Navigating Challenges in Appalachian Production

The economics of oil & gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Haynesville, and Marcellus and Utica plays. The cost of producing oil and gas depends on the geological makeup of the reserve, depth of the reserve, and cost to transport the raw crude to market. We can observe different costs in different regions depending on these factors. This quarter, we take a closer look at the Marcellus and Utica shales.

Production and Activity Levels

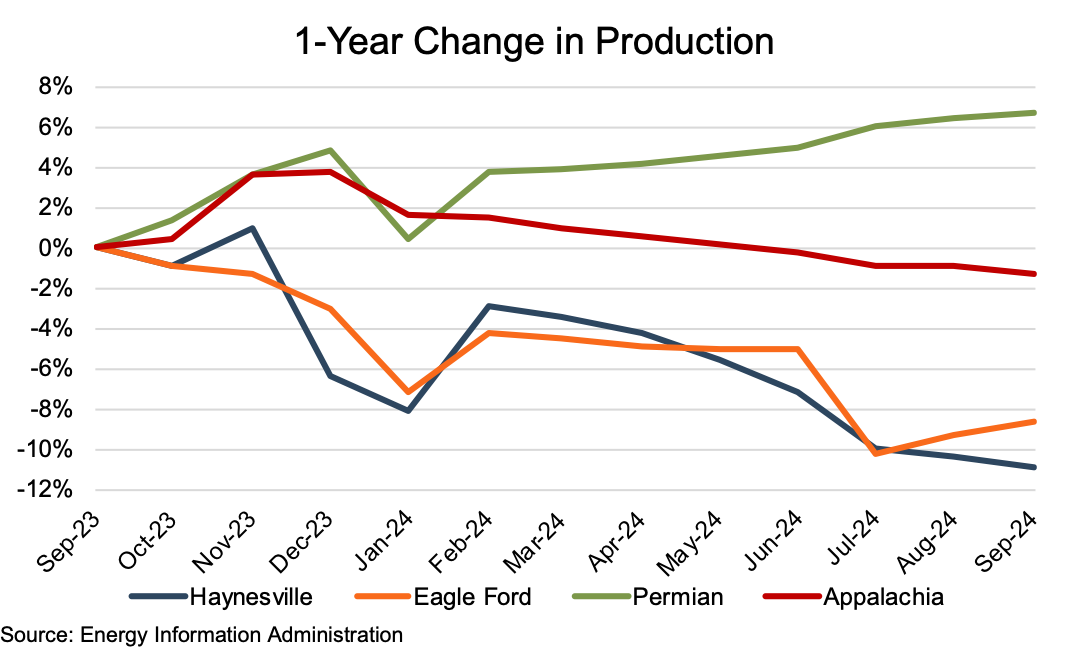

Appalachian production (on a barrels of oil equivalent, or “boe” basis) edged lower by 1.3% over the latest twelve-month (“LTM”) period. After an initial 3.7% production run-up through November 2023, Appalachian production began a long, steady decline through August 2024. The production slide was precipitated by multiple factors, including seasonal declines, weak commodity pricing, and competition from other regions closer to LNG export facilities. In particular, EQT — the largest U.S. natural gas producer — purposefully reduced production volumes in consideration of surplus storage levels. Other Appalachian producers were following the same strategy.

Among the other major basins included in our analysis, only the Permian fared better from a production perspective, with an LTM increase of 6.6% — the only increase posted from the four basins. The Eagle Ford and Haynesville formations posted the largest production declines at 8.5% and 10.8%, respectively.

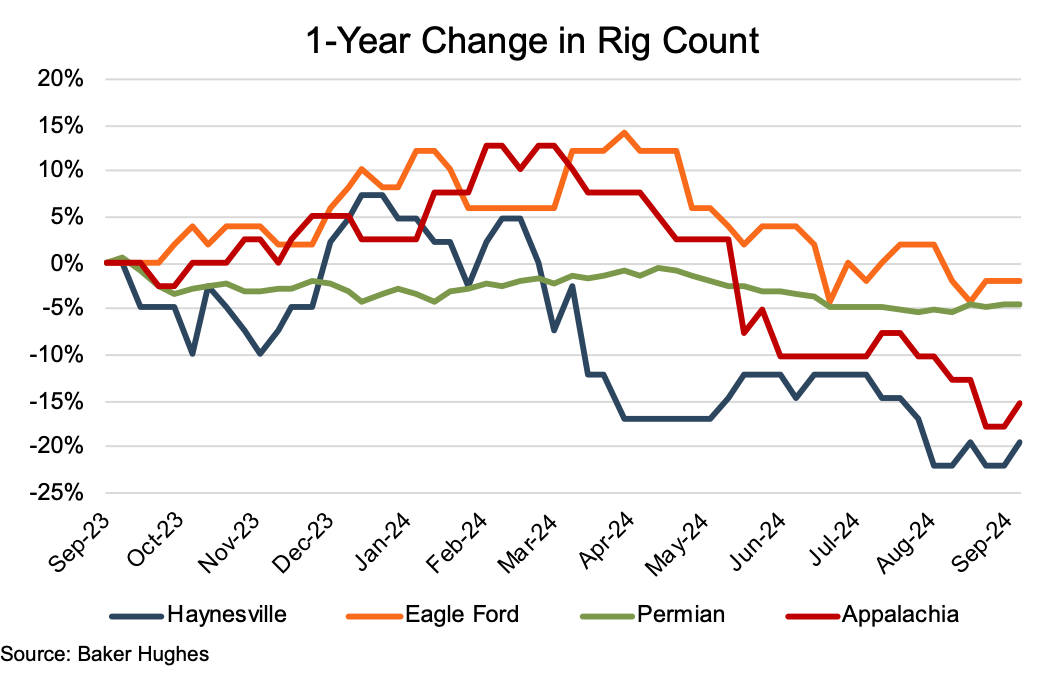

Rig counts fell across all four basins over the LTM period, with the gas-heavy Appalachian and Haynesville basins leading the decline with decreases of 15% and 20%, respectively — largely due to natural gas prices hitting a three-decade low and sitting in the lower end of the $2 range for much of the period. Appalachian rig counts rose over the front end of the review period, up 13% from 39 to 44 active rigs in the six months through March. Thereafter, the Appalachian count headed downward, with particularly sharp declines in May and August.

The oil-heavy Permian and Eagle Ford basins fared better, albeit still posting declines of 4% and 2% in the LTM period, respectively.

Commodity Price Volatility

Henry Hub natural gas front month futures prices showed the commodity’s usual seasonal volatility over the September 2023 to September 2024 review period. The futures’ price ran from $2.84 in early October to $3.82 in mid-October due to unusually low temperatures across much of the U.S., pushing residential and commercial consumption up 51%. Beginning in November, the Henry Hup futures turned sharply downward, with the decline continuing nearly uninterrupted through mid-February. The November to February 57% drop was precipitated in large part by excess supply. While gas producers were proactively cutting drilling and production in the face of 30-year low prices, gas production from oil producers that produce gas as a byproduct of their oil production operations continued to buoy supplies.

The Biden Administration’s “temporary pause” in LNG export project approvals in late January precipitated the last leg of the price slide from $2.18 at the time of the pause’s announcement to the review period low of $1.65 just 20 days later. Futures prices generally increased from mid-April to mid-June largely on expectations for warming temperatures, spurring increased cooling-related demand. The unusually mild summer, however, held down demand, and rising storage inventories in the third quarter drove Hub futures lower from June to early August, reaching a third-quarter low of $1.94 on August 5. Prices generally recovered over the remainder of the review period, ending at $2.61 as of September 18.

Oil prices, as benchmarked by West Texas Intermediate (WTI) and Brent Crude (Brent) front-month future contracts, showed much less volatility during the twelve-month period, varying from $66.75 to $92.20 for the WTI and $69.19 to $94.36 for the Brent. Oil prices started the LTM review period at their review period highs and generally declined through mid-December. Prices rose 25% over the following four months (through early April) before generally declining over the remainder of the review period. Review period lows were reached in early September.

Financial Performance

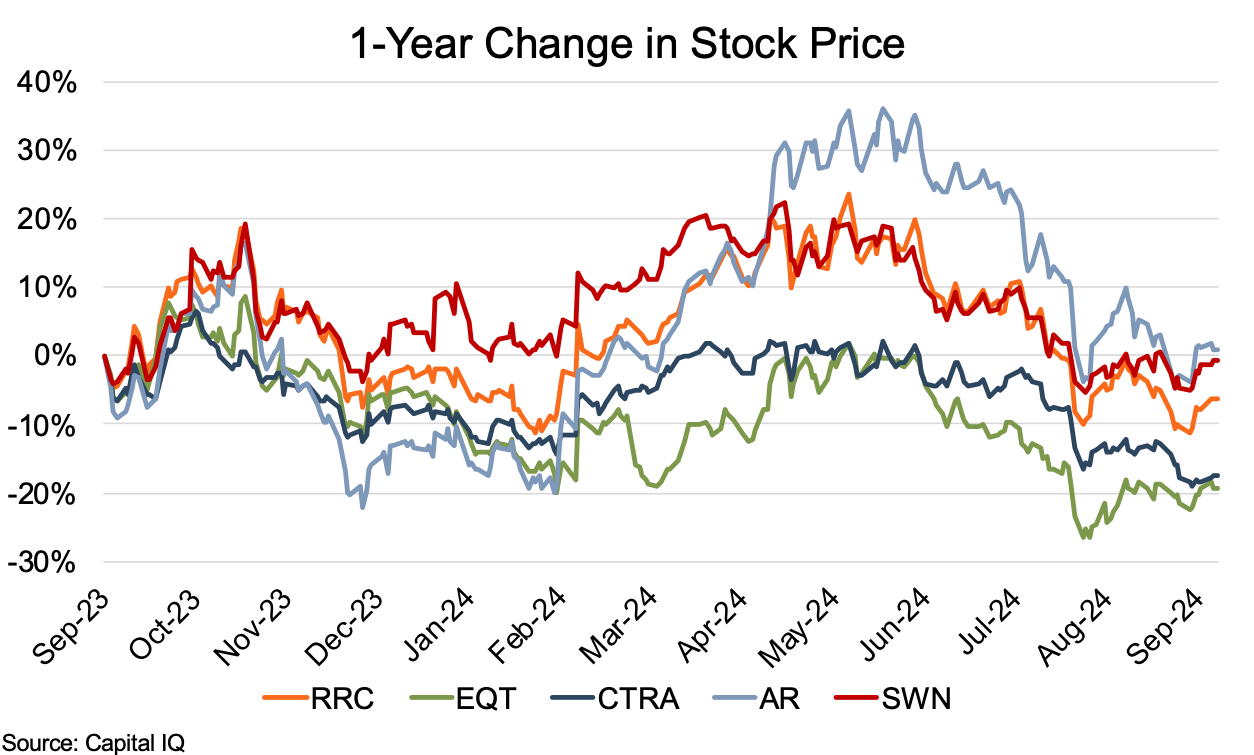

The Appalachian public comp group saw notably high stock price movements over the course of the LTM period — although that is not unexpected for companies producing a commodity with significant price volatility. Four of the five comps posted stock price declines during the review period, with only Antero posting a price increase, albeit a very modest increase of just under 1%. Southwestern posted the smallest decline at -1%, while the remainder showed more substantial price declines ranging from -6% to -19%. EQT and Range Resources nearly tied for the largest declines at -19% and -18%, respectively.

The comp groups’ price changes from September 18, 2023, were negative through early October before crossing into positive territory, where they remained through late October (Coterra), early November (Antero and EQT), or December (Southwestern and Range Resources). The stock prices showed no clear directional trend from December to mid-February when all five began a generally upward run through early May. The price run-up largely coincided with the same period rise in the Henry Hub futures price. Since May, all five posted generally declining stock prices in-line with the late-period drop in natural gas prices.

Antero showed the greatest price volatility over the review period, with both a 22% decline as of mid-December and a review period high increase of 36% as of mid-May. Roth MKM Analyst Leo Mariani noted that Antero has one of the longer inventory lives and higher quality inventory among the E&P sector, with approximately 20 years of high-quality drilling. However, Roth further noted that Antero has almost no remaining hedges in place, rendering its cash flows significantly more sensitive to natural gas price movements.

Conclusion

Appalachian production suffered over the LTM period due to intentional reductions in drilling activity (rig count) tied to historically low natural gas prices and higher-than-usual storage inventory. As a result, the Appalachian comp group posted stock price changes over the review period, ranging from near zero to nearly 20% declines.

Despite the recent negative news for the Appalachian basin, there’s hope for improvement in 2025. During EQT’s second quarter conference call, CFO Jeremy Knop noted that the ramp-up in June of the Mountain Valley Pipeline LLC (“MVP”) system “should provide support to Appalachian differentials moving forward.” During the second quarter, EQT retook ownership of Equitrans Midstream Corp., which operates MVP’s 2 Bcf/d pipeline system that is poised to play an integral part in plans to meet future gas demand. Similarly, VettaFi Research noted on September 19 that pipeline solutions are helping to alleviate the takeaway constraints in the Appalachian basin, most notably with the start-up of the Mountain Valley Pipeline. In addition, while the Appalachian basin is best known for its natural gas production, the Utica shale portion of the basin in Ohio represents an emerging oil play. EOG Resources (EOG) has accumulated acreage in the Utica but has mainly focused 225,000 acres in the oil window of the play with plans to complete 20 net wells in the Utica this year. Results have been indicated as encouraging and even competitive with the Permian basin.

We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights