Should Appalachian Natural Gas Producers’ Stock Price Resiliency Be Surprising?

In a year where natural gas prices have spent almost the entire year under $3.00 per mcf, including a few months under $2.00, the stock prices of publicly traded Appalachian gas producers have remained remarkably stable. In fact, Antero Resources’ price is up this year and Range Resources is basically flat for the year so far. Others such as EQT and Coterra Energy are down only marginally. This could come across as surprising. Appalachia has some disadvantages to other US gas producing basins, such as takeaway capacity, logistics, and longer distances to major LNG production facilities. However, since 2022 the stock market has held steady for these companies; of which this confidence has outlasted commodity price and earnings declines over the past two years.

Higher Valuation Multiples

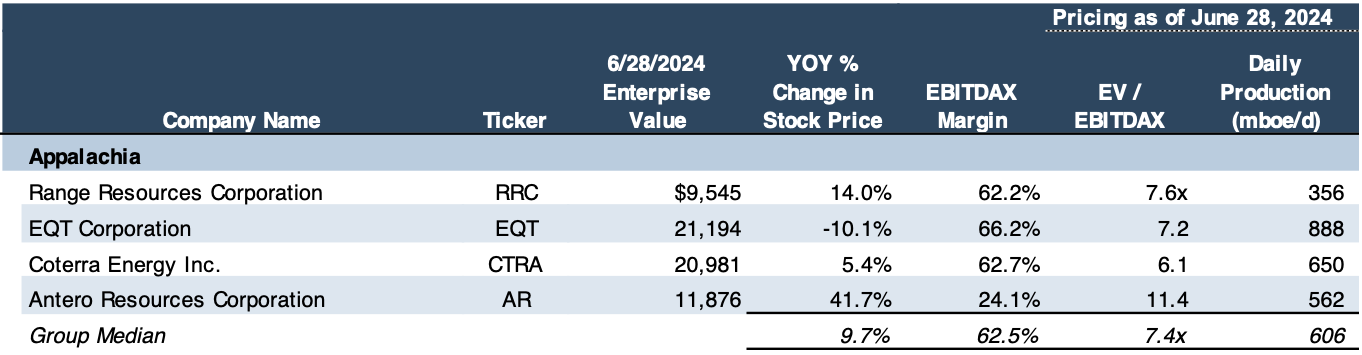

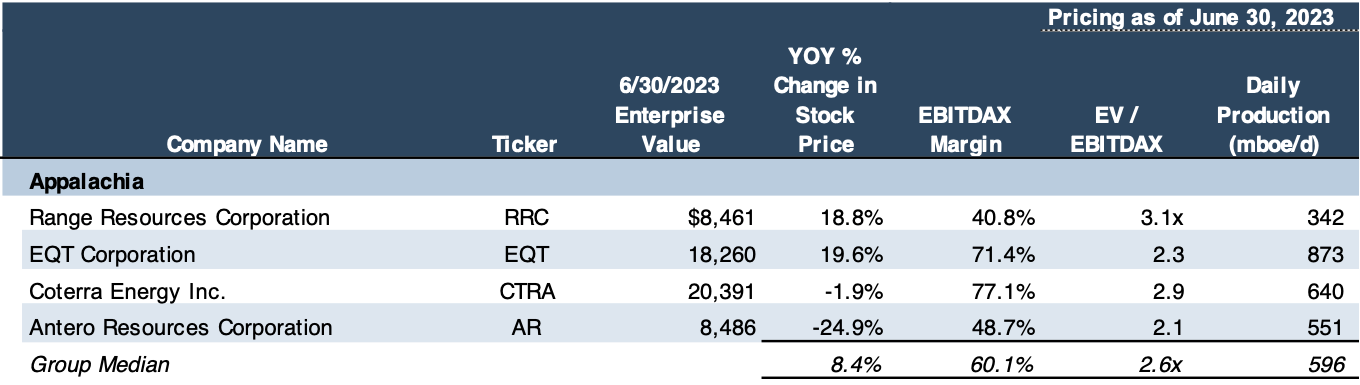

One of the indicators of this buoyed optimism for Appalachian upstream producers are the cash flow or EBITDA multiples that they are trading at. As a group, they were averaging above a seven (7x) multiple. In the past several years, they have more often traded closer to three (3x) times. Take for example, Mercer Capital’s second quarter data this year versus 2023.

Click here to expand the image above

Click here to expand the image above

Over the last year, combined raw EBITDAX (earnings before interest, taxes, depreciation, amortization and exploration expenses) has dropped over 40% while market capitalization has ticked up a bit. This suggests that investors anticipated the profitability drop but did not run for the exits. It is also notable that except for EQT, analysts expect these producers to continue to have cash flow declines in the next few quarters due to continued weak commodity price forecasts. In past years, the stock prices of these companies tended to follow closer to natural gas prices for a host of reasons. However, through the volatility and lean times, these producers have toughened themselves through cost efficiencies and stronger balance sheets.

Natural Gas has spent so much time at or below $3.00 per mcf since 2016 that it has essentially required operators to operate profitably at prices below that threshold. Now, all four of the major publicly traded Appalachian producers currently have drilling break evens below $2.75, according to analysts and investor presentations. Laterals are going longer, and turnaround times are getting shorter which continues to notch away at overall drilling and completion costs. In addition, these companies have aggressively paid down debt over the last several years, which has been timely from a cash flow perspective as well as an interest rate perspective. As such, stockholders have more reason for confidence in the stability of their investment as well as their dividend streams. As an example, Antero Resources’ credit rating was recently bumped up to investment grade (BBB-).

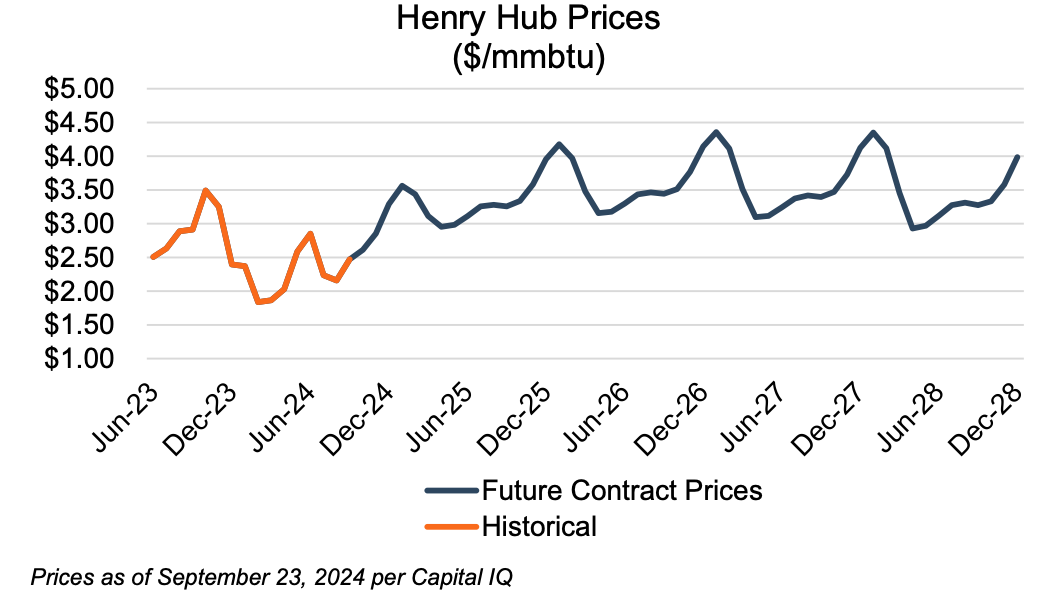

Although able to withstand low prices, these kinds of EBITDAX multiples do imply longer term price lifts for natural gas. Depending on hedging exposure, these stock prices tend to be suggesting that investors expect Henry Hub prices to be north of $3.50 per mcf in the longer term. This could easily be possible with the anticipated ability for demand takeaway to catch up closer to supply more frequently in the next few years. If this happens, all these companies have over a decade (or two) worth of relatively low-cost drilling locations waiting in the wings.

Gas Industry Optimism

Appalachia’s production has been relatively flat this year, however some of this has been the result of resource management as opposed to resource scarcity. These companies do not have the geographic advantage of being close to the Gulf Coast where almost all of LNG capacity growth has been and will continue to be developed. However, the recent opening of the Mountain Valley Pipeline is helping to relieve some of the constraints. In addition, although LNG permits have been delayed to the consternation of some and applause of others, pre-existing development projects should double export capacity over the next four years. LNG makes natural gas more tradeable worldwide. The world is adding millions of new appliances, computers and electric cars every year. China and India continue to grow. Appalachian companies will be able to participate in some of that, although other basins (Permian, Haynesville, and Eagle Ford) are more proximate.

Still, Appalachia does not even have to ship their gas overseas to find markets that need it. Presenters at the recent Gastech conference, which has been covered by some of my Forbes.com colleagues, claimed that domestic Electricity demand will grow by 15% by 2030, which has been substantiated by others such as Wells Fargo who claim it will grow by 20%. A CNBC article back in May cited that A.I. is expected to add 323 terawatt hours of demand by 2030, which is seven times greater than New York City’s consumption. That’s a lot in a short period of time. Natural Gas will have to be a major contributor to that growth need. Renewables and Nuclear growth can help, but not that much or that fast at this juncture.

Investors have been waiting for years for supply takeaway and demand to catch up with the robust supply that technology and innovation has afforded the U.S. natural gas industry. For years, this optimism has been pushed off so far into the future, that stockholders had not appeared to meaningfully price in the timing of when that demand might really kick in. Perhaps now this growth potential is starting to be captured in their market metrics more visibly. Some observers might be surprised at this, but long-time investors are probably thinking that it is about time.

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights