M&A in the Marcellus-Utica Shale

The Beast in the East

The domestic natural gas market has benefitted from large expansion in recent years, and this can be largely attributed to the growth experienced in Appalachia. According to a Deloitte study, Appalachia was the world’s 32nd-largest natural gas producing region in 2007, with levels comparable to Bolivia and Kazakhstan. As of 2017, it was the third largest, trailing only the full United States and Russia.

Companies already with an established presence are planning to put more wells online in the coming year and increase infrastructure to supply a growing demand in the natural gas market.

Henry Hub prices have been hovering around $3/MMBtu for over three years and recently have increased to just over $4/MMBtu in November due to a combination of expectations of colder than usual weather and short squeezes, increasing trading and price influencing in a market that is much smaller than oil. Despite the long-term low price environment, supply and demand have increased, driven primarily by the increased demand needs from the power sector. Economic viability of recoverability has not been impacted in light of the lower prices as Deloitte estimates that 50 years’ worth of natural gas can be recovered for less than $3/Mcfe.

Despite the continued growth, transaction activity in the Marcellus-Utica in 2018 was slower than in 2017. Some companies have been moving in to capitalize on the increased demand for natural gas, as indicated by the energy outlook by the EIA, while others are restructuring their balance sheets in order to focus primarily on oil. While companies may not be rushing to the Marcellus-Utica in a similar manner as the Permian, companies already with an established presence are planning to put more wells online in the coming year and increase infrastructure to supply a growing demand in the natural gas market.

Recent Transactions in the Marcellus-Utica

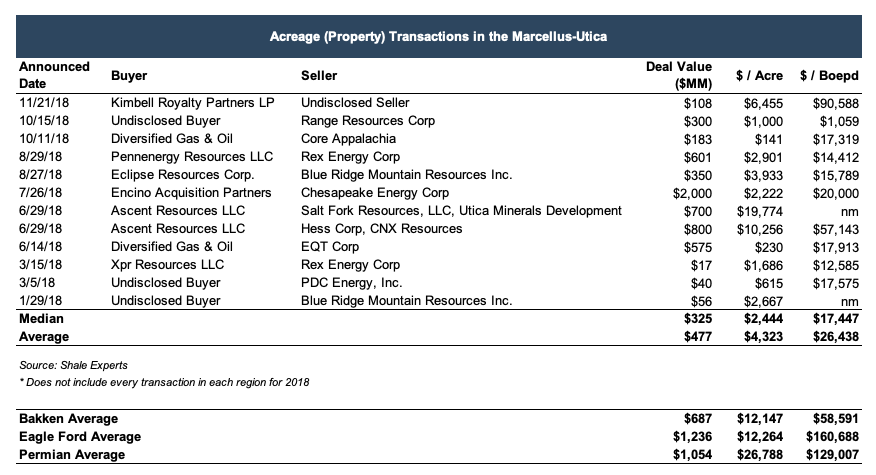

Details of recent transactions in the Marcellus-Utica, including some comparative valuation metrics are shown below. Overall, deal count and average deal size have decreased from twelve months ago. There have been a handful of large deals though that show increased interest in the area.

Ascent Resources Acquires 113,400 Acres in Ohio

Ascent Resources, a company founded by Aubrey McClendon after he left Chesapeake Energy, announced that it is buying 113,400 Utica Shale acres in multiple deals along with 93 operating wells located in eastern Ohio for a total of $1.5 billion. The new acreage puts Ascent at over 300,000 Utica acres and catapults the company into one of the largest privately owned E&P drillers in the U.S. The selling companies are CNX Resources and Hess (each selling their share of a joint venture for $400 million each), Utica Minerals Development and a fourth, unnamed seller.

The CNX and Hess JV sale marks a complete exit in the play, and both companies plan to utilize proceeds to fund share repurchase programs, pay down debt, and focus on growth opportunities in other established plays, such as the Bakken.

Chesapeake Energy Sells Entire Utica Position to Encino

In an even larger deal, Chesapeake Energy disposed of its entire interest in the Utica Shale to Encino Acquisition Partners for about $2 billion. EAP is backed by the Canadian Pension Plan Investment Board and Encino Energy. Chesapeake sold its stake in the Utica Shale to strengthen its balance sheet and further shifts its focus from gas production to oil, Chesapeake CEO Doug Lawler said in an interview. “We will absolutely be driving for a greater percentage of oil production in our portfolio,” Lawler said. “We hope to achieve that through organic growth, exploration and future acquisitions.”

The sale to Encino Acquisition Partners includes 320,000 net acres in Ohio’s Utica Shale and 920 wells that currently produce about 107,000 barrels of oil equivalent per day. The purchase price also includes a $100 million contingent payment based on future natural gas prices. With a sale price of approximately, $2,222 per acre, this appears to be in line with the median transaction amount for 2018.

Observed M&A Trends in the Marcellus-Utica

Large Exits and Balance Sheet Adjustments

Similar to trends we observed last year in the Marcellus-Utica, large companies that have had established presences are moving out of the play entirely to focus on higher margin assets. Demand for natural gas is very high, but the inexpensive extraction costs paired with longer laterals for extraction have allowed supply to catch up, causing prices to remain low and relatively flat in the long term, with the exception of the high trading volume experienced last month.

The price run-up in November, however, appears to be short-lived, and the commodity appeared to be overbought. High expectations and rising EIA forecasts for domestic production explain why the U.S. gas futures market has held backwardation even though near-term pricing has spiked. Futures prices for 2019 and 2020 have declined back to the $2.50 to $3.00 range, and with margins remaining low for the foreseeable future, it makes sense for companies to adjust their balance sheets and unload assets that are not meeting their margin goals.

Continued Ease of M&A

Although the low price and low margin environment has caused some to exit the Marcellus and Utica plays, the stable prices environments make mergers and acquisitions easier, with public companies in a better position to make deals than private equity investors.

The stable prices environments make M&A easier, with public companies in a better position to make deals than private equity investors.

According to Robert Hagerich, Senior Vice President at Macquarie Capital (USA) Inc., established public companies are looking to expand acreage and existing holdings, and can use their stock as currency to buy leases that are adjacent to their holdings with operating midstream infrastructure and production volumes that can be immediately booked with the purchasing company. On the other hand, private equity buyers are usually financing the exploratory drilling that expands the core fairways of the shale plays essentially buying an option on improved prices.

This trend began in the later part of 2017, and it has continued into 2018. “Stable pricing brings buyers to the table,” says Hagerich. “Buyers are looking for leases that are exposed to the core areas of the shales, contiguous acreage, leases held by production, ownership of the gathering system and access to more than one transportation pipeline.”

The low volatility nature of the natural gas market compared to oil or LNG facilitates M&A activity and allows for consolidation opportunities as observed from the merger of Blue Ridge Mountain Resources and Eclipse Resources Corp. in August and the heavy consolidation activity from EQT in 2017.

The Marcellus-Utica continues to be a powerhouse for natural gas production and doesn’t show signs of slowing down anytime soon. Strategic transactions in the area allow companies to focus on assets that drive their core business and others to consolidate in the area and supply the growing demand for natural gas in the U.S.

We have assisted many clients with various valuation needs in the upstream oil and gas in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights