Limited Partners, What Are Your Rights?

Legal Rights and Valuation Considerations For Your Limited Partner Interest

A partnership is a business owned by two or more individuals. In its most basic form, a partnership typically falls into one of three categories: a general partnership, a joint venture, or a limited partnership. While the specifics of these three types can vary depending on the goals of the business, they all share similar features.

For the purposes of this post, we will be examining benefits and rights we have come across in performing valuations over various types of partnership structures and their relation to value. And while Mercer Capital has worked with complex legal structures in the scope of our work, we do caveat that we are examining these issues through the lens of informed business professionals. If you have specific matters regarding your investment that require legal advice, you should consult an attorney.

How Does a Limited Partnership Work?

A limited partnership is a type of partnership that has at least one general partner and one or more limited partners. Under this structure, the partners unite to conduct business and only the general partner is liable beyond the extent of the amount of money invested. Each limited partnership has a general partner who is responsible for the day-to-day management of the business. While a general partner is typically an individual, it is not uncommon for separate entities, such as a management company, to fill this position. This type of general partner structure is seen commonly in private equity and hedge funds. The general partner has complete control of operations, and they assume the debts and liabilities of the partnership. Since the general partner is in charge of the successful operation of the business, they are typically compensated in the form of management fees, performance fees, or both depending on the structure and purpose of the entity.

Because limited partners do not participate in the day-to-day operations, their financial liability is limited to the amount of invested money into the partnership.

In addition to a general partner, the limited partnership also has to have at least one limited partner. Sometimes referred to as “silent partners,” limited partners do not have to do anything except invest in the business and receive a share of the profits. Because limited partners do not participate in the day-to-day operations, their financial liability is limited to the amount of invested money into the partnership, similar to owners (members) in a limited liability company (LLC). In order to maintain this “limited” status, though, limited partners may not contribute more than 500 hours of work towards the limited partnership or else they may be considered a general partner.

The tradeoff to this financial limit of liability is that limited partners have no say in management or business decisions. They are also only compensated in the form of dividends or capital appreciation pro rata or as otherwise agreed upon in the partnership agreement. More to the point, they do not have the ability to request dividends or sell/partition the underlying assets directly. We will show further below how this lack of ability directly impacts value of a limited partner’s interest.

However, this does not mean that limited partners do not have other rights and entitlements to ensure that their investment is appropriately utilized. First, we will look at activities in which limited partners may participate and still retain limited liability.

Safe Harbors

As mentioned, limited partners are not only limited by the amount of their investment but also in their involvement in business operations. However, there are some activities in which a limited partner can engage which will not impact their level of liability, these are known as, “safe harbors.” These activities may include the following:

- Serving as an agent, contractor or employee of the company

- Serving as a board member, officer, director or shareholder of the company, provided they do not own a majority share

- Providing consultation to the general partner(s) of the company

- Requesting or attending a meeting of partners

- Acting as a surety for the partnership to guarantee or assume its specific obligations

- Voting on changes that may affect the nature of the limited partner relationship

Many limited partners do not realize they have these safe harbor activities allowing them to exercise a level of power while protecting their liability and maintaining limited status. Best practice, of course, would be to consult your partnership agreement or attorney to ensure that no conflicts arise.

Rights as a Limited Partner

Although not a requirement, the vast majority of partnerships are born through a partnership agreement (sometimes referred to as a limited partnership agreement or “LPA”). This contract is between two or more partners and is used to establish the rules and responsibilities of the parties conducting business, such as capital contributions, withdrawals, profit and loss distribution, and financial reporting.

Contained within partnership agreements are specific rights and duties outlined for both limited partners and those acting as the general partner. The rights of limited partners in a limited partnership, LLP, or even an LLC theoretically share similar to those of a shareholder in a corporation.

In the absence of specific provisions in a partnership agreement, there are generally rights available to a limited partner in conjunction with the safe harbor activities mentioned above. A summary of rights we have encountered include the following:

- Voting within safe harbor provisions

- Inspection of books and records

- Ability to bring derivative action

- Assignment of interest without dissolution of partnership

- Right to withdraw from partnership

- Application for dissolution of partnership if business purpose cannot be fulfilled

Specific rights available to you may vary depending on the facts, circumstances, and structure of your partnership. To fully understand what is available to you, be sure to review your partnership agreement or consult an attorney.

Valuation Considerations

Knowing your rights as a limited partner is important so that you can stay informed and ensure that your investment is deployed and utilized correctly. Another important item to understand is the valuation considerations of your limited partnership interest.

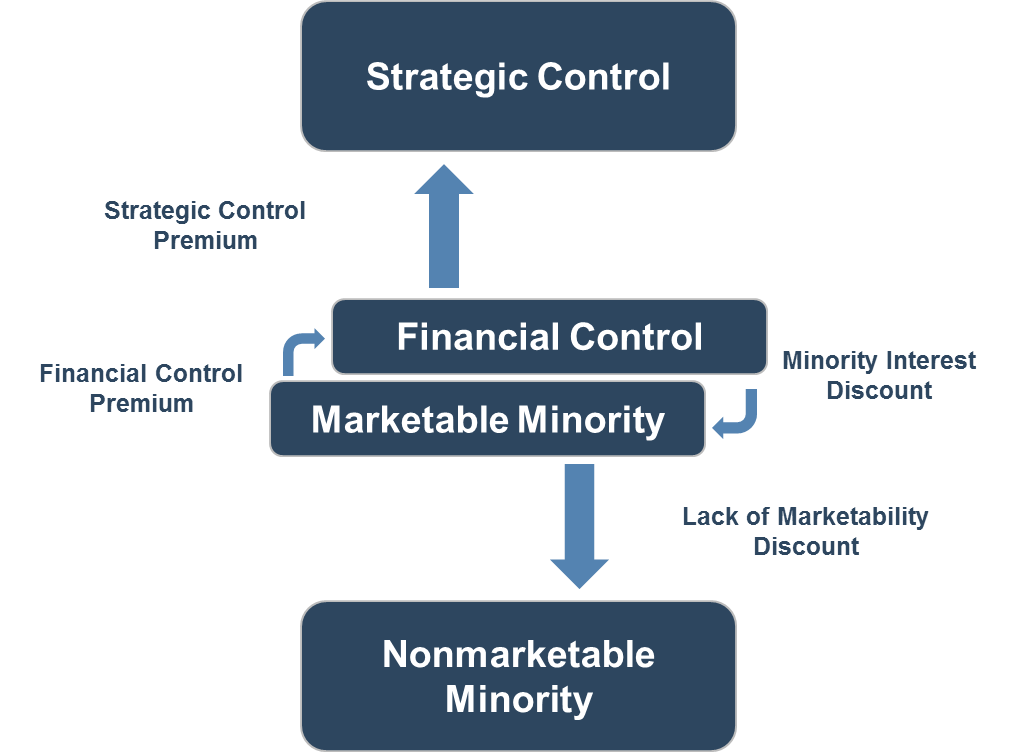

We can differentiate the roles and responsibilities fairly easily as general partners do the work to ensure successful operation and limited partners provide the capital, let the general partners work, and earn a passive return. From a valuation standpoint, it may be harder to conceptualize how much a limited partner interest is worth compared to a general partner, a different limited partner, or even the entire partnership as a whole. We refer to our “Levels of Value” chart to provide a visualization of where a limited partnership interest may fit in terms of a valuation hierarchy.

A limited partner that owns a minority interest in a private partnership falls at the bottom of this chart. But how do we get down there from the net asset value?

There are likely multiple tiers of discounts applicable to a limited partner interest. The first is the portion attributable to the general partners. This is made in accordance with their capital contribution, though it is frequently small as the general partner receives payment through management fees.

Secondly, because limited partners lack the ability to make the decisions afforded to general partners, they will likely be subject to a minority interest discount. There have been observed ranges of 7-10% for the minority discount, but this amount can be much higher or even lower. It all depends on specific characteristics of the partnership. This brings us to the marketable minority level of value in the above chart. However, limited partner interests aren’t typically marketable, meaning limited partners do not have the ability to freely dispose of their interests like they could sell shares in a publicly traded company for instance.

Knowing your rights as a limited partner is important so that you can stay informed and ensure that your investment is deployed and utilized correctly.

This brings us to our final discount, the marketability discount. There is a wide range of potential marketability discounts and again, these depend on the characteristics of the partnership in question. At Mercer we have seen marketability discounts range between 20-45%, but similar to the minority interest discount, these discounts can go much lower or even much higher depending on multiple factors regarding the partnership. Frequently, these discounts are considered in tandem with any minority interest discount applied, and the total effective discount must be considered.

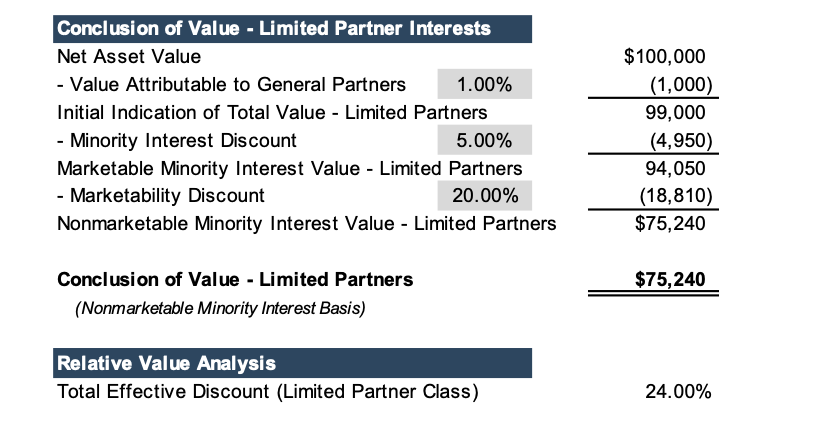

An example of this tiered discounting is provided below of a limited partnership with a total Net Asset Value of $100,000 and a general partner interest of 1%. In order to illustrate the calculation of value at the non-marketable minority interest level, we have used a minority interest discount rate of 5% and a discount for lack of marketability of 20%.

The result of the calculation yields a conclusion of value at $75,240 with an effective discount rate of 24%. This shows how a limited partner whose net asset value share of $95,000 can be discounted to reflect the lack of control over their position and the lack of marketability for a sale or assignment of interest.

Conclusion

Knowing rights entitled to a limited partner in connection with understanding the relative value of their investment enables limited partners to make informed decisions.

Mercer Capital is an employee-owned independent financial advisory firm with significant experience (both nationally and internationally) valuing assets, companies, and partnership interests in the energy industry (primarily oil and gas, biofuels, and other minerals). Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors.

As a disinterested party, we can help you understand the fair market value of your limited partnership interest. Contact a Mercer Capital professional today to discuss your limited partnership valuation questions in confidence.

Energy Valuation Insights

Energy Valuation Insights