BP & Diamondback Mergers Set Q3 Tone For Upstream Producers

The third quarter just wrapped for upstream producers. Stock performance has been volatile, infrastructure issues are lurking and the industry as a whole ended the quarter a notch above flat. However, approximately $21 billion in strategic acquisitions by BP and Diamondback Energy highlighted the continued optimism for the segment. BP’s merger looks particularly interesting as it focuses on the Eagle Ford while most investors have been looking to the Permian. BP’s earnings have yet to be reported, so stay tuned.

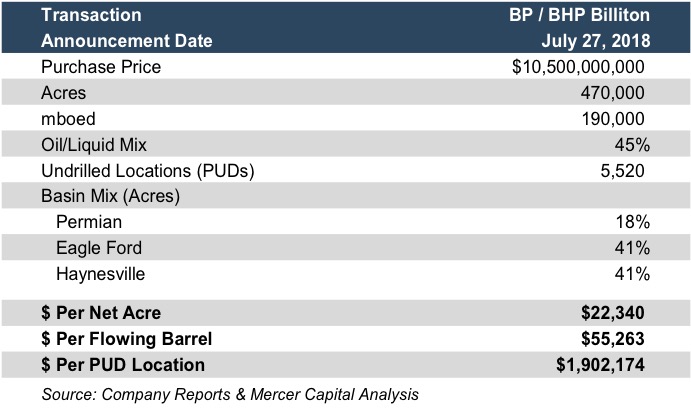

BP’s Big Deal

BP brought on approximately 470,000 acres of rights and 90,000 barrels per day of current production.

BP certainly wasn’t waiting for the industry’s current infrastructure issues to sort themselves out as they forged ahead with the biggest single upstream merger this year, a $10.5 billion acquisition of BHP Billiton. This is BP’s biggest acquisition in nearly 20 years. The primary assets acquired were spread across the Eagle Ford shale in South Texas, the Haynesville Shale in East Texas and to a lesser extent, the Permian Basin. Through this transaction, BP brought on approximately 470,000 acres of rights and 90,000 barrels per day of current production. BP was naturally enthusiastic about the deal, and after some review, this deal appears to have a lot of potential to create value for BP. Here’s why:

This Is Not BP’s First Venture Into The Texas Shale Plays

BP dipped their toe into the Eagle Ford shale back in 2010, before they fully jumped into this deal. Joining with local dry gas powerhouse Lewis Energy, BP bought at $4,000 to 5,000 per acre for joint venture rights on the dry gas window of the Eagle Ford shale. Over the course of the past few years, BP has more than doubled per-well production in the Eagle Ford by utilizing improved production techniques. This experience, particularly in that region, could serve BP’s shareholders well going forward.

There’s Commodity Price Upside

BP based their return models on $55 oil and $2.75 gas. As of the acquisition, oil prices were already in the mid-$60’s and closed around $75 this week. On the other hand, gas prices have been flat and returns have been driven by the cost side of the equation. Although only about 45% of the reserves purchased are liquids-based, it has the potential to boost returns and increase values.

At First Glance, BP Does Not Appear To Have Overpaid

With over 80% of the assets weighted towards the lesser celebrated Eagle Ford and Haynesville plays, BP did not focus on the higher priced Permian Basin as much in this deal. Although the Permian’s stacked geology is superior, it is also more expensive. On a per net acre basis, BP paid just over $22,000 per acre.

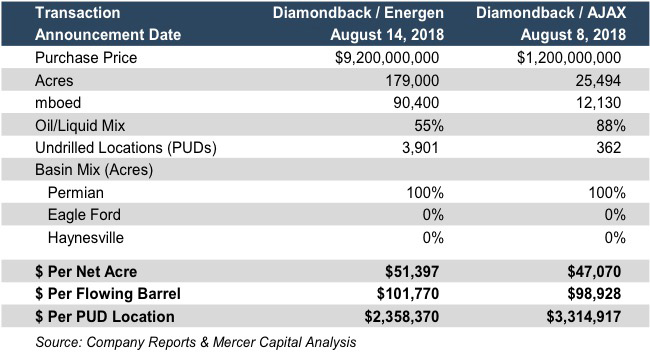

Diamondback Energy’s Big Deal

Not to be outdone, Diamondback Energy made two acquisitions within a week of each other that cost around $10.4 billion. Both transactions were in the Permian and were spread between the Delaware and Midland Basins. Both were similarly priced and are more oil and liquids heavy than BP’s acquisition, notable because margins for oil and liquids are generally much better than gas.

The deals were notable because margins for oil and liquids are generally much better than gas.

Diamondback’s larger deal was its purchase of Energen for $9.2 billion, providing 179,000 acres and about 90,400 barrels per day of current production. Diamondback also purchased AJAX Resources for $1.2 billion, gaining over 25,000 acres and about 12,130 barrels per day of production. Although smaller, this deal was more focused on acreage located in the Midland Basin.

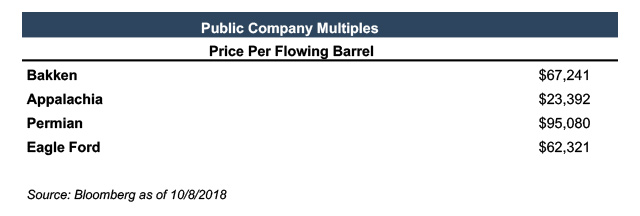

Betting On Success

Based on implied production multiples of other companies, deal pricing for both Diamondback mergers was generally in line with current implied values and creates one of the largest pure-play Permian producers. All three transactions appear to either be generally in line with implied public company market valuations in their respective regions.

Overall, upstream indexes were muddled in the third quarter, although earnings reports could shift the sentiment. BP and Diamondback are betting big that future quarterly (and annual) performance will be better.

The Bigger Picture

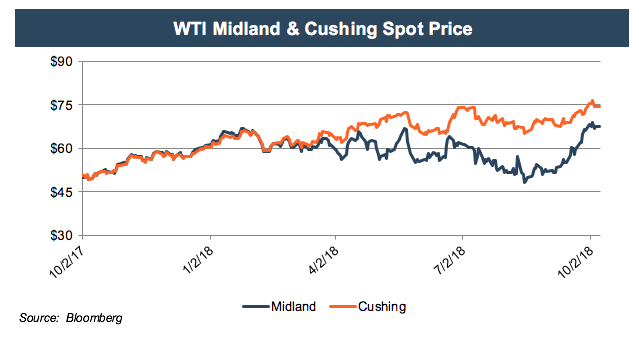

Generally, oil prices started and ended the quarter in almost the same place – around $73-$74 per barrel, but it took a circuitous route, dropping down to $65 in mid-August before climbing back. West Texas, however, has been a different story. Differentials between the standardized Cushing, Oklahoma prices and more localized Midland prices have been climbing for much of the year and remained wide until the end of the third quarter.

This gap has been created as a result of a supply traffic jam that has overwhelmed the Permian’s infrastructure. Production in Texas actually fell this summer due in large part to these issues, and this dynamic pervades beyond the Permian Basin. Appalachia and the Bakken have similar issues, although not discussed as often. Efforts are underway to alleviate these bottleneck issues in all of these areas, but it will continue to take time and capital. This extends not only from public markets, but private equity as well.

Have these issues impacted productivity or activity? So far, the answer is no. Capex budgets, a harbinger of drilling plans, have continued to grow and be revised upward for many producers. Drilling and production figures continue to climb everywhere but West Texas. However, that is temporary. Noting the Permian’s drilled but uncompleted (“DUC”) well figure, the Permian’s effective inventory is waiting to be unleashed on the market.

Could this be setting up strong earnings and production? One can only hope, and Diamondback and BP seem to think so. It appears the market may be transitioning from ascribing value on enthusiasm about potential shale production from undrilled reserves to realization of those reserves and more real dollars to show for it.

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights