M&A in the Bakken

Deals May Be Slow, But Production Remains Steady

Acquisition and divestiture activity in the Bakken for last twelve months has been minimal. The lack of deals, however, does not mean that activity or production hasn’t been meaningful. In fact, as mentioned in our most recent post, production has grown approximately 10% year-over-year through September with new well production per rig increasing over 29%. Also, while other major basins have been decreasing rig counts, the Bakken has remained steady year-over-year as of the end of September.

While the fundamentals of this basin are strong, relatively few companies remain interested. As such, deal activity has largely involved the familiar faces in the region. Companies with smaller positions in the region have continued to divest “non-core” positions as they focus their efforts in other regions. Contrast this trend to the controlling acquisitions or takeovers like those that have been popular in the Permian.

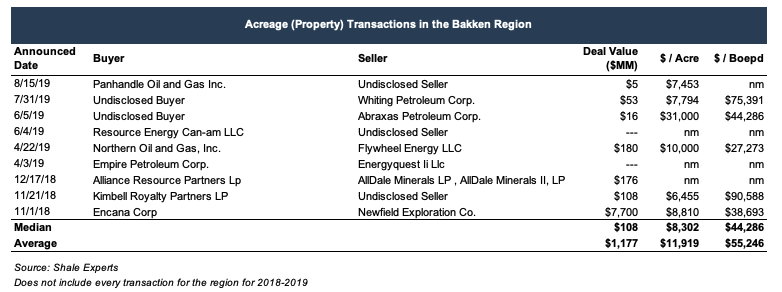

Recent Transactions in the Bakken

Details of recent transactions in the Bakken, including some comparative valuation metrics, are shown below.

Balance Sheet Cleanup: Whiting and Abraxas

A recurring theme observed throughout the year in multiple basins has been the optimization of assets. The theme continues in the Bakken for 2019 as transactions in the basin have primarily consisted of offloading portions of non-operated assets, the largest of which was the deal with Whiting Petroleum and an undisclosed buyer for $53 million. However, Whiting remains the third largest holder of net acreage in the basin.

Abraxas Petroleum also sold approximately $16 million in non-operated assets in June. These assets were not part of Abraxas’ core Williston position. However, Abraxas appears to be open to conversations with parties interested in acquiring both operated and non-operated assets, as the company is seemingly in deal talks with Whiting Petroleum.

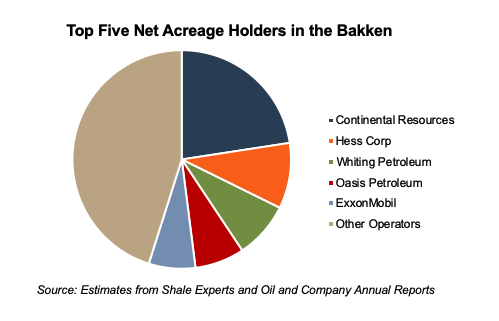

Given the age of the basin and smaller number of players, consolidation and strategic deals between operators have been prevalent. Several players have left the Bakken for the Permian, and as a result, the top five net acreage holders account for roughly half of the existing operating acreage in the basin. Abraxas undertook a sizable debt load in 2018 to finance further capital expenditures and restructure debt maturities ($180 million due in 2020-20211). An exit from the Bakken to pay down its debt and expand their Permian operations does not seem unreasonable.

Continued Non-Operator Acquisitions: Northern Oil and Gas

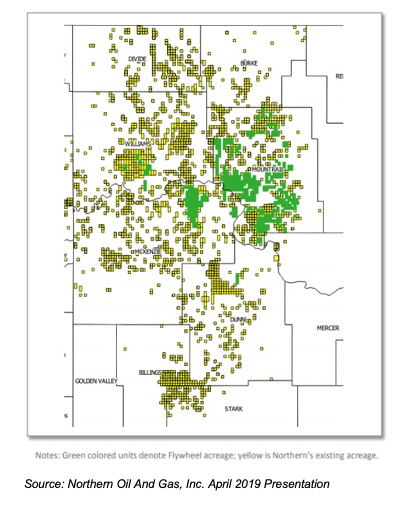

Similar to trends observed in the Bakken last year, acquisitions by non-operators have continued into 2019. For instance, Northern Oil and Gas has made several deals in the basin and its acquisition of private equity-backed Flywheel Energy LLC in April 2019 was one of the largest of the year, and represents a continuance of this trend.

Northern Oil and Gas has been the basin’s most consistent acquirer of non-operating interests. As a nonoperator, Northern can enjoy cash flows received from acreage without the operator risk that has become ever more prevalent in the current environment, and consequently, the company has the luxury of continuing to strategically consolidate acreage in the basin. Since the start of 2018, the company has made four large publicly announced transactions totaling more than $820 million.

Below is a map of the acreage Northern Oil and Gas acquired in the Flywheel transaction as well existing acreage to show its overall footprint in the basin.

Conclusion

Even though transaction activity in the Bakken has been minimal compared to basins like the Permian, production is up, and rig counts are steady. Acquisitions for operators and non-operators alike have been strategic and pinpointed as the experienced players look to build and maintain their large positions relative to others in the area. Despite a slowdown of A&D activity in the back half of 2019, the operators and non-operators in the Bakken appear undeterred and are staying the course.

We have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

1 Abraxas Petroleum Corporation Annual Report December 31, 2018

Energy Valuation Insights

Energy Valuation Insights