M&A Activity in the Bakken

Crude prices in North Dakota are even lower than the already depressed price of WTI and Brent. This is largely due to region’s insufficient pipeline network. This creates high transportation costs, and in turn decreases realized wellhead prices. As of June 15th crude oil prices in North Dakota were almost 20% lower than the price of WTI and 21% lower than the price of Brent. On top of lower revenue per barrel, the Bakken faces higher initial drilling costs than many other mineral reserves. Together these factors mean that production is not economically feasible in the current low price environment. As of June 17, even as oil prices rose to above $45 per barrel, Baker Hughes reported that there were only 24 rigs operating in North Dakota. In order to survive, when producing is no longer economically feasible, production companies are selling “non-core” assets to generate the cash.

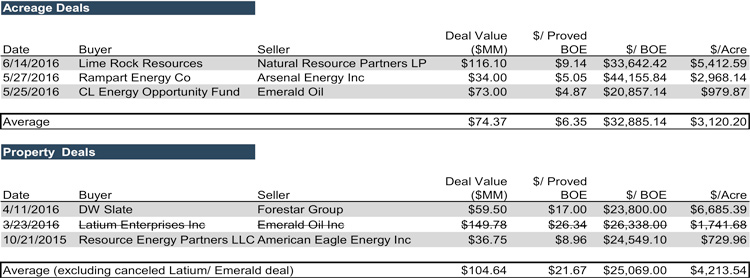

In October of 2015, Occidental Petroleum Corporation sold its Bakken Assets to Lime Rock Resources. This sale marked the first exit of the downturn by a major oil company from the Bakken Shale formation. So far, M&A activity of Bakken assets has slowed in 2016, but most Bakken assets are selling for heavy discounts making them attractive to buyers. Some other recent transactions in the Bakken are highlighted below.

The sale of Emerald Oil’s Bakken assets can help us understand the current pricing environment. Emerald Oil, an independent producer in the Williston Basin, filed for Chapter 11 Bankruptcy on March 22 and was delisted from the NYSE on March 24. During this time, Emerald had entered into a deal with Latium Enterprises to sell acreage at $1,740 per acre, but the transaction fell through. Last month, Emerald Oil announced that CL Energy Opportunity fund would buy substantially all of their assets for $73 million which equates to less than $980 per acre. This represents a 44% haircut in just two months. What we see in this case is a continuing fall in the value of acreage as investors learn that assets in the Bakken can be bought at even lower discounts if they wait for the continuation of low oil prices to put more and more pressure on distressed buyers to make a sale. While this is a stalking horse offer, they are not likely to get much higher on the final deal. As Emerald oil became more desperate to reorganize in order to avoid Chapter 7 bankruptcy, they became more willing to sell at a lower price.

Oil Prices are expected to remain low into the third quarter of this year and possibly into the second quarter of 2017. As the price of oil remains depressed, many companies avoiding bankruptcy or reorganizing through Chapter 11 will be forced to sell non-core assets in order to generate cash. In a distressed market, it is extremely important to push for the best offer possible. Mercer Capital can help you understand the true value of your assets and can help you through the Chapter 11 Process.

Energy Valuation Insights

Energy Valuation Insights