Oil & Gas Roadblocks: Prices, Production, and People Holding Sway

There are always going to be barriers to success in an industry. Barriers to entry, barriers to growth, barriers to profitability, and barriers to progress can lurk to name a few. The upstream industry has its share. For gas, its own oversupply and low prices are an issue. For oil, capital constraints are reining in investment. Both commodities also thirst for quality labor to fuel growth and longer-term underlying optimism, but that workforce does not exist right now and may take a while to develop.

Natural Gas Prices Low – But For How Much Longer?

I wrote earlier this year that natural gas appears to be oversupplied. That sentiment has not changed, but what has changed is a view towards optimism – maybe not this year, but the industry continues to plan investment in LNG, and key industry players believe it will be the fastest-growing energy source by 2050. CERAWeek by S&P Global had several industry players remaining bullish on investing in this space. Even Saudi Aramco continues to eye funding U.S. LNG projects. This optimism comes amid the “pause” on approvals of LNG exports. For example, Jerry Jones recently doubled down on his investment in Comstock Resources as he bought $100 million of additional stock in the Haynesville producer.

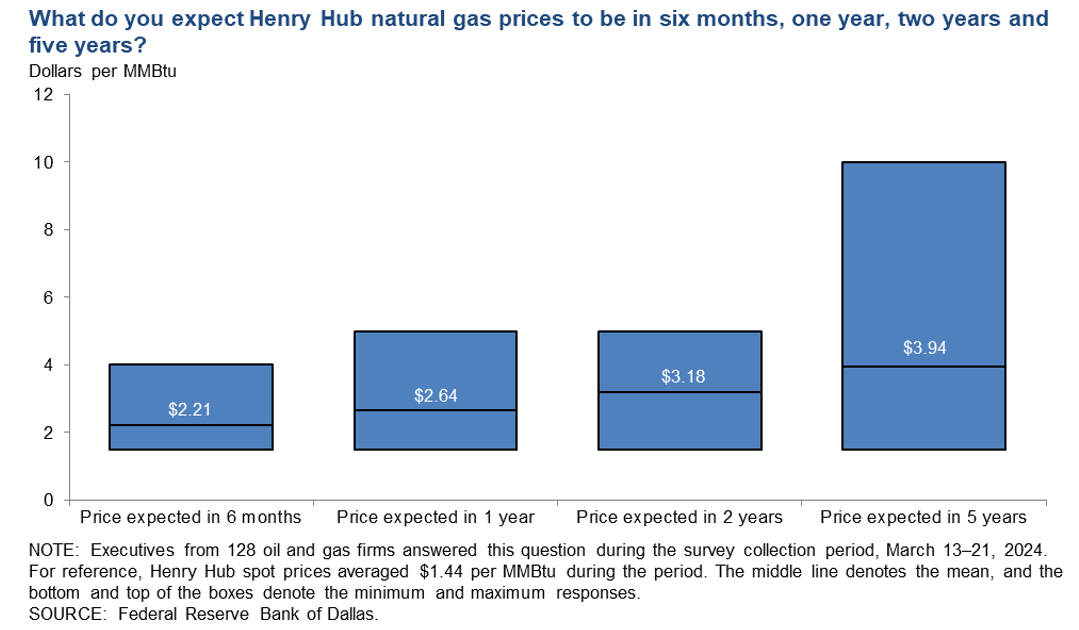

The latest Fed Energy Survey came out this week and it posits an expectation for higher prices by the end of this year, partially as a result of the LNG export approval pause:

However, this also comes as one commenter in the survey mentioning that natural gas needs to be at $4.00 to attract exploration attention from their firm. (That’s not true for all firms though.)

Oil Prices Rising – And May Keep Going

Speaking of breakeven prices, these are rising according to the Fed Energy Survey and as U.S. shale locations continue to drain, liquids supply could also come into a structural shortage position, with additional influence by OPEC restraint and limited investment for infrastructure and finding new reserves. Take for example, not only Jerry Jones’ equity investment, but Matador Resources is working on a stock offering to fund acquisitions. This demonstrates a continuing trend that equity raises, as opposed to debt, are being more frequently seen. Debt sources remain relatively reticent to loan money to the upstream industry. This is harder for everyone, but particularly smaller firms who have higher breakeven prices to contend with ($67 per barrel for small firms vs. $58 for larger firms – as defined by the Fed Survey).

As a result of these trends, consolidation remains in focus for the industry as well. There was over $200 billion in merger and acquisition activity in 2023 and it continues in 2024. Diamondback bought Endeavor for $26 billion in the first quarter of the year, and Kimmeridge remains in a battle to buy Silverbow, which incidentally believes it is undervalued. Part of the overarching rationale for consolidation is for companies to accumulate high quality acreage with lower breakeven costs for future drilling. However, this may not be easy. Acreage exists, but quality acreage with low breakeven costs are not so easy to find.

Underscoring all this optimism is the need for more quality and talented people to execute on future growth. There has been a growing cry for more people to handle infrastructure and growth needs for the industry. The American Geoscience Institute estimates a shortage of 130,000 geoscientists by 2029. There are also construction needs on the Gulf Coast as well to push these LNG projects forward, yet there remains a perception issue with younger workers who do not see the attractiveness to their careers. This could pose a serious impediment if the people are not available, even if the prospects and projects are.

That said, some believe that efficiency will take extra years as training new people in the field will take additional unwanted time and expense. Perhaps some of this will resolve after the election. According to the Fed Survey, many companies are watching to see what will happen and are in flux until then. Then again, some others believe it doesn’t matter who gets elected president in November. Can markets wait to move until then?

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights