Optional Insights on Valuing PUDs and Unproven Reserves

One of the primary challenges for industry participants when valuing and pricing oil and gas reserves is addressing proven undeveloped reserves (PUDs) and unproven reserves, particularly in today’s volatile price environment. The onslaught of COVID-19 and the Russian-Saudi price war caused significant operational implications with arguably all E&P companies. Companies’ forecasts were no longer reasonable. Drilling stopped and the market took a dive. The implication of these events had impacts on the valuations of PUDs and unproven reserves valuations. While the market approach can sometimes be used to understand the value of PUDs and unproven reserves, every transaction is unique. Why then, and under what circumstances, might the PUDs and unproven reserves have significant value?

Public transactions do not disclose the value associated with PUDs and unproven reserves, but instead, they indicate an aggregate value for a bundle of assets. The allocation of that value across the various assets acquired is up for debate. Recent transaction sheds some light on asset pricing in the current environment.

Optionality Value

The answer lies within the optionality of a property’s future DCF values. In particular, if the acquirer has a long time to drill, one of two forces come into play: either the PUDs potential for development can be altered by fluctuations in the current price outlook for a resource, or as seen with the rise of hydraulic fracturing, drilling technology can drive significant increases in the DCF value of the unproven reserves.

This optionality premium or valuation increment is often most pronounced in unconventional resource play reserves, such as coal bed methane gas, heavy oil, or foreign reserves. This is especially apparent when the PUDs and unproven reserves are reliant on future production. These types of reserves do not require investment within a fixed short timeframe.

PUDs are typically valued using the same discounted cash flow (DCF) model as proven producing reserves after adding in an estimate for the capital costs (capital expenditures) to drill. Then the pricing level is adjusted for the incremental risk and the uncertainty of drilling “success,” i.e., commercial volumes, life, risk of excessive water volumes, etc. This incremental risk could be accounted for with either a higher discount rate in the DCF or a reserve adjustment factor (RAF). Historically, in lower oil price environments like we face today, a raw DCF would suggest little to no value for PUDs or unproven reserves in several plays and basins.

In practice, undeveloped acreage ownership functions as an option for reserve owners; they can hold the asset and wait until the market improves to start production. Therefore, an option pricing model can be a realistic way to guide a prospective acquirer or valuation expert to the appropriate segment of market pricing for undeveloped acreage.

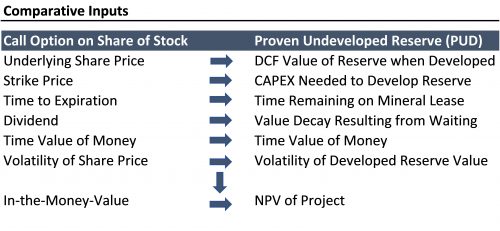

Adaptation of Black Scholes Option Model

The PUD and unproved valuation model is typically seen as an adaptation of the Black Scholes option model. The Black Scholes option model is widely used to develop the value of European-style options. The adaptation is most accurate and useful when the owners of the PUDs have the opportunity, but not the requirement, to drill the PUD and unproven wells and the time periods are long, (i.e., five to ten years). The value of the PUDs thus includes both a DCF value, if applicable, plus the optionality of the upside, driven by potentially higher future commodity prices and other factors. The comparative inputs, viewed as a real option, are shown in the table below.

When these inputs are used in an option pricing model, the resulting value of the PUDs reflects the unpredictable nature of the oil and gas market. This application of option modeling becomes most relevant near the lower end of historic cycles for a commodity. In a high oil price environment, adding this consideration to a DCF will have little impact as development is scheduled for the near future and the chances for future fluctuations have little impact on the timing of cash flows. At low points, on the other hand, PUDs and unproved reserves may not generate positive returns and thus will not be exploited immediately.

If the right to drill is postponed for an extended period, (i.e., five to ten years), those reserves still have value based on the likelihood they will become positive investments when the market shifts at some point. In the language of options, the time value of the out-of-the-money drilling opportunities can have significant worth. This worth is not strictly theoretical, either, or only applicable to reorganization negotiations. Market transactions with little or no proven producing reserves have demonstrated significant value attributable to non-producing reserves, demonstrating the recognition by the pool of buyers of this optionality upside.

Conclusion

We caution, however, that there can be limitations in the model’s effectiveness, as we describe in Bridging Valuation Gaps Part 3. Specific and careful applications of assumptions are needed, and even then, Black Sholes’ inputs do not always capture some of the inherent risks that must be considered in proper valuation efforts. Nevertheless, option pricing can be a valuable tool if wielded with knowledge, skill, and good information, providing an additional lens to peer into a sometimes-murky marketplace. Today’s marketplace is particularly uncertain, and a quality appraisal is extremely valuable since establishing reasonable and supportable evidence for PUD, probable, and possible reserve values may assist in a reorganization process that determines the survival of a company, the return profile for a potential investment, or simply standing up to third-party scrutiny. Given these conditions, we feel that the benefits of using option pricing far outweigh its challenges.

Energy Valuation Insights

Energy Valuation Insights