Royalties And Minerals: A New Market Is Emerging

The marketplace has delivered some jarring blows over the past few months to players in the mineral and royalty space. Although this asset class enjoys certain benefits relative to oil and gas producers, its value is still connected to commodity prices. The recent swing downward has staggered market participants and quickly changed several assumptions regarding a sense of normalcy. In analyzing the sector, we pulsed EnergyNet, one of the largest private mineral transaction platforms in the market. Chris Atherton, EnergyNet’s CEO, is about as close to the royalty and mineral market as anyone. How close? Consider the following:

- EnergyNet has closed over 400 royalty, overriding royalty, and/or mineral transactions this year through April 2020.

- The platform frequently handles transactions with participants ranging from individuals all the way to integrated majors such as Chevron CVX and Shell.

- Geographically, they handle transactions across the contiguous United States.

- They regularly broker transactions across the dollar size spectrum in this market, ranging all the way from five figures to eight figures.

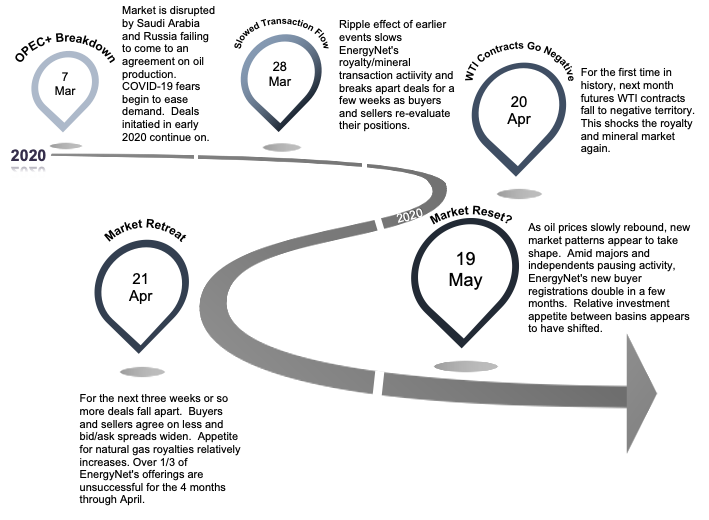

Therefore, it is reasonable to suggest EnergyNet represents an excellent glimpse into the royalty and mineral market at large (no – I did not get paid to say that). In the course of my correspondence with Chris Atherton, several interesting market movements began to emerge. After the March 7th launching point with the OPEC+ impasse, EnergyNet’s platform has taken several twists and turns. Both demand and supply shocks have squeezed the market and values have plummeted. The timeline below chronicles this:

Observations

The fact that valuations have decreased is not news at this point, but what is interesting is that this environment has changed a lot of things along the way:

- Buyer Pool – Currently EnergyNet has 33,000 buyers vs. 7,000 sellers on its platform. Buyer registrations have skyrocketed in the past few months. New investors are seeking what they perceive as a potential good deal. At the same time, many of the larger participants on their platform (majors and independent producers) have paused much of their selling activity. Possibilities for this hiatus can vary. Changing economics are certainly a factor, but sellers also may be concerned about entering restructuring negotiations and do not want to be divesting assets in the time leading up to what may eventually be a bankruptcy filing.

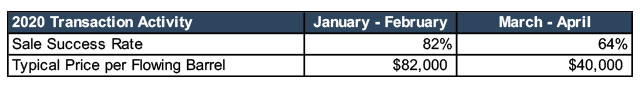

- Liquidity and Valuations – Although typically not falling as far as upstream producers, valuations for minerals and royalties have plummeted. Deals, even in quality basins, are trading for half of what they were a few months ago. Liquidity has been a part of this. As buyers and sellers wallow in uncertainty, more and more deals are either terminating or not happening at all.

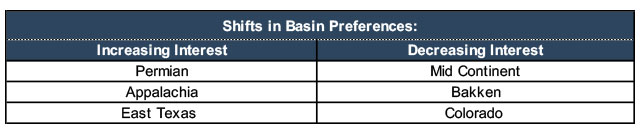

- Basin Preferences – During this time, a previously unexpected occurrence has happened: gas assets are considered a more “tradeable” investment. Said Atherton: “With gas in the proverbial doghouse, buyers are becoming more attracted to its relative stability. Sellers have noticed this too and are more reticent to trade. The transaction volume is still thin, but interestingly, the rationale has shifted.” This has led to an uptick in Appalachian and East Texas interest. Colorado has lost favor, as much due to its changing regulatory climate as commodity prices. The Bakken has had decreasing interest as well with its higher breakeven prices and transportation issues.

Takeaways

“We are going to have a different market coming out of this.” says Atherton. What exactly that market will look like is another question. Speaking of questions, what will drilling activity look like going forward? How might the relationship between the mineral owner and operator change? It is possible that litigations between royalty owners and operators will pick up?

Arguably, the most pertinent question above all is this: How will horizontal wells respond to being shut-in? This is an experiment that has never been tried before. Nobody knows how the wells may or may not respond when the spigots get re-opened at some future point. This uncertainty is part of why values are so depressed right now. The answer, whenever it comes, could be the lynchpin to what royalty and mineral valuations will look like in the future.

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights