M&A Focus: The Pioneer-DoublePoint Deal

After what felt like an eternity of quiet transaction activity in the O&G industry, the M&A market in 2021 has been off to a more active start in 2021.

According to S&P Global Market Intelligence, the industry announced 117 whole-company and minority stake deals in the first quarter of 2021, an increase of 28 transactions from the same period last year. The combined deal value has also increased from $3.86 billion to $26.4 billion, as supermajors like Exxon Mobil Corp., Royal Dutch Shell PLC and Equinor ASA divested assets and corporate consolidation continued. The trend continued early in the second quarter.

In this post, we discuss the Pioneer-DoublePoint transaction (the “Transaction”) that could foreshadow for more M&A activity to come.

Transaction Summary & Asset Details

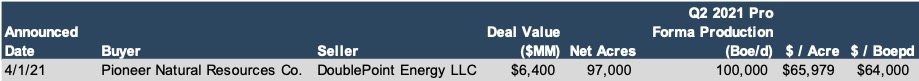

On April 1, 2021, Double Eagle III Midco 2 LLC, wholly owned by DoublePoint Energy, LLC, announced that it entered a definitive purchase agreement to sell all leasehold interest, subsidiaries, and related assets to Pioneer Natural Resources Company (PXD) in a transaction valued at $6.4 billion. DoublePoint is a Fort Worth, Texas-based upstream oil and gas company that is backed by equity commitments from funds managed by affiliates of Apollo Global Management, Quantum Energy Partners, Magnetar Capital, and Blackstone Credit.

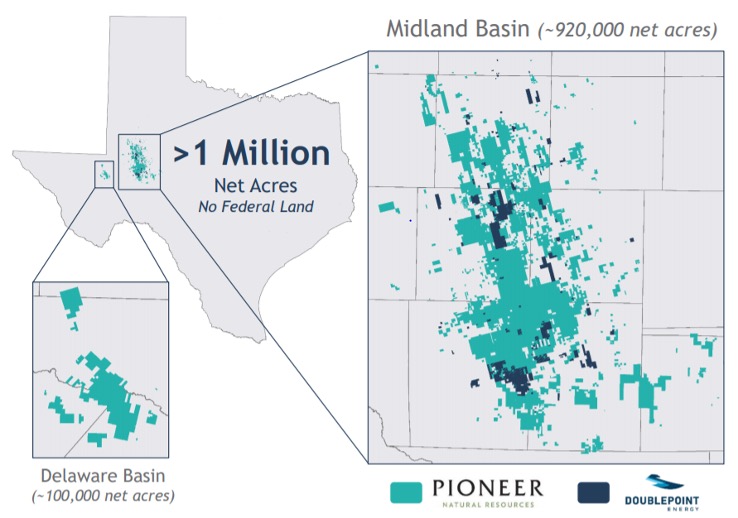

According to Piconeer’s Investor Presentation, the Transaction adds approximately 100,000 Tier 1 Midland Basin net acres to Pioneer’s existing assets. The bolt-on acquisition will lead to the combined company owning approximately 920,000 net acres in the Midland Basin, making it the largest producer in that area. The deal is expected to close in the second quarter of 2021.

The purchase price is comprised of the following:

- Approximately 27.2mm shares of Pioneer stock (PXD) based on Pioneer’s closing share price as of 4/1/2021 ($164.60). After closing, PXD shareholders will own approximately 89% of the combined company and existing DoublePoint owners will own approximately 11%.

- Cash of $1.0bn

- Approximately $0.9bn of liabilities that includes debt of $650mm at 7.75% and approximately $300mm of reserve-based lending and working capital

Per PXD Investor Presentation

The Transaction implies the following valuation metrics:

Pioneer anticipates approximately $175 mm in annual synergies related to G&A, interest, and operations. The company expects to save approximately $15 mm in G&A by reducing DoublePoint’s expense by 60% in the second half of 2021. Pioneer also plans to refinance DoublePoint’s bonds after closing to save roughly $60mm. Last, the company projects about $100 mm in operational savings. According to Pioneer’s Investor Presentation, the acquired acreage is highly contiguous and largely undeveloped, adding greater than 1,200 high-return locations. Although the exact amount Pioneer attributed to PDPs and PUDs is unknown, this suggests that PXD most likely associated option value to the undeveloped acreage in their purchase consideration.

Mixed Market Signals

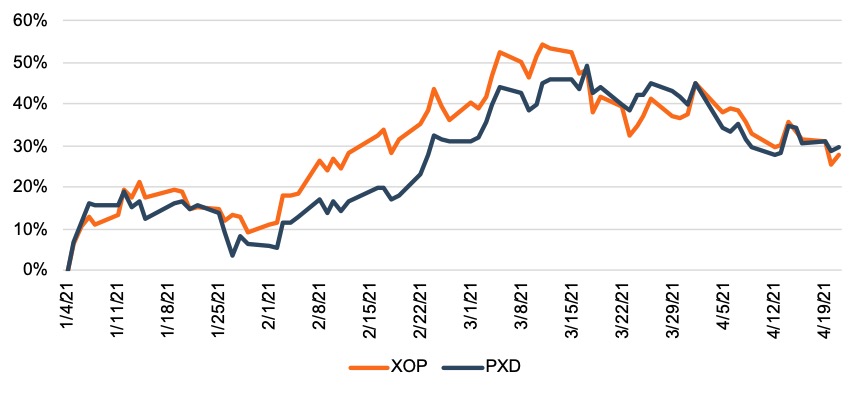

Investors responded relatively well the day of the announcement (prior to the press release), as PXD’s share price increased 3.64%, closing at $164.60 on April 1. However, the stock has since produced mixed signals. The next trading day, April 5, the stock closed at $152.18, a 7.55% decrease from the announcement. The stock closed at $147.10 on April 21, a 10.63% decrease from April 1. The company has still performed well in 2021, as PXD share price is up 29.63% year-to-date. PXD has followed similar trends to the broad E&P value index (as proxied by the SPDR S&P Oil & Gas Exploration & Production ETF, ticker XOP) since the beginning of year, so this decrease may be geared more towards industry sentiment rather than deal reaction.

On April 5, 2021 Fitch Ratings released a statement that Pioneer’s ratings are unaffected by the company’s deal announcement with DoublePoint. On April 22, 2021 Fitch affirmed Pioneer’s long-term issuer default ratings and unsecured debt ratings at BBB. Fitch also assigned a BBB rating to Pioneer’s 364-day unsecured revolving credit facility. Fitch notes that their rating outlook for PXD is stable. Pioneer’s credit rating outlook is a testament to its strong balance sheet and 2021 estimated net debt / EBITDAX of 0.9x.

Conclusion

The Pioneer-DoublePoint transaction could set the stage for an active M&A market relative to a quiet 2020. Also, Pioneer’s Fitch Rating could serve as a positive signal for utilizing leverage in future deals. It will also be interesting to monitor deal values as it relates to what buyers are willing to pay for specific producing and non-producing assets (to the extent that the information is disclosed). If an industry recovery is in sight, transaction activity could continue its healthy pace, but also has the potential to soften if uncertainty looms, causing the bid-ask spread to widen if buyers and sellers are not on the same page.

We have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights