The Uinta Basin Resurgence

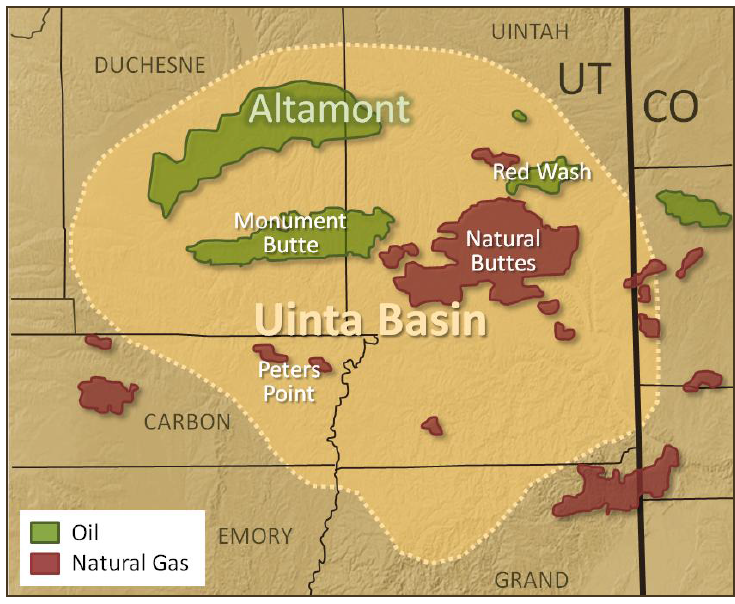

The Uinta Basin is a geological formation located in northeastern Utah that extends into Western Colorado on its easternmost front where it is bound by the Piceance Basin. The Uinta Basin is rich in oil and gas reserves and is a stacked formation with pay zones ranging from around 1,300′ to 18,000′ in depth. It is also home to the Uintah and Ouray Indian Reservation, one of the largest Native American reservations in the U.S. Major oil discoveries led to the basin’s first significant development in the 1940s. Average crude oil production dropped by more than half from 1985 (44 mbbl/d) to 2002 (20 mbbl/d), but with the rise of hydraulic fracturing (fracking) and horizontal drilling, the basin’s relevance has resurged, making it a hotspot for tight oil development and a significant contributor to U.S. oil and gas production. The basin is currently thought to produce around 160 mbbl/d.

Characteristics

The Uinta Basin’s waxy crude oil (consistency similar to shoe polish) stands out due to its low sulfur, metals, and nitrogen content, making it a more environmentally friendly option than other crude oils. Uinta crude features a medium-to-light API gravity (a measure of how heavy or light a petroleum liquid is compared to water), ranging from 32 degrees to 36 degrees for the “black wax” variant and 38 degrees to 44 degrees for the “yellow wax” type.

Transportation remains a challenge, as pipelines are not an option due to the crude’s tendency to solidify at ambient temperatures. The crude must be heated before being transported in insulated tanker trucks to one of five Salt Lake City refineries or various rail terminals. Approximately 90 mbbl/d are processed locally in the Salt Lake City area, while 70 mbbl/d are shipped to Gulf Coast refineries via truck and rail.

Recent Deals in the Uinta

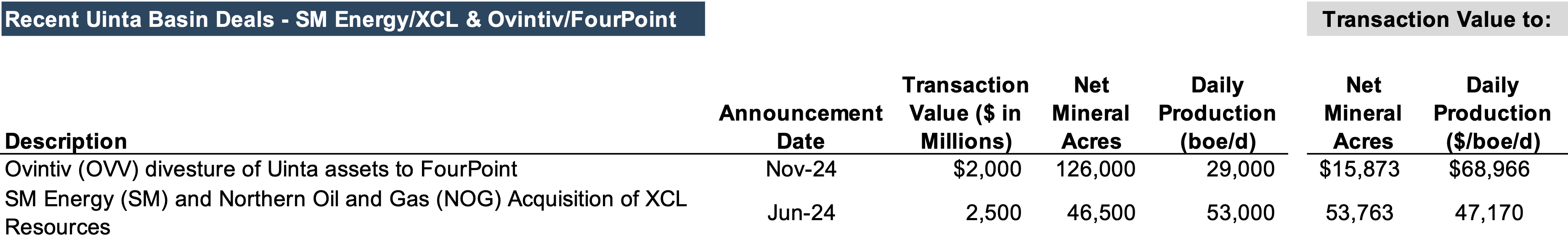

Public E&P companies with a current presence in the Uinta basin include SM Energy (NYSE: SM), Crescent Energy Company (NYSE: CRGY), and Berry Corporation (NASDAQ: BRY). Just a few weeks ago, Ovintiv (NYSE: OVV) completed the $2 billion all-cash sale of all of its Uinta assets to FourPoint Energy, a private equity-backed oil and gas company. The transaction was first announced in November 2024, and the divesture by Ovintiv included 126,000 net acres and an average oil production of 29,000 bbls/d.

SM Energy first entered the basin in June 2024 when it announced the $2.5 billion acquisition of XCL’s Uinta assets, whereby SM Energy will acquire an 80% interest in the assets for $2 billion, and Northern Gas and Oil (NYSE: NOG) will acquire the remaining 20% for $510 million. The total assets from the combined sale include 46,500 net acres and 53,000 barrels of oil equivalent per day (boe/d) (85% oil).

Click here to expand the image above

In August 2024, Quantum Capital Group closed on a deal to purchase Caerus’ oil and gas operations located in the Piceance Basin in western Colorado and the Uinta Basin in Utah. The upstream assets acquired are primarily natural gas assets, including 600,000 net acres in the Piceance Basin and 160,000 in the Uinta Basin. The purchase also includes midstream assets from Caerus and was made through two portfolio companies of Quantum: QB Energy to acquire the Piceance assets and Koda Resources to acquire the Uinta assets. The deal was reported to include producing acreage, though current production levels were not specified.

Market Dynamics and Comparative Analysis

The Uinta-Piceance basin has become an area targeted by smaller public and private companies following a wave of megadeals since late 2023. This flurry has left fewer areas for growth, specifically in the Permian Basin, where many upstream companies are effectively priced out.

As a recent example of seemingly outsized Permian valuation multiples and large deal sizing, last week on Jan. 30, 2025, Permian-focused royalty interest owner and manager Viper Energy Partners (NASDAQ: VNOM) announced that it had purchased royalty assets in the Midland Basin from parent company Diamondback Energy (NASDAQ: FANG) in a dropdown transaction for nearly $4.5 billion.

The dropdown was announced in combination with Viper’s purchase of mineral and royalty interests from Morita Ranches Minerals LLC for $330 million based on the 30-day average price of Viper’s units. The combined purchase includes 23,100 net royalty acres in the Midland Basin and 1,700 net royalty acres in the Delaware and Williston Basins. Expected 2025 production from the combined assets is 32,000 boe/d).

Click here to expand the image above

The dropdown follows Diamondback’s $26 billion acquisition of Endeavor Energy Resources in February 2024. David Deckelbaum, managing director at TD Cowen, estimates around $520 million in 2025E EBITDA from the royalty dropdown based on a $70 WTI price deck, which implies an 8.5x 2025E EBITDA for the dropdown, compared to 5.5x for FANG’s stock based on 2025 estimates for Diamondback.

Conclusion

The Uinta Basin has gained renewed relevance due to advancements in fracking and horizontal drilling and is increasing in significance as oil and gas companies are priced out of the Permian. While transportation challenges remain due to the unique properties of the basin’s waxy crude oil, the region’s potential is attracting significant attention, especially as companies seek acreage outside the increasingly competitive and expensive Permian Basin. With renewed investment and interest from both public and private operators, the Uinta Basin is poised to play a growing role in U.S. oil production.

The professionals of Mercer Capital assist clients with various valuation needs in the upstream oil and gas industry in both conventional and unconventional plays in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights