Impairment Testing of Oil & Gas Reserves

2020 Global Events Causing Significant Reserve Write-Downs

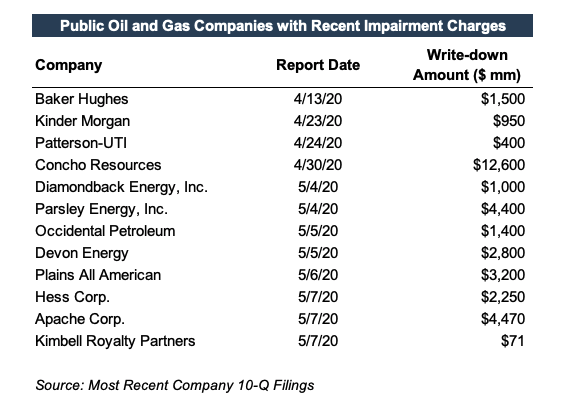

Oil & gas producers have been forced to take steps to improve their liquidity and make production cuts as prices have fallen to the lowest in decades, primarily due to a price war between Saudi Arabia and Russia as well as a demand slump amid the coronavirus pandemic. Weakness in the equity markets at the end of Q1 and through Q2 in 2020, due to the virus outbreak and substantial decline in commodity prices, have forced public oil & gas companies to take large impairment charges in recent quarterly reports (See table below for a non-exhaustive list of companies that have taken Q1 impairment charges).

Even before prices started to collapse, energy companies were cutting outlooks and planning major asset write-downs. Last fall, Schlumberger planned to take a $12.7 billion charge as shale drilling slowed, and Chevron Corp. announced a $10 billion charge related to offshore assets in the Gulf of Mexico and its Appalachia shale assets.

This post is aimed at discerning whether an oil & gas company may need to make interim impairment assessments in light of recent major global events and discuss the impairment testing process.

The Basics of Impairment Testing

In an earlier post from Mercer Capital titled Goodwill Impairment Testing in Uncertain Times, we cover the basics of impairments, namely when it is appropriate to assess and how to perform tests of impairment with the most notable item for testing relating to goodwill on a company’s balance sheet.

In short, under ASC Topic 360 impairment tests for long-lived assets should follow a two-or three-step process:

- Assess Impairment Indicators

- Test for Recoverability

- Measure the Impairment

In addition to the listed indicators in the accounting guidance, an entity may identify other indicators or “triggering events” that are particular to its business or industry. Once an indicator is identified, a company then tests for recoverability.

For oil & gas companies, conditions such as extreme volatility of supply, demand, and sustained periods of low commodity prices brought on by international commodity price wars, adverse global politicking, and the novel coronavirus pandemic can constitute as triggering events to necessitate interim impairment testing.

Oil & Gas Reserves – Accounting Methodology

As opposed to the vast majority of companies outside of the energy sector, oil & gas companies have reserves that are considered long-lived assets for accounting purposes. These reserves are subject to the same impairment testing rules outlined above such that they are required to be tested on a periodic basis or when triggering events occur.

Before performing any impairment testing, however, the accounting methods used to account for these oil & gas reserves need to be considered. Under ASC Topic 932, companies can use one of two methods to account for their oil and gas operations: the successful efforts method or the full cost method.

Under the successful efforts method, the cost of drilling an oil well cannot be capitalized unless the well is successful. Costs for unsuccessful wells (dry holes) must be charged as an expense against revenue in the matching period.

Under the full cost method, companies may capitalize all operating expenses relating to searching for and producing new oil reserves. Costs are then totaled and grouped into cost pools.

Impairment Considerations Related to Oil & Gas Reserves

In Statement of Financial Accounting Standards No. 19, the FASB requires that oil & gas companies use the successful efforts method. However, the SEC allows companies to use the full cost method. Guidance for impairment testing of reserves under both methods differ but are available to valuation and other practitioners conducting the tests.

Successful Efforts Method

Oil & gas companies that use the successful efforts method apply the guidance in ASC 932-360-35 and ASC 360-10-35 to account for the impairment of their reserve assets.

Timing of Impairment Testing and Impairment Indicators

Under the successful efforts method, an oil & gas company generally performs a traditional two-step impairment analysis in accordance with ASC 360 when assessing reserves for indications of impairment. As mentioned above, impairment assessment for reserves may be determined on an annual basis or in the case of a triggering event. To begin, we bifurcate the total reserve assets into two major groups: proved properties and unproved properties.

Proved properties in an asset group should be tested for recoverability whenever triggering events or changes in circumstances indicate that the asset group’s carrying amount may not be recoverable. Generally, companies that apply the successful efforts method will perform an annual impairment assessment upon receiving their annual reserve report by preparing a cash flow analysis. Companies can consider proved (P1), probable (P2), and possible (P3) reserves and other resources since these are all included in the value of the assets. Typically, the impairment evaluation of proved properties are performed on a field-by-field basis. Property groupings may differ due to specific circumstances like shared platform infrastructure or other logical reasons.

Oil & gas companies should also assess unproved properties periodically to determine whether they have been impaired. The assessment of these properties is based mostly on qualitative factors and are generally assessed on a property-by-property basis.

Measurement of Impairment Loss

A company that applies the successful efforts method then evaluates each asset group for impairment using the two-step approach under ASC Topic 360. In step one, the company will perform a cash flow recoverability test by comparing the summation of an asset group’s undiscounted cash flows with the asset group’s carrying value. If the undiscounted cash flows are less than the asset group’s carrying value, the assets are likely impaired. The company would then proceed to step two of the impairment test to compare the asset group’s determined fair value with its carrying amount. An impairment loss would be recorded and measured as the amount by which the asset group’s carrying amount exceeds this determined fair value.

Recognition of Impairment Loss

An impairment loss for a proved property asset group will reduce only the carrying amounts of the group’s long-lived assets. The loss should be allocated to the long-lived assets of the group on a pro rata basis by using the relative carrying amounts of those assets. However, the loss allocated to an individual long-lived asset of the group should not reduce the asset’s carrying amount to less than its fair value if that fair value is determinable without undue cost and effort.

For unproved properties, if the results of the assessment indicate impairment, a loss should be recognized by providing a valuation allowance. Under the successful efforts method and consistent with U.S. GAAP, companies are prohibited from reversing write-downs.

In most cases, write-downs occur when oil & gas reserves cannot be extracted economically, such as on properties where drilling has not started or where properties were expected to be developed based on higher oil prices than are currently estimated. As evidenced in recent market events, if oil prices drop too low, the cost to develop the properties may outweigh the net revenues associated with production.

Full Cost Method

Although less common in U.S financial reporting, companies that use the full-cost method of accounting should apply the guidance in Regulation S-X, Rule 4-10; SAB Topic 12.D; and FRC Section 406.01.c.

Timing of Impairment Testing and Impairment Indicators

Under the full-cost method, a full-cost ceiling test must be performed on proved properties each reporting period. This “ceiling” is a formulaic limitation on the net book value of capitalized costs prescribed by SEC guidance listed above. This ceiling formula is equal to:

+ The present value of estimated future net revenues, minus any estimated future expenditures to develop and produce proved reserves, using a discount rate of 10%

+ The cost of any properties not being amortized

+ The lower of cost or the estimated fair value of unproved properties that are included in the amortized costs

– Any income tax effects associated with differences between the book and tax basis of the excluded properties and the unproven properties being amortized

Similar to the successful efforts method, unproved properties must be assessed periodically for inclusion in the full-cost pool, subject to amortization.

Measurement and Recognition of Impairment Loss

If a full cost pool ceiling is exceeded, the excess amount must be recorded as an expense. If the cost center ceiling later increases, like the successful efforts method, write-downs may not be reversed and the amount written off may not be reinstated.

Determination of Fair Value of Oil & Gas Reserves

In the event that a step two analysis needs to be performed, the determination of fair value of the reserve assets can be performed under three approaches:

- Income approach — Under this approach, valuation techniques are used to convert future cash flows to a single present amount using a discount rate. The measurement is based on the value indicated by current market expectations about those future amounts.

- Market approach — This approach requires entities to consider prices and other relevant information in market prices and transactions that involve identical or comparable assets or companies. Valuation techniques commonly used under the market approach include the guideline public company and guideline transaction methods.

- Asset approach —Also known as the cost approach, the value of a business, business ownership interest, or tangible or intangible asset is estimated by determining the sum of total costs required to replace the investment or asset with similar utility.

When determining the fair value of oil & gas reserves, companies use various methods and approaches. The vast majority utilize a discounted cash flow (DCF) model to estimate the fair value of reserves. Depending on circumstances other approaches or a mix of approaches may be appropriate for determining fair value of a company’s reserves.

Concluding Thoughts

The oil & gas market and the energy sector as a whole have taken a beating and experienced unprecedented events due to the global impacts from the pandemic and international price wars. While the scale of the full economic effects from these events has yet to be seen, companies are having to question and consider the need for interim impairment testing on reserves.

At Mercer Capital, we have experience in implementing both the qualitative and quantitative aspects of interim oil & gas reserve impairment testing. To discuss the implications and timing of triggering events, please contact a professional in Mercer Capital’s Energy Group.

Energy Valuation Insights

Energy Valuation Insights