Permian Production Growth Holds

The economics of Oil & Gas production vary by region. Mercer Capital focuses on trends in the Eagle Ford, Permian, Bakken, and Marcellus and Utica plays. The cost of producing oil and gas depends on the geological makeup of the reserve, the depth of the reserve, and the cost of transporting the raw crude to market. We can observe different costs in different regions depending on these factors. In this post, we take a closer look at the Permian.

Production and Activity Levels

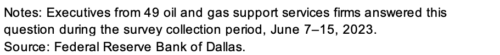

Estimated Permian production (on a barrels of oil equivalent, or “boe” basis) increased 9.9% year-over-year through June. Other basins analyzed (Bakken, Eagle Ford, and Appalachian) showed markedly lower production increases ranging from 2.5% to 5.5%.

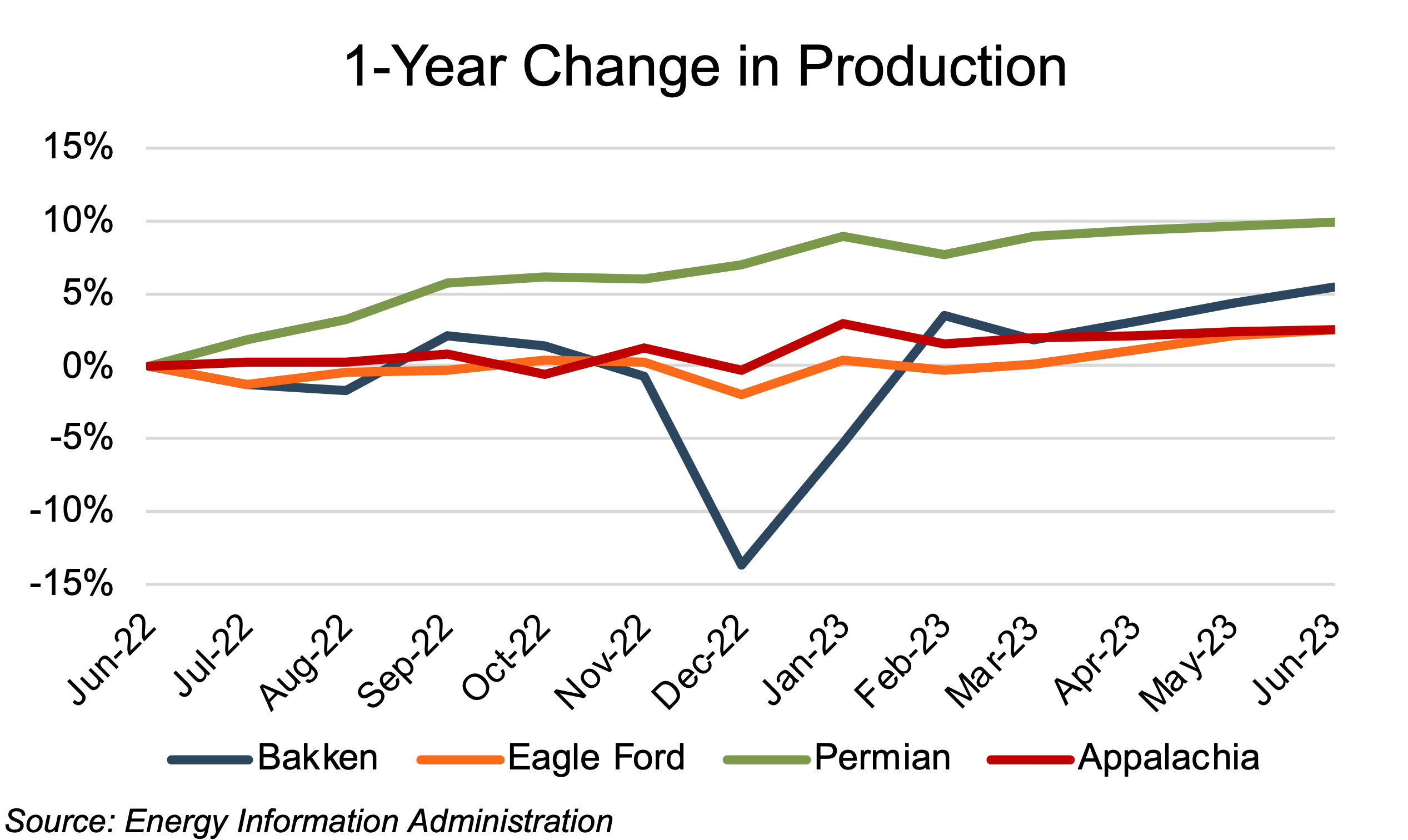

Rig counts declined across all four basins by nearly 11%. The Permian showed the lowest year-over-year decline at 2.3%. The other basins posted rig count losses of 9% to 15%, with the gas-heavy Appalachian basin recording the lowest decline after the Permian. The Permian’s rig count declined from 349 to 342, but Permian rigs edged upward from 46% of total four-basin rigs to 51%.

Commodity Prices on the Decline

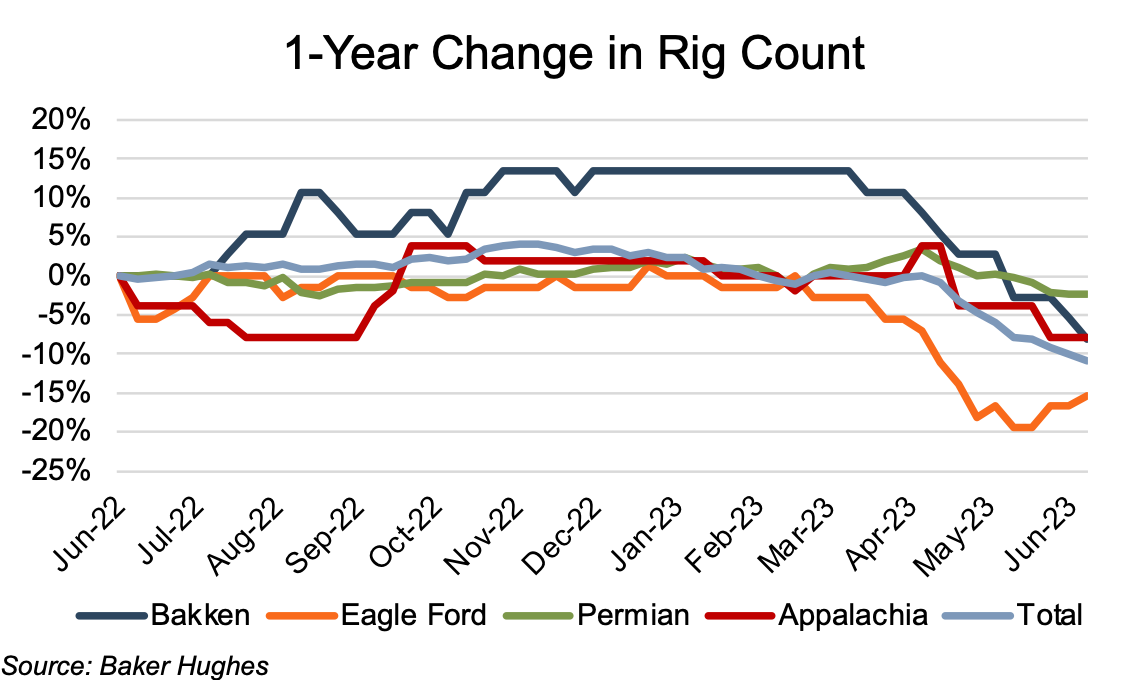

Oil prices generally declined over the latest twelve months from $106 WTI and $109 Brent to $71 WTI and $75 Brent. Short-lived increases occurred in October 2022 (12% for WTI and 11% for Brent) and March-April 2023 (21% WTI and 16% Brent). Oil prices remained within fairly narrow ranges between the September-October and March-April increases. A similar narrow price range occurred following the March-April increase, with WTI varying between $67 and $79 and Brent varying within a broader band of $72 to $83. The latter part of the September-October 2022 oil price rise was spurred on by the October 5 OPEC+ announcement of a two million barrels per day output reduction. Another OPEC+ voluntary reduction of 1.16 million barrels per day contributed significantly to the March-April price increase.

Gas prices experienced much wider swings, with the Henry Hub running up 80% from $5.39 on June 30, 2021, to a month high of $9.42 on August 25, 2021. Henry Hub slid over the next five months reaching $2.40 in early February 2023, with only a short intervening increase in November. Since February, gas prices have ranged from $2.01 to $2.87. The long slide in gas prices from December to February primarily resulted in an unexpectedly mild winter that contributed to natural gas inventories ending above the trailing five-year average.

Financial Performance

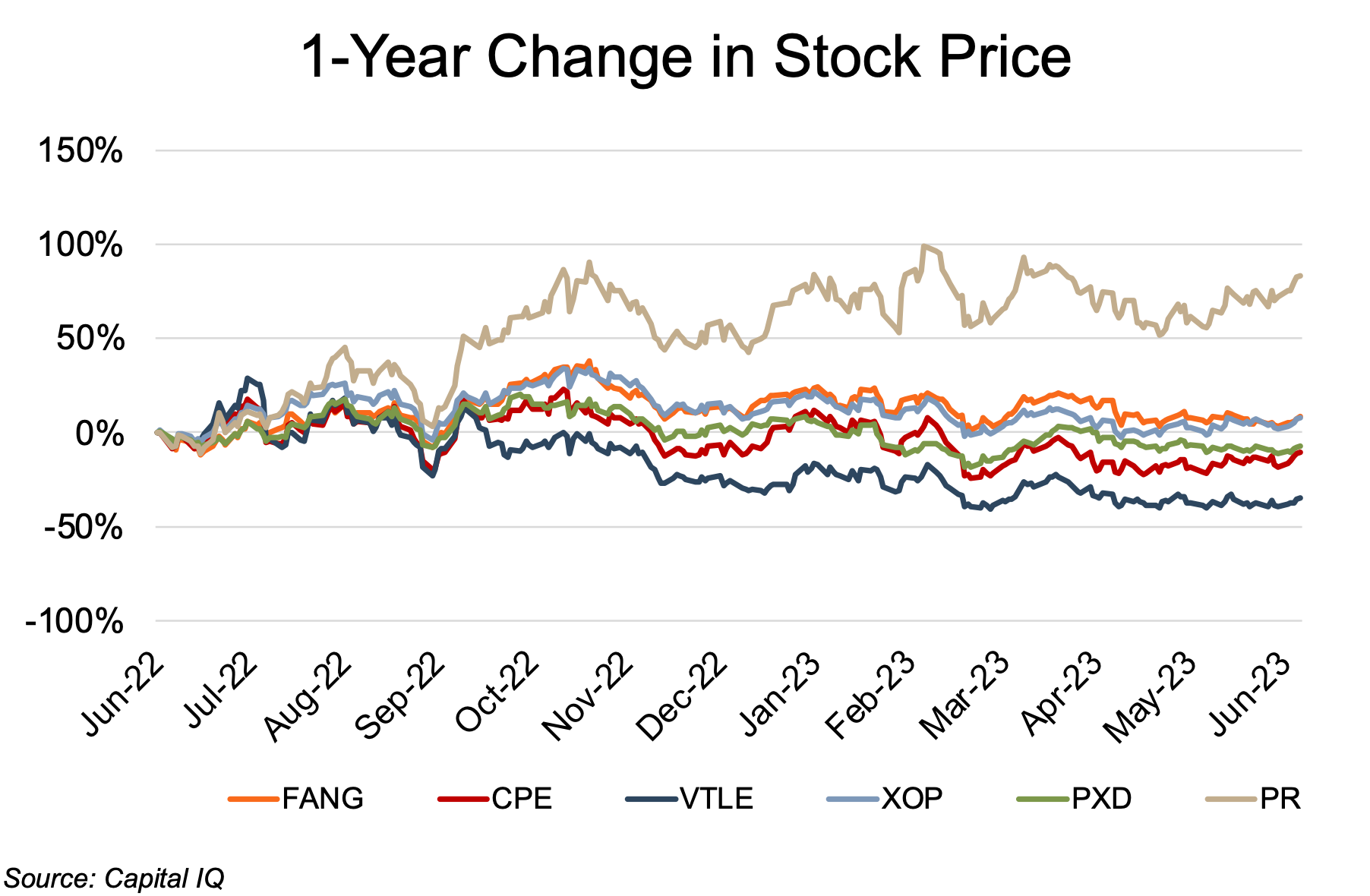

The Permian public comp group showed a mixed bag of stock price performance over the past year (through June 30). Three of the five members (Diamondback, Callon, and Pioneer) posted price performance from -7.1% to 8.4%, with an average among the three of -3.1%. Permian Resources posted an outlier high-side increase of 83.3% following its September 1 formation from the merger of Centennial Resources and Colgate Energy. The low-side outlier was Vital, with a price decline of -34.1%.

Fed Survey Points to Higher Cost Expectations

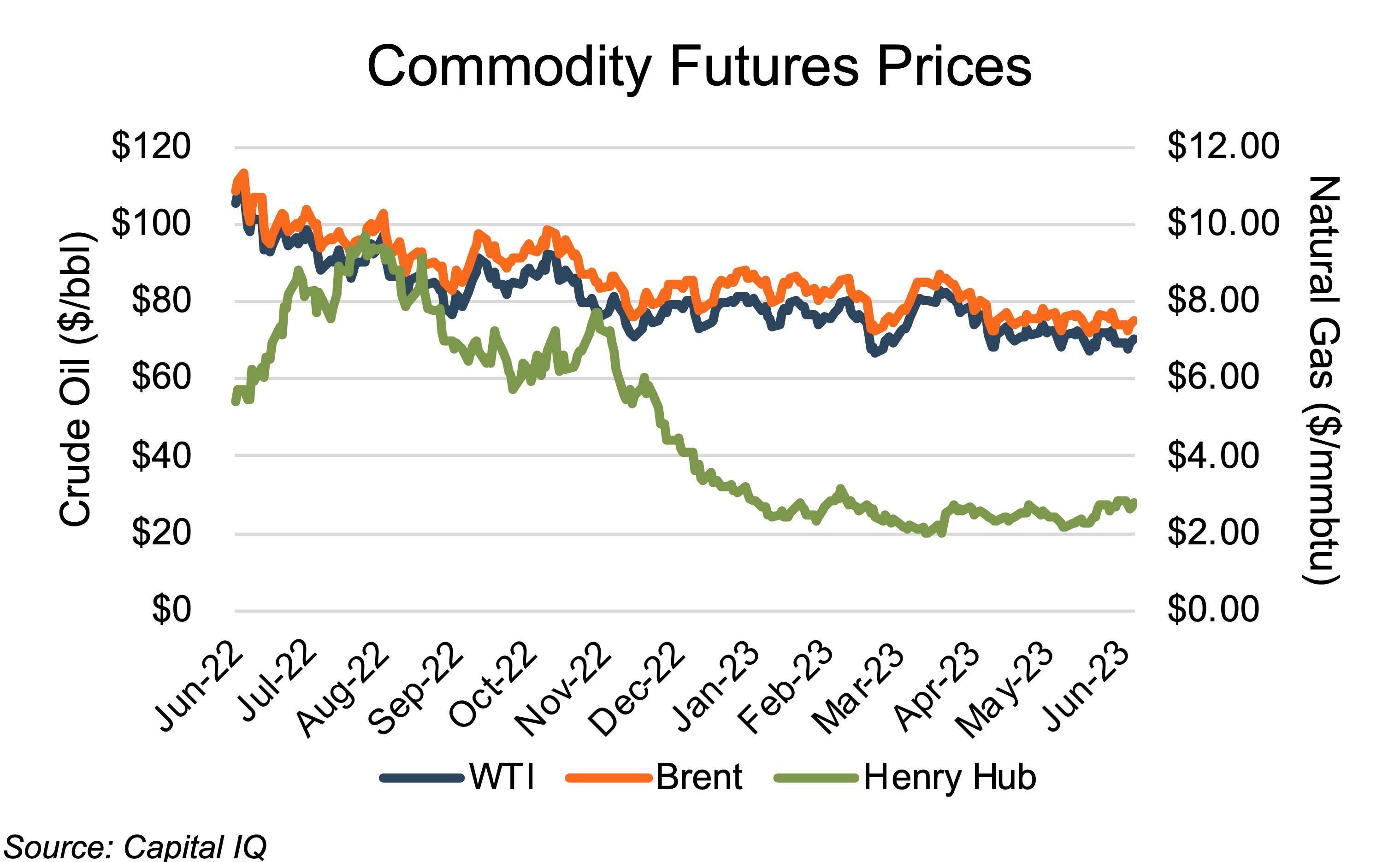

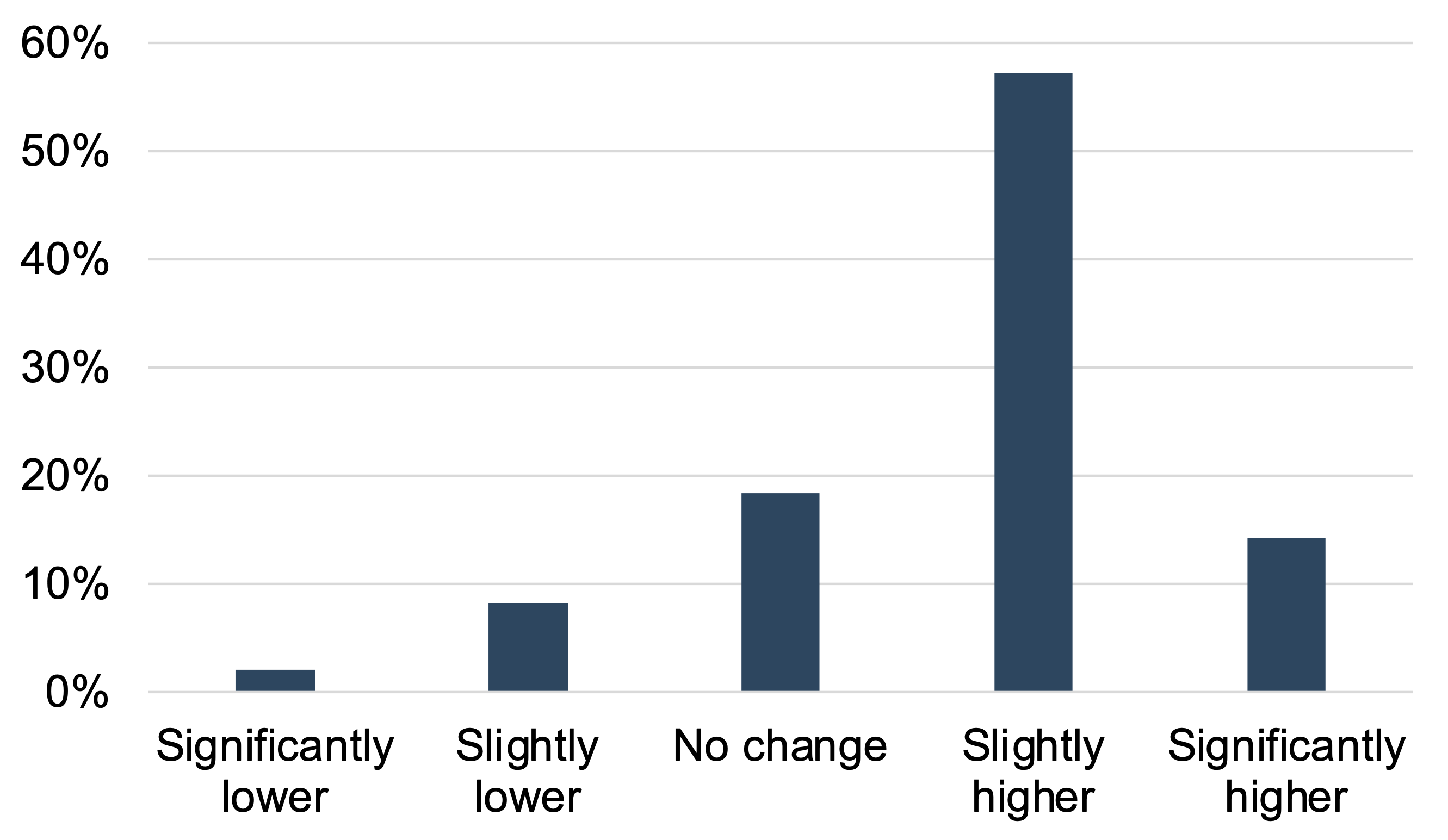

The Dallas Fed’s Second Quarter 2023 Energy Survey focused on input cost expectations (excluding labor) for the coming year. Over 70% of E&P industry executives surveyed expected these costs to increase either slightly or significantly from year-end 2022 to year-end 2023. 19% of executives expected costs to remain relatively unchanged, and only 10% expected costs to decline over the period.

Conclusion

Permian production growth over the past year continued to run well ahead of growth in the Eagle Ford, Appalachian, and Bakken, as the Permian basin remains one of the most economic regions for U.S. energy production. With the decline in commodity prices over the past year, rig counts fell, with the most significant decline occurring in May. With E&P firms expecting continued cost increases through the remainder of 2023, the Permian’s existing cost advantage will contribute to its continued dominance over the major U.S. basins. We have assisted many clients with various valuation needs in the upstream oil and gas space for both conventional and unconventional plays in North America and around the world. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights