Eagle Ford Q1 2018

Lower Breakevens Yet Some Plan Fewer Wells

A milestone worth noting: The EIA recently announced that 2017 marked the first time since 1957 that U.S. natural gas exports exceeded imports.

The economics of the Eagle Ford Shale have been steadily improving for the past year. While the Permian has been receiving the most attention given its low-cost economics and large well potential, the Eagle Ford (particularly its oil window) has increased well production whilst dropping its costs. However, based on recent announcements, many companies will be reducing the number of wells drilled in 2018 as compared to 2017.

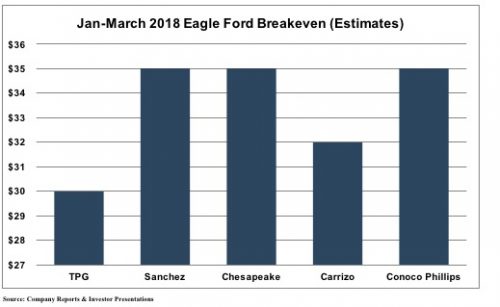

Breakeven Prices

As recently as a year ago, several companies and outlets reported breakeven oil price estimates in the low-to-mid $40s. Recently, several operators in the Eagle Ford are estimating breakeven as low as $28 and many around $35. This is a significant drop and points to anticipated efficiencies in drilling and completion costs.

This is positive, but the trend is generally moving away from the Eagle Ford relative to other plays. According to IHS Markit, “only 1,415 new wells were brought online in 2016 compared to 2,717 in 2015 and 4,040 in 2014″. IHS also noted “the play’s overall annual base has been decreasing year-over-year as a result of production coming from older wells. The annual base decline in the Eagle Ford in 2016 was 46% compared to 49% and 50% in 2015 and 2014, respectively.”

IHS Markit also reported that a key reason for the decline in activity in the Eagle Ford is due to the rising interest in the Permian Basin and STACK/SCOOP plays, which have attracted the interest of key Eagle Ford players, including Pioneer Resources, Devon Energy, and Marathon Oil.

TPG Acquisition

It is notable, and probably not a coincidence, that TPG, the most optimistic company per the Figure above, last week made one of the largest acquisitions in the Eagle Ford in the past few years (we will discuss this acquisition and other recent ones in more detail in a few weeks. Stay tuned.).

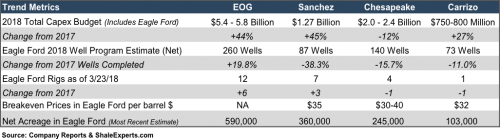

2018 Plans

Tis the season for 2018 guidance and several of the major Eagle Ford shale operators have given theirs. As mentioned, several companies (Sanchez, Chesapeake, and Carrizo) are decreasing their estimates for new well compared to last year, but are increasing their capex budgets. Overall, EOG and Sanchez have increased their rig presence as of last week, but those figures fluctuate even week-to-week. EOG is leading the way in its activity from well count to acreage. In terms of new activity planned in 2018, it is the most aggressive of the four companies we follow (see Figure below). It’s also notable that EOG continues to test its position in the Austin Chalk formation – completing four wells in 4Q2017.

Bill Thomas, the company’s chairman and CEO, said last year was a success, considering lingering weakness in crude oil prices and headwinds from the series of hurricanes that hammered southern U.S. shale basins in late 2017.

“EOG emerged from the industry downturn in 2017 with unprecedented levels of efficiency and productivity, driving oil production volumes to record levels with capital expenditures approximately one half the prior peak,” he said in a statement.

Carrizo’s strategy revolves around “multipads” wherever possible in the Eagle Ford. In 2018, Carrizo is completing a 16-well multipad utilizing three completion crews. In addition, Carrizo sees more than 700 remaining PUDs in the core of its Eagle Ford position at a 330-500 foot spacing profile (depending on the geology of the project area).

Chesapeake, meanwhile, continues to manage its balance sheet with asset sales and tempered activity which makes its activity profile a little harder to discern.

Performance

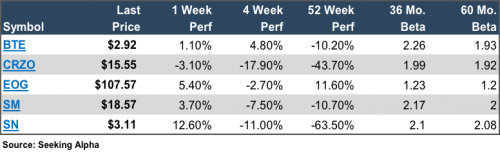

What does this mean for performance? Well, the past week has been good to a number of producers, but it comes after a subpar stock price performance for everyone on this list not named EOG.

However, if efficiencies compound for Eagle Ford players, this chart could look very different a year from now. Time will tell.

Have a great week!

Energy Valuation Insights

Energy Valuation Insights