A Matter of Life (Insurance) and Death

Life Insurance as a Funding Mechanism for Shareholder Buyouts

A buy-sell agreement among family shareholders should provide clear instructions for how the company’s stock is to be valued upon the occurrence of a triggering event, such as the departure or death of a shareholder. For companies using life insurance as a funding mechanism for shareholder buyouts, the treatment of life insurance proceeds in determining the buyout price is always a thorny issue. A recent estate tax case (Connelly v. United States) addresses this issue. For our full analysis, read the article here.

Background

Crown C Supply Company, Inc. is a roofing and siding materials company founded in 1976 and headquartered in St. Louis, Missouri. Crown C (an S corporation) and brothers Michael, Thomas, and Mark Connelly originally entered into a stock purchase agreement (“SPA”) in January 1983. Mark’s interest in Crown C was terminated prior to the stock purchase agreement being amended and restated in August 2001. Crown C had 500 shares of common stock at the date of the SPA’s execution. Michael, via a trust, owned 385.9 shares of Crown C stock (~77%), and Thomas, individually, owned the remaining shares (~23%).

Pursuant to the terms of the SPA, Michael and Thomas executed a certificate of agreed value that set the purchase price of Crown C’s stock upon a triggering event at $10,000 per share. Disregarding accepted valuation principles and methodologies, this agreed value implied an aggregate company value of $5.0 million in August 2001.

Therefore, at that date, Michael’s shares would have had an agreed value of approximately $3.9 million, while Thomas’s shares would have had an agreed value of approximately $1.1 million. In July 2009, with no update to the agreed value of the company’s equity, Crown C purchased life insurance policies on both Michael’s and Thomas’s lives for $3.5 million each. The SPA stated that life insurance proceeds were to be used to redeem a deceased shareholder’s interest.

Michael, Crown C’s president and CEO, died on October 1, 2013. Effective November 13, 2013, Thomas, together with Michael’s son, Michael P. Connelly, Jr., executed an agreement for the company to redeem the estate’s shares in Crown C for a purchase price of $3.0 million.

The estate noted that the $3.0 million purchase price “resulted from extensive analysis of Crown C’s books and the proper valuation of assets and liabilities of the company. Thomas Connelly, as an experienced businessman extremely acquainted with Crown C’s finances, was able to ensure an accurate appraisal of the shares.”

Valuation Conclusion — Taxpayer

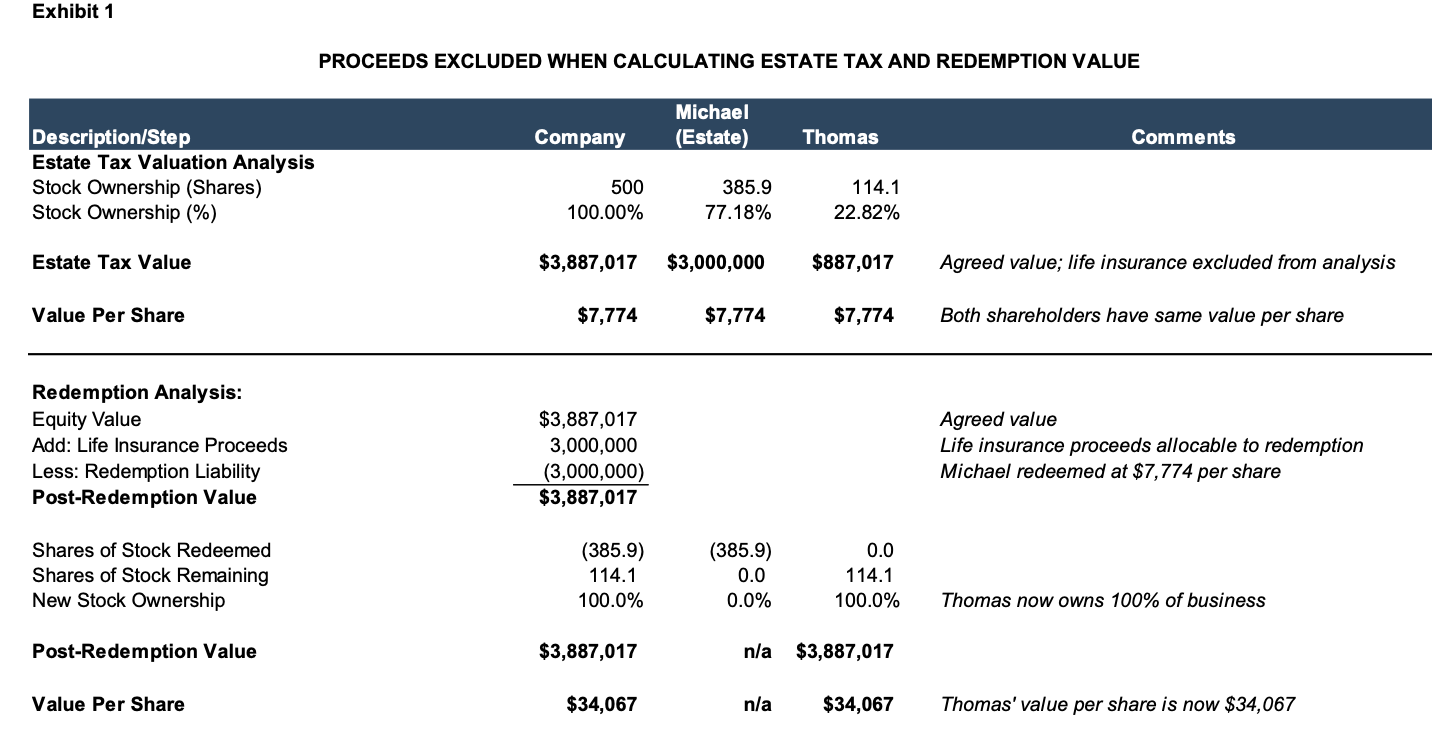

Crown C received $3.5 million in life insurance proceeds upon Michael’s death. Crown C then used $3.0 million of the life insurance proceeds to redeem the estate’s interest. The remaining life insurance proceeds were used to fund company operations. Exhibit 1 illustrates the effect of the transaction on the value of Thomas’s ownership interest.

Click here to expand the image above

Key takeaways:

- Michael’s estate was redeemed at a price of $7,774 per share ($3.0 million / 385.9 shares).

- The total value of the company’s equity does not change and the share count decreases from 500 shares to 114.1 shares, all owned by Thomas.

- Thomas now owns 100% of the company at an implied value of $34,067 per share ($3.9 million / 114.1 shares), which is approximately 4.4x the per-share value at which Michael’s estate was redeemed.

Valuation Conclusion — IRS

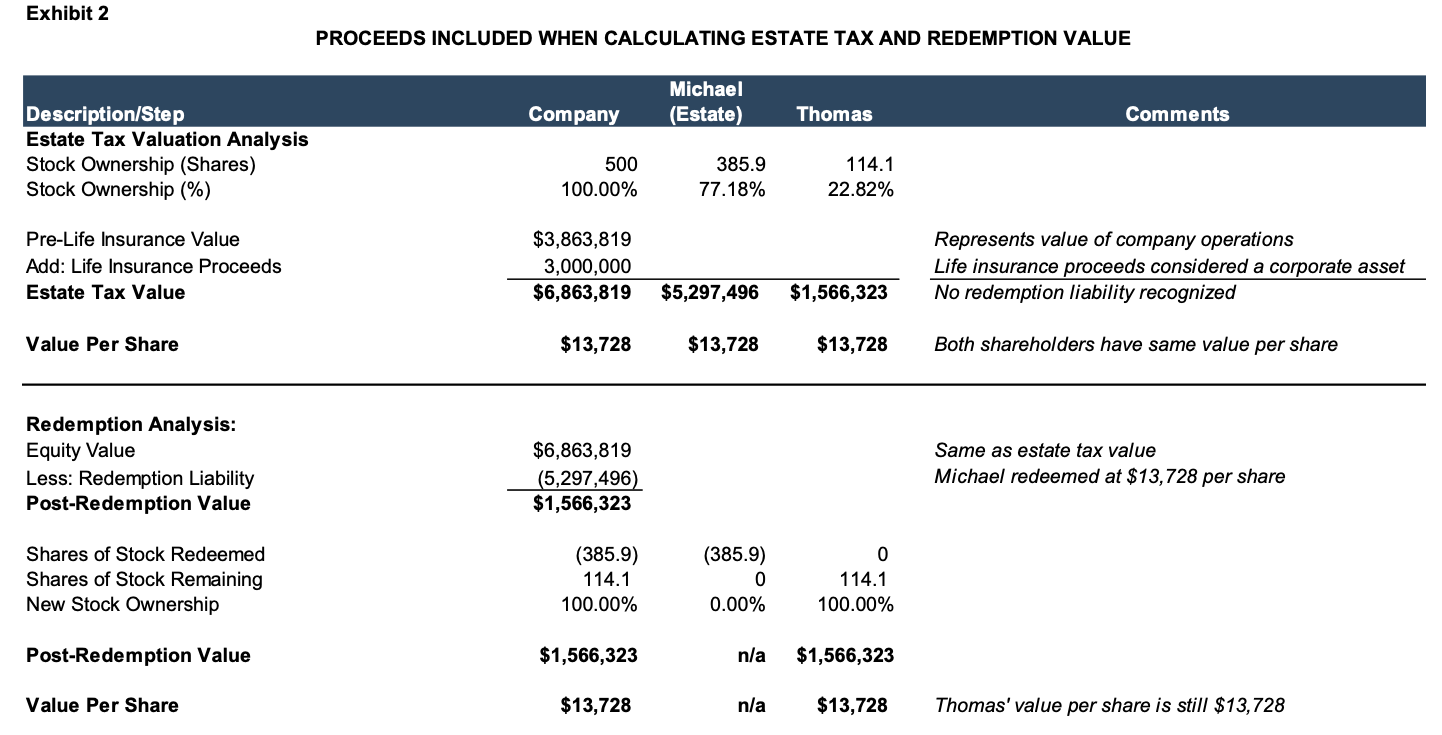

The IRS saw things differently, arguing that the insurance proceeds should be included in Crown C’s equity value. See Exhibit 2 below.

Click here to expand the image above

Key takeaways:

- The equity value of the business for estate tax purposes was $6.9 million inclusive of the $3.0 million in life insurance proceeds.

- The resulting value per share is $13,728 ($6.9 million / 500 shares).

- The estate’s 385.9 shares have a total value of $5.3 million.

- Assuming the estate was redeemed at the IRS value of Crown C (the IRS did not include the $500,000 in excess life insurance proceeds), the post-redemption value of the company’s equity is $1.6 million or $13,728 per share ($1.6million / 114.1), and Thomas is the sole remaining shareholder.

- Since the proposed redemption price ($5.3 million) exceeds the life insurance proceeds ($3.0 million), the company would need to access other funding sources to redeem the estate.

Tax Court Conclusions

The Connelly case was first decided by the District Court in September 2021. Having been appealed by the estate, the Eighth Circuit affirmed the District Court’s decision in June 2023.

The District Court Decision

The IRS had contended that the life insurance proceeds should be included in the valuation of Crown C’s equity. The estate argued that the redemption obligation was a corporate liability that offset the life insurance proceeds dollar for dollar. The District Court sided with the IRS, noting, “Because the insurance proceeds are not offset by Crown C’s obligation to redeem Michael’s shares, the fair market value of Crown C at the date of death and of Michael’s shares includes all of the insurance proceeds.”

The Circuit Court Decision

The Circuit Court affirmed the District Court’s decision, noting, “In sum, the brothers’ arrangement had nothing to do with corporate liabilities. The proceeds were simply an asset that increased shareholders’ equity. A fair market value of Michael’s shares must account for that reality.”

Current Status

At the request of the estate, the Supreme Court agreed in December 2023 to accept the case for review. As of January 2024, the case has not yet been set for argument.

As the sunset provisions of the Tax Cut and Jobs Act of 2017 draw nearer, family shareholders will find the coming months an opportune time to advance their broader estate planning objectives and consider how life insurance might fit into them. Give one of our valuation professionals a call today to discuss your valuation needs in confidence.

Family Business Director

Family Business Director