Leading America Toward Energy Independence

Hart Energy LIVE’s America’s Natural Gas Conference 2023

Last week, I attended Hart Energy LIVE’s second annual America’s Natural Gas conference in Houston. The speaker roster included CEOs of companies operating in the Utica (Encino Energy) and Haynesville shales (Rockcliff Energy) and Green River basin (PureWest Energy), investment bankers, private equity investors, and consultants, among others. CO2 emissions reduction, demand for LNG exports despite inadequate transportation and storage infrastructure, and the energy transition were three of the more prevalent themes discussed. Below are a few highlights I would like to share with you.

LNG Demand Is Increasing; Pipeline and Storage Infrastructure Is Lacking

Chad Zamarin, Executive Vice President of Corporate Strategic Development at natural gas processing and transportation company Williams, pointed out that natural gas is the only energy source that is simultaneously reliable, affordable, and emissions-light. The big challenge facing the U.S., as Zamarin sees it, is the lack of infrastructure, namely pipeline capacity (cumulative growth of 27% since 2010) and storage capacity (cumulative growth of 12% since 2010), relative to the demand for natural gas (cumulative growth of 56% since 2010). Case in point — the Appalachian basin is one of the cheapest sources of natural gas in the U.S. Despite the basin’s close proximity to New England, the region imported liquified natural gas (LNG) from Russia (pre-Ukraine war) due to unaddressed hurdles in building a new pipeline.

When it comes to LNG demand outside of the U.S., Zamarin noted:

- The U.S. currently has 26 Bcf/d of large-scale liquefaction either in operation or under construction.

- 15 Bcf/d of LNG export projects have been federally permitted and await final investment decisions.

- LNG exports account for 10% of U.S. demand and are expected to double to 20% by 2032.

- S. LNG exports comprise approximately 20% of global LNG demand and are forecasted to grow to 30% by 2030.

Dumitru Deidu, partner at global management consulting firm McKinsey, observed that from an export standpoint, Europe is driving near-term demand for U.S.-sourced LNG, with southeast Asia beyond China driving long-term demand.

Efforts Are Being Made to Build-Out LNG Infrastructure

Blake Webster, partner at Quantum Energy Partners, a private equity firm focused on investments in the sustainable energy ecosystem, featured portfolio company Mexico Pacific’s efforts to improve LNG infrastructure. Located in Puerto Libertad, Sonora, Mexico, the company’s project is focused on constructing and operating an LNG facility and dedicated natural gas pipeline that will deliver responsibly sourced natural gas from the Permian Basin to Asian markets. This strategic location in Western Mexico will reduce shipping distances and provide better netback pricing to Asia than U.S. Gulf Coast LNG projects that rely on the Panama Canal, which can add up to 30 extra shipping days to Asia.

Mexico Pacific offers a fee-for-service business model, contracting with Conoco Phillips, ExxonMobil, and Shell under 20-year off-take agreements. In 2026, the company expects to commission its first two LNG trains and its dedicated pipeline (the Sierra Madre pipeline) from the Permian basin. Mexico Pacific can export up to 28 million tons of LNG annually (approximately 4 Bcf/d) under a full site development if all six prospective LNG trains are contracted and fully operational.

Natural Gas Naturally Reduces CO2 Emissions

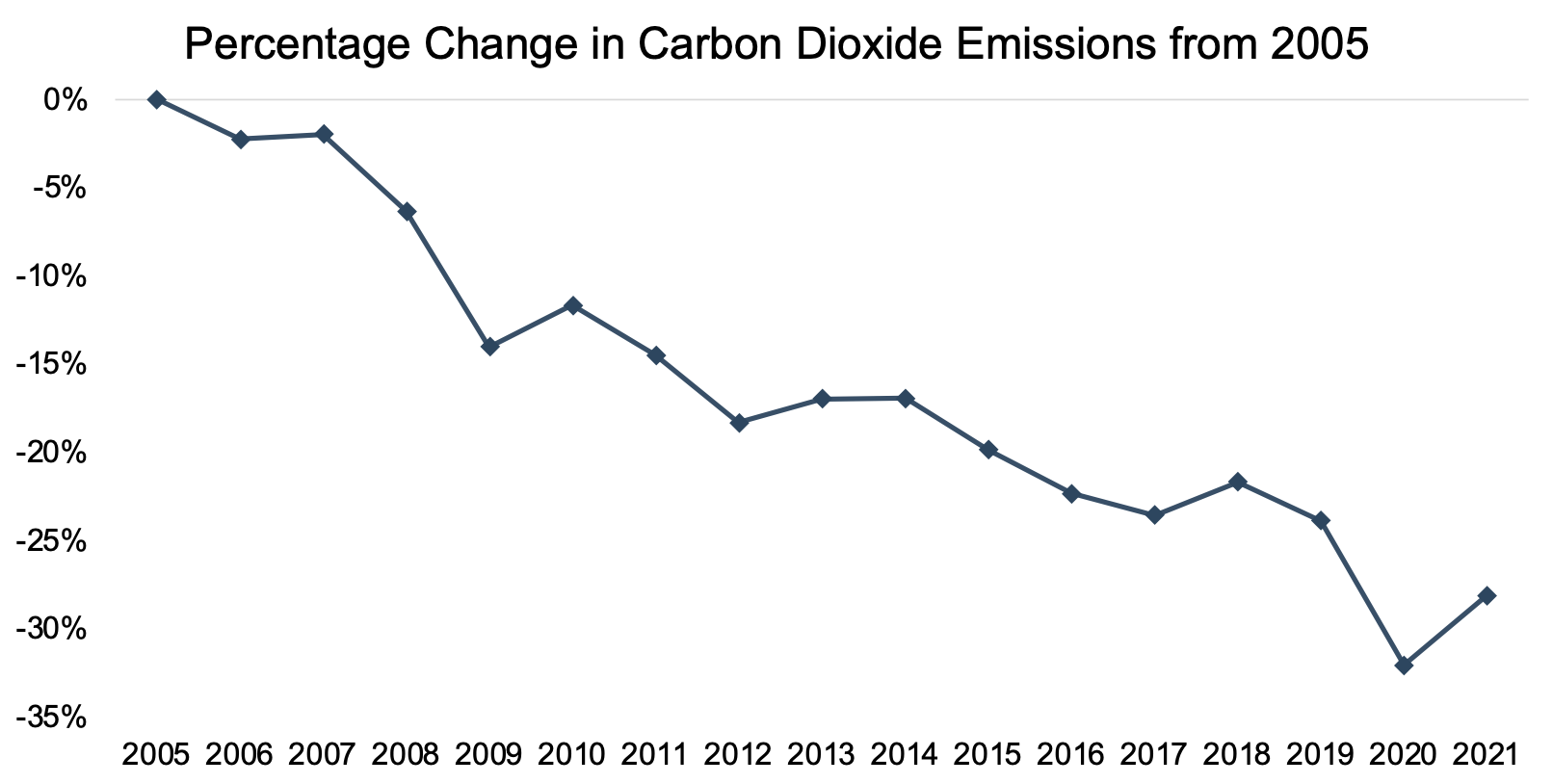

Zamarin also noted that as natural gas market share has increased since 2005, CO2 emissions have declined. As a point of reference, I refer to the chart below, which is based on data from the Global Carbon Project (2022). The data indicate a decline in CO2 emissions of nearly 30% in the U.S. since 2005.

In 2005, the natural gas market share was 18%, with 2.4 billion metric tons of CO2 produced. By 2022, natural gas market share had more than doubled to 39%, with only 1.5 billion metric tons of CO2 produced. Natural gas was directly responsible for approximately 500 million metric tons of CO2 reduction during this time period. Zamarin further noted that replacing all 230 operating coal plants in the U.S. with natural gas-fired generation would cut CO2 emissions by 34%, equivalent to removing all U.S. gasoline cars off the road today.

The Energy “Transition”

Robert Bryce has written about energy, power, politics, and innovation for more than three decades, including six books on energy and innovation, including most recently, A Question of Power: Electricity and the Wealth of Nations. Bryce offered the following data points on the energy transition, or as he sees it, “what energy transition?”

- In 2022, U.S. natural gas-based electricity grew 2.0 times faster than wind and solar-based electricity combined.

- At least 407 rejections of/restrictions on U.S. wind energy projects have occurred since 2015.

- At least 171 rejections of/restrictions on U.S. solar energy projects have occurred since 2017.

- The Department of Energy has estimated that the U.S. needs 57% growth in high voltage Currently, the U.S. has approximately 240,000 miles of high voltage transmission, with only 1,700 miles built per year from 2008 to 2021. At that rate, it would take approximately 80 years to build the 136,800 miles needed to reach the DOE’s goal.

Concluding Thoughts

The global dependence on U.S. shale is expected to increase in the forthcoming years, driven by ensuring energy security and affordability. The growth of the LNG industry is facilitating expansions in natural gas production, which is likely to result in a surge in demand and pricing in the foreseeable future. While renewable energy sources will continue to make headlines, the stability of energy grids still relies on the consistent supply of reliable natural gas to complement wind and solar power. Moreover, U.S. gas producers are actively striving to enhance their environmental performance by certifying their methane intensity, thereby contributing to a cleaner gas production process.

Energy Valuation Insights

Energy Valuation Insights