Is TXO’s Strategy Paying Off?

The TXO Energy Partners IPO

As our colleague Bryce Erickson said in a recent post, uncertainty rules the day in the upstream world despite strong demand for oil and elevated commodity prices. The war in Ukraine has contributed to this, but there is no way of knowing when or if it will wind down. Interest rates continue to rise, and recession fears loom. We believe the recent initial public offering (IPO) of TXO Energy Partners LP offers an interesting case study of how investors are responding to these mixed signals.

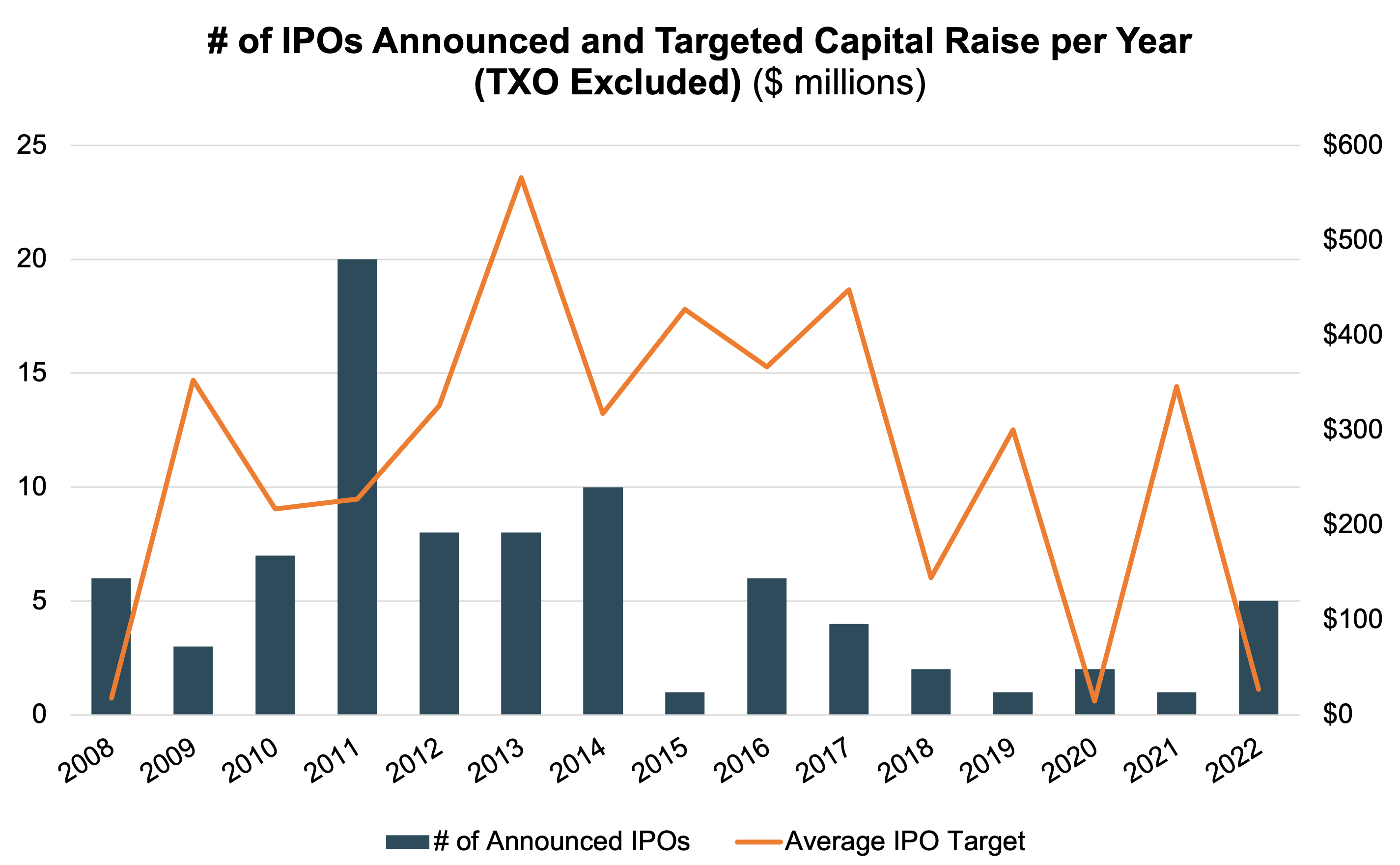

In the early 2010s, upstream IPOs were at a peak. In 2011, there were no fewer than 20 IPO announcements, and the average targeted capital raises for IPOs climbed to well over $550 million by 2013. Things went sour from there. Since 2015, there have only been 22 IPOs announced. Due in part to the pandemic, average IPO targets for upstream firms have sunk to $15 million. Despite the vital role of oil and gas in the US economy, the market for public equity in upstream firms can certainly be described as underweight due to few publicly available investments in the sector and, thus, fewer opportunities for investment. Despite this, 2022 featured more IPO announcements than any year since 2016. Soaring commodity prices are bringing back interest in upstream investments. Upstream managers are confronting investor uncertainty by strengthening their balance sheets, using their historically high revenue to continue ramping production, and making generous distributions to shareholders.

Click here to expand the image above

Valuation Considerations

TXO Energy Partners LP, formerly MorningStar Partners LP, is an E&P firm that IPO’d on the New York Stock Exchange on January 26, 2023, under the ticker TXO. The Partnership is focused on plays in the Permian and San Juan Basins within Texas, New Mexico, and Colorado. TXO offered five million common shares with a target price of approximately $20 per share (which would raise about $100 million). The IPO also allowed underwriters to purchase another 750,000 common shares at the IPO price net of discounts and commissions.

One of the most important factors when considering TXO’s fundamentals is its recent acquisitions. In late 2021, they purchased 24,052 leasehold acres, a CO2 plant in the Permian Basin, and additional CO2 assets in Colorado (these assets are referred to as the “Vacuum Properties”). Within just a month, they also acquired an additional 21,112 gross leasehold acres in the Permian (the “Andrew Parker Acquisition”). Finally, they increased their interest in the Vacuum Properties in August 2022. Every transaction involved proven producing wells.

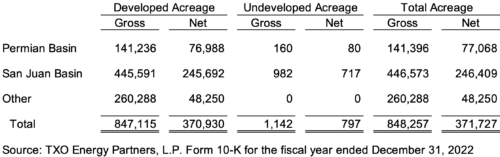

Further, these wells have an average decline rate of just 7% (compared to a 9% projected decline rate across all TXO’s assets). By making such acquisitions, TXO noticed a short-term impact on its income statement but has ultimately set itself up for reliable, comparatively non-risky cash flows. The table below summarizes TXO’s developed and undeveloped acreage as of December 31, 2022. One observation immediately jumps off the page: despite the recent Permian Basin acquisitions discussed above, TXO’s acreage is heavily weighted towards developed acreage in the San Juan Basin. Questions arise from this observation: Is TXO indicating a shift in priorities from the San Juan Basin to the Permian Basin? Will the company sell some of its San Juan Basin assets and use the proceeds to purchase more developed acreage in the Permian Basin after 2023? At the very least, the company’s focus is clearly on developed acreage rather than undeveloped acreage (see below for management’s immediate investment plans).

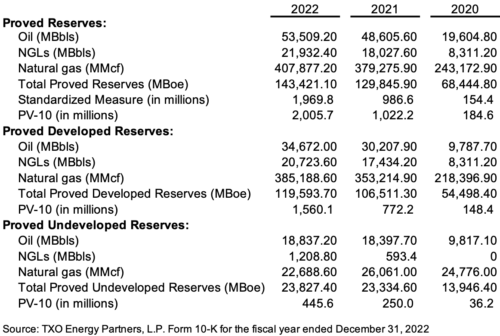

In its S-1 statement, TXO reported PV-10 as of year-end 2021 of $986.6 million, compared to established firms like Diamondback Energy ($21.8 billion) and Black Stone Minerals ($972.1 million). A summary of TXO’s reserves per its most recent 10-K is shown below.

Despite its comparatively small war chest of reserves (per the table above this paragraph showing the company’s reserve portfolio as of December 31, 2022), management has indicated that they anticipate most of their 2023 expenditures will go towards optimizing existing wells rather than continuing to make acquisitions to grow the wells in their portfolio.

In the nine-month period ended September 30, 2022, revenues for TXO were $204.0 million, as opposed to $138.9 million for the same period in the prior year. TXO’s Vacuum and Andrews Parker acquisitions helped boost production volumes by almost 1,200 Mboe. Higher commodity prices also provided a significant boost, with realized prices for both oil and gas over 50% higher than in 2021. TXO reported net income of $14.6 million for the nine-month period ended September 30, 2022, compared to $25.2 million for the nine months ended September 30, 2021 ($0.58 per unit and $1.01 per unit for each respective year). The year-over-year decrease in net income was primarily attributable to higher production expenses in 2022 as well as transportation and tax expenses. On a year-over-year basis, production expenses climbed 105% as of September 30, 2022, while taxes and transportation expenses climbed 92%. Management stated that both items increased due to the two Vacuum and Andrews Parker property acquisitions. The higher production cost is a function of the acquired properties’ strong focus on oil production, which is typically more expensive on a Boe basis than natural gas production. The increase in taxes and transportation expenses was caused by rising commodity prices and changes in the Partnership’s production mix.

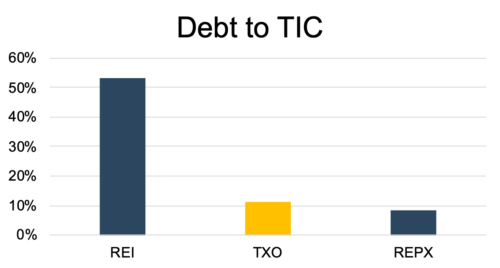

In its S1, TXO portrays itself as holding a conservative balance sheet. Per Capital IQ, at the end of 4Q 2022, their largest liability was a credit facility with a balance of $113 million. Paying this debt down was the primary reason for their IPO. TXO has one of the smallest debt-to-capital ratios among its peers, as shown below. With less leverage, TXO is a comparatively less risky investment, all else being equal. This makes it particularly attractive to investors preparing for a potential downturn in the larger economy or upstream space.

What is interesting about these financials is that despite tailwinds from commodity prices and growth from new acquisitions, YTD EPS shrank by 50%, yet TXO filed for an IPO anyway. Why? First, the EPS shrinkage is related to their acquisitions. Second, TXO’s stated strategy plays to the current desires of the market. As mentioned earlier, TXO is spending most of its money optimizing existing wells. Despite this, they still have plans to identify new opportunities. When describing how they are going to go about spending the portion of their capital dedicated to development, TXO stated that “over the next 24 months we anticipate that approximately half of our development activity will be focused on drilling new wells, virtually all of which we expect to be conventional, vertical wells.”

Additionally, 97% of TXO’s current wells are conventional plays rather than more risky shale operations. By focusing on conventional plays, TXO can take advantage of slower production volume decline rates and earn steady cash flows to pay out dividends. The Partnership clearly had a distribution-focused plan in mind setting up their firm, as their Partnership Agreement specifies that every quarter it must pay out virtually all cash available for distributions. At one point, the S1 directly states that “our primary goal is to maximize investor returns through cash distributions and flat to low production and reserves growth over time.” At the time of this blog post, TXO has yet to make its first distribution since its IPO. How it sets its policy relative to other smaller upstream companies will be an interesting phenomenon to watch.

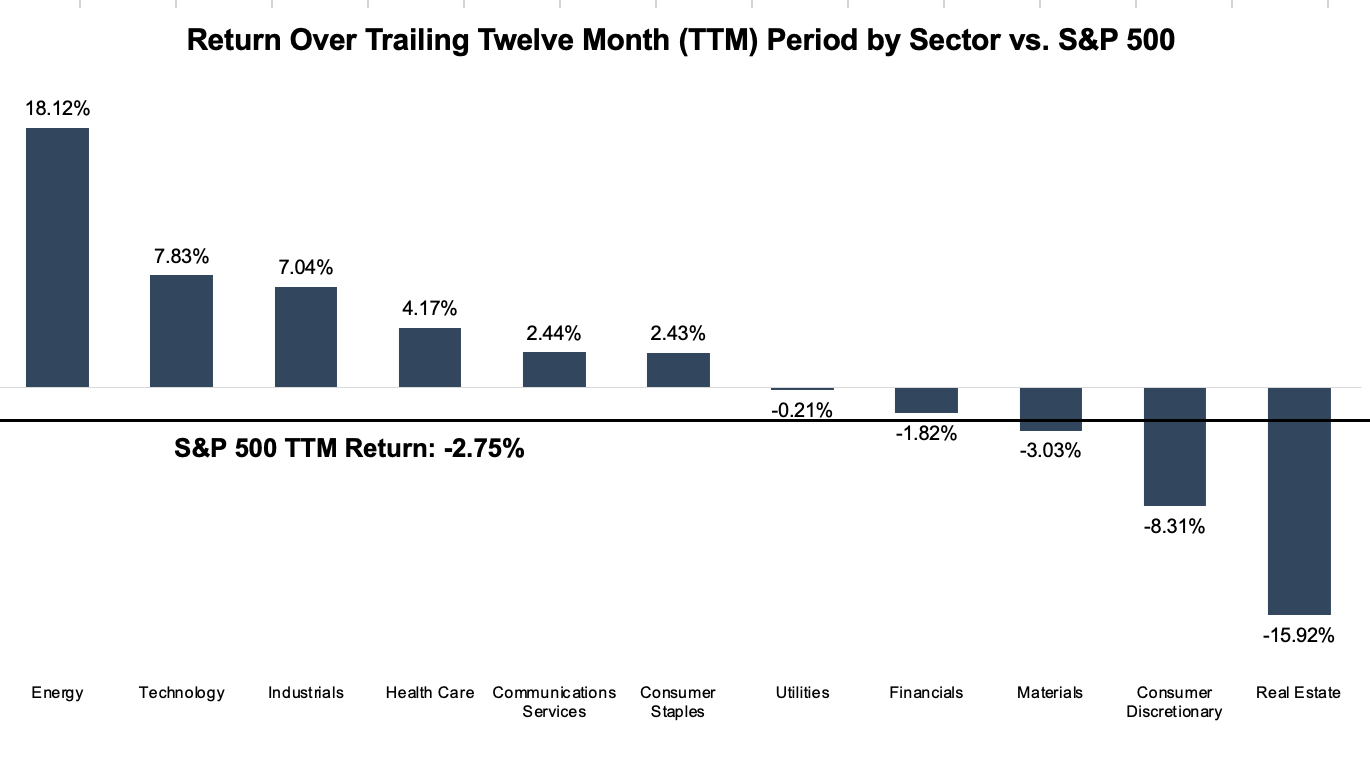

The market does not currently seem to be valuing aggressive growth programs. Instead, investors are looking for companies like TXO with conservative balance sheets, large amounts of distributable cash, comparatively non-risky reserves, and steady, stable growth.

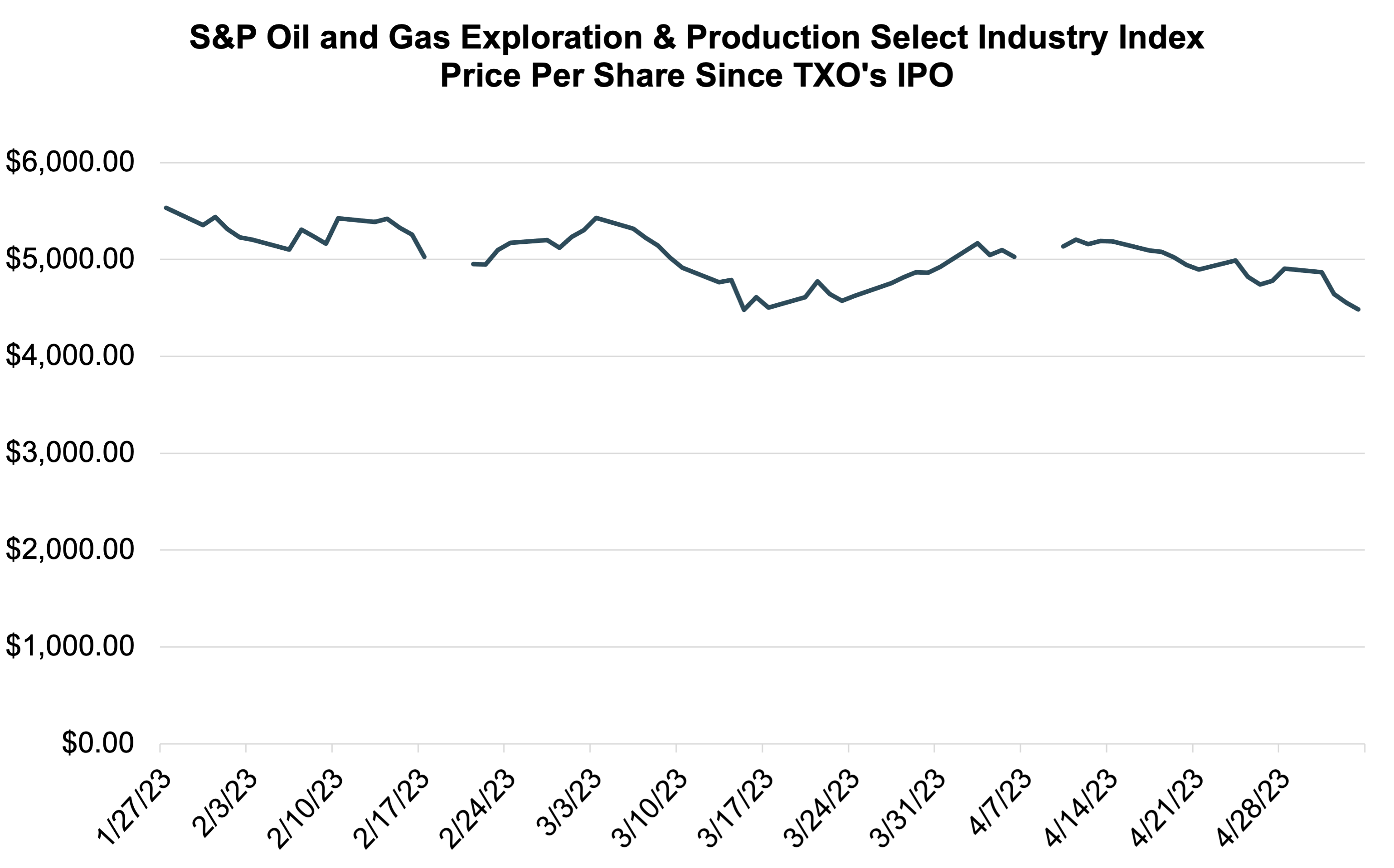

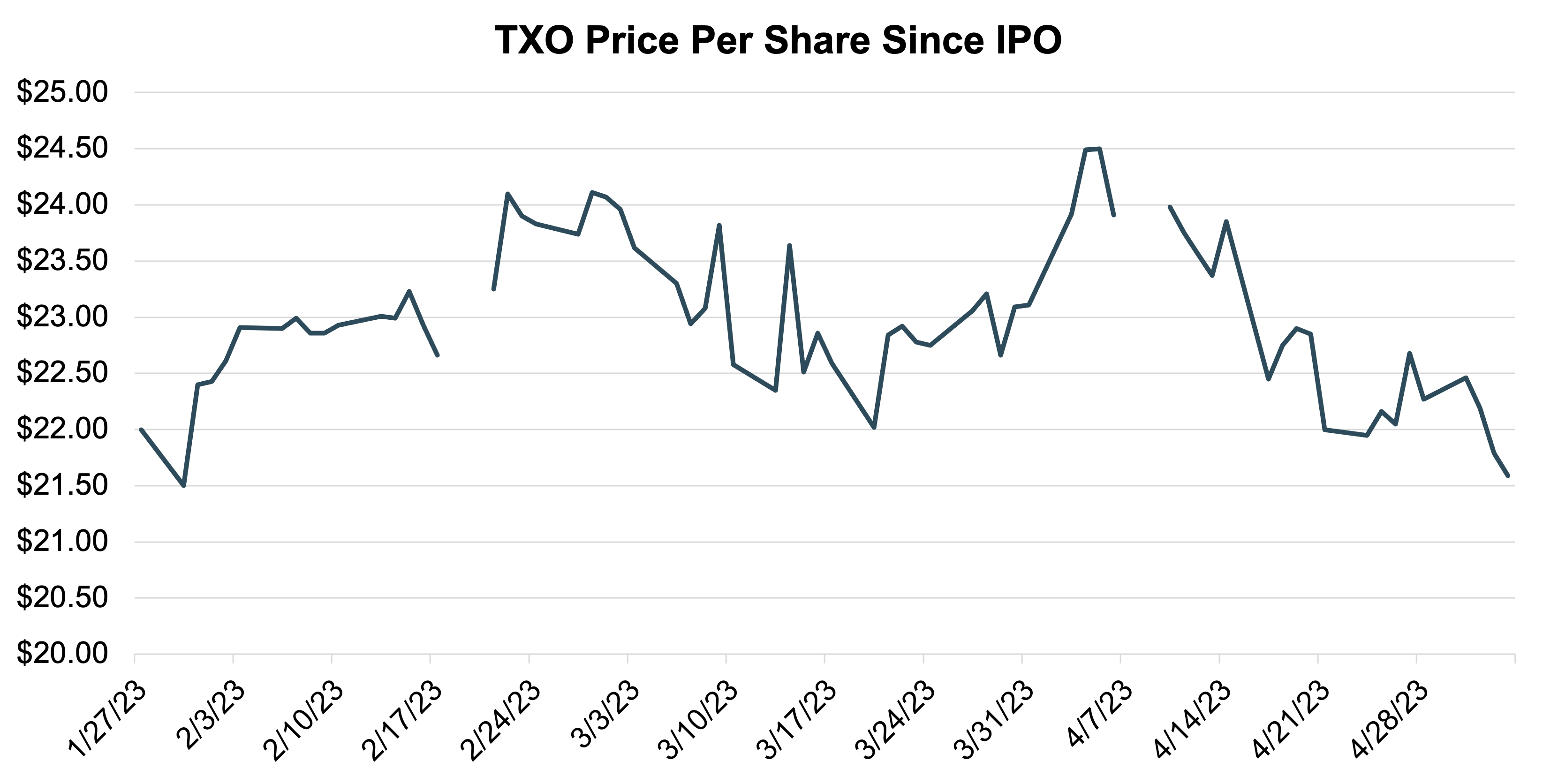

All of this naturally begs the question of whether TXO’s strategy is paying off. Between TXO’s IPO date and May 4, the market price of the Standard and Poor’s Exploration & Production Select Industry Index has decreased by about 19%. On the other hand, TXO’s share price has only decreased by just under 2%.

With such a high degree of uncertainty in the market, investors are bracing themselves for Murphy’s Law to take effect. They are seeking shelter in stable growth, safe balance sheets, and frequent dividend payments. TXO offered that, so investors have rewarded it.

Mercer Capital has its finger on the pulse of the energy industry. As the oil and gas industry evolves through these pivotal times, we take a holistic perspective to bring you thoughtful analysis and commentary regarding the full hydrocarbon stream, including the E&P operators and mineral aggregators comprising the upstream space. For a more targeted energy sector analysis that meets your valuation needs, please contact a member of the Mercer Capital Oil & Gas Team.

Energy Valuation Insights

Energy Valuation Insights