Oil and Gas Market Discussion: Part 1

Like the first few holes on an early morning golf round, the current oil and gas market is very foggy. In golf, hitting a shot into the unknown can be peaceful, enjoyable, and exciting. However, in the oil and gas market, blindly taking investment shots is downright frightening. Uncertainty on the direction of the price of oil, the cause of the historical decline, the future of demand, leverage levels of E&P companies, and the value of oil and gas assets will delay many investment decisions. In May 2016, we attended a panel event discussing investment opportunities in the financially distressed oil and gas sector. The panel included a “who’s who” of oil and gas experts located in Texas. Two industry participants, two consultants, one analyst and one economist discussed the economic outlook for energy prices; and then corporate strategy and investment opportunities given the economic outlook. This post, the first of two summarizing this panel discussion, will report on the economic discussion.

Economic Outlook for Energy Prices

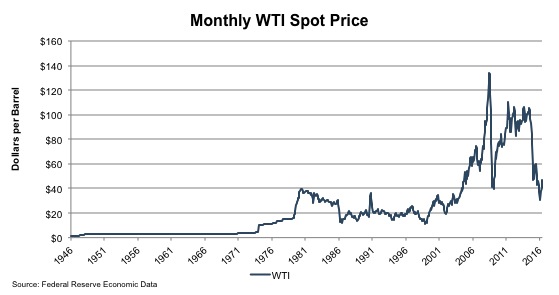

To no one’s surprise, the outlook for energy prices depends on forecasts of future supply and demand, and those forecasts in turn depend on predicting the timing and interaction of complex global events. On the demand side, economists do not anticipate significant change in the near term. Many economists are hesitant to project growth as others indicate a global pull back is due. Even looking only at the U.S. we can see how the way we use oil has changed in the last 40 years. Oil was used to power houses, offices, and factories in the 1970’s and 1980’s, but environmental pressure since then has reduced the use of oil in favor of cleaner energy. Combine the changes to the power grid with efforts to help both the environment and consumers by increasing the energy efficiency of automobiles, and it appears pressure to reduce U.S. demand for oil will continue into the future. Therefore, it is difficult to argue convincingly that an increase in foreign or domestic demand will drive near-term oil price growth.

On the supply side, the world is still reacting to OPEC’s increased production, which has enabled those countries to maintain market share by driving down prices. North American production, for instance, is anticipated to continue its decline in the near term — the result of a slow-down in investment over the past year and a half as many resource plays are no longer economically viable. While wells are continuing to produce oil, completion and drilling of new wells has been delayed. As hydrocarbons are a depleting resource, anything produced must be replaced by discoveries elsewhere. Without investment to replenish reserves, depletion becomes a significant hindrance on growth as inventory and reserve levels drop. It is now a waiting game for current wells’ production to decline enough to impact inventory levels. When this happens to companies across an entire region, oil prices may rise.

One traditional market indicator frequently monitored by industry participants to determine investment levels is rig count. As rig counts fall, the indication is that new production will go down; as rig counts rise, the opposite is true. However, one panelist suggested, “Rig count is not as important to measure future production as the number of drilled but uncompleted wells.” As the price of oil started to decline in 2014, many drillers chose to delay the completion of their wells, hoping for a rebound in price. This price rebound has yet to happen, but the number of uncompleted wells continues to increase. Since it takes less time to complete a well than it does to drill and then complete one, it seems reasonable to assume that companies might be more capable of quickly replenishing their depleted inventories than we would think from looking at the number of rigs. This will help U.S. companies to capitalize if prices start to rise, but also will keep in check any growth in oil prices as supply will increase faster than it normally would.

In a shift away from the U.S. market, the panel then emphasized that one should not develop a narrow focus on investment and that production in the U.S. International production decisions, especially those of OPEC, will continue to drive much of the change in oil price going forward. For this international sector, the economist on the panel communicated the theme: “History doesn’t repeat but it does rhyme.” He explained his point by highlighting one particular period in the oil industry’s last 50 years that can help us to understand the decisions OPEC is making now.

From 1978-2003, the Saudi’s acted as the swing producer in OPEC to influence prices. At the end of this time period, they learned that the swing producer ultimately loses market share. They vowed never again to act in a manner that would shrink their market share. At the time, U.S. production was dropping consistently year over year, and so people paid little attention to the change in attitude. In the mid to late 2000s, however, fracking technology helped unlock significant U.S. inventory. This new technology made the U.S. energy independent, at least as long as oil prices remained above a certain price point needed for the main resource plays to be economical. Jump forward to 2014, and everyone was “shocked” when a significant drop in the price of oil was not met with an OPEC cut in production. From the perspective of Saudi Arabia and the rest of the OPEC nations, however, they simply kept their earlier vow. Deciding to produce at the same or increased levels would better enable them to fend off challenges to their market share from countries such as the U.S. who were starting to fulfill a larger share of the world’s oil needs.

Ultimately, however, the economist ended the discussion of future prices by emphasizing that while certain trends can seem clear, especially in hindsight, there are many factors that can influence oil and gas prices. While people have their opinions, no one can consistently and accurately forecast all these complex factors, and thus “no one knows where the prices of oil and gas will go.” All we can really say with reasonable certainty is that the “drivers impacting the price will be similar to the past ones.” Although this explanation was not “ground breaking”material, we find it helpful to be reminded of the basics during times of turmoil.

In the next blog post, we will look at how one can navigate this turmoil to find successful opportunities as either an investor or a business. If you want to discuss further how the current price outlook can shape asset valuations, and how one can project value when the future is so uncertain, please contact a Mercer Capital professional.

Energy Valuation Insights

Energy Valuation Insights