M&A in the Bakken

Immense Drop in Deal Activity Due to COVID Concerns

Over the past several years, the Bakken has generally had much lighter acquisition and divestiture activity than other major basins in the United States. Given that deal activity across the energy sector has dropped an immense 42.7% over the past year, acquisition and divestiture activity has dropped even further in this basin over the past year.

Observed deal activity has largely been the result of Northern Oil and Gas growing its production base in the area during the past several years.

Recent Transactions in the Bakken

Details of recent transactions in the Bakken, including some comparative valuation metrics, are shown below.

Northern Oil and Gas Continues Core Acreage Buildout

Northern Oil has constituted approximately two-thirds of the observed deal activity (based on disclosed deal value) in the basin, including its bolt on acquisitions in June and August 2020 for several hundred acres. This activity furthers Northern Oil’s mission of building out its core position in non-operating interests through consistent, strategic acquisitions.

Although production is down across the country, wells are slowly beginning to come back online, and Northern Oil believes increasing inventory while pricing is advantageous should drive returns in the future.

According to Northern COO Adam Dirlam, “We continue to add to our core inventory. Record levels of wells-in-process should drive strong volumes, and improve upon our return on capital employed metrics in 2021 and beyond.”

Since the start of 2018, the company has made six large publicly announced transactions totaling more than $820 million, including its large acquisition of private equity-backed Flywheel Energy LLC in April 2019.

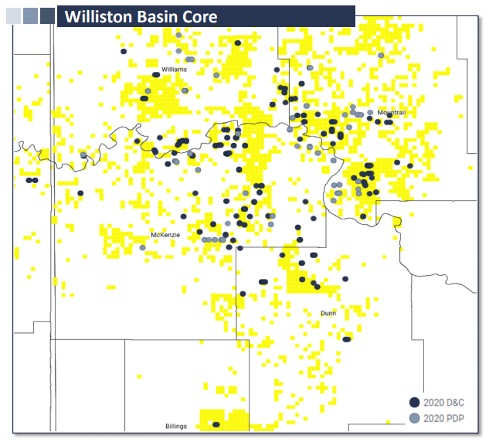

Below is a map of Northern Oil’s acreage to show its overall footprint in the basin.

Conclusion

The energy industry in Q1 and Q2 2020 has seen extreme volatility that has had investors and operators alike remaining cautious and waiting to see what happens next. As a result, acquisition and divestiture activity has been put on the back burner as companies struggle to plan ahead while remaining solvent.

As we have moved from the second quarter to the third quarter, fundamentals in the Bakken have steadily improved as crude oil pipeline and storage limitations were alleviated. Stabilization of WTI pricing and well differentials in the region over the past couple of months have also aided as well. Companies like Northern Oil look towards the future as demand begins to creep upward from its mid-year lows, and the company has taken advantage of lower pricing to accrete acreage to its core position.

We have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights