M&A in the Bakken

Under the Radar

Over the past year, followers of the oil and gas industry have taken note of the multitude of transactions occurring in the Permian Basin with large deal values and hefty multiples. But the price differential between WTI and other benchmarks has grown over the last few months, and some attention has moved from the Permian to other domestic shale plays. The activity in other regions such as the Bakken was at one point slow (when compared to the Permian) causing the recent increase in production and the swapping of acreage to fly under the radar while many were focused on Texas.

Transaction activity in the Bakken in 2017 marked the departure of a number of companies that were active in the play, such as Halcon Resources. At the end of 2017 and into 2018, the exodus from the Bakken to the Permian continued. Recently, the Bakken is being viewed as another viable option to the Permian Basin, which has seen a growing price differential due to insufficient infrastructure. This, and rising oil prices, has resulted in an increase in production in the region, leading to more transaction activity and inflows of capital.

Recent Transactions in the Bakken

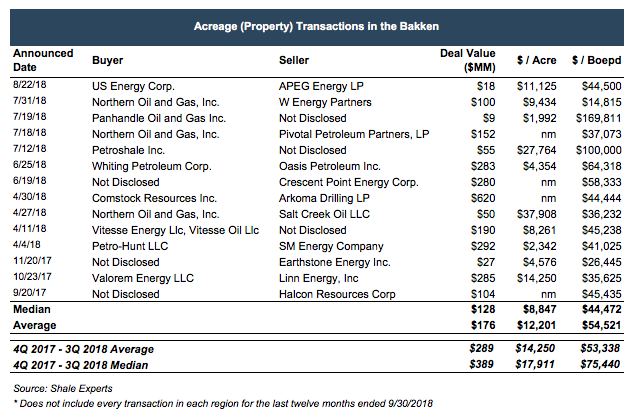

Details of recent transactions in the Bakken, including some comparative valuation metrics are shown below.

Overall, the average deal size has decreased from twelve months ago when companies sold off large bundles of assets to clean up their balance sheets and survive in the low oil price environment. While deals today may be smaller in size, they are more strategic in nature.

Whiting Acquires 65,000 Acres from Oasis

One of the largest deals in the region over the last twelve months was Whiting Petroleum Corp. purchase of 65,000 acres from Oasis Petroleum Inc. in June for $283 million. A Seeking Alpha contributor noted that this transaction is a “case of one company believing that it can achieve better results in an area that the other company considered lower quality acreage.” This is observed in Oasis’ acceptance of a lower than average transaction price per acre, and Whiting’s willingness to pay an above average price flowing barrel.

US Energy Acquires 1,600 Acres from APEG

One of the smaller deals was US Energy Corp.’s acquisition of 1,600 acres from APEG Energy LP (a related party) for $18 million. US Energy and APEG Energy II, LP announced a strategic partnership in October of 2017 in a deleveraging transaction. APEG Energy II is one of Angelus Capital’s (a private equity firm headquartered in Austin, Texas) funds focused on acquiring domestic oil and gas assets. Since then, US Energy has focused on cleaning up its balance sheet to focus on producing oil assets. Recently, US Energy has been working to add assets that will immediately increase production in the Williston Basin and South Texas.

US Energy expects their most recent transaction “will create additional opportunities for development and acreage swaps that would permit the company to continue consolidating its leasehold position in the area.” US Energy paid $44,500 per flowing barrel, which is in line with average production multiples paid in the region but is somewhat lower than those observed last year. Deal values last year may have been based on the expectation that production would increase in the future, inflating current multiples. Now that production has picked back up in the Bakken, deal multiples appear to have normalized somewhat.

Observed M&A Trends in the Bakken

The following are two good examples of transactions we are seeing in the region this year:

Strategic Deals Between Regional Operators

One of the disadvantages of the Bakken, as compared to the Permian, is that it is an older play and many of its sweetest spots have already been drilled. However, age is often equated with wisdom, and the significant experience of operators who have been in this region since the early 2000s gives them a competitive edge. As Senior Beck, a senior director at Statas Advisors explained, “The Bakken’s maturity and production characteristics could lead to a growth in consolidation over the next few years.”

Acquisitions of Property by Non-Operators

Additionally, the prominence of activity of non-operators in the Bakken has increased. Private equity funds like Angelus Capital, single-family offices, and other providers of capital that see an opportunity in the Bakken are buying acreage and partnering with the best operators in order to realize superior returns on investment.

Combining these trends, Northern Oil and Gas Inc. is a non-operator who aims to be the Bakken’s “natural consolidator.” In July it completed its largest acquisition yet of 10,600 net acres for $100 million cash plus approximately $190 million of Northern Oil stock. Northern Oil is relying upon the superior abilities of longtime regional operators and the trend towards consolidation. However, it is also an example of a non-operator who has become more prominent in the last year.

The Bakken may have gone unnoticed for a couple years after the downturn in oil prices in 2014, but it may be rising back to prominence as increases in efficiency and cost reductions impress investors.

We have assisted many clients with various valuation needs in the upstream oil and gas in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights