A Guide to Corporate Finance Fundamentals

Part 4 | Finance Basics: Distribution Policy

This post is the fourth and final installment from our Corporate Finance in 30 Minutes whitepaper. In this series of posts, we walk through the three key decisions of capital structure, capital budgeting, and dividend policy to assist family business directors and shareholders without a finance background to make relevant and meaningful contributions to the most consequential financial decisions all companies must make.

Three Questions

Corporate finance is the search for rational answers to three fundamental questions.

- The Capital Structure Question: What is the most efficient mix of capital? In other words, is there such a thing as too little or too much debt?

- The Capital Budgeting Question: What capital projects merit investment? In other words, given the expectations of those providing capital to the business, how should potential capital projects be evaluated and selected?

- The Distribution Policy Question: What mix of returns do shareholders desire? In other words, do shareholders prefer current income or capital appreciation? Do these shareholder preferences “fit” the company’s strategic position? Can these shareholder preferences be accommodated within the existing capital structure?

These three questions do not stand alone, but the answer to each one influences the answers to the others.

Question #3: Distribution Policy

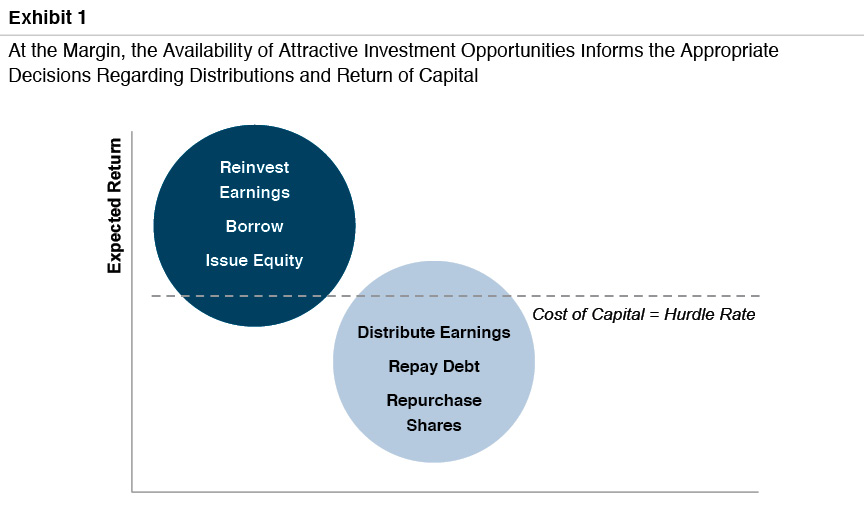

Capital structure and capital budgeting intersect at the point of the cost of capital, which serves as the hurdle rate for evaluating potential capital projects. As shown in Exhibit 1, capital budgeting also shares an intersection point with distribution policy.

If capital projects having expected returns in excess of the cost of capital are abundant, it may be appropriate to retain a greater proportion of earnings for reinvestment than if attractive capital projects are scarce.

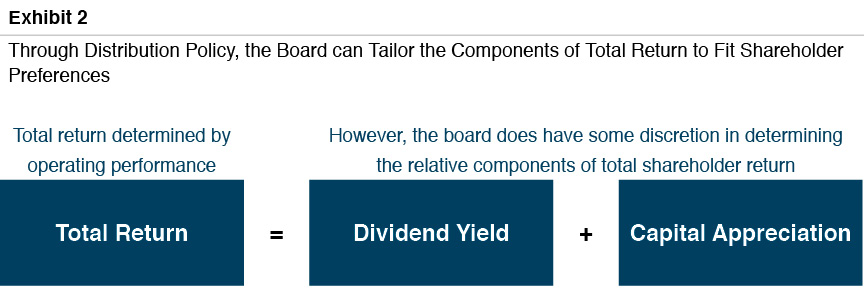

Ultimately, the total return available to shareholders is determined by the operating performance of the business. Beyond that, however, the board does have some measure of discretion with regard to the form of that return (yield vs. capital appreciation).

Family shareholders are likely to have a unique set of preferences with regard to the composition of their total return. Those preferences may vary over time and, potentially, within the shareholder base at a particular point in time. In the public markets, shareholders can sell shares if the mix of return components does not correspond to their preferences. Family business shareholders do not have ready liquidity, so it is important for directors and managers to solicit input regarding shareholder preferences.

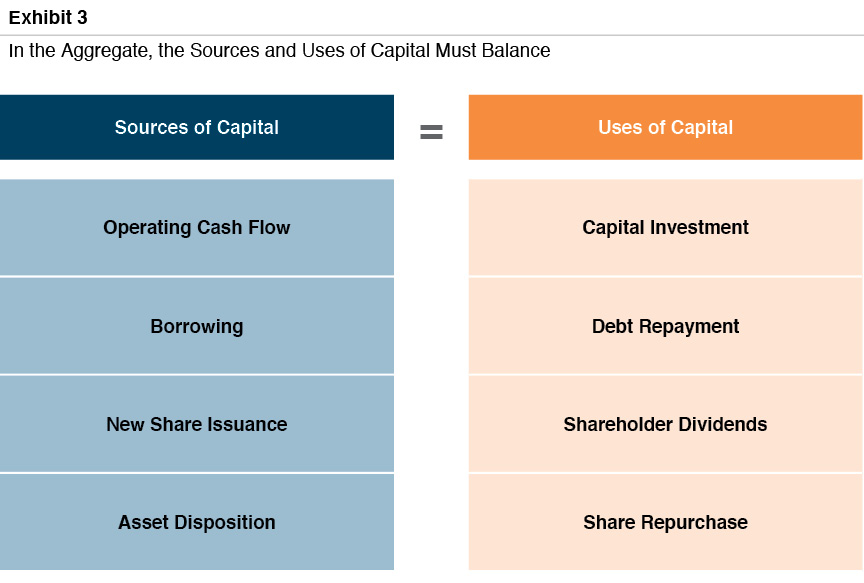

The ability to configure the desired mix of return components is constrained by the availability of incremental debt and equity capital. For example, for a given level of operating cash flow and capital investment, higher dividends can be achieved through incremental borrowing, new share issuance, or asset sales. In each case, boosting dividend yield would come at the expense of capital appreciation. Incremental borrowing capacity may be limited if the company’s capital structure is already optimally leveraged. For family businesses, it may be infeasible to issue illiquid shares at a fair price. And asset sales are not a sustainable source of cash flow.

If family shareholders have diverse preferences regarding the composition of total return, perhaps the best means of tailoring returns is to implement a share repurchase program. Shareholders desiring current income can sell a portion of their shares to the company, which fuels capital appreciation for those preferring future upside. In order to implement this strategy, however, there must be a mutually agreeable share price. If the price is too low, the selling shareholders will effectively be subsidizing the remaining shareholders, while a price that exceeds fair market value will benefit the selling shareholders.

Topics for Board Discussion

Distribution policy is the most transparent board action for family shareholders. There may be many things shareholders are content not to know regarding the company, but the timing and amount of periodic dividends will not be one of them.

- Where is the company in its life cycle? Mature companies with more limited opportunities for attractive capital investment are more natural dividend payers.

- How does the company’s current capital structure compare to its target capital structure? Over time, the board can use dividend policy to migrate the company to its target capital structure while minimizing transaction costs.

- What are shareholder preferences? Do the shareholders have a consistent set of expectations regarding return composition or do different shareholder groups have conflicting preferences?

- What type of distribution policy best fits the company and its shareholder base: a set dollar amount, fixed payout ratio, fixed yield on value, or residual distributions after attractive capital investments have been funded? Dividend policies can provide much desired predictability to shareholders, but can also place artificial constraints on the board.

- How much financial flexibility does the company have to accommodate shareholder preferences? Can the company borrow additional funds? Is there a market for issuance of new shares? If so, at what price?

- Is a share redemption program feasible? Can the board formulate a market-clearing price that does not unduly reward or punish either group of shareholders?

WHITEPAPER

Family Business Director

Family Business Director