Oilfield Services in 2018

A Year in Review

Companies in the energy sector and the broader market experienced an interesting year showing steady and strong growth in Q1-Q3 and met volatility in Q4, which effectively erased gains on the year and even resulted in negative returns.

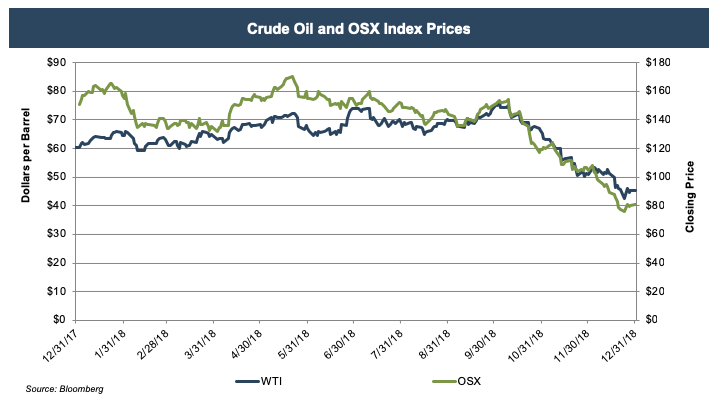

The oilfield services (OFS) sector, in particular, was impacted heavily during last quarter’s downturn driven primarily by fears of oversupply in the market and E&P companies cutting back and looking for discounts. Oil prices steadily rose from about $47 per barrel in August 2017 to over $73 per barrel in October 2018 as OPEC and a Russia-led pact of non-OPEC members coordinated efforts to bring supply production into balance.

However, reports of increased global supplies, including from countries such as Saudi Arabia, Russia, and the U.S. resulted in prices falling again. WTI experienced a 44% decline from a 2018 high of $75 per barrel to lows of around $43 in late December. The OSX, the index tracking OFS sector stock performance, was sideways for the most of 2018 and fell in tandem with the fourth quarter oil crash, resulting in an all-time low for the index of $80.

The large and rapid hits were reminiscent of the declines experienced in 2014, and operators have been playing it close to the chest in terms of spending. Volatile oil prices and E&P spending will be among the major factors contributing to overall OFS performance going into the new year.

M&A Review

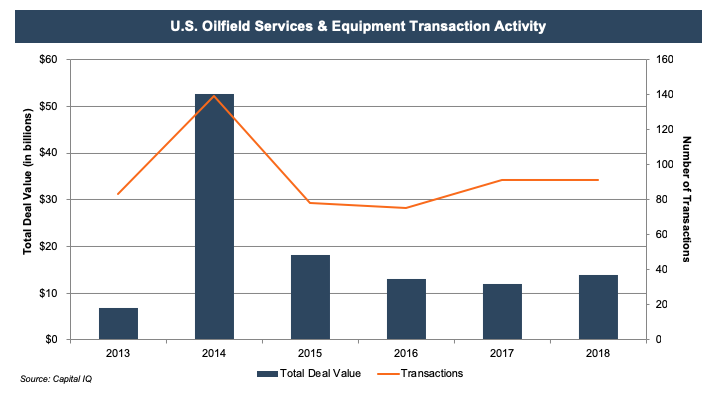

Transaction activity for the oilfield services sector for 2018 was near identical to 2017 in terms of number of deals, and total deal value saw a slight uptick. Low volatility and stable growth that defined 2017 markets and steadily increasing oil prices for most of 2018 have allowed for moderate transaction activity compared to the two years prior to 2017. This environment has also facilitated OFS companies to be more methodical in acquisitions compared to the past.

As we discussed in a prior post, factors influencing transaction activity shifted from financial stress and cost efficiencies to economies of scale and enhanced offerings especially in technology and other efficiencies.

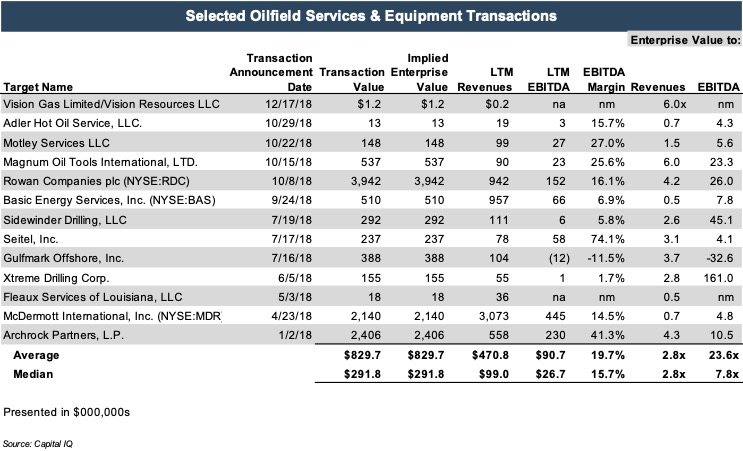

The following table shows select transactions that occurred in 2018 with relevant enterprise value multiples, as companies sought strategic growth opportunities. Despite the fourth quarter turmoil, transactions from October to December constituted over 30% of total year deals.

The observed mix of transactions for the year covered a broad spectrum of subsectors within the OFS sector. Contract drilling and well servicing/completion companies appeared to have slightly more transaction activity compared to other subsectors, but there was not an apparent trend identified within subsector deal activity.

Fewer Bankruptcies for 2018

Bankruptcies in the energy sector have ebbed since 2015 and 2016, but the recent slump in commodity prices do not point toward continued improvement for 2019, according to the latest bankruptcy tracking report from Haynes and Boone LLP.

During 2018, the OFS bankruptcy filings decreased both in number to 12 filings and in aggregate debt of $3.85 billion compared to 2017 which consisted of approximately 40 filings and aggregate debt of $35 billion.

However, with oil prices dropping over a third of its value in the final quarter of the year, a number of public companies made announcements of significant reductions in their 2019 exploration and production budgets, directly impacting prospects for many OFS companies. In turn, this could lead to an increase in filings in the first quarter of 2019 in the event of capex and budgetary strains.

But while a number of companies are expecting to make budgetary reductions, several are looking to maintain or even increase spending in 2019.

Spending and Outlook for 2019

Analysts with Moody’s Investors Service believe that the health of the OFS sector is still quite weak with many burdened by high debt and added pressure brought by the drop in crude prices in late 2018. But the sector could see a 10% to 15% increase in overall earnings in 2019 as E&Ps increase spending. The key factor alluded here is that spending for many of these companies is anticipated to follow later in the year after riding out Q4 2018 shocks.

Spending for many of these companies is anticipated to follow later in the year after riding out Q4 2018 shocks.

Sajjad Alam, vice president-senior analyst for Moody’s, said in his report, “Most of that growth will likely come only later in 2019 after the heightened oil-price volatility of late 2018. Infrastructure constraints in the Permian Basin will also limit OFS operators’ ability to raise prices early in 2019.”

Limited spending is a concern for OFS companies as many E&Ps weigh the choices surrounding budget appropriations. But many companies and private equity firms still appear to be committed to proposed capex budgets of increased spending on much needed infrastructure.

Hess Corp announced a 2019 E&P capital and exploratory budget of $2.9 billion slated for 2019, up from $2.1 billion in 2018. Approximately 75% will be allocated to high return growth assets in the Bakken and Guyanna.

ConocoPhillips has set a capex budget for 2019 of $6.1 billion, which is comparable to its 2018 capex, excluding any acquisition costs. Approximately $3.1 billion will be allocated to rigs across the Eagle Ford, Bakken, and Delaware plays.

North American E&P spending as a whole is expected to lag behind international markets but is estimated to grow 9% in 2019, according to a global E&P report released from Barclays. Barclays noted, however, “spending is exposed to more downside risk given the recent oil price collapse,” which isn’t fully captured in budgets that have been approved thus far.

Value Considerations

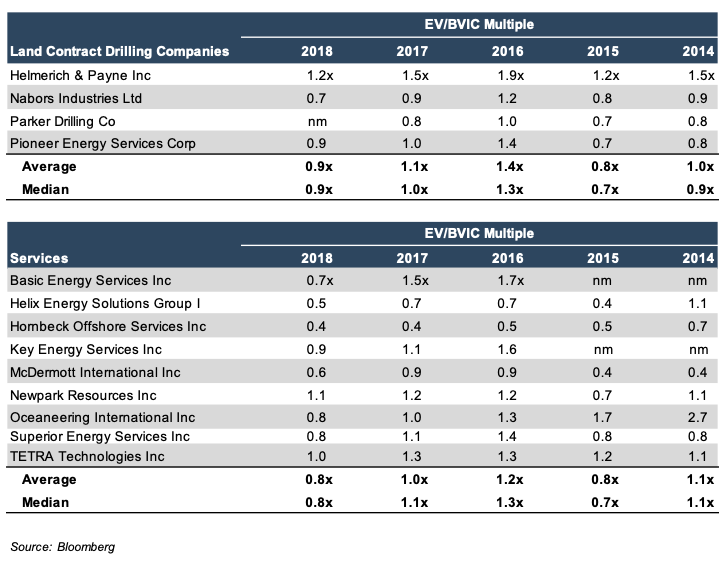

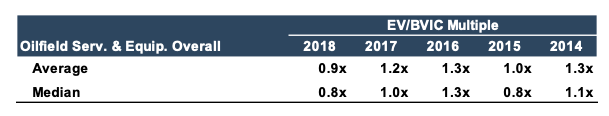

From a valuation perspective, we examined a selection of guideline company groups for relative value changes over time. One way to observe this relative value change is to look at enterprise value, adjusted for cash, relative to total book value of net invested capital (debt and equity) held by the company or “BVIC.” Any multiple over 1.0x indicates valuations above what net capital investors have placed into the firm.

Take for example, Land Contract Drilling and Services subsectors:

EV/BVIC multiples have fallen since the middle of the year and even below observed 2017 levels. Investors were not expecting to receive adequate return on capital deployed at these companies. After analyzing our guideline companies for oilfield services and equipment overall, observed average and median multiples for 2018 were below 1.0x for 2018.

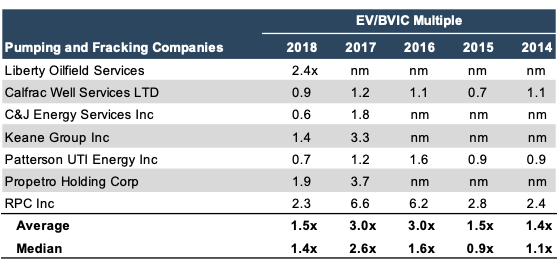

The only outliers within this sector are pressure pumping and fracking concentrated businesses, which are more directly tied into the value expansion in the oil patch. The demand for pumpers’ technology and services has driven through the fourth quarter woes, showing that the market recognizes the contributions from these companies.

Conclusion

As the energy sector brings in the new year, continued strategic M&A and fewer bankruptcies indicated positive signals for the health of the sector, but the fourth quarter collapse in oil prices have had companies and analysts alike cautious on the outlook for 2019 as evidenced in value considerations above.

Ultimately OFS is weak right now due to multiple factors; however, there are reasons for optimism in the sector and growth opportunities during these uncertain times.

Several companies underperformed to close out 2018, and many have made adjustments to conserve cash through debt restructurings, leverage reduction, and stringent capital discipline. Although oil prices have rebounded somewhat in the first weeks of January, volatility is still a primary concern when it comes to forward planning.

U.S. spending is expected to increase in the next year, but many budgets among larger North American E&Ps have been reduced or have yet to be unveiled, which could mean further reduction of spending compared to preliminary estimates.

Ultimately OFS is weak due to multiple factors stemming volatility, general market uncertainty, and the price crash; however, steady and methodical M&A during the year coupled with very few bankruptcy filings and prospects for late E&P spending increases offer optimism in the sector and growth opportunities during uncertain times.

In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results.

Whether you are selling your business, acquiring another business or division, or have needs related to mergers, valuations, fairness opinions, and other transaction advisory needs, we can help. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights