What Is a Fairness Opinion And What Triggers the Need for One?

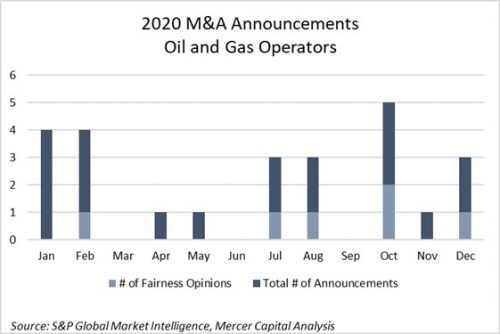

Based on available public data from S&P Global’s Market Intelligence platform, there were 25 merger and acquisition announcements in 2020 related to oil and gas companies at the entity level (including natural gas midstream and utility companies). These 25 announcements represented at least $16.2 billion in total deal value, notwithstanding three deals where the value was not publicly disclosed. On a quarterly basis, there were eight announcements in Q1 2020, eight in Q2 and Q3 combined, and nine in Q4.

While the trend in the quarterly announcements is not very surprising, one phrase, in particular, creeps up with increasing frequency when reviewing transaction details as 2020 progressed: “Fairness Opinion.”

In Q1, only one of the eight transactions was reported to have had a Fairness Opinion conducted. None of the two transactions announced in Q2 had Fairness Opinions, but two of the six announced deals in Q3 did. As the Oil and Gas industry began to get somewhat comfortable again, Q4 finished out strong with nine announced deals. However, nearly half of them were accompanied by Fairness Opinions. We examine this trend from a monthly perspective in the following chart:

Irrespective of what industry or sector a company may operate in, a fundamental question arises as mergers and acquisitions persist and company boards and management teams survey their options when a proposed transaction is put on the table: is it fair to all direct stakeholders?

What Is a Fairness Opinion?

A Fairness Opinion involves a comprehensive review of a transaction from a financial point of view and is typically provided by an independent financial advisor to the board of directors of the buyer or seller. The financial advisor must look at pricing, terms, and consideration received in the context of the market for similar companies. The advisor then opines that the transaction is fair, from a financial point of view and from the perspective of the seller’s minority shareholders. In cases where the transaction is considered to be material for the acquiring company, a second Fairness Opinion from a separate financial advisor on behalf of the buyer may be pursued. On this point, we note that among the six deals announced in 2020 where a Fairness Opinion was conducted, only one of the six had Fairness Opinions conducted on behalf of both the buyer and the seller; the opinions performed for the other five deals were solely on behalf of the sellers in those transactions.

Why Is a Fairness Opinion Important?

Why is a Fairness Opinion important? There are no specific guidelines as to when to obtain a Fairness Opinion, yet it is important to recognize that the board of directors is endeavoring to demonstrate that it is acting in the best interest of all the shareholders by seeking outside assurance that its actions are prudent.

One answer to this question is that good intention(s) without proper diligence may still give rise to potential liability. In its ruling in the landmark case Smith v. Van Gorkom, (Trans Union), (488 A. 2d Del. 1985), the Delaware Supreme Court effectively made the issuance of Fairness Opinions de rigueur in M&A and other significant corporate transactions. The backstory to this case is the Trans Union board approved an LBO that was engineered by the CEO without hiring a financial advisor to vet a transaction that was presented to them without any supporting materials. Regardless of any specific factors that may have led the Trans Union board to approve the transaction without extensive review, the Delaware Supreme Court found that the board was grossly negligent in approving the offer despite acting in good faith. Good intentions, but lack of proper diligence.

The facts and circumstances of any particular transaction can lead reasonable (or unreasonable) parties to conclude that a number of perhaps preferable alternatives are present. A Fairness Opinion from a qualified financial advisor can minimize the risks of disagreement among shareholders and misunderstandings about a deal. They can also serve to limit the possibilities of litigation which could kill the deal. Perhaps just as important as being qualified, a Fairness Opinion may be further fortified if conducted by a financial advisor who is independent of the transaction. In other words, a financial advisor hired solely to evaluate the transaction, as opposed to the banker who is paid a success fee in addition to receiving a fee for issuing a Fairness Opinion.

When Should You Obtain a Fairness Opinion?

While the following is not a complete list, consideration should be given to obtaining a Fairness Opinion if one or more of these situations are present:

- Competing bids have been received that are different in price or structure, leading to potential disagreements in the adequacy and/or interpretation of the terms being offered, and which offer may be “best”; Conversely, when there is only one bid for the company, and competing bids have not been solicited.

- The offer is hostile or unsolicited.

- Insiders or other affiliated parties are involved in the transaction, giving rise to potential or perceived conflicts of interest.

- There is concern that the shareholders fully understand that considerable efforts were expended to assure fairness to all parties.

What Does a Fairness Opinion Cover?

A Fairness Opinion involves a review of a transaction from a financial point of view that considers value (as a range concept) and the process the board followed in reaching a decision to consummate a transaction. The financial advisor must look at pricing, terms, and consideration received in the context of the market. The advisor then opines that the consideration to be received (sell-side) or paid (buy-side) is fair from a financial point of view of shareholders, especially minority shareholders in particular, provided the advisor’s analysis leads to such a conclusion.

While the Fairness Opinion itself may be conveyed in a short document, most typically as a simple letter, the supporting work behind the Fairness Opinion letter is substantial. This analysis may be provided and presented in a separate fairness memorandum or equivalent document.

A well-developed Fairness Opinion will be based upon the following considerations that are expounded upon in the accompanying opinion memorandum:

- A review of the proposed transaction, including terms and price and the process the board followed to reach an agreement.

- The subject company’s capital table/structure.

- Financial performance and factors impacting earnings.

- Management’s current year budget and multi-year forecast.

- Valuation analysis that considers multiple methods that provide the basis to develop a range of value to compare with the proposed transaction price.

- The investment characteristics of the shares to be received (or issued), including the pro-forma impact on the buyer’s capital structure, regulatory capital ratios, earnings capacity, and the accretion/dilution to earnings per share, tangible book value per share, dividends per share, or other pertinent value metrics.

- Address the source of funds for the buyer.

What Is Not Covered in a Fairness Opinion?

It is important to note what a Fairness Opinion does not prescribe, including:

- The highest obtainable price.

- The advisability of the action the board is taking versus an alternative.

- Where a company’s shares may trade in the future.

- How shareholders should vote a prox.y

- The reasonableness of compensation that may be paid to executives as a result of the transaction.

Due diligence work is crucial to the development of the Fairness Opinion because there is no bright-line test that consideration to be received or paid is fair or not. The financial advisor must take steps to develop an opinion of the value of the selling company and the investment prospects of the buyer (when selling stock).

Conclusion

The Professionals at Mercer Capital may not be able to predict the future, but we have nearly four decades of experience in helping boards assess transactions as qualified and independent financial advisors. Sometimes paths and fairness from a financial point of view seem clear; other times they do not.

Please give us a call if we can assist your company in evaluating a transaction.

Energy Valuation Insights

Energy Valuation Insights