Royalty MLP Is Delivering Yield Against Backdrop Of Energy Sector Struggles

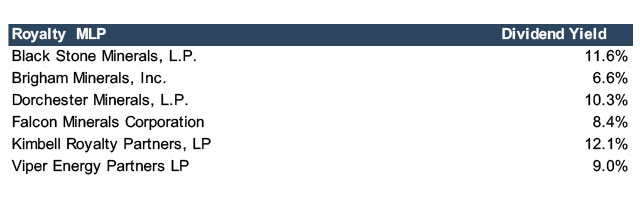

Energy commodity cycles can sometimes proffer interesting market dynamics. At various points, participants along the energy chain can benefit or suffer from the natural consequences of these changes. In the long run, commodity prices ultimately drive economics. Right now, exploration and production companies and oilfield service providers are grappling with austerity measures that investors are demanding. Most other upstream areas are struggling too; however, publicly-traded royalty and mineral aggregators are performing relatively better than their operating counterparts. While equity prices have dropped by approximately 30% for producers (according to SPDR Oil and Gas ETF), six publicly-traded royalty aggregators relatively outperformed the SPDR Index. These Royalty MLP’s (a bit of a misnomer as all are not partnerships) have tracked closer to crude oil prices, anchored by sizeable dividend payments, thus buoying sliding equity prices. If dividend yields are added back, some of them have been outperforming crude prices.

Upstream Producers Thirsting For Capital

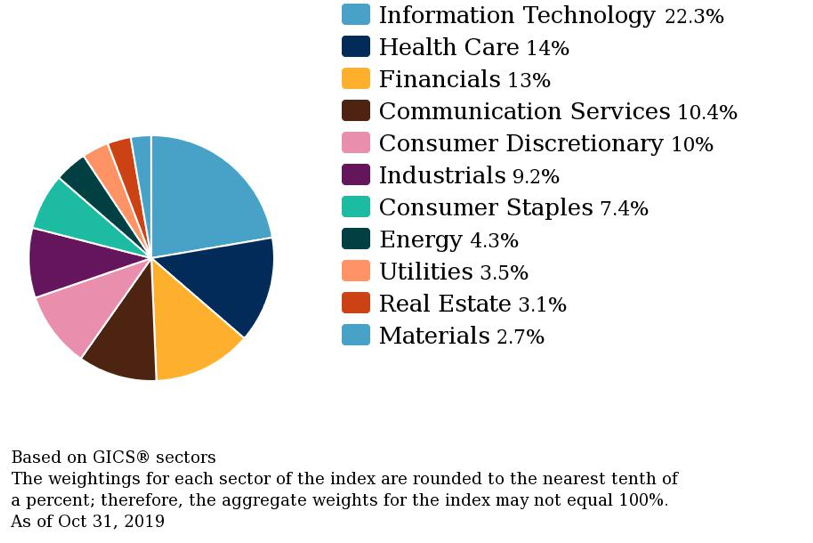

At recent industry conferences, panelists and management teams for exploration and production companies have consistently lamented the dearth of available capital. As banks re-evaluate their credit facilities, some analysts estimate a 10%-25% reduction in reserve-based lending capacity. Investors have communicated a sink or swim message to the sector and the term “capital discipline” is echoed frequently. Producers must subsist on their own cash flow for the foreseeable future and performance must improve before capital flows back upstream. This trend partially explains why energy currently comprises less than 5% of the sector weighting value of S&P Index, a historical low. It is notable and somewhat ironic that part of the success of the remaining 95% of the S&P has been attributable directly or indirectly to the cheap energy prices being delivered by the energy sector.

E&P’s Primed For Consolidating? Bankruptcy Bargains?

Cost control and efficiencies are on the top of the industry’s mind. In response, the consolidation trend for upstream producers is underway. Parsley’s acquisition of Jagged Peak and Comstock’s acquisition of Covey Park are examples of this, with more likely to come. Consolidation will occur through bankruptcy sales as well. According to Haynes and Boone bankruptcies in the oil patch have consistently ticked up with nearly $13 billion in new debt under bankruptcy in 2019. Therefore, Section 363 sales to consolidators should be available among other things. The big problem circles back to where this article started – where to obtain the funds to buy them? Those with pocketbooks at this time may be able to unearth some bargains and returns down the road to show for it. In fact, Comstock may be back in that distressed market as there are reports about negotiations for buying Chesapeake’s Haynesville Shale assets.

Royalty MLP Subsector Still Has Capital Flowing In

Meanwhile, like a small oasis in this desert, Royalty MLP’s have been and continue to successfully attract capital flow to this sub-space. Brigham Minerals, for example, not only went public earlier this year but had its line of credit expanded. Recent third quarter call transcripts from these Royalty MLP’s all suggest that acquisitions and growth (while disciplined) will continue. Indeed, Kimbell Royalty Partners has had one of the biggest dividend boosts in the marketplace this year. The primary reason for this is simple, while benefitting from well production, royalty holders do not bear operating and drilling costs. Therefore, they can get the best of both worlds. Of course, returns are also predicated upon the cost to acquire. Even if Royalty MLP’s overpay for the acreage they acquire, this tends to limit or delay returns as opposed to zero or negative returns at the asset level.

Additionally, Royalty MLP’s will be the logical and likely recipient of larger packages of minerals as private equity firms, who flocked to this sector a few years ago, begin to monetize their funds. This is significant because it is beginning to change the nature of a typical mineral owner’s profile, mindset and holding period expectations. As more investment-minded participants enter the space, the sophistication and expectations of buyers and sellers change along the way. The public royalty firms are preparing for this, which is why their acquisition budgets are steady or growing as opposed to shrinking across the board for producers.

On a side note, this is not isolated to only publicly traded mineral and royalty participants. From a more macro perspective, this growth dynamic can be observed right at the U.S. budget where billions more flow into government coffers. U.S. public lands drove a 30% increase in federal energy and minerals revenue disbursements in fiscal year 2019 to $11.69 billion. The biggest contributor to that boost is in the New Mexico portion of the Permian Basin.

Conclusion

Overall the upstream sector has challenges right now, but the royalty and mineral sub-sector is weathering the changes better than some other sub-sectors. Strong dividend payments, with the promise for more in the future aligns more with investor expectations right now. As always, the lynchpin to industry health is commodity prices. Crude prices dropped in the late spring and have been treading water for the past several months. Many industry observers suggest stagnant prices in the $50-$60 range for the foreseeable future. However, others suggest that while the industry tightens its belt, prices may creep back up into the $60-$70 range. If that happens, shareholder returns will accrue to more than just producers and royalty holders.

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights