Coming Soon: Mercer Capital’s 2019 Energy Purchase Price Allocation Study

We at Mercer Capital love movies. One fun aspect of a movie is the anticipation for new releases that comes from watching movie trailers, which inform and tease simultaneously. If done well, they can build anticipation for the show to come. While not quite a movie trailer, we wanted to introduce you to a new study from our energy team that we are excited about: Mercer Capital’s 2019 Energy Purchase Price Allocation Study.

This study is unlike any other in terms of energy industry specificity and depth.

Valuation, by nature, is an inherently forward-looking exercise. However, as we are still unable to see the future, history remains the window through which we look to gauge it. As we plunge forward into a new year and a new decade, we take this opportunity to look back at the energy sector through the lens of transactions and GAAP financial reporting. This study researches and observes publicly available purchase price allocation data for four sub-sectors of the energy industry: (i) exploration and production; (ii) midstream; (iii) oilfield services; and (iv) refining. We are excited about this study because we think you’ll find it useful, informative, and helpful. We are also excited because our study is unlike any other in terms of energy industry specificity and depth.

Mercer Capital’s upcoming 2019 Energy Purchase Price Allocation Study provides a detailed analysis and overview of valuation and accounting trends in these subsectors of the energy space. This study enables key users and preparers of financial statements to better understand the asset mix, valuation methods, and useful life trends in the energy space as they pertain to business combinations under ASC 805 and GAAP fair value standards under ASC 820. We utilized transactions that closed and reported their purchase allocation data in calendar year 2018.

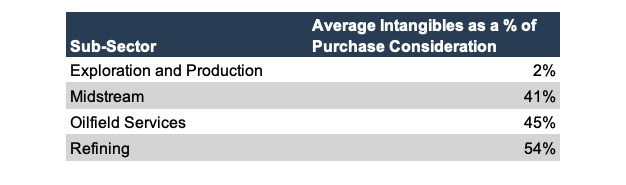

This study is a useful tool for management teams, investors, auditors, and even insurance underwriters as market participants grapple with ever-increasing market complexity. This study provides data and analytics for readers seeking to understand undergirding economics and deal rationale for individual transactions. The study also assists in risk assessment and underwriting of assets involved in these sectors. Further, it helps readers to better comprehend financial statement impacts of business combinations. Intangible assets comprised approximately 84% of the S&P 500s market value in 2018, according to a Ponemon Institute study. Other studies suggest that the energy sector’s concentration of intangible assets approximates less than half of that. Averages from year’s study across a total sample of 33 transactions bracket those estimates and they vary by sub-sector:

When we prepared this analysis, we came across a few noteworthy items:

- Exploration and production transactions were primarily allocated to reserves, and particularly more proved reserves than unproved reserves. Only one transaction recorded goodwill.

- Oilfield services transactions had the most diverse set of allocations to intangibles.

- Midstream transactions (gathering/disposal, processing, compression and terminals) had the highest concentration within the sector groups of customer-related intangible assets as a percentage of purchase consideration.

- Useful life reporting varied, but oilfield services transactions tended to have longer remaining lives (10 years or longer) ascribed to them.

There is a lot to learn from this study as it illuminates some key industry aspects which we will be discussing and referencing in future posts. In the meantime, we hope the upcoming study will come to serve as a valuable reference. Get your popcorn ready, you won’t want to miss the premiere.

Energy Valuation Insights

Energy Valuation Insights