SilverBow’s Shareholder Brawl

It is an election year, and the battle is on. SilverBow Resources, a publicly traded oil and gas company operating in South Texas’ Eagle Ford shale, is wrapped up in a big conflict with some of its own shareholders. Kimmeridge Energy Management, both a large shareholder and a rival operator in the Eagle Ford, has proposed a merger (which it, at least temporarily, withdrew last month), and now is proposing several new board members in a proxy battle. The primary question centers on the direction of SilverBow’s value enhancement strategy. However, it appears this strategy hinges, in part, on its debt position, and dividend policy. Management has one idea on how this should go; Kimmeridge clearly has another.

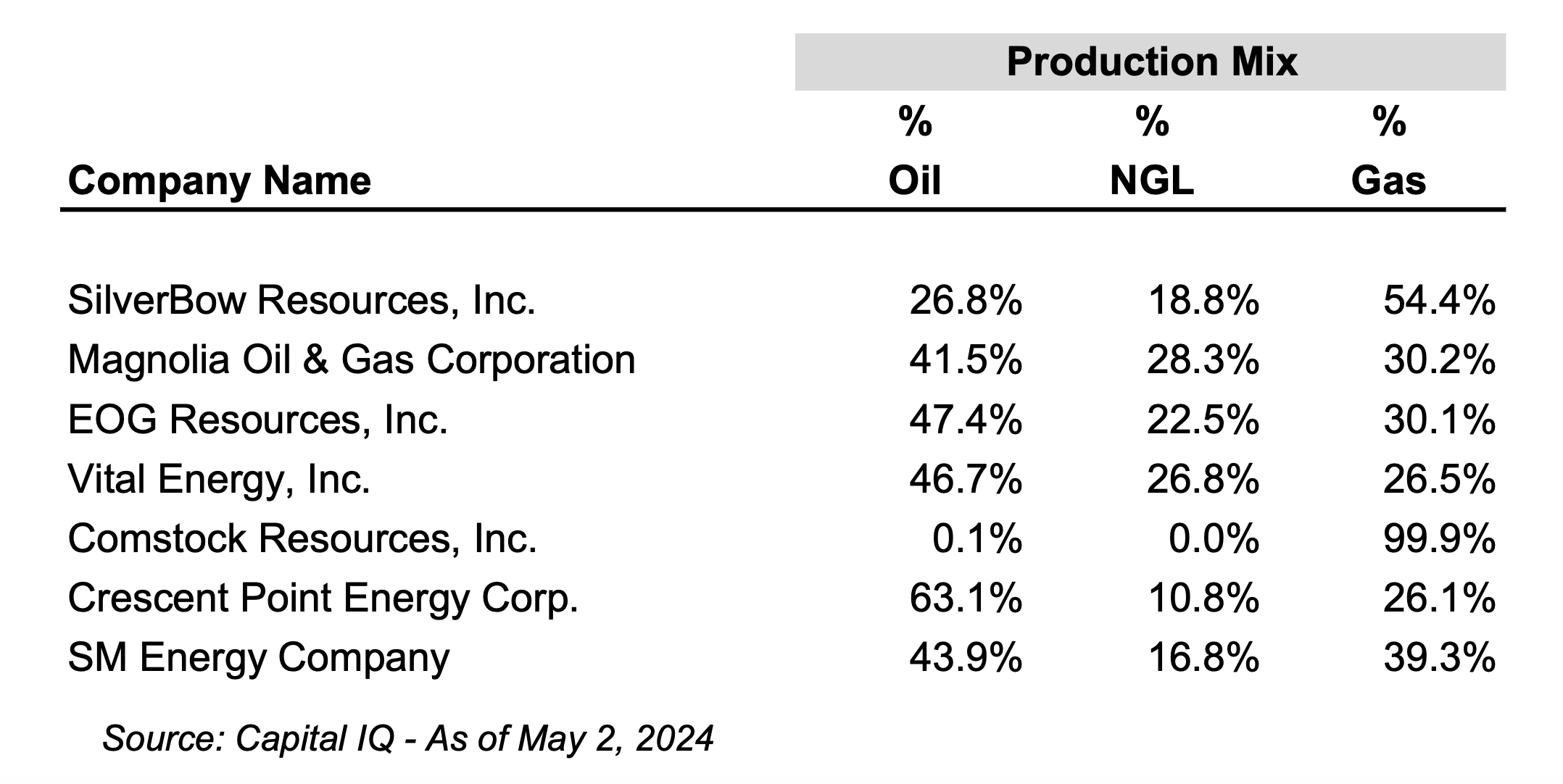

This clash has arisen from a myriad of circumstances, but it could reasonably be condensed down to two dynamics: leveraged acquisitions in the past few years and the drop in gas prices from their highs in 2022. Since 2021 SilverBow has made several acquisitions. These acquisitions, highlighted by its purchase of Sundance Energy in 2022 and most recently Chesapeake’s Eagle Ford portfolio in the second half of 2023, can be broadly characterized by three things: (i) mostly oil and liquids production driven (a change from their more historically gas heavy portfolio), (ii) purchased at opportunistic prices (SilverBow’s blended acquisition price to flowing barrel metric was approximately $25,000 for its eight deals since the second half of 2021 compared to other publicly traded oil and liquids tilted Eagle Ford producers such as Magnolia and SM Energy who both trade for over $40,000 per flowing barrel), and (iii) mostly funded with debt.

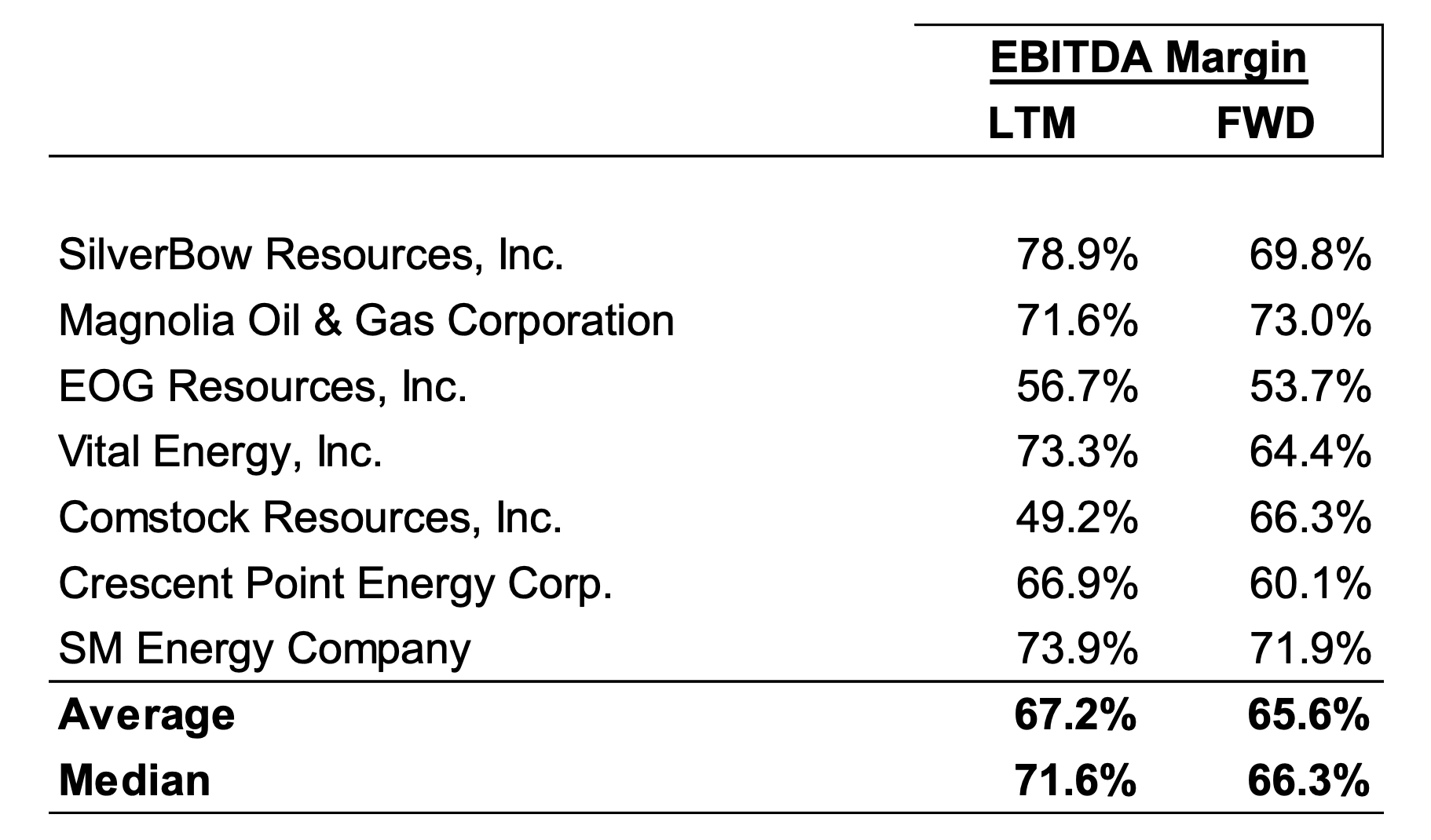

The good news for SilverBow is that oil and natural gas liquids tend to be higher-margin products than gas right now, and SilverBow’s EBITDA margin was relatively high (79%) to show for it. By contrast, Comstock Resources, a pure-play gas producer in the Haynesville Shale, has had its margin battered by low gas prices in 2023.

Through these acquisitions, SilverBow has shifted its production mix significantly and it creates optionality to drill for oil and liquids during periods of low gas prices. Although SilverBow is still producing relatively more gas than its Eagle Ford peers such as SM Energy, Magnolia, or EOG it is now much more liquids-driven than in recent years.

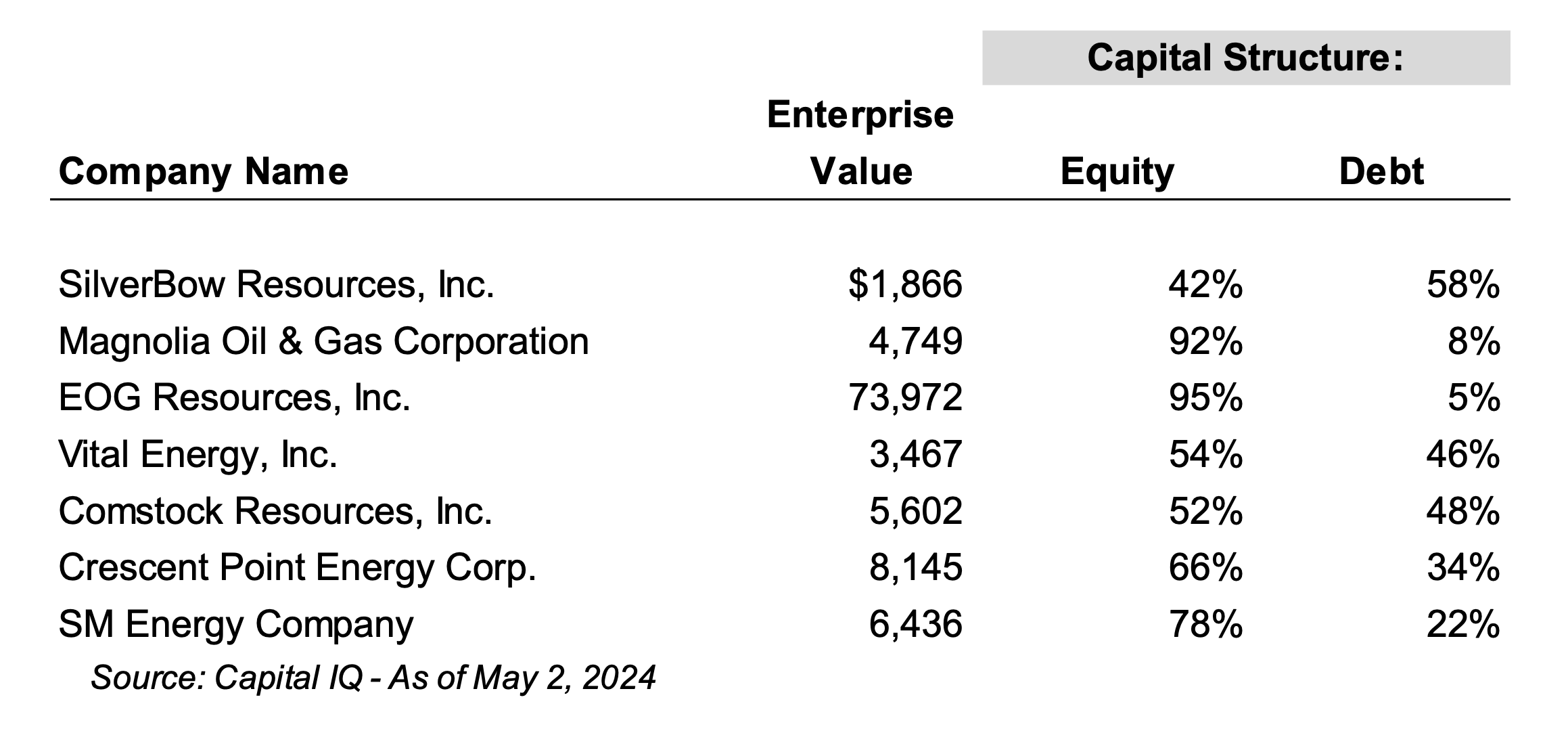

In addition, funding with debt is usually cheaper than equity, so it offers a leveraged return opportunity for shareholders. However, the trade-off is that too much debt can be risky. SilverBow used to be Swift Energy but filed bankruptcy in 2015 and restructured after the collapse of oil prices, so it has a history of too much debt in the capital structure at the wrong time. This is worrisome to investors and it can tamp down on equity value. Equity markets for the upstream sector have frowned on heavy debt loads for several years now in the wake of bankruptcies after 2014.

How Much Debt Is Too Much Debt?

What defines a heavy debt load? It depends. The ratio of debt to EBITDA is cited often in the industry. These days at or below a 1.0x ratio is what companies frequently aim for, SilverBow included. However, there is not a definitive answer to the question. From a capital structure perspective, SilverBow has a higher debt-to-equity market capitalization percentage than the companies listed below that have varying similarities to SilverBow:

Kimmeridge has criticized SilverBow for taking on this much debt and offered to inject cash to pay it down in its now-abandoned merger proposal. Management has countered with its position that the value and optionality it received in its acquisitions will allow the company to reap high margins and cash flow to accelerate debt repayment and eventually get to that 1.0x debt ratio by the end of 2025. Kimmeridge seems to believe that if SilverBow de-levers more quickly, then the stock price will rise more quickly. This is logical, but that would require selling equity or assets or both.

Dividends Matter

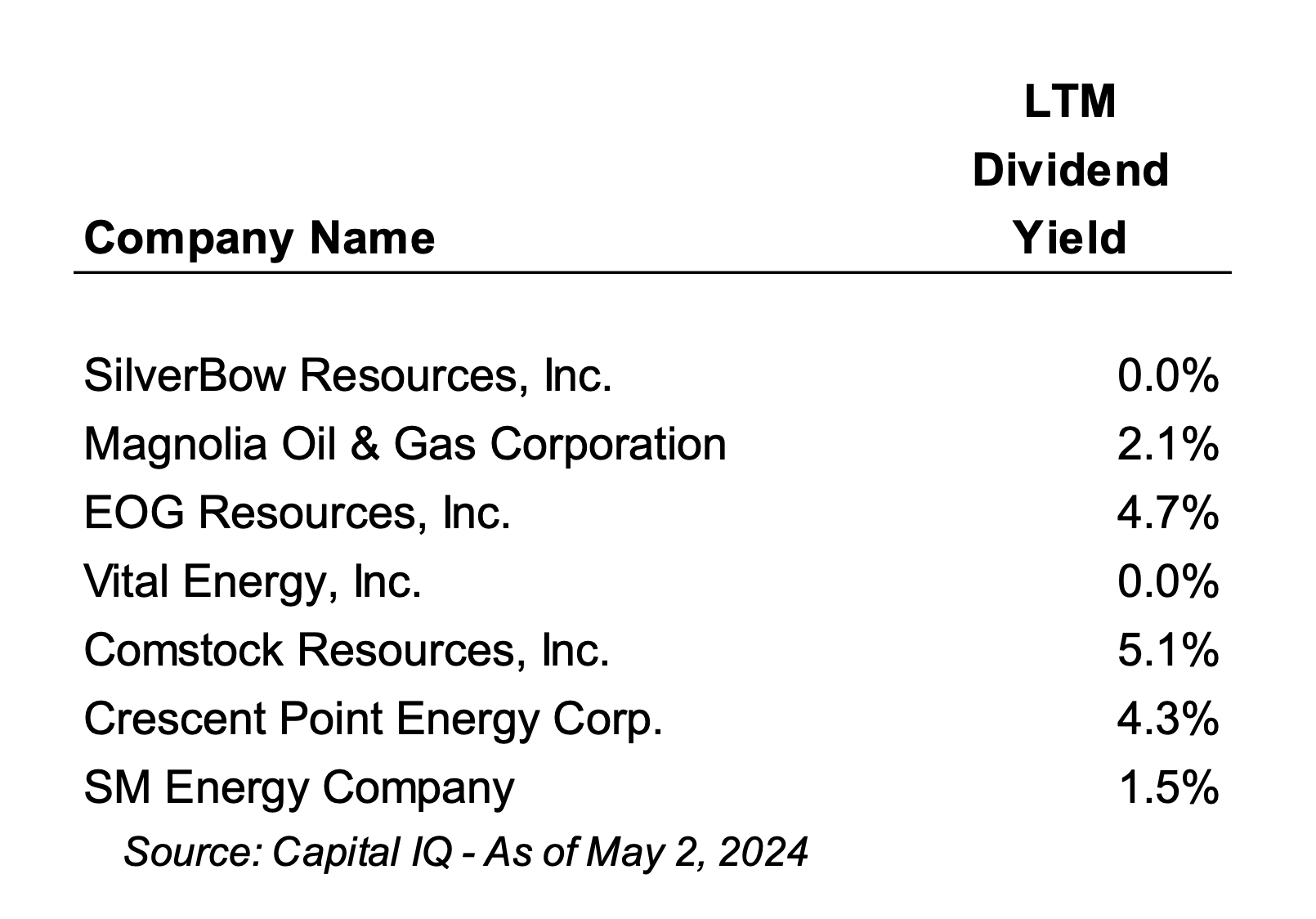

Dividends have been a big trend in the oil and gas industry. Investors have pined for oil and gas companies to pay dividends for many years now. Growth and reinvestment have been curtailed in favor of direct shareholder returns in the form of stock buybacks and more importantly, dividends. SilverBow does not pay a dividend. Most publicly traded peers do.

Companies that pay a dividend tend to have higher multiples as well. Kimmeridge has pointed this out and also proposed a dividend in their merger proposal. However, adding a dividend is not a guarantee of a value boost. Comstock Resources suspended its dividend early in 2024, and its stock has gone up significantly since then. However, it is also a gas producer only, which has hamstrung it in a cash burn position so far in 2024. SilverBow’s shift towards liquids has buoyed its cash flow.

Value Now Or Value Later?

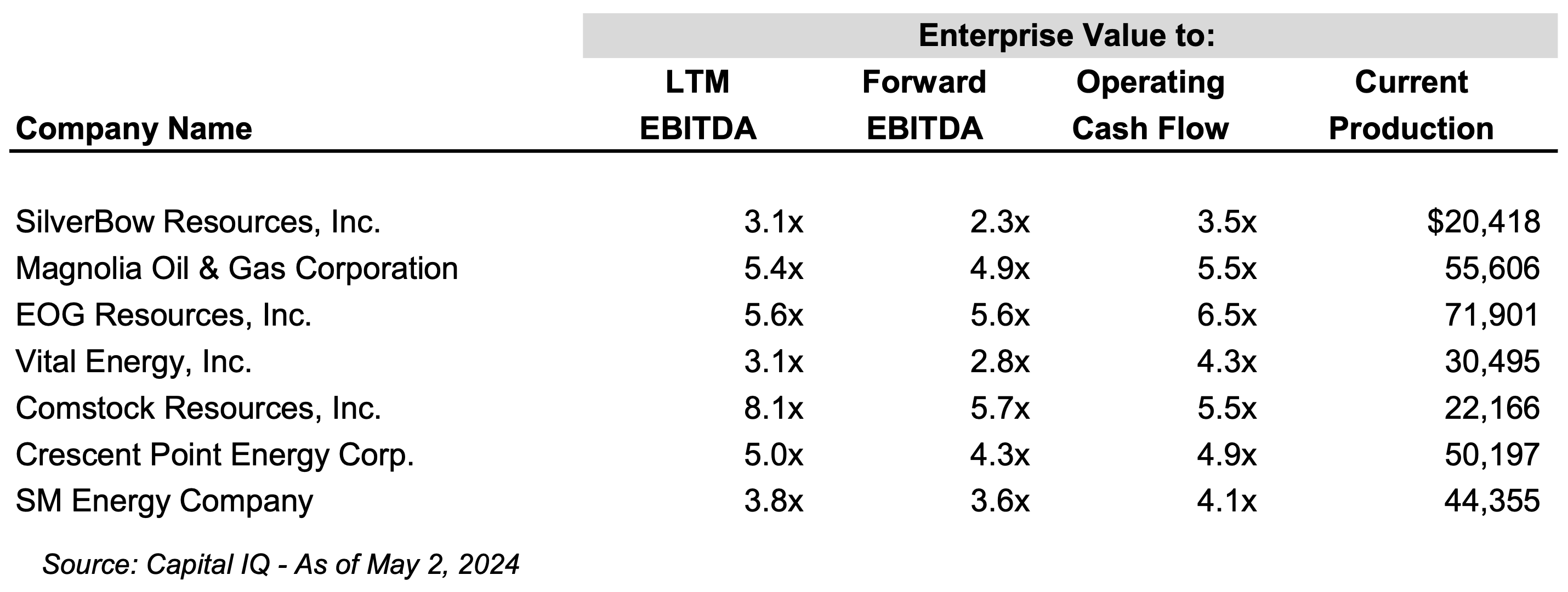

The market has shown skepticism from a valuation standpoint of SilverBow’s acquisition appetite over the past few years. As such its valuation metrics lag almost everyone in this group in a meaningful way:

It is notable that although SilverBow is increasingly liquids-driven and has excellent margins, its valuation multiples still lag this group. Even Vital Energy, which also has a lot of debt and doesn’t pay a dividend either, has superior metrics. If SilverBow lowers risk by de-levering to industry norms, the equity value may be rewarded. But when? It may be over a year before that happens. A lot can happen between now and then. Kimmeridge does not want to wait. It wants policy changes now. Management has pointed to strong cash flow and results above expectations so far in 2024 as proof that its strategy is working. Management is skeptical of Kimmeridge’s intentions. They believe Kimmeridge’s end game is to force a dilutive transaction with Kimmeridge Texas Gas. Both sides want a higher stock price. Which one presents the better path to get there remains to be seen and will come down to what the shareholders decide.

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights