity in the Haynesville shale throughout 2023 as natural gas prices dipped below $3/Mcf, the result of a combination of warmer-than-normal winter weather and new volumes reaching the market before the opening of new LNG terminals on the Gulf Coast. Natural gas prices dropped nearly 70% from $8.81/Mcf at the end of August 2022 to $2.74/Mcf at the end of November 2023.

[caption id="" align="alignnone" width="2824"]

Source: U.S. Energy Information Administration[/caption]

Source: U.S. Energy Information Administration[/caption]

Click here to expand the image above

Natural gas prices are expected to recover in the second half of 2024 in anticipation of new LNG terminals coming online at the end of 2024. Approximately 8.4 million mt/year of new capacity could be added by year-end 2024 on top of the 8.4 million mt/year of liquefaction capacity currently in operation, according to S&P Global Commodity Insights analysts. By early 2025, additions could rise to around 18 million mt/year, with the expansion expected to reach more than 53 million mt/year. LNG terminals are turning a domestic energy source in the form of natural gas into a globally traded commodity in the form of LNG. The impact is a likely increase in domestic natural gas prices stemming from global market demand for LNG.

Along the U.S. Gulf Coast, for which proximity to the Haynesville shale is advantageous from a transportation standpoint, LNG facilities expected to start commissioning work in 2024 include Venture Global’s Plaquemines LNG terminal in Louisiana, Cheniere’s midscale expansion of its Corpus Christi, Texas plant, and the QatarEnergies and ExxonMobil-sponsored Golden Pass LNG export facility in Texas.

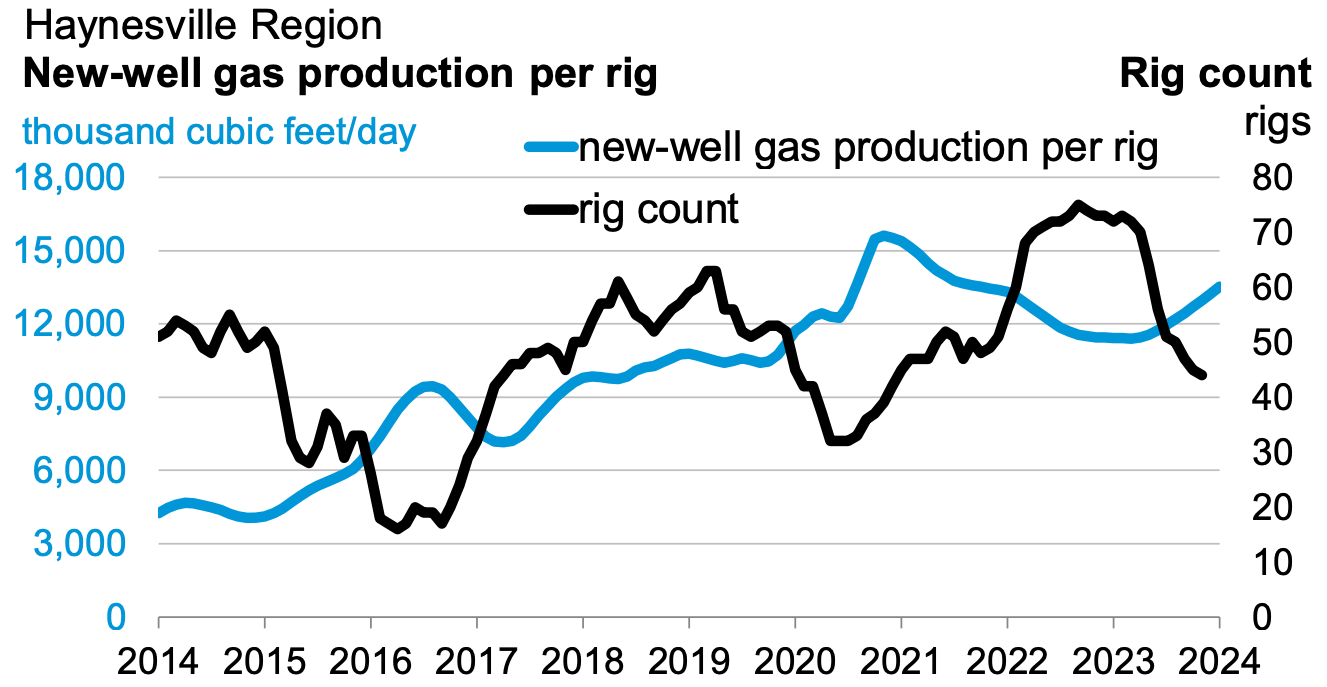

It should be no surprise that as natural gas prices declined in 2023, so did rig count. In the Haynesville shale, lower natural gas prices resulted in a decline in rig counts to 44 for the week ending December 29, 2023, down from 72 (a 40% decline) in August 2022.

[caption id="" align="alignnone" width="1327"]

Source: U.S. Energy Information Administration Drilling Productivity Report[/caption]

Along with the decline in rig count came a decline in day rates. The October 2023 composite Ark-La-Tex day rate was $24,447, down $1,129 from the May day rate. The 4.4% decline was the largest day-rate decline observed among the seven regions covered by the Enervus Day Rate Survey for 2023.

Source: U.S. Energy Information Administration Drilling Productivity Report[/caption]

Along with the decline in rig count came a decline in day rates. The October 2023 composite Ark-La-Tex day rate was $24,447, down $1,129 from the May day rate. The 4.4% decline was the largest day-rate decline observed among the seven regions covered by the Enervus Day Rate Survey for 2023.

Slim M&A Activity in 2023

Per the Shale Experts database, the Haynesville shale saw no meaningful M&A activity in 2023. This compares to seven deals in 2022, with the most recently closed deal occurring in July 2022 (Tellurian Inc.’s acquisition of natural gas assets from Ensight IV Energy Management LLC for $125.0 million).

M&A activity in 2023, however, was not completely dead despite the volatility in natural gas prices. WhiteHawk Energy LLC purchased mineral and royalty interests in the Haynesville basin from Mesa Minerals Partners II, LLC in August. WhiteHawk Energy previously acquired up to $105 million of natural gas mineral and royalty assets in the Haynesville basin in January 2023, covering approximately 350,000 gross acres.

As recently as November 15, 2023, Chevron was considering the sale of its assets in the eastern Texas portion of the Haynesville in response to its recent acquisition of Hess. Those Haynesville assets Chevron is considering selling produce approximately 40,000 cubic feet of natural gas per day and encompass approximately 70,000 acres of land. The potential sale is part of a larger plan by Chevron to divest approximately $15 billion of assets over the next five years. Considering the assets’ close proximity to LNG terminals along the Gulf Coast, the potential sale could be an attractive investment for prospective buyers as demand for U.S. LNG exports spiked upon Russia’s invasion of Ukraine in 2022. The estimated acreage value is in the low hundreds of millions of dollars.

On December 18, 2023, TG Natural Resources agreed to purchase 100% of the assets of Rockcliff Energy II, a portfolio company of Quantum Energy Partners, for $2.7 billion. Rockcliff operates over 200,000 net acres with more than 1.3 bcf/d of gross operated natural gas production. Per Akira Inukai, president and CEO of Tokyo Gas America, which owns the parent companies of TG Natural Resources, “The Texas and Louisiana areas where TGNR owns assets are in close proximity to new LNG export terminals where future gas demand is expected to increase, and TGNR has been seeking to acquire superior assets in those areas.”

M&A Activity Looking Stronger in 2024

Activity could pick up in 2024. Lower natural gas prices have crimped access to capital for certain private companies, making them attractive targets to publics.

One rumored deal on the horizon in 2024 is the potential acquisition of Southwestern Energy by Chesapeake Energy, which would create a combined company that would overtake EQT as the largest natural gas-focused E&P company in the United States based on market capitalization. Chesapeake Energy and Southwestern Energy have assets in both the Haynesville and Appalachian basins. Kimmeridge Energy Management, a 2% stakeholder in Chesapeake Energy, is positive on a potential deal. Per Mark Viviano, managing partner at Kimmeridge, “A potential merger between Chesapeake and Southwestern aligns with our views on industry consolidation, given the high degree of operational overlap, opportunity for material synergies, and valuation re-rating opportunity.”

About Mercer Capital

We have assisted many clients with various valuation needs in the oil and gas industry in North America and globally. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.