The Fair Market Value of Oil and Gas Reserves

Oil and gas assets represent the majority of value of an E&P company. The Oil and Gas Financial Journal describes reserves as “a measurable value of a company’s worth and a basic measure of its life span.” Thus, understanding the fair market value of a company’s PDP, PDNP, and PUDs is key to understanding the fair market value of the Company. As we discussed before, the FASB and SEC offer reporting guidelines regarding the disclosure of proved reserves, but none of these represent the actual market price. It is especially important to understand the price one can receive for reserves as many companies have recently sold “non-core” assets to generate cash to pay off debt and fund operations. It is especially important to understand the price one can receive for reserves as many companies have recently sold “non-core” assets to generate cash to pay off debt and fund operations.

The American Society of Appraisers defines the Fair market value as:

The price, expressed in terms of cash equivalents, at which property would change hands between a hypothetical willing and able buyer and a hypothetical willing and able seller, acting at arm’s length in an open and unrestricted market, when neither is under compulsion to buy or sell and when both have reasonable knowledge of the relevant facts.1

The American Society of Appraisers recognizes three general approaches to valuation: (1) The Cost Approach, (2) The Income Approach, and (3) The Market Approach. The IRS provides guidance in determining the fair market value of an oil and gas producing property. Treasury Reg. 1.611–2(d) offers that if possible the cost approach or comparative sale approach should be used before a discounted cash flow analysis (DCF). When valuing acreage rights comparable transactions do provide the best indication of value. However, when valuing reserves, a DCF is often the best way to allocate value to different reserve categories because comparable transactions are very rare as the details needed to compare these specific characteristics of reserves are rarely disclosed.

Cost Approach

The cost approach determines a value indication of an asset by considering the cost to replicate the existing operations of an asset. The cost approach is used when reserves have not been proved up and there have been no historical transactions, yet a participant has spent significant time, talents, and investments into exploratory data on an oil and gas prospect project.

Market Approach

The market approach is a general way of determining a value indication of an asset by using one or more methods that compare the subject to similar assets that have been sold.

Because reserve values vary between oil and gas plays and even within a single play, finding comparable transactions is difficult. A comparable sale must have occurred at a similar time due to the volatile nature of oil and gas prices. A comparable sale should be for a property that is located within the same play and within a field of similar maturity. Additionally, comparable transactions must be thoroughly analyzed to make sure that they were not transacted at a premium or discount due to external factors. Thus, the market approach is often difficult to perform because true comparable transactions are rare. However, the transaction method generally provides the best indication of fair market value for acreage and lease rights.

Income Approach

The income approach estimates a value indication of an asset by converting anticipated economic benefits into a present single amount. Treasury Reg 1.611 – 2(e)(4) provides a straightforward outline of how the approach should be used.

In practice, this method requires that:

- The appraiser project income, expense, and net income on an annual basis

- Each year’s net income is discounted for interest at the “going rate” to determine the present worth of the future income on an annual and total basis

- The total present worth of future income is then discounted further, a percentage based on market conditions, to determine the fair market value. The costs of any expected additional equipment necessary to realize the profits are included in the annual expense, and the proceeds of any expected salvaged of equipment is included in the appropriate annual income.

Although the income approach is the least preferred method of the IRS, these techniques are generally accepted and understood in oil and gas circles to provide reasonable and accurate appraisals of hydrocarbon reserves, and most closely resembles the financial statement reporting requirements discussed in our previous post. This method is the best indication of value when a seismic survey has been performed and reliable reserve estimates are available. In order to properly account for risk, we divide the reserves by PDP, PDNP, PUD, Probable, and Possible reserves. We will review the key inputs in a DCF analysis of oil and gas reserves below.

Cash Inflows

In order to estimate revenue generated by an oil and gas reserve, we must have an estimate of production volume and price. Estimates of production are collected from Reserve reports which are produced by geological engineers.

The forward price curve provides monthly price estimates for 84 months from the current date. Generally, the price a producer receives varies with the price of benchmark crude such as WTI or Brent. Thus, it is important to carefully consider a producers contract with distributors. For example a company may sell raw crude to the distributor at 65% of Brent.

Cash Outflows

Many E&P companies do not own the land on which they produce. Instead they pay royalty payments to the land owner as a form of a lease payment. Royalty payments are generally negotiated as a percentage of the gross or net revenues derived from the use of the property. Besides royalty payments and daily operating costs, it is important to have conversations with management to understand future infrastructure maintenance and capital expenditures.

Discount

Oil and gas reserves can be based on pre-tax or after-tax cash flows. Pre-tax cash flows make reserve values more comparable as tax rates vary by location. When using pre-tax cash flows, we use a pre-tax cost of debt and pre-tax cost of equity to develop a WACC.

Risk Adjustment Factors

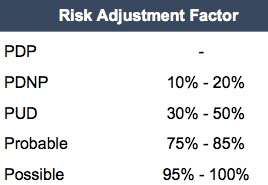

While DCF techniques are generally reliable for proven developed reserves (PDPs), they do not always capture the uncertainties and opportunities associated with the proven undeveloped reserves (PUDs) and particularly are not representative of the less certain upside of the Probable and Possible reserve categories. A risk adjustment factor could be used to the discounted present value of cash flows according to the category of the reserves being valued to account for PUDs upside and uncertainty by reducing expected returns from an industry weighted average cost of capital (WACC). You could also add a risk premium for each reserve category to adjust a baseline WACC, or keep the same WACC for all reserves but discount the present value of the cash flows accordingly with comparable discounts to those shown below.

The low oil price environment forced many companies to sell acreage and proved reserves in order to generate cash to pay off debt. In order to create a new business models in the face of low oil prices, it is critical for companies to understand the value of their assets. The valuation implications of reserves and acreage rights can swing dramatically in resource plays. Utilizing an experienced oil and gas reserve appraiser can help to understand how location impacts valuation issues in this current environment. Contact Mercer Capital to discuss your needs and learn more about how we can help you succeed.

End Notes

1 American Society of Appraisers, ASA Business Valuation Standards© (Revision published November 2009), “Definitions,” p. 27.

Energy Valuation Insights

Energy Valuation Insights