The Latest in Natural Gas Valuations

Continued Optimism for Global Demand Buoys Multiples

Natural gas markets continue an optimistic trend towards greater demand to meet a U.S. supply glut. The incoming Trump Administration has promised to pull back regulatory restraints and unleash the industry to “drill baby drill.”

However, when it comes to natural gas, there is already plenty of supply; the question is, can that supply become more portable to meet global (instead of regional) demands? That question drives eyes to watch the Gulf Coast LNG construction that has been developing for the past decade and continues to expand capacity. In addition, the Dallas Fed Energy Survey has indicated activity and outlook upticks from upstream producers after the election. The industry is encouraged.

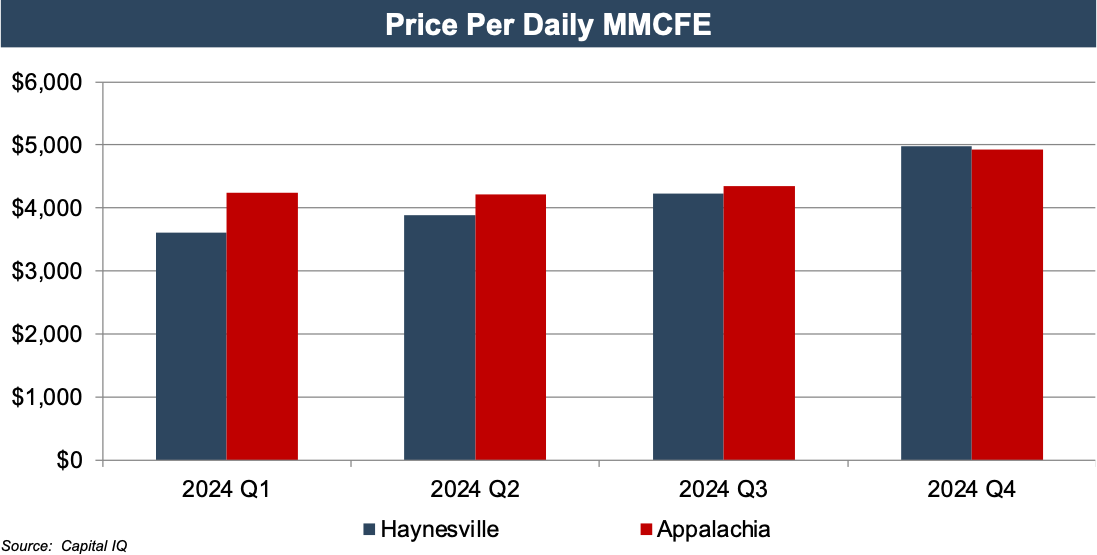

At the same time, most U.S. firms surveyed recently are not planning on increasing their drilling and completion investments for 2025, even after now knowing who will be in the White House for the next four years. Enthusiasm is not stemming from more production but from the new places that production can go. As a result, values from existing production have risen around 20% since early last year. The chart below, from Mercer Capital’s Quarterly Value Focus, shows this trend.

Demand: Mixed Signals — China’s Appetite for LNG to Ease While Europe’s Demand Rises

Demand around the world is growing for gas. Even with China hedging its energy sources by increasing its nuclear power capacity with 28 nuclear power plants under construction, future demand optimism remains high. According to the International Energy Agency, fast-growing Asian markets are driving global gas demand. Demand rose by 2.8%, or 115 billion cubic meters (bcm), in 2024 — well above the 2% average growth rate between 2010 and 2020.

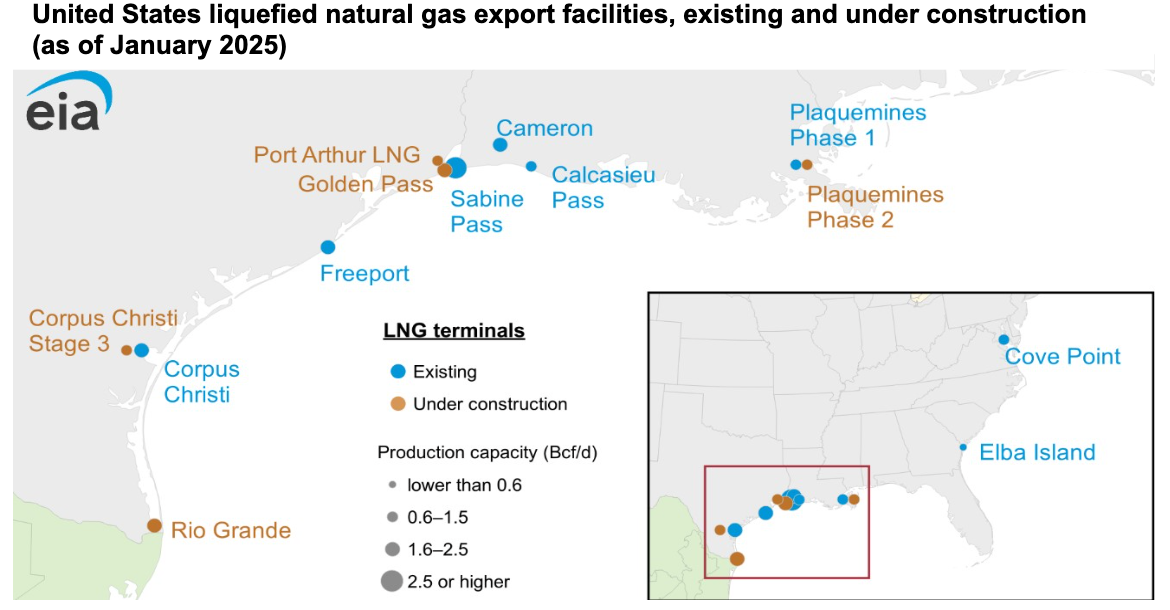

At the same time, below-average growth in liquefied natural gas (LNG) output kept supply tight, while extreme weather events added to market strains. According to the report, similar dynamics are expected to persist in 2025 before the arrival of a wave of new LNG export capacity, led by the United States and Qatar, that is set to come online throughout the second half of this decade. The most recent expansion is the opening of the Plaquemines LNG facility in Louisiana this past month. There are several more to come, as shown in the chart below.

Once both phases of Plaquemines LNG are completed and Corpus Christi LNG Stage 3 starts LNG exports, the EIA estimates LNG nominal production capacity in the United States will total 15.4 Bcf/d (18.7 Bcf/d peak). EIA also estimates nominal LNG export capacity will expand to 21.2 Bcf/d (25.2 Bcf/d peak) by 2028 once three other U.S. LNG export projects currently under construction — Golden Pass LNG, Rio Grande LNG, and Port Arthur LNG — are completed.

This change comes as more resources have been orienting themselves towards meeting China’s and Europe’s demands, as the Ukraine War has shown the need to depend on natural gas from sources other than Russia. Some shops, such as Bernstein, have upgraded natural gas stocks to Outperform from Market Perform. As an undersupplied natural gas market drives prices above $5/mcf starting this year and continuing to 2030, it provides a unique opportunity for long-term value creation.

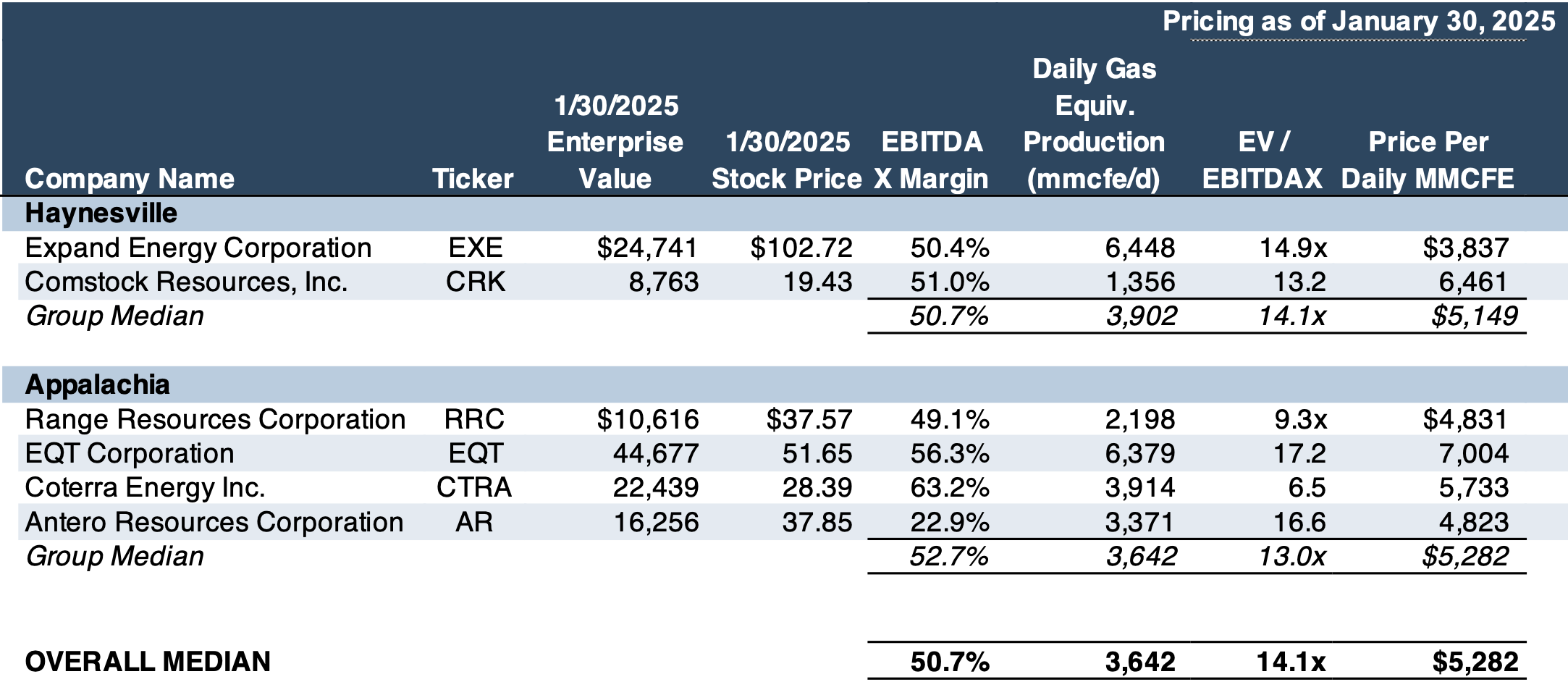

Valuations: Relatively High Cash Flow Multiples Indicate Growth

These market sentiments have led to a stronger stock price market for natural gas companies in 2025. On average, multiples of earnings and EBITDA(X) are much higher than their oil-focused counterparts. In the last year, stock prices have risen across the board in our gas-focused sample group, while most oil stocks have fallen. Cash flows are anticipated to grow, and as most companies have relatively low debt loads now, much of the cash flow will fall to equity investors.

Public company stocks in the Haynesville and Appalachia have performed under this premise. That sentiment is continuing into longer-term price estimates as well. The NYMEX curve was in normal backwardation, meaning future contracts are priced higher than spot prices as of the time of this article. The December 2026 contract was $4.42 on January 31st (today’s spot price was $3.02 at the time of writing). The Dallas Fed Survey respondents were also optimistic about overall prices but slightly more conservative in their estimates, estimating gas prices around $3.89 in five years.

The world is getting more direct access to LNG than ever before. Natural gas is becoming more globally portable. Going forward, it will help stabilize regional prices and market volatilities, which, in turn, will help U.S. producers that have more gas than the U.S. needs. Investors are optimistic that as more global portability of gas becomes available, more opportunities await to maximize potential in U.S. gas plays.

Energy Valuation Insights

Energy Valuation Insights