Premiums for Inventory Scale

In the last year, M&A activity in the upstream area of the oil and gas industry has increasingly become top-heavy, characterized by several headline deals. While the broader North American E&P deal count has been shrinking since 2022, a handful of major acquisitions in the last year have led to a spike in upstream M&A spending.

Recent Deal Sizes: Top-Heavy Skew

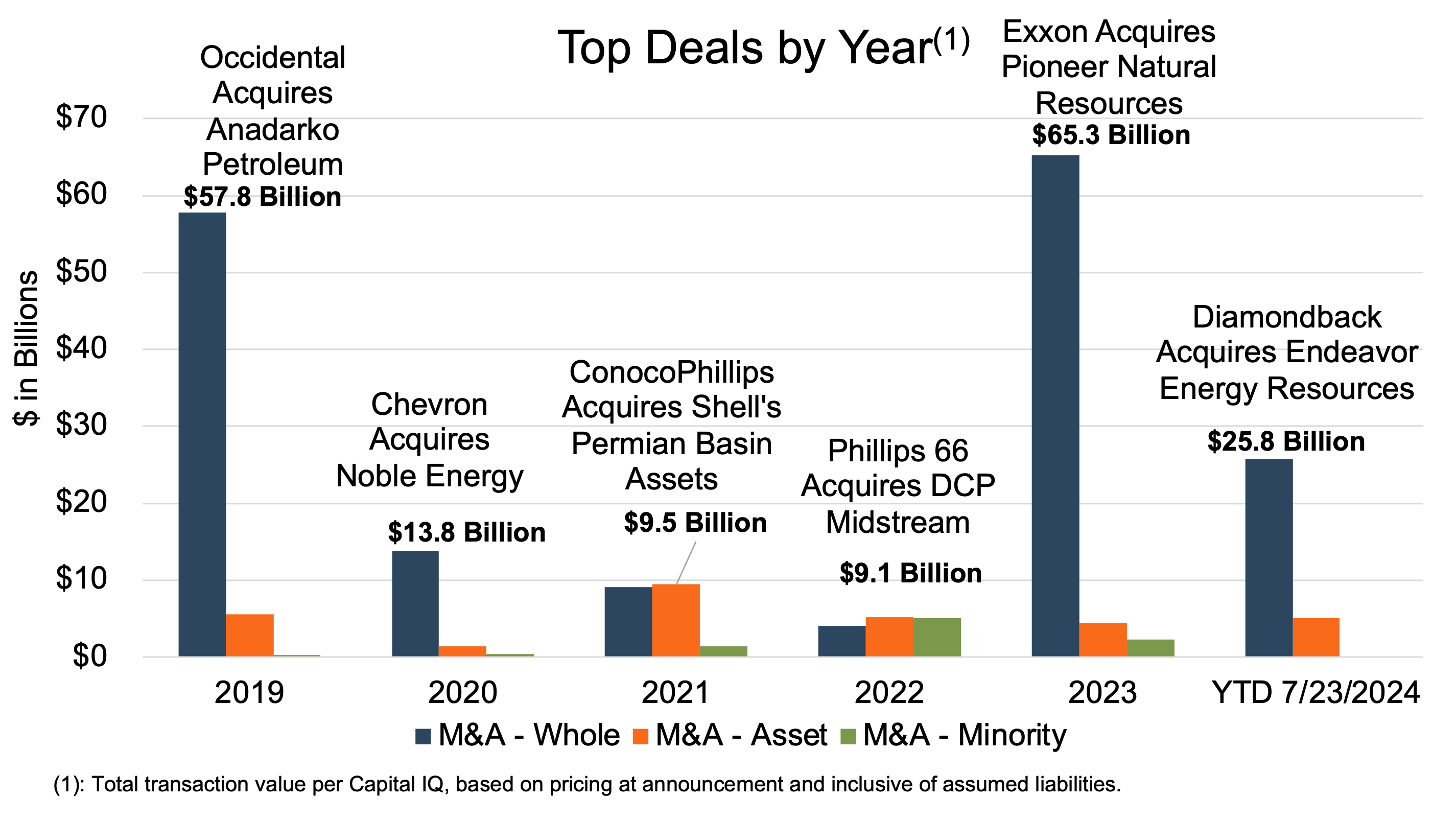

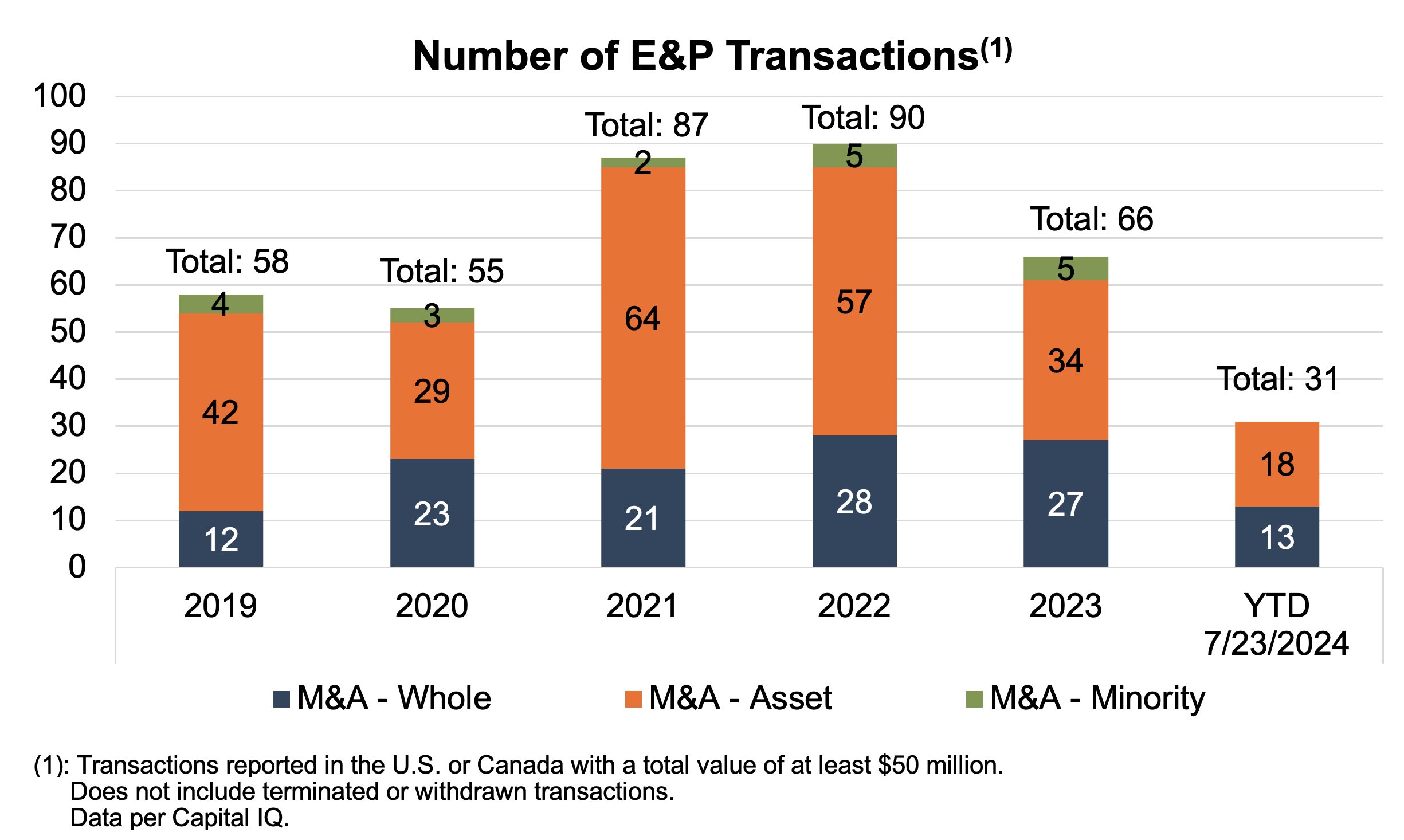

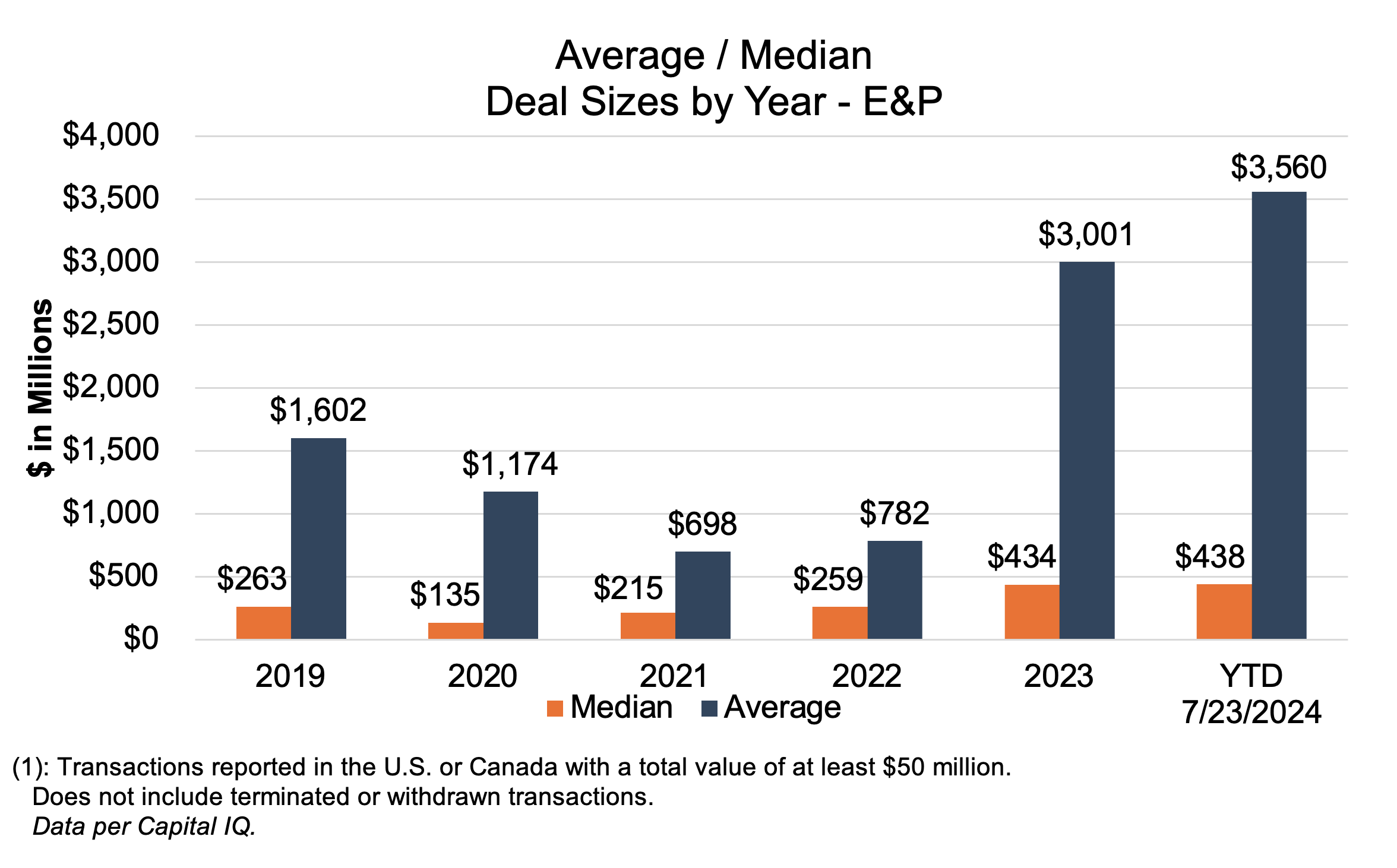

Despite the shrinking deal count, 2023 E&P spending on M&A grew to $234 billion per the EIA, led by Exxon Mobil’s (XOM) $65 billion acquisition of Pioneer Natural Resources (PXD) and Chevron’s (CVX) acquisition of Hess (HES) for $61 billion. These two deals combined account for more than half of the $234 billion in spending reported by the EIA. The trend of fewer but larger deals continued into 2024, with significant transactions like Diamondback Energy acquiring Endeavor Energy Resources for $26 billion and ConocoPhillips acquiring Marathon Oil for $23 billion. Based on our research of North American E&P transactions (at least $50 million), the deal count for E&P targets declined 27% in 2023 to 66 transactions, and the 2024 count is on pace to continue the fall.

Large producers have continued to be targeted in 2024, including Diamondback Energy acquiring Endeavor Energy Resources for $26 billion, and ConocoPhillips acquiring Marathon Oil for $23 billion. For context, apart from the Pioneer and Hess acquisitions in 2023, the acquisitions of Endeavor and Marathon were both larger than any other E&P deal since 2019. Of the 31 transactions announced through mid-July of this year (at least $50 million), the top ten deals comprised over 90% of the total based on announcement pricing.

Click here to expand the image above

Premiums for Inventory Scale

One driving factor for recent M&A is the focus on expanding portfolios of core acreage. Over the past twelve months, there has been a willingness to acquire the right assets at a higher price. A growing subset of producers — the larger public E&Ps — are increasingly choosing inventory growth via acquisition, as evidenced by the median transaction multiples after 2022.

Additionally, boards and management teams are opting to buy these large packages of long-term assets at higher multiples, accepting lower potential returns in exchange for the lower risk profile (relative to new exploration and development activities). This is especially true when it comes to premiums on proven reserves at the scale required to meaningfully grow long-term inventory. This concept is highlighted best by the two largest deals in the twelve months. When the acquisition was announced late last year, Pioneer was valued at 28 times its proved barrels of oil equivalent and Hess at a multiple in the higher 40s, granted the Hess acreage is largely overseas.

Mercer Capital has assisted many clients with various valuation needs in the oil and gas industry in North America and globally. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights