Why Aren’t We Talking About the Gulf of Mexico?

Artem Abramov, of Rystad Energy, recently published an article in the Oil and Gas Financial Journal comparing shale and offshore drilling. He claims, the “Gulf of Mexico [is] as important as [the] Permian Basin for U.S. oil production” but it has been overlooked since the advancement of shale gas. The EIA reports that offshore drilling accounts for 17% of total domestic crude oil production. So, why aren’t we talking more about oil and gas production from the Gulf of Mexico (GoM)?

Unlike shale plays, where production varies with oil prices, production in the Gulf of Mexico has been resilient to fluctuations in prices because projects in the Gulf of Mexico have longer time horizons. After the downturn in oil prices drilling activity remained relatively flat at 25-35 wellbores per quarter. The relative price insensitivity over the short term meant that the Gulf of Mexico did not see substantial production drops like many other oil producing regions of the U.S. when prices fell in mid-2014. However, this also means that as oil prices have recently increased, the Gulf has not seen substantial increases in production.

The Oil and Gas Financial Journal article stated:

Only two sources of oil supply in the U.S. remained exceptionally resilient throughout the downturn: The Permian Basin and the Gulf of Mexico. The Permian Basin’s output was growing every quarter, adding 300 Mbbl/d from the first quarter of 2015 through the fourth quarter of 2016. While exposed to seasonal disruptions, GoM’s production was able to deliver a 240 Mbbl/d growth over the same period, contributing almost equally with the Permian Basin to the limited decline pace of the total U.S. oil production.

Right before the 2014 downturn in oil prices, many deepwater drilling projects were approved. This led to increased start-up activity in the Gulf in the second half of 2016 which increased crude and condensate production by 400 Mbbl/d from 2014 to 2016. In 2016, eight projects came online in the GoM and another seven projects are expected to come online by the end of 2018. In 2016, crude oil production in the Gulf of Mexico reached an annual high of 1.6 Mmbbl/d which surpassed the previous high which was set in 2009. Oil production is expected to reach 1.7 Mmbbl/d in 2017 and 1.8 Mmbbl/d in 2018 in the Gulf of Mexico.

Recently, most oil and gas news has been centered on the Permian Basin. As we explained in a recent post, the Permian Basin has had recent success due to its locational advantage, vast amount of untapped reserves, and low breakeven prices. Most of the major M&A deals in the upstream sector were in the Permian Basin in 2016. According to James Scarlett of RS Energy Group, approximately 25% of the U.S.’ lower 48 production came from the Permian Basin and 38% of the rigs in the U.S. are in the Permian. The reason for so much concentration is that about 80% of currently economic (economic meaning under $50 breakeven oil) oil is in the Permian, particularly the Delaware Basin. Secondly, due to the numerous potential production zones (Wolfcamp, Bone Spring, Leonard Shale, Delaware Sands, etc.), there is a huge amount of oil in place for potential recovery (3,000 feet of pay zones). Couple this with an area (West Texas) that has ample existing infrastructure from decades of development, and this has led to what some people are calling a land grab in the area.

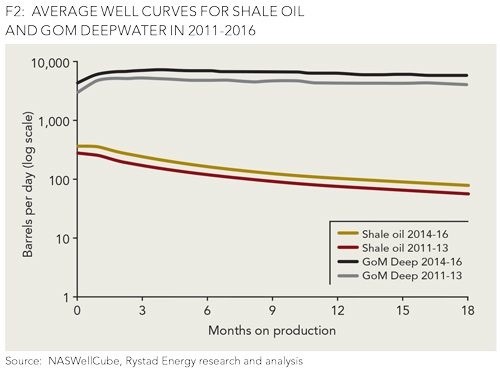

The Gulf of Mexico’s success can be similarly explained. The EAI reports that 45% of total petroleum refining capital and 51% of U.S. natural gas processing plant capacity is located along the Gulf Coast, giving the Gulf easy access to its downstream market. Additionally, much of the midstream infrastructure is already in place, which allows companies to save money by utilizing already developed pipelines. Further, the Gulf of Mexico had 4.8 billion barrels of crude oil proved reserves at year end 2015, according to the most recent information published by the EIA. In comparison, RRC Districts 7C, 8, and 8A, which includes the majority of the Permian Basin, combined proved reserves at year end 2015 of 7.3 billion barrels, and North Dakota, home to the Bakken shale play, had 5.2 billion barrels of proved reserves (2015 reserve estimates do not include some recent significant discoveries, including the discovery of an estimated 20 billion barrels in the Wolfcamp shale play in the Permian Basin). In addition, the Gulf of Mexico has been able to realize increased drilling efficiency for many years. Average drilling speed in shale increased by 100% from 2011 to 2016, but the Gulf of Mexico was not far behind, averaging an increase in drilling speeds by 60-75% from 2015 to 2016. As shown in the chart below sourced from the Oil and Gas Financial Journal, drilling efficiency improvement in the GoM is greater than in shale oil.

While the energy sector as a whole is expected to benefit from President Trump’s pro-energy policy, offshore drilling has recently been at the center of political talks. Interior Department Secretary Ryan Zinke signed two secretarial orders last week which are expected to increase America’s offshore energy potential. The first order, directed by the Bureau of Ocean Energy Management (BOEM), is to develop a new five-year plan for offshore oil and gas exploration and to reconsider the regulations surrounding these activities. Secretary Zinke said that regulations which were created with good intentions, but that have been harmful to America’s energy industry, will be reviewed. While some regulations have been removed, such as the Offshore Air Quality Control, Reporting, and Compliance Rule, Offshore Petroleum Industry Training Organization (OPITO) officials are encouraging the U.S. to follow their common industry standards, which have been adopted by 45 other oil producing regions internationally.

The second order established a new position to coordinate the Interior Departments energy portfolio. Zinke noted that in 2008 federal leasing revenue for the Outer Continental Shelf (OCS) was approximately $18 billion, but it was only $2.8 billion in 2016. Focused on increasing leasing revenue, President Trump is likely to experience some legal obstacles. In 2006, Congress placed a moratorium on drilling within 125 miles of the Florida Coast until 2022. However, this area is estimated to contain up to 2.35 billion barrels of oil. President Obama in November 2016 permitted 10 lease sales in areas of the Gulf of Mexico in moratorium, but this plan only covered a small portion of the eastern gulf coast. President Trump wants to expand leasing rights but will likely have to battle much of this argument in court because it requires a public comment period.1

One impact of the recent downturn in oil prices was the need for shorter term capital projects. As we talked about in a recent post, “The Wild Goose Chase Is Over“, companies have been looking to invest in quick ventures that have short payback periods. The Gulf of Mexico is known to have longer payback periods but has been working to shorten investment time horizons. Companies are focusing on “Subsea completions and tiebacks where you already have the infrastructure – the platform in place, the pipeline to the market place – so those require significantly less capital and faster lead times than the big spars that people think of in offshore projects” as Deloitte’s Andrew Slaughter said in a recent interview with the Oil and Gas Financial Journal.2

While the Permian Basin has been the center of most oil and gas discussion recently, there are notable investments being made in other oil rich areas of the U.S. In February, Shell invested in the Kaikias oil and gas project in the Gulf of Mexico. It will start production in 2019 and will be able to generate profits even with oil prices lower than $40 /bbl. Last December BP made a similar announcement of a $9 billion investment, called “Mad Dog Phase 2” in the Gulf of Mexico that is expected to be profitable at $40/ bbl oil. With uncertainty surrounding the future price of oil due to the unpredictability of OPEC’s production cuts, it is important for oil and gas producers to find economically efficient plays. While the Permian is currently one of the most economical plays, we cannot rule out all others such as those in the Gulf of Mexico. Although the market is not rallying around the Gulf of Mexico like it is around the Permian, we can expect continued growth in the region over the next few years.

Mercer Capital has significant experience valuing assets and companies in the energy and construction industries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

End Notes

1 Dlouhy, Jennifer. “Trump to Expand Offshore Drilling, Review Deepwater Horizon Regs. Bloomberg News.

2 Tiebacks are subsea lines that connect new wells to existing projects.

Energy Valuation Insights

Energy Valuation Insights