On January 11th, 2024, Chesapeake Energy Corporation and Southwestern Energy Company announced that they would be merging, with the resulting (currently unnamed) company becoming the largest natural gas producer in the country. The deal is the largest merger for a natural gas company since 2017 and the culmination of Chesapeake’s comeback from its Chapter 11 bankruptcy several years ago. The combined company is expected to produce 7.9 billion cubic feet of gas per day, making it the largest natural gas-focused producer in the United States. The companies already collectively account for 7% of domestic natural gas production, according to the Energy Information Administration (EIA). A presentation from Chesapeake promised that 20% of its production would be linked to international markets after the merger.

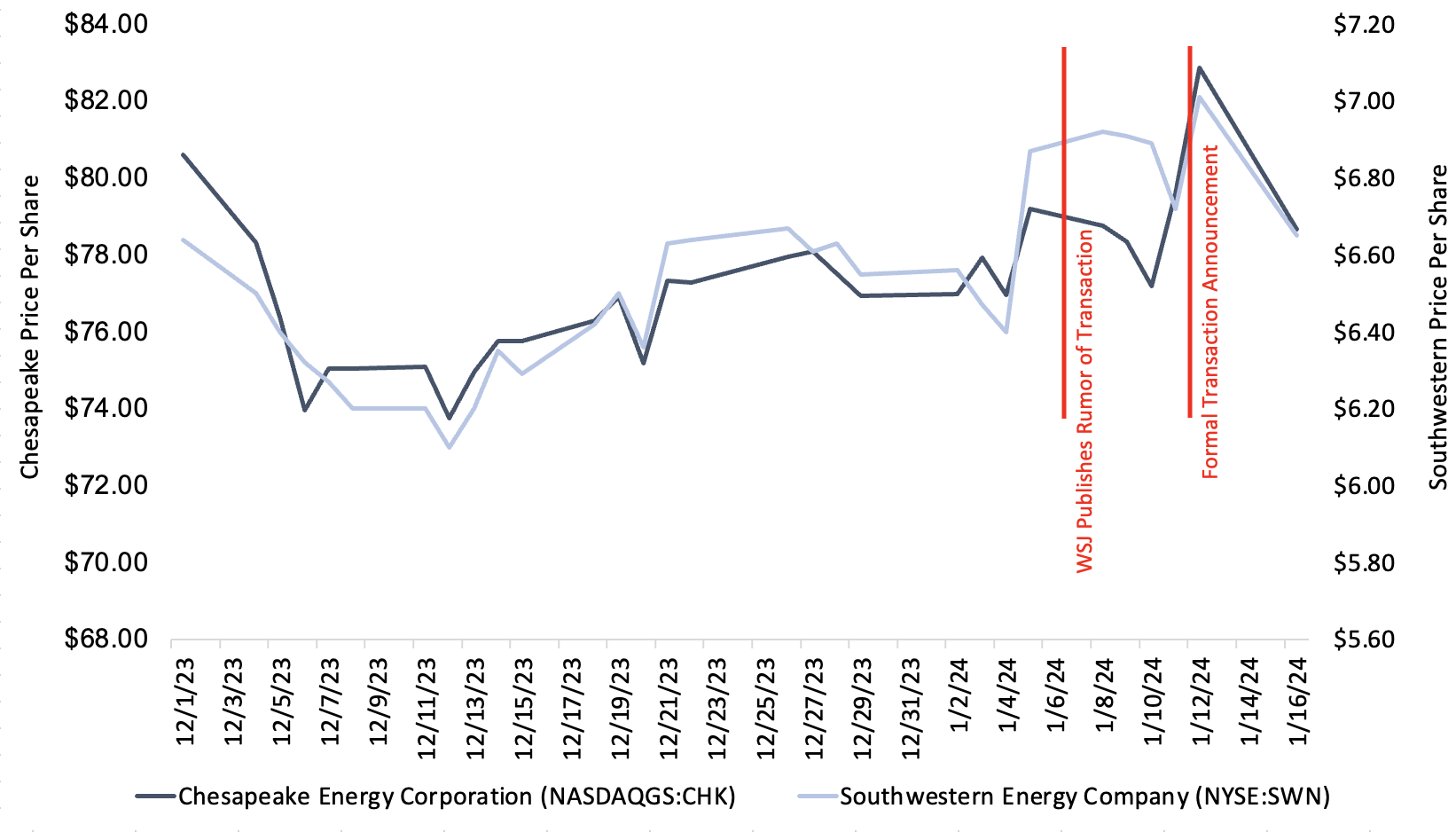

The total transaction value is $7.4 billion, paid entirely via stock. Per the terms of the deal, Southwestern investors will receive 0.0867 shares of Chesapeake for each share of Southwestern they own, implying a value of $6.69 for shares of Southwestern based on the close price of Chesapeake stock as of the transaction’s announcement. The merger implies an enterprise value of approximately $23 billion for the combined entity. The deal is expected to close in the second quarter of 2024.

Click here to expand the image above

In this post, we discuss the background, rationale, and outlook for the transaction, as well as its implications for the natural gas industry at large.

The History of Chesapeake and Southwestern

To understand the merger between Chesapeake and Southwestern, it is helpful to understand their respective histories.

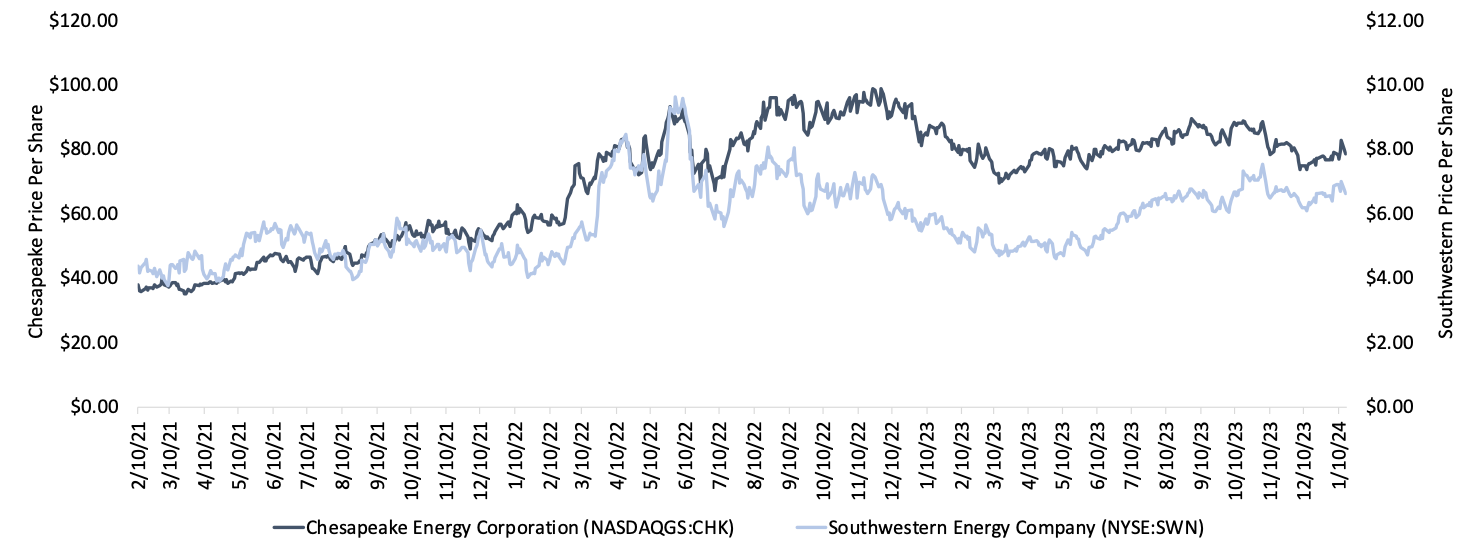

Chesapeake was one of the early players in fracking. To fund their acquisitions of land in Louisiana, Texas, and Appalachia, they relied heavily on debt financing. Overproduction led natural gas prices to fall in the early 2010s, so Chesapeake pivoted to oil-focused assets, taking on even more leverage in the process. When oil prices fell at the onset of COVID-19, Chesapeake filed for bankruptcy and managed to shed $7 billion in debt. Since then, it has focused on growing its natural gas activities both organically and inorganically while divesting from its oil operations. Its increased focus on natural gas has allowed Chesapeake to pursue lucrative agreements that have cemented its return to strength.

Southwestern Energy is a natural gas and liquids producer founded in 1929 as Arkansas Western Gas Company. It discovered the Fayetteville Shale in Arkansas, one of the largest natural gas basins in the USA, and expanded into the Appalachian Basin in Pennsylvania, West Virginia, and Ohio. In 2021, it acquired Indigo Natural Resources and GEP Haynesville, becoming the largest dual basin natural gas producer in the Haynesville and Marcellus Shales.

Cui Bono: Who Benefits?

Profit Begins at Home

U.S. natural gas exports have been on the rise and are generally expected to continue climbing in the years ahead. Both companies operate out of the Haynesville, but Southwestern brings significant Appalachian activity to the table. The overlap in the companies’ Haynesville activity is expected to generate significant synergies, while the Appalachian side of Southwestern’s operations will give Chesapeake access to new markets while improving the resources available to meet demand for Southwestern’s customers. The merger also increases Chesapeake’s ability to meet demand in the Gulf Coast area, which is home to most of the LNG plants in the country that enable natural gas to be liquefied and transported.

The companies have identified $400 million in synergies they expect to be created by the merger

International Implications

The deal is particularly advantageous because high demand in Europe and other international markets has led to a greater need for liquid natural gas (LNG) exports out of Texas and Louisiana. Furthermore, the companies have identified $400 million in synergies they expect to be created by the merger, partly due to their shared operations in the Haynesville and Marcellus basins (with Chesapeake currently having a cost advantage in each basin). The management of Chesapeake and Southwestern estimates about $200 million in savings will come from corporate and regional cost savings, primarily in the form of decreased regulatory fees and the removal of duplicative personnel. In addition to that, management intends to save $130 million on drilling and completion costs and another $70 million in miscellaneous operating cost cuts. The cuts will primarily be executed by consolidating the two firms’ operations in Louisiana and Pennsylvania to create stronger buying power from service providers and convenient clustering of resources.

A Financing Strategy That Will Pay Off in Dividends

The deal benefits Southwestern’s investors by providing sooner-than-anticipated dividend payments. As an individual company, Southwestern had one of the weakest capital returns in its sector over the past year relative to their enterprise value. The combined company expects to use those synergies to increase dividends by 20% over the next five years. While Chesapeake currently has a dividend yield of 4.7%, Southwestern does not pay a dividend. This could be a result of the differences in their balance sheets.

Having recently emerged from Chapter 11, Chesapeake has a net debt to EBITDA ratio of 0.2 times, well below Southwestern’s 0.6 times. As compensation for Chesapeake taking on significant debt from Southwestern, Chesapeake’s investors will receive a total ownership of 59.8% of the new company despite Southwestern and Chesapeake generating similar amounts of operating cash flow. Based on management commentary, the new entity intends to return $1.4 billion in capital to investors (about $2.30 per share plus other variable dividends), making the new entity one of the top E&P companies for dividends on the market.

The financial benefits go beyond dividend payments. The new company will have easier access to capital. It will likely be included in the S&P 500 and may receive an upgrade to investment-grade debt based on comments from S&P Global Ratings. Investment-grade status would allow the new company to borrow money at more efficient rates while also increasing its ability to pay down debt. In addition to easier access to capital, investment-grade status would prove attractive to worldwide LNG customers, who are more likely to sign long-term contracts with a company perceived as more stable.

Reactions to the Merger from Wall Street to the White House

Wall Street Likes the Deal

Investors have reacted positively towards the transaction, even though some analysts perceived both companies as “not all that appealing on their own.” When the Wall Street Journal announced that a deal might be approaching, Southwestern’s stock climbed by 7%, as expected from a company being acquired. More interestingly, Chesapeake stock rose by 3%. This is unusual, as acquirers typically experience a temporary decline in their stock due to taking on debt for the acquisition and the burden of paying a premium for the acquired firm.

Recently, investors have moved away from small and mid-size operators in favor of larger entities. This is one of the primary drivers behind recent consolidation in the upstream energy sector, although until now, natural gas producers have lagged oil-focused operators in terms of acquisitive activity due to low bid-ask spreads. It seems likely that part of the appeal Wall Street sees in the deal is creating a new large operator that can compete with more established players.

Government Approval Depends on Competing Priorities

Some analysts have noted that such a large deal may face antitrust resistance, especially if the government believes consolidation would raise natural gas prices during high inflation and purportedly low voter confidence in President Biden’s economic bona fides. Most of U.S.-produced natural gas consumption is domestic, even though exports have been growing since the outbreak of war in Ukraine. Antitrust scrutiny is not assured, though, as the government will be forced to weigh these concerns against its longer-term goal of displacing Russia’s prominent role in the worldwide energy space. The regulatory outlook is still unclear at this time. Whatever antitrust action is or is not taken will be a fascinating look into the current administration’s priorities.

Fool Me Once?

Another factor that will be interesting to watch going forward is how the combined entity either benefits or suffers from the broader trends shaping the industry. The U.S. is expected to have 1.9 trillion cubic feet of natural gas stored by March, which is 15% above its storage levels at the same time in 2023. The inventory levels are the result of sharply increasing production and warmer-than-expected temperatures throughout the winter thus far (with the notable exception of the week before the publishing of this post). On top of those short-term impacts, multiple LNG export terminals have been experiencing delays to their startup times, such as ExxonMobil’s Golden Pass. These delays may cause lower-than-expected demand until they become operational. Once they are online, there will likely be high demand, but exports may remain artificially limited up until 2025.

Click here to expand the image above

The EIA’s U.S. natural gas market outlook states that the U.S. benchmark natural gas spot price at the Henry Hub is expected to average under $3.00 per million British thermal units (MMBtu) in 2024 and 2025 due to strong natural gas production and storage inventories. This is more in line with gas prices in recent years, except for 2022. It also forecasts that U.S. natural gas demand will increase over that period of time, driven by growth in LNG exports and colder winter weather. The EIA suggests that the growth in demand will be partially offset by less consumption in the industrial and electric power sectors. In other words, despite increasing demand, the EIA believes the natural gas market will remain relatively low-priced in the next two years. This could provide a headwind for the entity created by the Chesapeake Southwestern merger.

To be clear, no one knows for sure what market dynamics will play out in either the short or long term. We do not intend to make a definitive statement about what will or will not happen. It is interesting to note that overproduction causing falling prices is a similar dynamic to the conditions surrounding Chesapeake when it transitioned into increasingly focusing more on oil rather than natural gas.

Conclusion

Chesapeake and Southwestern’s merger will likely transform domestic and international natural gas trade significantly, provided it navigates potential antitrust interests. Investors appear to have welcomed the transaction on account of the new company’s international reach and as much as $400 million in synergistic cost savings unlocked through reducing personnel redundancy and taking advantage of the two companies’ interlocking areas of operation. Going forward, it will be interesting to see the broader impacts of the transaction and the reaction to it on Wall Street and among E&P operators.

Mercer Capital has assisted many clients with various valuation needs in the oil and gas industry in North America and globally. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate, and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.