What is an Oilfield Service Company?

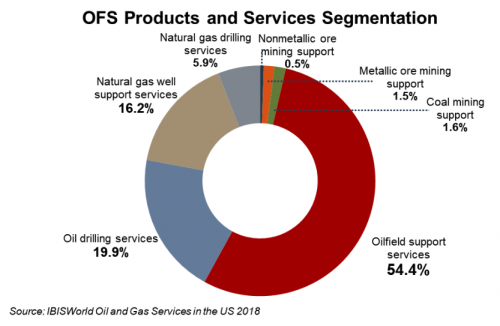

The oilfield equipment and services (or OFS) industry refers to all products and services associated with the oil and gas exploration and production process, i.e. the upstream sector of the energy industry. In general these companies are engaged in the manufacturing, repair, and maintenance of equipment used in oil extraction and transportation.

Products such as seismic testing, transport services, and directional services for horizontal drillers in addition to well construction, and production and completion services are generally what most would typically think when an oilfield services company comes to mind.

However, the range of products and services under the OFS umbrella is wide and include many technology-based services that are vital for successful field operations. Such services include locating energy sources, energy data management, drilling and formation evaluation, geological sciences, and many others.

Technological innovation over time has led to increased efficiencies in resource extraction and management, and larger OFS companies such as Schlumberger and Halliburton have capitalized on technology-based services to meet the increasing demand in this subsector. Other OFS companies such as Helmerich & Payne continue to specialize in legacy services, including rigs and equipment manufacturing, drilling services, and products.

How Do Oilfield Services Companies Fit in the Industry?

OFS providers in their modern form arose through a combination of factors dating back to the oil price slump in the late nineties and the mega-mergers of BP-Amoco in 1998 and Exxon-Mobil in 1999. Mergers of this size allowed for synergies of logistics and allowed for restructuring and optimization of assets.

While the advantages of these mergers were clear in the downstream segment, the impact for upstream was not so apparent. In fact, the in-house ownership of these various types of services created inefficiencies and redundant cost centers that made it expensive to provide necessary upstream services without impacting the bottom line.

These factors and segment trimmings enabled the development of a specialized oilfield service industry, which today provides the majority of the technology (primarily assets and people) and innovation essential across the life cycle of an oil and gas development.

The rationale for the outsourcing of service capability can be summarized in three key points:

- Economies of scale – Specialization of companies in the service chain allows for intense competition among suppliers while also facilitating technical innovation. In-house ownership of services might not have provided the rapid rise of such competition and technology advances that the industry has seen over the last couple of decades.

- Capital efficiency – A service company able to supply a wide range of clients (large/small public, government-owned, independents, etc.) would expect to be able to achieve higher rates of utilization for their assets and therefore better return on capital employed than could an E&P company limited by their own inventory.

- Accountability – Third-party service providers arguably allow for increased accountability and efficient creation of reward structures between operator/contractor. However outsourcing may lead to greater operator risk, execution delays, and even contract mispricing.

Key Drivers and Indicators of the Oilfield Services Industry

At its core, the revenue of the OFS companies is a function of the capital and operating expenditure of the E&P companies, which is in turn governed by current and future expectations of the price of oil & natural gas.

There are of course several other factors that come into play (advances in technology, climate, seasonality of spending, availability of financing, political factors, etc.), but ultimately it is the supply and demand balance and market fundamentals which determine incentives for investment by these companies. Below is a non-exclusive list of leading indicators that are used to gauge the outlook and demand across the OFS sector:

- E&P Capital Expenditure Budgets – Size of capex budgets will ultimately determine how the OFS industry will perform as whole. E&P companies will typically begin drafting capex budgets for the next year in the final quarter of the current year. Many will then announce their forward spending plans, strategy, and quarterly/annual results to the market through quarterly earnings calls and press releases. These calls and news releases tend to be closely watched as a leading indicator of future demand. However, historical trends before the oil collapse in 2014 showed that large companies tended to overspend whereas companies at year end 2018 have been tight on capex budgets, even in rising oil price environments. Lean budgets will push the use of third party services down the priority list resulting in hard hits to an OFS company’s revenue stream.

- Rig and Well Counts – Historically, one of the most closely followed measures of the level of demand for the OFS industry is the active rotary rig count. Baker Hughes began publishing the North American active rig count on a weekly basis since 1944 and initiated the monthly international rig count in 1975. Rig counts have historically been treated as a business barometer for the drilling industry and its suppliers. The thought is when drilling rigs are active, they consume products & services produced by the OFS industry; however, well counts have been trending towards being the primary leading indicator of profits. The reason is in part due to “pad drilling”, in which multiple wells are drilled from one site. Combined with technological advances and logistical efficiencies, having multiple wells per pad in a shale play has a greater effect on performance in a given area. In essence, fluctuating well counts on a seemingly stagnant overall rig count provide a different picture of the health of the sector. Therefore tracking well counts in the last decade has improved predictive power than indications provided solely by rig counts.

- Day-rates – Day rate refers to all in daily costs of renting a drilling rig, and roughly makes up half of the cost of an oil well. The operator of a drilling project pays a day rate to the drilling contractor who provides the rig, the drilling personnel and other incidentals. The oil companies and the drilling contractors usually agree on a flat fee per contract, so the day rate is determined by dividing the total value of the contract by the number of days in the contract. Although less easily observable, it is also possible to track trends through day rate announcements for other less ‘liquid’ marine sectors, such as seismic vessels, supply boats, support vessels and installation/heavy-lift vessels. Analyzing day rates in combination with metrics like rig utilization allows investors to gain insight into the overall supply and demand picture of the OFS industry at large. When day rates increase, this implies decreased supply of OFS providers or increased demand for their services.

- Equipment orders – A steady stream of new orders is critical of any manufacturing company, and it is no different with OFS sector. It is customary for OFS companies to announce major equipment orders, i.e. rig orders, floating production storage and offloading (FPSO) orders, underwater equipment orders, drilling packages, etc. and these announcements provide useful insights as to the level of demand across various parts of the service lifecycle.

- Backlogs – Similar to engineering and construction companies, many OFS companies announce backlogs as a snapshot of the health of their businesses. Since backlog is not an audited measure and its definition can vary from company to company, it is not a hard and fast figure that should be taken at face value. While a sufficient backlog typically means the company is busy, there is give and take for backlogs that extend too far out. Unless specified by management, the timing of backlogged projects can be fairly unpredictable with durations as short as a few months to as long as a few years. But the general thought in analyzing company backlog is to provide an indication of value of revenue not yet recognized and demand for services to be rendered in the future.

In our next post, we’ll explore valuation issues relevant to oilfield service companies. Stay tuned.

Energy Valuation Insights

Energy Valuation Insights