M&A Overview: Race to the Permian

M&A activity in the exploration and production industry has recovered from the standstill experienced one year ago as oil and gas companies waited to see what the market would throw at them next. When crude oil prices dropped, companies reduced their exploration budgets and stopped drilling new wells. When prices remained low, many companies began to sell off non-core assets in order to generate cash to pay off debt. Companies, who cut drilling activity when prices collapsed, are now looking to replace their reserves through acquisitions. Bloomberg analysts predict that the majority of M&A activity going forward will be asset purchases as E&P companies look to acquire more than 50% of their reserve replacement.

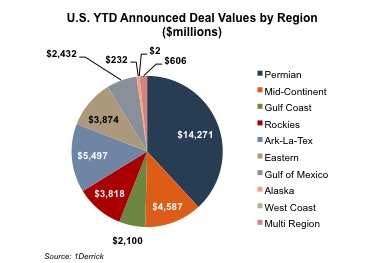

The majority of these transactions have occurred in the Permian. This year, 38% of total E&P deal value was generated from deals in the Permian, and 24% of the number of total deals occurred in the Permian.1 This demonstrates that more deals and larger deals are happening in the Permian than in other plays in the U.S.

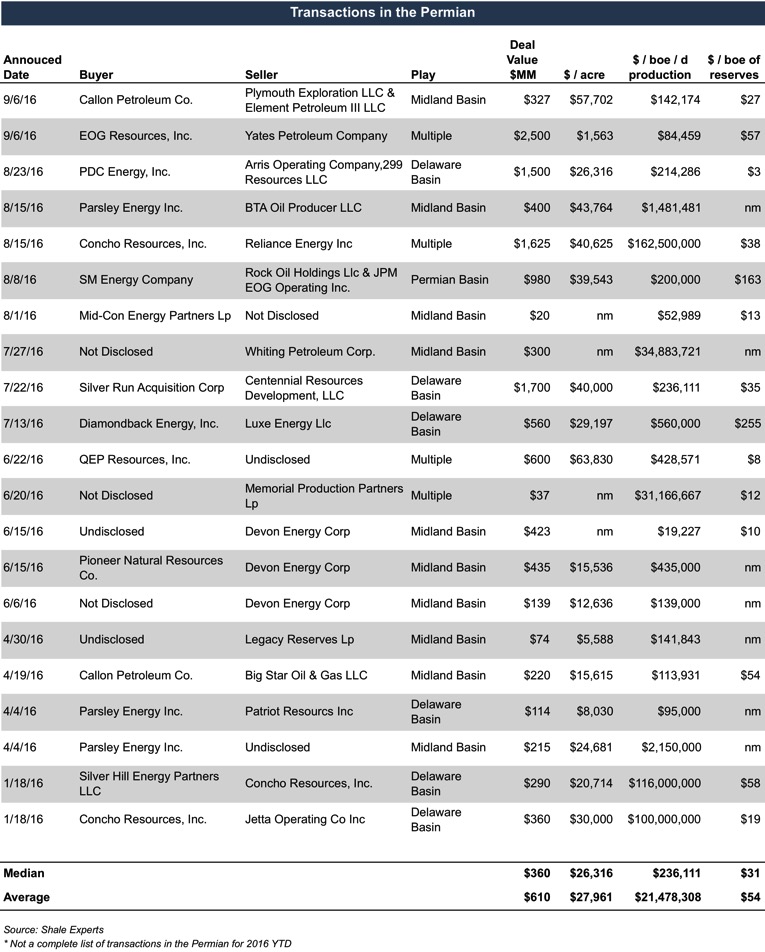

Last week we looked in depth at EOG’s acquisition of Yates Petroleum for $2.5 billion. The acquisition helped EOG shift from the Eagle Ford into the Permian. EOG’s CEO Bill Thomas told investors, “We’ll be able to grow oil (production) with less capital and more efficiently than we do now.” EOG’s share price rose by more than 6% the day after the transaction.

E&P companies are flocking to the Permian for many reasons, including its (1) upside potential, (2) low break even prices, and (3) diversity of resources.

Upside Potential

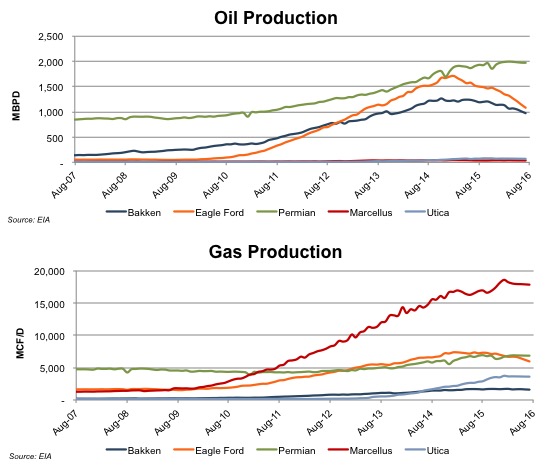

Although the Permian was discovered in the 1920s, the true potential of the Permian was not realized until 2007 when hydraulic fracturing techniques were used to access the tight sand layers of the play. Since then the Permian has been revitalized as producers have begun using unconventional drilling techniques in addition to traditional vertical wells. Because the crude in the shale layers have only recently been explored, there are still tremendous reserves left.

Low Breakeven Prices

The Permian has low break even prices compared to other reserves in the U.S. Although production costs may not be as low as Pioneer Natural Resources CEO, Scott Sheffield, boasted ($2.25 per barrel excluding taxes), costs are lower than other plays due to the geological makeup of the shale.

The Permian is a stacked play which means that multiple horizontal wells can be drilled from one main wellbore. This provides increased productivity as multilateral wells have greater drainage areas than single wellbore. Additionally, it can reduce overall drilling risk and cost. For deep reservoirs like the Permian, a multilateral well eliminates the cost of drilling the total depth twice.2

In many plays, the low price of crude oil has made drilling uneconomical. Many companies are trying to acquire acreage in the Permian, where production is cheaper, because it is unclear when crude prices will rise and if they will ever rise to the same levels as before.

Diversity of Resources

The Permian is the largest producer of oil and the second largest producer of gas, after the Marcellus. Even as gas prices collapsed, production in the Permian increased. Companies that operate in the Permian do not have to choose between oil and gas, but can diversify operations. The market for commodities is inherently risky because producers are price takers. Although related, the price of natural gas and crude oil are not perfectly correlated. Thus when the price of natural gas fell six years ago, producers in the Marcellus and Utica were entirely exposed to the natural gas market, while producers in the Permian were able to rely on their profits from crude oil to fund operations.

Exploration and Production companies are trying to get their hands on acreage in the Permian now before the next swing in crude oil prices. OPEC agreed on Wednesday to cut its production of crude oil. IEA analysts believe that the proposed cuts to between 32.5 million and 33 million barrels per day would bring production back in line with demand until the second half of 2017. Definitive policies are expected to be set in November, but there still remains doubt that the deal will be able to relieve supply due to OPEC’s inability to enforce these quotas.

This uncertainty about the future price of crude oil has caused producers to leave other plays and increase their acreage in the Permian. Consequently, this has increased acreage prices in the Permian compared to other plays, such as the Bakken and Eagle Ford. A summary of some transactions in the Permian this year is shown below.

Callon Petroleum increased its position in the Permian the same day as the EOG / Yates transaction. Callon was traditionally an offshore driller in the Gulf of Mexico. They began shifting out of the Gulf in 2010 due to the high costs of offshore drilling and sold their last offshore asset in 2013. Since then the company has steadily been increasing its stake in the Permian. Since the second quarter of last year the Company has increased production by 56%, while at the same time reducing capital expenditures by 48%.3 The company has recently been using its highly valued stock to fund acquisitions in the Permian. The price of Callon’s stock price has tripled since January even though they have increased their shares outstanding by 50% over the same time period. This demonstrates investor’s confidence in the Permian.

The valuation implications of reserves and acreage can swing dramatically in resource plays. Utilizing an experienced oil and gas reserve appraiser can help to understand how location impacts valuation issues in this current environment. Mercer Capital has significant experience valuing assets and companies in the energy industry, primarily oil and gas, bio fuels, and other minerals. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs.

End Notes

1 1Derrick

2 New Aspects of Multilateral Well Construction. Fraija, José; Ohmer, Hervé; and Pulick, Tom. Online Available at http://www.slb.com/~/media/Files/resources/oilfield_review/ors02/aut02/p52_69.ashx.

3 1Derrick

Energy Valuation Insights

Energy Valuation Insights