M&A in Appalachia: Moving Day in the Neighborhood

This week we look back at transaction activity and trends in the Marcellus & Utica plays in 2017. When I reflect about what happened, for whatever reason, images resembling something out of an episode of Desperate Housewives come to mind whereby the prying eyes of the marketplace peer out of their windows, surveilling old competitors that pack up and leave whilst new, and sometimes mysterious, neighbors move in.

But first, we point out recent articles that forecast that the U.S. may challenge Saudi Arabia and Russia in total oil production sometime in the next two years. For someone who has followed and worked within energy markets for many years, including before the shale fracking revolution, this is something I wasn’t sure I’d ever read. Of course it is likely a temporary surge once the OPEC/non-OPEC agreement expires, but it’s still fascinating to contemplate.

The Appalachian Basin

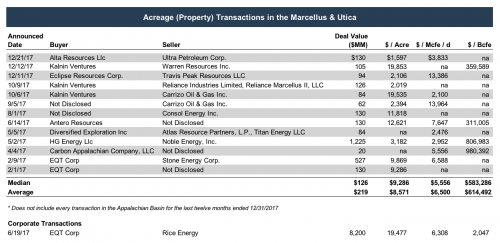

OK, now back to the subject at hand. Transaction activity in the Marcellus & Utica shale was generally steady throughout the year and individual transactions were typically smaller in size. Rationale for these deals were varied, from bankruptcy sales, to consolidation of acreage, strategy changes to more liquid rich plays, leverage reduction, and more. The chart below, drawn from Mercer Capital’s forthcoming 4Q17 Marcellus & Utica-focused newsletter, provides transaction detail and comparative valuation metrics.

Back Up the Truck, Dear! We’re Moving onto Bigger and Better Things.

In one of the few large transactions last year, Noble Energy exited the Marcellus in order to focus on more liquid rich regions with its $1.2 billion sale to HG Energy. David L. Stover, Noble Energy’s Chairman, President and CEO, commented, “The Marcellus has been a strong performer for Noble Energy over the last few years, which is a direct result of the success of our employees’ efforts. During the same time period, we have also significantly expanded the inventory of investment opportunities in our liquids-rich, higher-margin onshore assets, which has led us to now divest our Marcellus position.”

In a similar vein, Carrizo Energy, a Houston-based producer, exited the play, utilizing the familiar “non-core” term to describe its position in the Appalachia region. S.P. “Chip” Johnson, IV, Carrizo’s President and CEO, commented, “With the announced sale of our Marcellus package, we have continued to execute on the divestiture program we outlined earlier this year. We expect to close the sale of both of our Appalachian packages during the fourth quarter and remain on track to reach our divestiture program goals.” Carrizo has stated its desire to focus on liquid plays and reduce leverage which these sales went towards achieving.

Look Honey, Those Folks Are Moving Out … and Their Wells Are Just Perfect for Us!

Looking at the other end of the rationale spectrum, there were a number of buyers that were enthusiastic about the opportunities that companies like Noble & Carrizo left behind. Kalnin Ventures, a Thai-based coal and power generation company, made their 5th acquisition in the play in the past two years by buying positions from Carrizo’s and Reliance Marcellus II, LLC. They also made a 6th in December by taking out Warren Resource’s entire Northeast Marcellus position for $105 million. In strategic contrast to Carrizo’s sentiment, Kalnin thinks these assets fit within their strategy of acquiring profitable, consolidated, low-risk assets that provide strong cash flow yields.

Believe it or not, Kalnin’s activity actually did not top the acquisition charts in 2017. That distinction belonged to EQT, beginning with EQT’s $527 million bankruptcy auction bid of Stone Energy’s Marcellus and Utica acreage in February 2017. EQT, who made nearly $9 billion of Marcellus & Utica acquisitions in 2017, went on to highlight the year by its merger with Rice Energy in June 2017. Steve Schlotterbeck, EQT’s president and chief executive officer said, “This transaction complements our production and midstream businesses and will deliver significant operational synergies to help us maintain our status as one of the lowest-cost operators in the United States.” For a more in-depth valuation oriented discussion on the Rice Energy transaction, a prior Mercer Capital blog post breaks down the deal.

Are You Watching This, Sweetie? So, What Kind of Deal Did They Get?

Valuations for these transactions were relatively spread out depending on the metric observed, but were within an observable range. Kalnin appeared to pay more than other buyers in a few deals from a $/Acre perspective (over $19,500/Acre), but it can be argued that they baked in economies of scale in light of their overlapping positions and infrastructure. EQT appeared to buy in a very tight range from a $/Mcfe/Day perspective ($6,300-$6,600). That said, due to the steady activity and universe of buyers and sellers, pricing and values appeared to be fairly consistent. We shall see if that continues in 2018, and speaking of that – we wish you all a happy 2018!

A Plug for Mercer Capital

Mercer Capital has significant experience valuing assets and companies in the energy industry. Because drilling economics vary by region it is imperative that your valuation specialist understands the local economics faced by your E&P company. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Energy Valuation Insights

Energy Valuation Insights