M&A in Marcellus & Utica Basins

Activity in 2021 Was Muted Relative to 2020

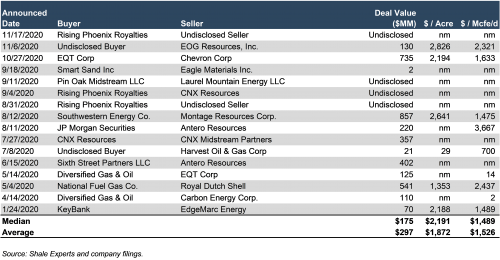

The three transactions in the Marcellus & Utica basins over the past year were just a trickle compared to the 16 transactions reported in the prior year for the Appalachian basins. The number of transactions in 2020 was more than double the seven transactions in 2019, driven in part by the relative price stability of natural gas as compared to oil which would naturally tend to favor M&A activity in these gas-heavy basins. One key observation of the transactions in 2020 was that companies were making critical decisions regarding where to operate on a forward-looking basis. Companies, such as Shell, took the position of divesting their Appalachia assets, while other companies, such as EQT, chose to augment their Appalachian footprint. The following table summarizes transaction activity in the Marcellus & Utica in 2020:

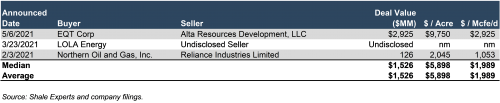

Appalachia transactions announced so far in 2021 are shown in the following table:

The decline in transaction activity in 2021 most likely indicates that anyone looking to get into or out of the Appalachian basins effectively did so in 2020, or was concerned with natural gas price volatility, which increased sharply in 2021 after several years of relative calm. However, that is not to say that the activity in 2021 was any less interesting. Notable changes in the statistics between the transactions in 2020 and 2021 include a sizable increase in the median and average deal values, price per acre, and price per production unit. Based on the much smaller sample size of 2021, the magnitude of these differences probably doesn’t mean too much. But one metric, production per acre (or MMcf/Acre), on an annualized basis, could be indicative of a greater focus on obtaining more productive assets in 2021 than the transactions observed in 2020.

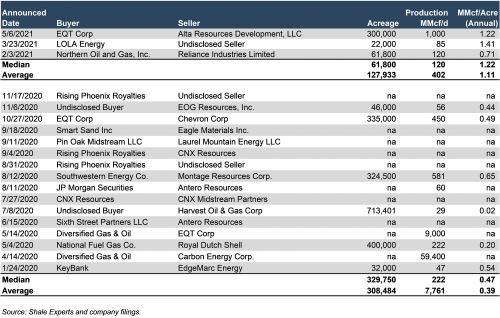

The following table summarizes the estimated annualized production per acre, including the median and average values, for the transactions in 2020 and 2021:

Buyers in 2021 seemed to target producing rather than prospective, assets, as indicated by, as indicated by the median and average annualized MMcf/Acre metrics. Irrespective of the smaller transaction count (sample size) in recent history, the minimum production density metric in 2021 (0.71 MMcf/Acre) was nearly 9% greater than the maximum metric observed in the 2020 transactions (0.65 MMcf/Acre), and 52% and 82% higher than the median (0.47 MMcf/Acre) and average ( 0.39 MMcf/Acre) metrics, respectively, observed among the transactions in 2020. Again, this back-of-the-napkin statistical analysis may fall far short of being arguably significant, technically speaking, but it’s pretty interesting as far as an eyeball test is concerned.

EQT Corporation Adds to Core Marcellus Asset Base

On May 6, EQT Corporation (NYSE: EQT) announced that it entered into a purchase agreement with Alta Resources Development, LLC (“Alta”), pursuant to which EQT would acquire all of the membership interests in Alta’s upstream and midstream subsidiaries for approximately $2.93 billion. EQT intended to finance the acquisition with $1.0 billion in cash, drawing upon its revolving credit facility and/or through one of more debt capital market transactions, and stock consideration consisting of approximately 105 million EQT common shares, representing $1.93 billion. The asset was comprised of approximately 300,000 core acres positioned in the northeast Marcellus region. Net production as of the transaction date was approximately 1.0 Bcfe per day, comprised of 100% dry gas. The transaction also included 300-miles of owned and operated midstream gathering systems and a 100-mile freshwater system with 255 million gallons of storage capacity. Toby Rice, President and CEO of EQT, stated that the acquisition represents an attractive entry into the northeast Marcellus while accelerating the company’s deleveraging path, providing attractive free cash flow per share accretion for EQT shareholders and adding highly economic inventory to the company’s robust portfolio. Mr. Rice also noted the transaction increases the company’s long-term optionality, and should accelerate its path back to investment grade metrics while simultaneously achieving its shareholder return initiatives.

Northern Oil and Gas, Inc. Acquires Non-Operated Appalachian Assets

On February 3, Northern Oil and Gas (NYSEAM: NOG) agreed to acquire certain non-operated natural gas assets in the Appalachian basin from Reliance Marcellus, LLC (“Reliance”), a subsidiary of Reliance Industries, Ltd., for total consideration of $175 million in cash and approximately 3.25 million warrants to purchase shares of NOG common stock at an exercise price of $14.00 per share. The transaction was expected to be funded through a combination of equity and debt financings and anticipated to be leverage neutral on a trailing basis and leverage accretive on a forward basis. At the effective date of July 1, 2020, the acquired assets were producing approximately 120 MMcfe/d of natural gas equivalents, net to Northern Oil and Gas. The assets were expected to produce approximately 100?110 MMcfe/d (or approximately 19,000 Boe/d) in 2021, net to Northern Oil and Gas, and consisted of approximately 64,000 net acres containing approximately 102.2 net producing wells, approximately 22.6 net wells in process, and approximately 231.1 net undrilled locations in the core of the Marcellus and Utica plays. Furthermore, an inventory of 94 gross highly-economic, work-in-progress (“WIP”) wells was slated for completion over the following five years by EQT. As of the transaction announcement, approximately $50 million of net development capital had already been deployed on the WIP wells, which was not subject to reimbursement by Northern Oil and Gas. The acquisition complemented Northern Oil and Gas’s then-existing approximate 183,000 net acreage portfolio in the Williston and Permian basins. As of year-end 2020, the acquired assets held an estimated 493 Bcf of proved reserves, of which approximately 55% were comprised of PDP reserves, with PV-10 of $269 million (at strip pricing as of January 20, 2021).

Nick O’Grady, Northern Oil and Gas’s CEO, commented, “This transaction furthers our goal of becoming a national non-operated franchise with low leverage, strong free cash flow and a path towards returning capital to shareholders. With this transaction, we expect increased opportunities to efficiently allocate capital and diversify risk, our commodity mix and geographic footprint.”

Conclusion

M&A transaction activity in the Marcellus & Utica shrank in number in 2021 relative to 2020. However, the relatively greater magnitude of production density represented by the transactions in 2021 could prove to be a bellwether of more “transformational” transactions to come in 2022 as companies stake their claim in the gas and gas liquids rich basins of Appalachia.

We have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights