The Permian Basin: Loaves and Fishes

One of the most commonly taught Bible stories is the miracle of Jesus feeding five thousand people with only five loaves of bread and two fish. Last week we learned of a new miracle story of never ending sustenance. The Permian Basin, which has been drilled since the 1920s and produced billions of barrels of oil, was discovered to hold the largest unconventional crude accumulation in the US.

Less than 10 years ago, the United States Geological Survey (USGS) estimated that the Permian Basin held just 1.0 billion barrels of conventional oil and 1.3 billion barrels of unconventional oil classified as technically recoverable reserves.1 The advancement of horizontal drilling techniques, however, increased the amount of recoverable reserves. Now, according to the Texas Rail Road commission, over 29 billion barrels of oil and 75 trillion cubic feet of gas have been produced from the Permian over the last 90 years. Further, last Tuesday, the USGS announced an estimated 20 billion barrels of crude oil, 1.6 billion barrels of NGLs, and 16 trillion cubic feet of natural gas were discovered in four layers of shale in the Wolfcamp formation. This discovery alone is 3x larger than the entire Bakken play in North Dakota, and equates an estimated $900 billion of oil.

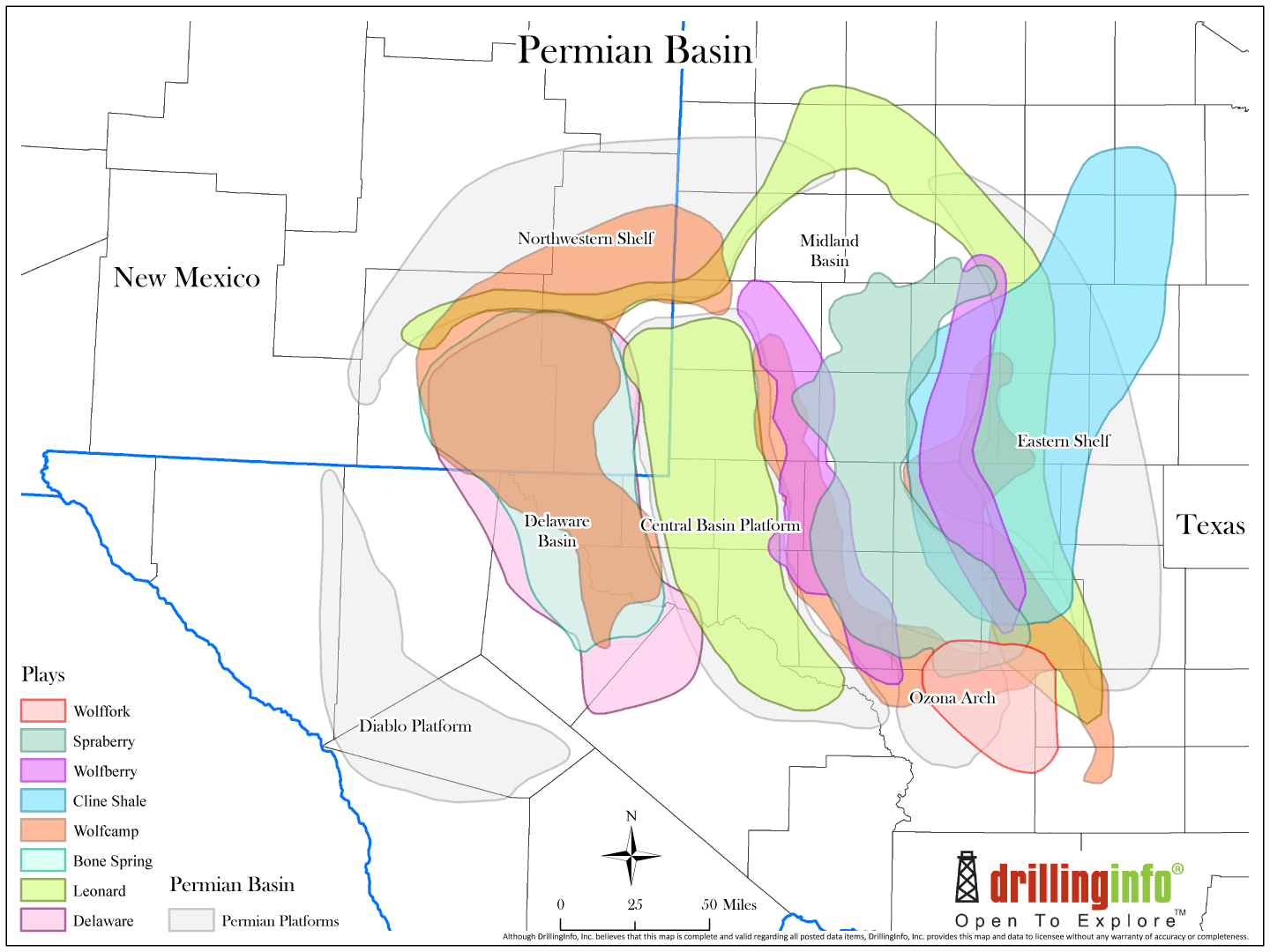

The Wolfcamp Shale has been a recent target of E&P companies in the face of two years of low oil prices. The Wolfcamp is an oil and gas zone located below the Spraberry oil play in the Midland Basin. The Spraberry oil play has been developed since 1943 but the Wolfcamp was not developed until the onset of horizontal drilling. Companies saw opportunity in the Wolfcamp shale because of its depth and geological makeup. The Permian Basin is a stacked play which means that multiple horizontal wells can be drilled from one main wellbore. This provides increased productivity as multilateral wells have greater drainage areas than single wellbore. Additionally, it can reduce overall drilling risk and cost. For deep reservoirs like the Permian, a multilateral well eliminates the cost of drilling the total depth twice. The Wolfcamp is as much as a mile deep at some points which means that operators can drill multiple horizontal wells from one main wellbore.

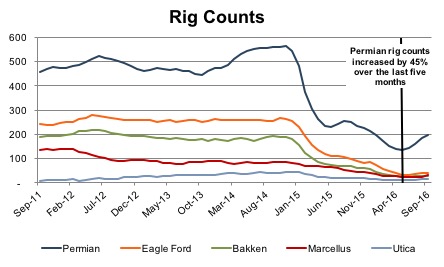

M&A activity in the E&P sector has picked up this year due to the opportunity seen in the Permian. There have been 132 deals in the Permian this year so far, totaling $20.8 billion in deal value, which is more than 40% of total E&P deal value generated throughout the US. Much of this activity has been focused in the Midland Basin. Because drilling costs in the Permian are lower than many other plays in the US, when oil prices began to show signs of recovery, rig counts in the Permian picked up faster than in any other domestic play. Producers were eager to begin operating after two years of an uneconomical drilling environment, and for many producers the Permian was the first play in which the cost of oil rose above breakeven costs. The chart below shows the combined rig counts of oil and gas rigs in various domestic plays.

What Does This Mean?

Business Insider associates some of the collapse of oil prices in 2014 to be driven by the increase in production in the Permian. The oversupply of oil pushed prices down worldwide. Just as oil prices have started recovering, this new discovery makes producers seriously consider if $50 per barrel oil is a thing of the past. Walter Guidroz, program coordinator for the USGS Energy Resources Program said, “The fact that this is the largest assessment of continuous oil we have ever done just goes to show that, even in areas that have produced billions of barrels of oil, there is still the potential to find billions more.”

From a valuation perspective, acreage values in the Permian are likely to continue increasing as more producers try to get their hands on valuable Permian acreage and available land becomes scarcer. However, there is one problem with talking about technically recoverable resources: cost is not considered. Many headlines recently boasted that the discovery in the Wolfcamp is worth $900 billion in revenue at today’s prices… but what about cost? When using the income approach to value oil and gas assets, earnings estimates, not revenue, are capitalized. Art Berman, a petroleum geologist, described this best: “if the oil magically leaped out of the ground without the cost of drilling and completing wells; if there were no operating costs to produce it; if there were no taxes and no royalties” then the Wolfcamp discovery would be worth $900 billion.

This is not to say that the Wolfcamp discovery is inconsequential, but to simply highlight the affect the pricing environment has on oil and gas valuations. The oil and gas industry is constantly changing. Each location in the Permian is different and costs vary by region. As a result, the valuation implications of reserves and acreage rights can swing dramatically in resource plays. Utilizing an experienced oil and gas reserve appraiser can help to understand how location impacts valuation issues in this current environment. Contact Mercer Capital to discuss your needs and learn more about how we can help you succeed.

End Note

1 The USGS defines recoverable resources as those that can be produced using currently available technology and industry practices. Whether or not it is profitable to produce these resources has not been evaluated.

Energy Valuation Insights

Energy Valuation Insights