Natural Gas Production Levels Are High, But So Are Prices

There’s been much coverage of the run-up in oil prices since November 2020, from $37/barrel (WTI) to current prices in excess of $80/barrel. That of course ignores the April to October 2020 $28/barrel recovery from the Covid/OPEC+/Russia-induced oil price death plunge during the February to April 2020 period. Now it seems that it’s natural gas’s turn at the price run-up game.

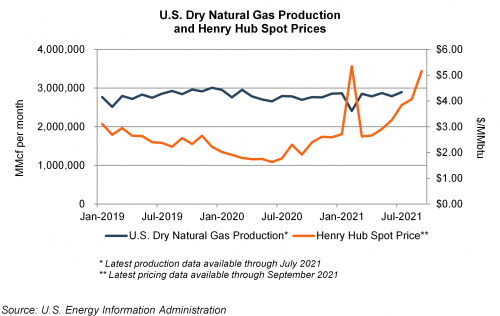

While Henry Hub (a benchmark for natural gas prices) also showed a post-Covid recovery from its March to June 2020 lows (near $1.60/MMbtu) to prices generally in the $2.60 to $3.00 range from October 2020 to May 2021, it has since been on a run that has taken it to recent highs over $5.70. So, what gives? In this week’s blog post, we address the market forces that have led to higher natural gas prices despite near record U.S. natural gas production levels.

Production Is High, So Why Are Prices Rising?

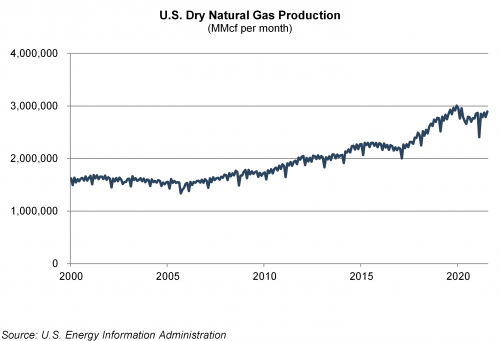

Per U.S. Energy Information Administration (EIA) data, 3Q2021 U.S. natural gas production neared its prior peak level, and EIA analysts expect that production will reach new record highs during 3Q2022. With such high production, basic economic theory would suggest that natural gas prices should be facing downward pressure. However, there’s the demand side of the equation to consider as well. Since the 2020 Covid-induced demand decline, the increase in natural gas demand has exceeded production recovery. Therefore, a supply versus demand imbalance has pushed prices up at an unusual rate.

Why Not Just Increase Production to Satisfy Demand?

A natural question to be asked is, why wouldn’t the gas producers simply increase production to meet the heightened level of demand? That’s where an interesting set of factors come into play, with one such factor being future gas price expectations.

Why wouldn’t gas producers simply increase production to meet demand? Future gas price expectations.

Tsvetana Paraskova, writing for OilPrice.com, notes that producers in Appalachia, America’s largest gas-producing basin, are expecting stronger pricing signals in the future curve for gas prices a year or two from now. As such, to some extent, those producers are looking at to (i) invest now to boost production for which they’ll receive current prices, or (ii) delay that investment to boost production until later when they’re expecting to sell the same volumes at higher prices. Depending on their level of confidence in those higher future prices, they may be significantly incentivized to hold off on those volume boosting investments.

Furthermore, Peter McNally, with the consulting firm, Third Bridge, reminds us that the more recent trend among oil and gas investors in preferring more near-term return on investment (current distributions to investors), rather than more drilling (with larger distributions down the road), has pressured the producers to ease back on their drilling programs that would otherwise help maintain production levels.

Where Is Demand Coming From?

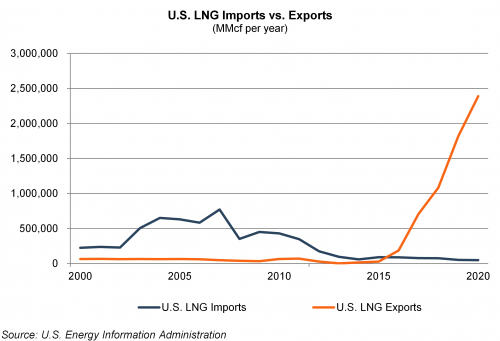

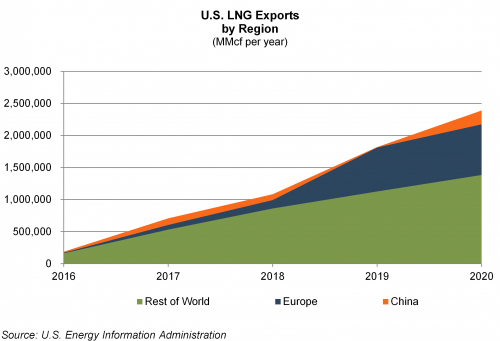

A natural question to be asked is, where is all the demand side pressure coming from? The answer, in large part, is exports. While the U.S. has exported natural gas via pipeline for many years, the capacity for LNG exports has ballooned in recent years and reached record levels in 2020 and 2021.

Two regions are driving demand for U.S. LNG exports. The first is Europe. After the much colder than usual winter, natural gas inventories remain well below typical seasonal levels. As a result of the lower inventories, Europeans are paying four to five times as much for natural gas relative to what is being paid in the U.S. That creates quite the incentive for U.S. produced natural gas to be exported, rather than staying within the country. The second is China. Reuters reports that China has become concerned in regard to its country-wide fuel security and is facing a winter fuel supply gap. That, in the midst of Asian gas prices that have increased more than 400% in 2021, has led to advanced talks between top Chinese energy companies and U.S. LNG exporters for the purpose of locking-in future U.S. LNG export volumes.

What Does This Mean for the U.S.?

As a result of the indicated supply and demand forces at play, Reuters reports that power crunches are already hitting large economies such as China and India. While the impact in the U.S. (so far) has been relatively modest, expectations are for U.S. consumers to spend much more to heat their homes this winter. In the U.S., nearly half of homes use natural gas for heating purposes, as natural gas has traditionally been the most economical source for heating residences. The U.S. Department of Energy estimates that those homeowners will pay 30% more for natural gas this winter compared to last winter.

What Are the Ripple Effects of Higher Natural Gas Prices?

While home heating is a more straight-forward result of the higher natural gas prices, there are numerous ripple effects that are far less obvious. Natural gas is a key input to a number of industries where higher natural gas costs will naturally be passed through to consumers. Bozorgmehr Sharafedin, Susanna Twidale and Roslan Khasawneh, with Reuters, note several such industries including steel producers, fertilizer manufacturers, and glass makers having been forced to reduce production due to the higher natural gas prices.

Industrial Energy Consumers of America, a trade group representing chemical, food and materials manufacturers has even urged the U.S. Department of Energy to limit U.S. LNG exports in order to ease their member firms’ energy-related expenses. Food producers in particular are reporting shortages of CO2 (a byproduct of fertilizer production) that is used in packaging processes, meat processing, and even for putting the “fizz” in carbonated drinks and beer. As a result, prices for those types of products are already on the rise.

Conclusion

As indicated, the market forces at work in the supply and demand for U.S.-produced natural gas are many, and come from both domestic and foreign sources. The current supply/demand gap has pushed natural gas prices to recent record levels, with the impacts being both obvious in winter heating costs, and not so obvious in higher food and beverage prices. Keep reading this blog as we continue to track natural gas pricing and other energy-related industry topics.

Mercer Capital has significant experience valuing assets and companies in the energy industry. Our energy industry valuations have been reviewed and relied on by buyers, sellers and Big 4 Auditors. These energy related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed energy industry valuations domestically throughout the United States and in foreign countries.

Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Energy Valuation Insights

Energy Valuation Insights