Supply Management: How The Market Is Handling Capital And Crude In 2019

The NAPE Expo in Houston, TX is one of the largest energy industry gatherings in the U.S. with over 12,000 attendees. Every February, NAPE’s Global Business Conference provides insight from multiple perspectives on the industry. This year it included, among other areas, capital market trends and pipeline capacity, particularly in the Permian Basin. There is concern that although valuations may be attractive, the realization of returns on capital deployed is experiencing challenges. Perhaps not surprisingly, the same thing could be said for crude and natural gas inventories in the U.S. Although there is ample supply, the ability to overcome pricing differentials and get product to market is a challenge.

Private (Not Public) Equity Is Pulling The Market Along

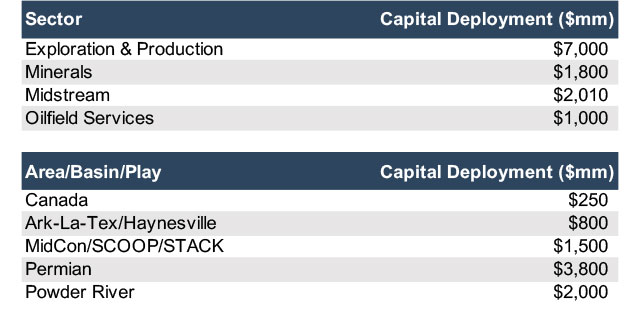

According to panelists discussing the capital markets environment, the public equity markets have been and may continue to be, quiet in the upstream sector. Most acquisitions and dispositions of assets in 2018 were private capital driven. According to Shale Experts, private equity deployed nearly $12 billion in 2018 across 40 new companies, with a concentration on the Permian and Powder River Basins.

Additionally, there is still more capital raised and thus dry powder out there as well. The focus of this capital is moving away from investing in raw acreage and more towards the drill bit and capital efficiency. Another sub-sector that is continuing to attract capital is the minerals sector. EnergyNet, an online auction firm, transacted over $2 billion in property in 2018. According to Chris Atherton, EnergyNet’s CEO, approximately $250 million of that was in the mineral, royalty and overriding royalty rights arena. In 2016 EnergyNet’s volume was around half of that, an indication of the rapid growth in the mineral and royalty space.

Another capital trend that is pushing the market towards private equity is the banking sector. Banks have been tightening their lending ratios over the past year. According to one panelist, lending ratios for many banks have tightened 25-30%, thus lowering relative debt loads and pressing the need for more equity.

Longer Holding Periods and Higher Exit Thresholds

Conference panelists also discussed the challenges that management and investor teams are facing in regard to finding an exit strategy. Large, billion-dollar style exits are the goal for many companies, but historically the vehicle to exit has been through public equity markets. As mentioned, this has been slow. “It’s hard to get the market’s attention if you’re smaller than $3-4 billion right now,” said David Humphreys of Wells Fargo Securities. As such, many private equity portfolios are in a holding pattern.

In the meantime, while investors are waiting for these exits, they are clamoring for more immediate returns in the form of cash flow yields, particularly in public markets. This is driving the trend for more “capital discipline” as it is being called. How exactly that cash flow pie will be split between returns and future growth is still to be determined, but it is something that management teams and investors are grappling with.

Releasing The Permian’s Pressure Valve: Takeaway Capacity

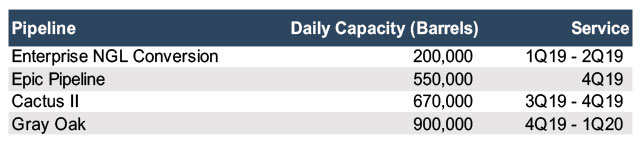

Perhaps more interesting, in a separate session on crude and gas supply, one of the key themes discussed by Wood Mackenzie’s John Coleman was the increasing takeaway capacity preparing to come online in the Permian. As upstream supply continues to increase in the basin, midstream pipelines are trying to keep up. Approximately two million barrels a day of crude pipeline capacity could be online by early next year. For many producers, the sooner this happens, the better. Crude production has grown about that much since 2016.

The relief will come from increased refinery consumption, a mix of converting NGL pipelines such as the Enterprise NGL Conversion Line and new pipelines such as the Epic Pipeline, Plains All American’s Cactus II pipeline, Phillips 66 and Enbridge’s Gray Oak pipeline. Much of the new volume will be going to Corpus Christi. This capacity could help to narrow the differentials between local Midland (Argus) prices and West Texas Intermediate crude prices, which were as wide as $15 per barrel late last year.

Forward curves suggest that the arrival of this takeaway capacity will return local pricing differentials back to more historical norms before the end of the year. This could move cash flow and earnings back up for many producers without changing production profiles. Of course, markets tend to behave more dynamically than that.

One of the repeated sentiments among several panelists was that valuations are compelling and attractive right now amid the decline in commodity prices coupled with logistics constraints. If both capital and resource supply are managed in an efficient fashion this year, it could align the strong upstream and midstream potential with cash flow reality. That would be welcoming news for management teams as well as investors. Valuations have taken a hit over the end of 2018 and into this year. Perhaps in 2019, they will experience a smoother and higher ascent.

Originally appeared on Forbes.com.

Energy Valuation Insights

Energy Valuation Insights