The Beginning of a Bakken Behemoth

Chord Energy and Enerplus

In a significant development for the energy industry, on February 21, 2024, Chord Energy Corporation and Enerplus Corporation announced a definitive agreement to merge. This strategic combination aims to create a powerhouse in the Williston Basin, leveraging their complementary strengths and operational expertise.

Transaction Overview

Under the terms of the transaction, each common share of Enerplus will be exchanged for 0.10125 shares of Chord common stock and $1.84 per share in cash, representing a 90% stock and 10% cash consideration. The transaction values Enerplus at an estimated $3.9 billion, while its market cap was approximately $3.4 billion as of February 21, 2024. Upon completion of the transaction, Chord shareholders will own approximately 67% of the combined company (which will retain the Chord Energy name), with Enerplus owning the remaining 33%. The combined company’s enterprise value is estimated at approximately $11 billion based on the exchange ratio and closing share prices for Chord and Enerplus as of February 20, 2024. Subject to customary closing conditions, including approvals from both Chord and Enerplus shareholders and regulatory bodies, the transaction is expected to close by mid-year 2024.

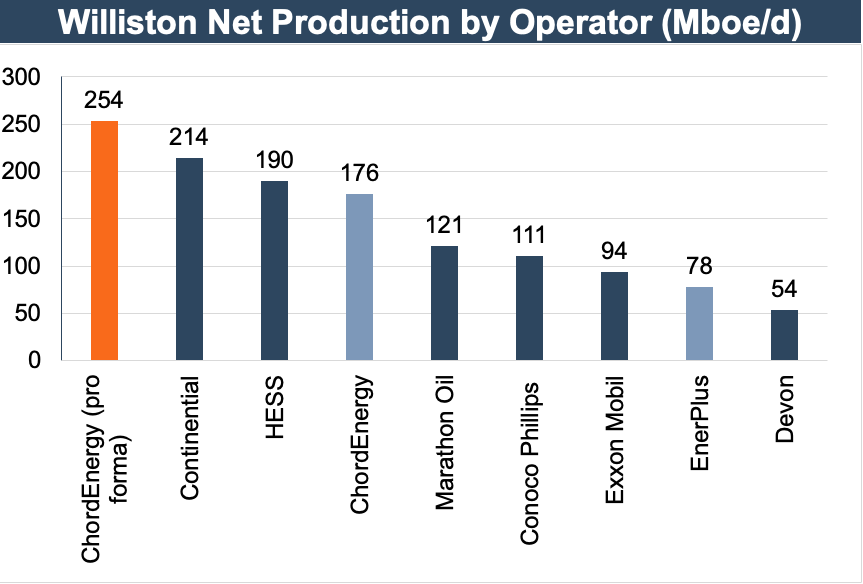

This merger brings together Chord Energy’s extensive acreage holdings and Enerplus’s robust production capabilities. The combined entity will control approximately 1.3 million net acres and produce roughly 279 Mboe/d (254 Mboe/d – Williston production), making it the largest producer in the Williston Basin and providing a combined inventory that supports roughly ten years of development. This production on a pro forma basis implies a price per flowing barrel of approximately $40,000, slightly higher than the implied multiple of Enerplus’s valuation of $3.8 billion, on a price per flowing barrel basis.

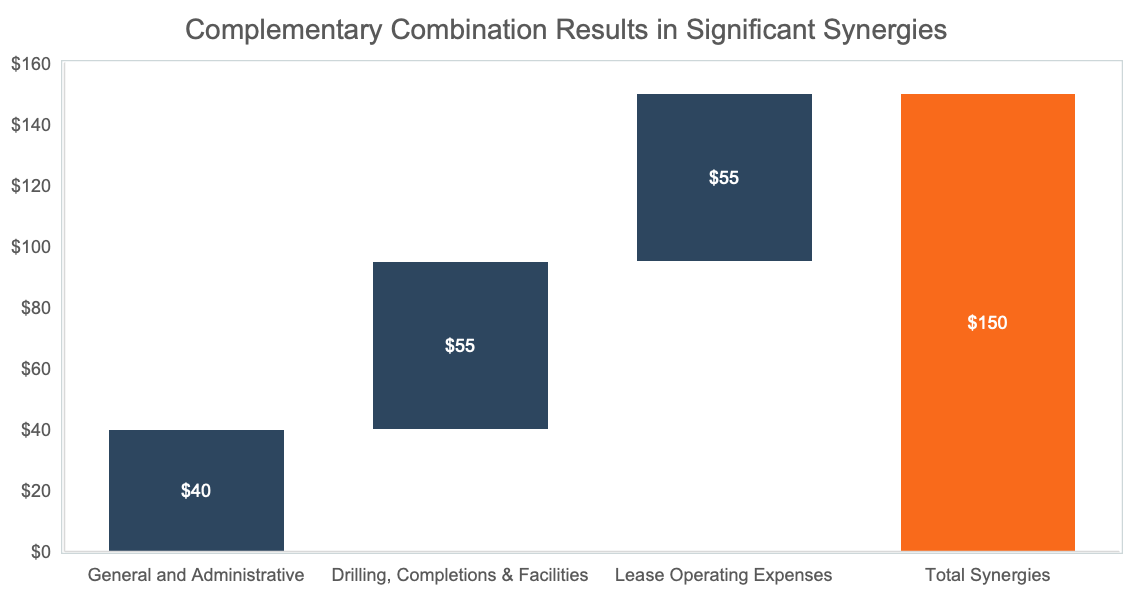

By pooling resources and streamlining operations, the merged company aims to achieve operational efficiencies that include administrative and operational cost savings of up to $150 million per year. This includes optimizing drilling programs, enhancing well completions, and leveraging shared infrastructure. The after-tax present value of these synergies is expected to exceed $750 million.

The acquisition sets the stage for enhanced innovation and collaboration in the energy sector beyond the immediate synergies it brings. By merging diverse perspectives and capabilities, the combined company has the opportunity to venture into uncharted territories for technological advancement and business growth. This collaborative spirit doesn’t just benefit the companies directly involved; it also drives progress across the entire energy landscape, fostering a more sustainable and adaptable future.

Is There Anything Else?

Acquisitions are not the only transactions happening in the Bakken. While M&A takes the front page for the big news, a smaller story takes the back seat. The University of North Dakota (UND) is positioned to receive substantial federal funding to investigate the potential of utilizing captured carbon dioxide to enhance oil recovery in the Bakken. This method, referred to as enhanced oil recovery (EOR), could become essential for sustaining high oil production beyond the 2030s as easily accessible oil reserves in the Bakken diminish.

The Federal Energy Department has allocated $11.6 million to UND for an 18-month research project. This initiative aims to investigate whether EOR techniques, which have shown effectiveness in conventional fields, can be applied similarly in shale formations. The research will involve both field studies and laboratory experiments to assist in the investigation.

The state is proactively gearing up the Bakken region for EOR through policy measures. The Department of Mineral Resources has recently formalized a rule, as directed by legislation, enabling operators to obtain a bond. This bond would designate a well, which might otherwise be categorized as “temporarily abandoned,” as having potential for EOR when the technology becomes more accessible in the future.

Conclusion

The merger between Chord Energy and Enerplus goes beyond simple financial dealings; it signifies a strategic maneuver to establish a resilient and visionary force in the energy sector. With regulatory approvals and closing conditions on the horizon, anticipation builds for the emergence of a new frontrunner in the Williston Basin.

The unfolding narratives prompt intrigue regarding the potential intersections of these developments. Will the expansion of the Bakken giant be influenced by discoveries from ongoing studies into enhancing oil recovery in unconventional wells? Only time will reveal the intricate dynamics at play.

Mercer Capital has assisted many clients with various valuation needs in the oil and gas industry in North America and globally. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights