Current Environment Challenges America’s Most Prolific Basin

Permian Basin Update

The economics of oil and gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. The cost of producing oil and gas depends on the geological makeup of the reserve, depth of reserve, and cost to transport the raw crude to market. We can observe different costs in different regions depending on these factors. In this post, we take a closer look at the Permian Basin.

Production and Activity Levels

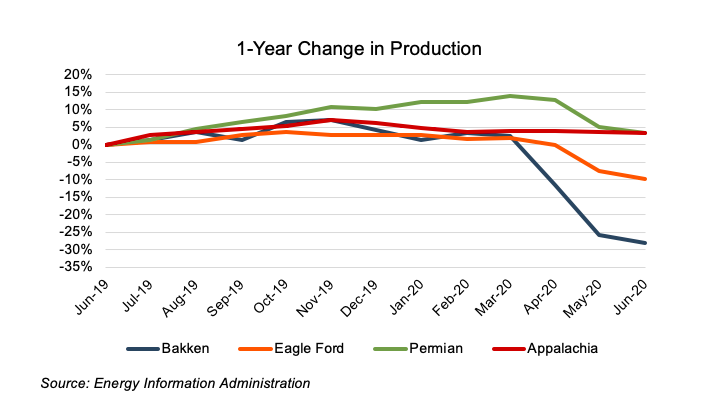

Permian production grew approximately 3% year-over-year through June, in line with Appalachia and avoiding the declines observed in the Bakken and Eagle Ford (down 28% and 10%, respectively). The Permian is still one of the focus areas of supermajors Exxon and Chevron, and also relatively well-capitalized independents such as Concho, Diamondback, Parsley, and Pioneer. As such, it has been more resilient than other oil-focused basins and experts expect to see production growth.

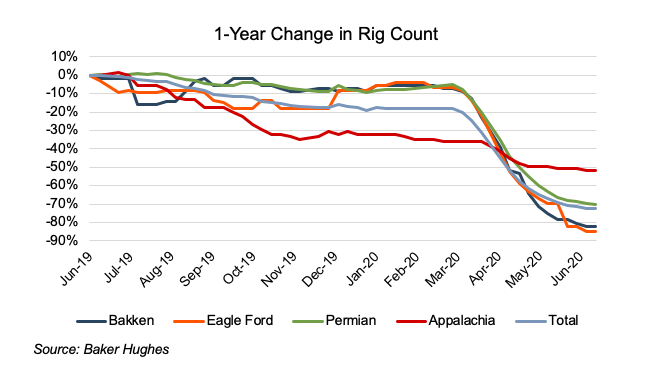

Rig count in the Permian at June 26th stood at 131, down 70% from the prior year. While significant, this decline is less severe than reductions seen in the Bakken and Eagle Ford of 82% and 85%, respectively. Appalachia rig counts declined by a more modest 52%, though the gas-focused basin had fewer rigs to drop and faced a more benign commodity price environment. With companies beginning to bring production back online, this may be the nadir, though significantly lower E&P capex budgets will likely keep a lid on rig counts in the near term.

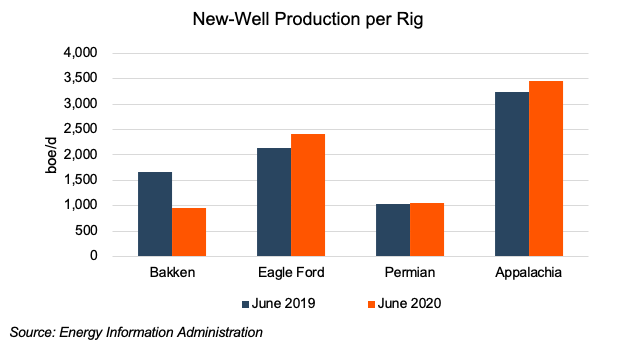

The Permian is also seeing gains in new-well production per rig. While this metric doesn’t cover the full life cycle of a well, it is a signal of the increasing efficiency of operators in the area. New-well production per rig in the Permian increased 2% on a year-over-year basis through June, compared to changes of -42%, 12%, and 6% in the Bakken, Eagle Ford, and Appalachia, respectively. (Note that the decline in Bakken production is an artifact of the significant production curtailments in the basin. The EIA forecasts a normalization in July.)

Commodity Prices Rebound After Unprecedented Decline

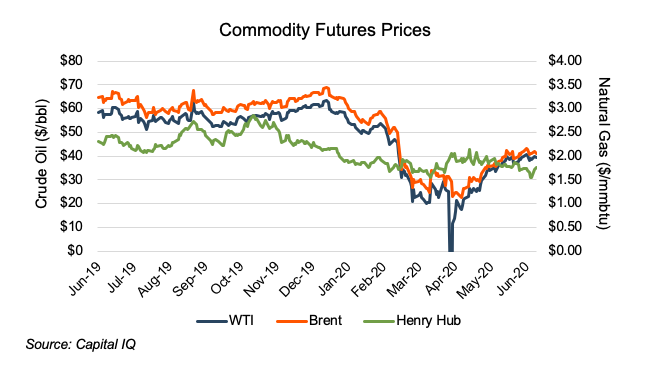

WTI front-month futures prices increased over 90% during the second quarter of 2020, though it was a bumpy road getting there. Prices at the beginning of the quarter were ~$20/bbl, still depressed in the wake of the Saudi/Russian price war, and demand destruction caused by COVID-19. In early April, prices generally increased, approaching nearly $30/bbl by the middle of the month. However, on April 20, WTI futures prices collapsed, falling below $0 to settle at negative $37/bbl. While there are numerous technical reasons for the collapse, there was significant concern regarding crude storage capacity as production had not declined in tandem with demand.

However, crude futures prices generally increased thereafter, driven by supply cuts from OPEC+, curtailments by US producers, and a recovery in demand. WTI front-month futures prices ended the quarter at $39.34/bbl.

Financial Performance

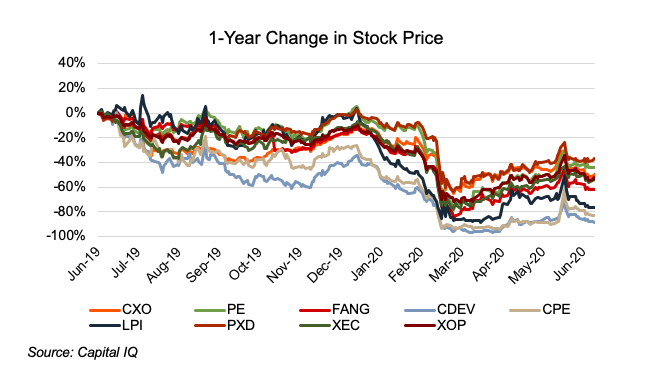

All Permian E&P operators analyzed have had year-over-year stock price declines. Pioneer and Parsley were the best performers in the Permian group, only down 37% and 44%, respectively. Concho also outperformed the broader E&P index (XOP), down 50% compared to the XOP’s 52% decline. Centennial was the worst performer in the group, down 88% year-over-year, though it has rebounded significantly since its lows in early April.

While the Permian has been less affected by the most recent batch of E&P bankruptcies, it has not been immune. At the end of June, two Permian operators filed for bankruptcy. Sable Permian filed for bankruptcy on June 25 with approximately $1.3 billion of interest-bearing debt. The company previously underwent debt restructurings in 2017 and 2019. On June 29, Lilis Energy filed for Chapter 11. The company entered proceedings with a Restructuring Support Agreement with certain investors. Under the terms of the agreement, common equity holders will not receive any consideration in the restructured entity.

Though commodity prices have recovered from recent lows, they remain below levels at which certain operators can cover operating expenses on existing wells (and well below prices required to drill new wells), according to a Dallas Fed survey. As such, more Permian bankruptcies are likely coming.

Texas Railroad Commission Decides Against Proration

On April 14, the Texas Railroad Commission (which, despite its name, regulates oil & gas activities in the state of Texas) held a meeting to discuss prorating production in the state in light of significant demand destruction and concerns regarding oversupply. Proponents of proportion, led by Scott Sheffield of Pioneer and Matt Gallagher of Parsley, argued that proration was needed to save American jobs and ensure that the energy industry is able to respond once demand returns. Opponents argue that government mandates were unnecessary and that operators should adjust production in response to market prices. Some, specifically midstream operators, were concerned that such a mandate would allow E&P companies to eschew contractual commitments.

On May 5, two of the three Texas Railroad commissioners voted against proration.

Conclusion

While commodity prices have recovered from recent lows, they remain below levels at which certain E&P companies can operate sustainably. Two Permian operators have filed for bankruptcy, and more are likely coming. However, the Permian’s economics remain superior relative to most basins, so it will likely fare better than other areas in this difficult environment.

We have assisted many clients with various valuation needs in the upstream oil and gas space in both conventional and unconventional plays in North America, and around the world. Contact a Mercer Capital professional to discuss your needs in confidence and learn more about how we can help you succeed.

Energy Valuation Insights

Energy Valuation Insights